Overview

Finding your Adjusted Gross Income (AGI) on your W-2 form is easier than you might think! Just look for Box 1, which shows your total taxable wages. From there, you can apply any adjustments to get your AGI just right. It's super important to gather all your necessary documents, like your W-2 and 1099 forms, and to understand the deductions you can claim. These steps not only help you report accurately but also maximize your potential tax benefits. So, are you ready to dive into your tax documents?

Introduction

Understanding Adjusted Gross Income (AGI) is super important for anyone dealing with the twists and turns of tax season. It's a key player in figuring out how much you owe and whether you qualify for various credits and deductions.

In this guide, we’ll walk you through a simple, step-by-step process to find and calculate your AGI right from your W-2 form. This way, you can make the most of your benefits and steer clear of common mistakes.

But with so many documents and possible adjustments to think about, how can you be sure your AGI is spot on and ready to help you save some cash?

Define Adjusted Gross Income (AGI)

So, what exactly is Adjusted Gross Revenue (AGI)? Think of it as your total gross earnings from all sources, but with a twist: it gets trimmed down by specific deductions, which we call adjustments. These can be things like your contributions to retirement accounts, student loan interest, and certain business expenses. is crucial because it helps determine your taxable revenue and whether you qualify for various tax perks, such as the Earned Income Tax Credit or deductions for medical expenses.

Now, as we look ahead to the 2025 tax year, grasping AGI becomes even more crucial. It not only affects your tax liability but also opens the door to credits and deductions that can seriously lighten your tax load. And here's a fun fact: the AGI on W2 form is reported on line 11 of IRS Form 1040, so it's key for filing your tax return accurately.

Did you know that a well-calculated AGI can lead to some pretty significant savings? Tax pros often suggest that you can lower your AGI by making strategic contributions to Health Savings Accounts or retirement plans, which can boost your eligibility for those sweet tax benefits. In fact, around 80% of taxpayers report their AGI accurately, highlighting just how vital it is to understand this number when it comes to tax planning and staying compliant. So, are you ready to dive into your AGI and see how it can work for you?

Gather Necessary Documents and Information

To accurately calculate your AGI on W2 form, gathering a few key documents is super important. Let’s break it down:

- : These little gems detail your wages, tips, and other compensation from your employers. Make sure you collect all W-2s from every job you held throughout the tax year to accurately report your AGI on W2 form. They’re crucial for figuring out your total earnings. As tax consultants often say, "Precise reporting of earnings and the calculation of AGI on W-2 forms is essential for optimizing tax advantages and ensuring adherence to regulations." Plus, checking your paystub can help confirm that the wages on your W-2 are spot-on, ensuring the right amount is being withheld for you.

- 1099 Forms: If you’ve earned money through freelance gigs or other non-employment sources, don’t forget to gather any relevant 1099 forms. These documents outline various types of earnings, like self-employment profits and interest.

- Other Earnings Statements: It’s a good idea to collect any additional earnings statements, such as bank interest or dividends from investments, to get a complete picture of your income.

- Deductions Documentation: Assemble records for any deductions you plan to claim, like student loan interest statements and receipts for retirement contributions. These can help lower your taxable income.

- Previous Year’s Tax Return: Having last year’s return handy can be a big help in identifying your previous AGI, which is often needed for e-filing and verifying your identity.

These days, it seems like more small businesses are hopping on the digital bandwagon to streamline the documentation process. This makes it easier than ever to gather and organize these essential forms. For example, Liane, an elementary school teacher, managed to collect her documents and calculated her AGI to be $40,430. By systematically gathering these documents and understanding the deductions on your paystub, you can simplify your tax prep and steer clear of potential pitfalls. So, let’s get started on this tax journey together!

