Overview

This article dives into the world of passive activity loss rules, shedding light on why they matter for small business owners looking to maximize tax deductions and minimize liabilities. It covers the essentials—like eligibility criteria, calculation methods, limitations, and even some strategic opportunities. By equipping you with this knowledge, we aim to help you navigate these regulations with ease and boost your financial management skills. So, are you ready to tackle these rules head-on?

Introduction

Understanding the complexities of passive activity loss rules is super important for small business owners who want to optimize their tax strategies. These regulations tell us how non-active income can be managed and deducted, which can really impact your financial outcomes. But let’s be honest—navigating these rules can feel like a maze!

So, how can business owners effectively leverage passive activity losses to boost their financial health while staying in line with IRS regulations? In this article, we’ll dive into ten critical insights that will help you master the ins and outs of passive activity loss rules and unlock some valuable tax benefits. Ready? Let’s get started!

Steinke and Company: Expert Guidance on Passive Activity Loss Rules

At Steinke and Company, we’re all about helping small business owners navigate the tricky world of non-operating expense regulations. We specialize in service-oriented businesses, offering tailored strategies that not only keep you compliant but also help you make the most of your tax benefits. Our team of seasoned experts is here to ensure you have the essential knowledge to manage your tax responsibilities related to those non-active pursuits.

With recent updates in compliance around , it’s crucial for small businesses to stay on top of changing regulations. Tax pros often stress that understanding the passive activity loss rules can significantly impact the ability to maximize deductions and minimize liabilities. A smart approach? Keep accurate records of those inactive pursuits and engage with them to avoid restrictions on your earnings.

For small business owners, grasping the ins and outs of non-active income regulations is vital. It’s essential to handle the passive activity loss rules wisely, as they can seriously affect your tax outcomes. At Steinke and Company, we take a holistic approach, ensuring that our clients not only follow these regulations but also use them to boost their overall financial health. So, let’s tackle this together and make sure you’re set up for success!

Understanding Passive Activity Loss: Definition and Importance

So, what exactly is passive engagement deficit? It’s all about the losses that come from activities where the taxpayer isn’t really involved. These losses can only offset income from other non-active ventures, which is why it’s super important for small business owners to get a handle on how these rules affect their finances.

Understanding non-active losses is key to crafting a and staying compliant with the passive activity loss rules. Have you thought about how this might play into your own financial planning?

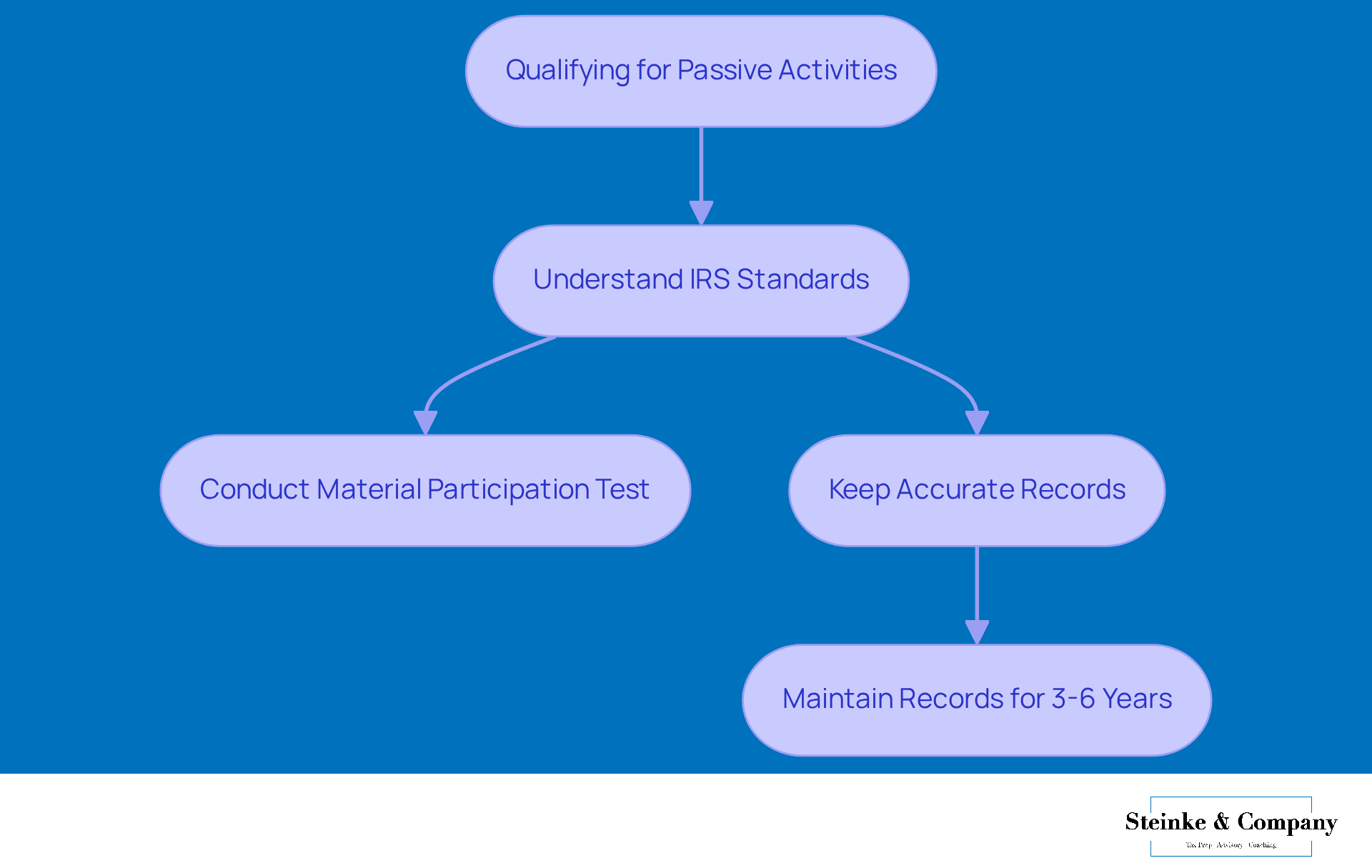

Qualifying for Participation in Passive Activities: Key Criteria

If you want to dive into non-active pursuits, there are some specific standards set by the IRS that you need to meet. These standards look at how involved you are in the activity, which can be measured through different tests, like the material participation test. Understanding the is crucial for small business owners who want to determine if they can claim unearned income deductions on their tax returns.

Plus, keeping accurate records of your tax returns and all supporting documents is a must for small agency owners. Generally, it’s a good idea to hold onto your income tax records for at least three years after the return's due date. But if you filed your original return late, then the actual filing date is what matters. And here’s a little tip: if you’ve left out more than 25% of your gross income, you might need to keep those records for up to six years.

Maintaining these records not only helps you stay compliant but also strengthens your claims related to the passive activity loss rules for non-active financial deductions. This way, you’ll have all the necessary documentation ready if the IRS comes knocking. So, make sure you’re organized—it’ll pay off in the long run!