Calculate Your AGI Using W-2 Data

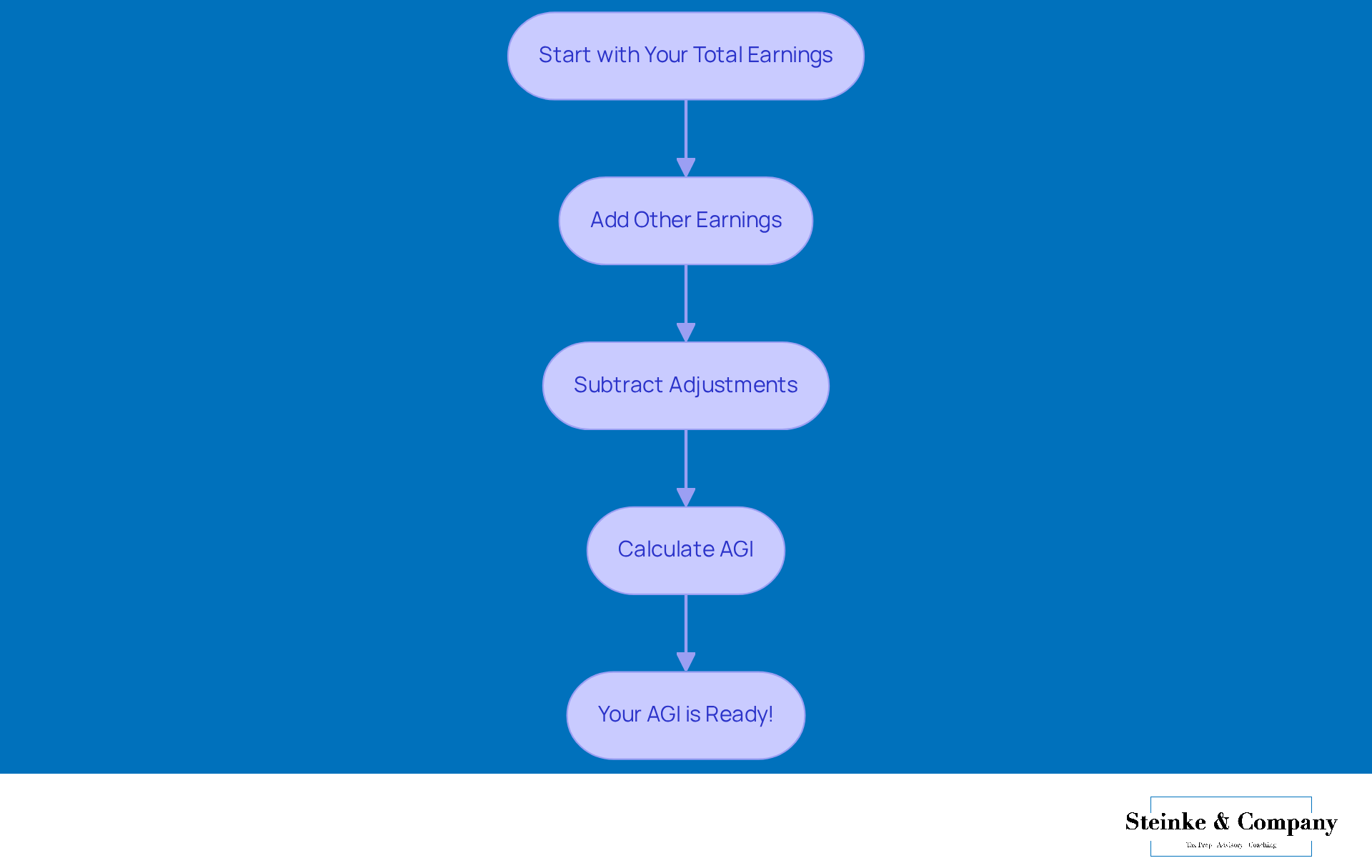

Calculating your Adjusted Gross Income (AGI) can be straightforward if you break it down into manageable steps. Let’s dive in!

Start with Your Total Earnings: First things first, gather all your sources of income. If you’re an employee, this means calculating your total income using the AGI on W-2 form. Just take a look at Box 1 on your W-2; that’s where you’ll find your total taxable wages, which contribute to your AGI on W-2 form.

Add Other Earnings: Next, don’t forget to include any extra income you might have, like freelance work reported on 1099 forms, interest, or dividends. Every little bit counts!

Subtract Adjustments: Now, it’s time to think about adjustments you can claim. Common ones include contributions to retirement accounts like an IRA, any student loan interest you’ve paid, or certain business expenses if you’re self-employed. These can really make a difference!

Calculate AGI: Finally, subtract those adjustments from your gross earnings. The number you get is your , and that's the on W-2 form that you'll report on your tax return.

Getting your AGI right is super important! Mistakes here can lead to either underpaying or overpaying your taxes, which might attract the IRS’s attention or even penalties. A lot of folks trip up by overlooking qualifying adjustments or miscalculating their income sources. By following these steps, you’ll be on your way to accurate reporting and maximizing those tax benefits. So, ready to tackle your taxes with confidence?

Troubleshoot Common AGI Calculation Issues

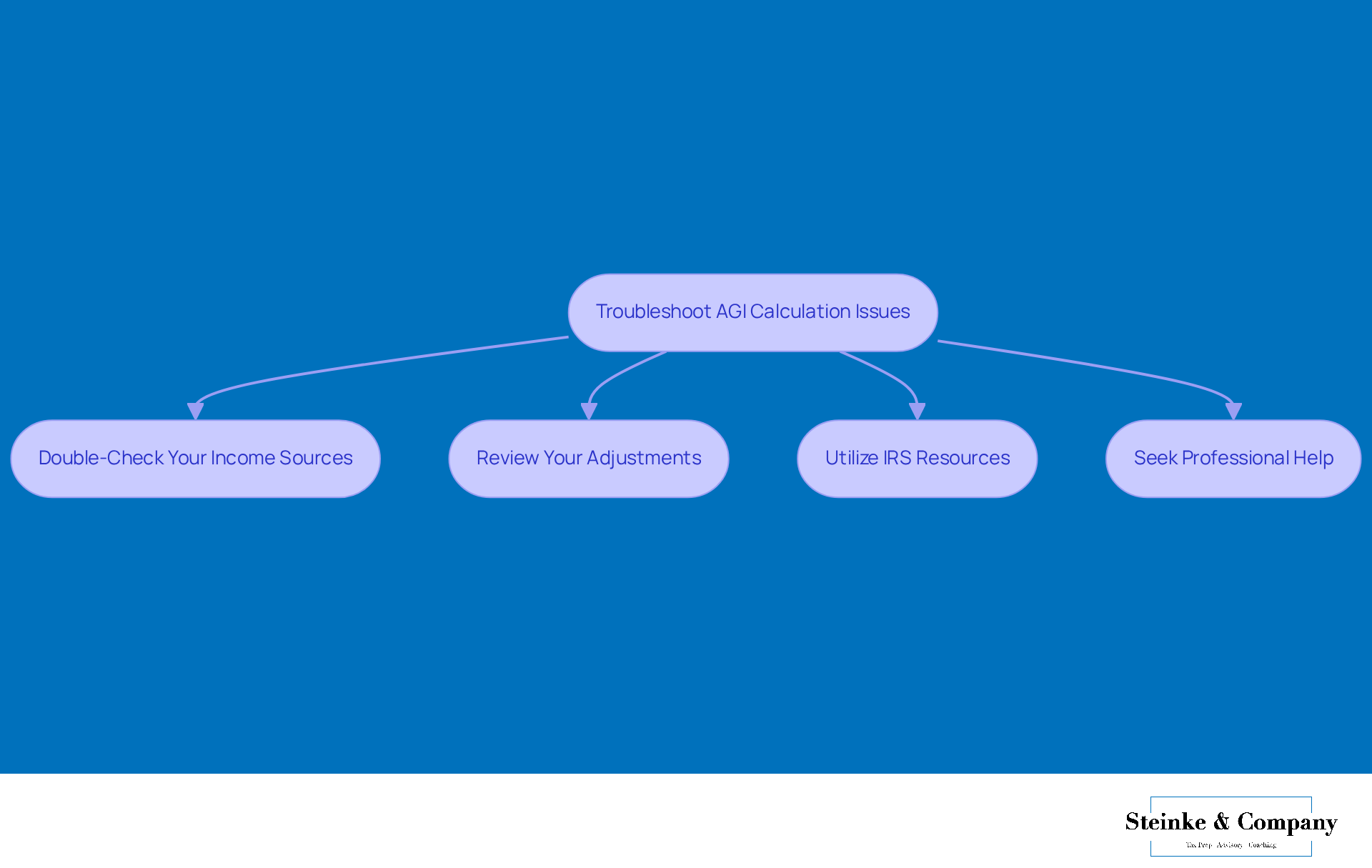

When you're calculating your AGI, running into a few bumps along the way is totally normal. Here are some handy troubleshooting tips to help you get it right:

- Double-Check Your Income Sources: Make sure you've accounted for all your income sources. If you miss a W-2 or 1099, it can really mess up your AGI on W2 form and lead to some unwelcome tax surprises.

- Review Your Adjustments: Get to know all the eligible adjustments you can make. It’s easy to overlook things like student loan interest or retirement contributions, which can help lower your AGI.

- Utilize IRS Resources: The IRS website is packed with helpful guidelines for calculating AGI. If you're feeling a bit lost, don't hesitate to check these out or consider using tax prep software that guides you step-by-step.

- Seek Professional Help: If you're still having trouble, chatting with a tax professional can be a game-changer. With about 22% of taxpayers going for CPAs, their clear up any confusion and ensure your calculations are spot on.

By following these tips, you can tackle those common AGI calculation hiccups and boost your confidence as you navigate your tax filing journey!

Conclusion

Getting a handle on how to find your Adjusted Gross Income (AGI) on your W-2 form is super important for smart tax planning and staying compliant. By understanding the ins and outs of AGI, you can really optimize your tax filings and maybe even unlock some sweet tax benefits. This guide has walked you through everything from what AGI is to how to gather the right documents and calculate your total income accurately.

We’ve chatted about the importance of collecting all those relevant income statements, like your W-2 and 1099 forms, and how crucial it is to spot any deductions that could help lower your AGI. Plus, we’ve tackled some common hiccups in AGI calculations to help you avoid any costly blunders, making your tax filing experience a whole lot smoother. By following the steps we’ve outlined, you can confidently figure out your AGI and maximize your potential savings.

At the end of the day, being proactive in understanding and calculating your AGI can really make a difference in your personal finances. It’s so important for taxpayers to take a moment to gather all the necessary documentation, use the resources available, and reach out for professional help if needed. Embracing this knowledge not only helps you stay compliant with taxes but also empowers you to make informed financial decisions down the line. So, let’s take charge of our AGI and make the most of our financial future!

Frequently Asked Questions

What is Adjusted Gross Income (AGI)?

Adjusted Gross Income (AGI) is your total gross earnings from all sources, reduced by specific deductions known as adjustments. These adjustments can include contributions to retirement accounts, student loan interest, and certain business expenses.

Why is understanding AGI important?

Understanding AGI is crucial because it helps determine your taxable income and eligibility for various tax benefits, such as the Earned Income Tax Credit and medical expense deductions.

How does AGI affect tax liability?

AGI affects your tax liability by influencing the amount of tax you owe and your eligibility for credits and deductions that can reduce your overall tax burden.

Where can I find AGI on my tax forms?

The AGI is reported on line 11 of IRS Form 1040, making it important for accurately filing your tax return.

How can I lower my AGI?

You can lower your AGI by making strategic contributions to Health Savings Accounts or retirement plans, which can enhance your eligibility for tax benefits.

How many taxpayers report their AGI accurately?

Approximately 80% of taxpayers report their AGI accurately, highlighting the importance of understanding this number for tax planning and compliance.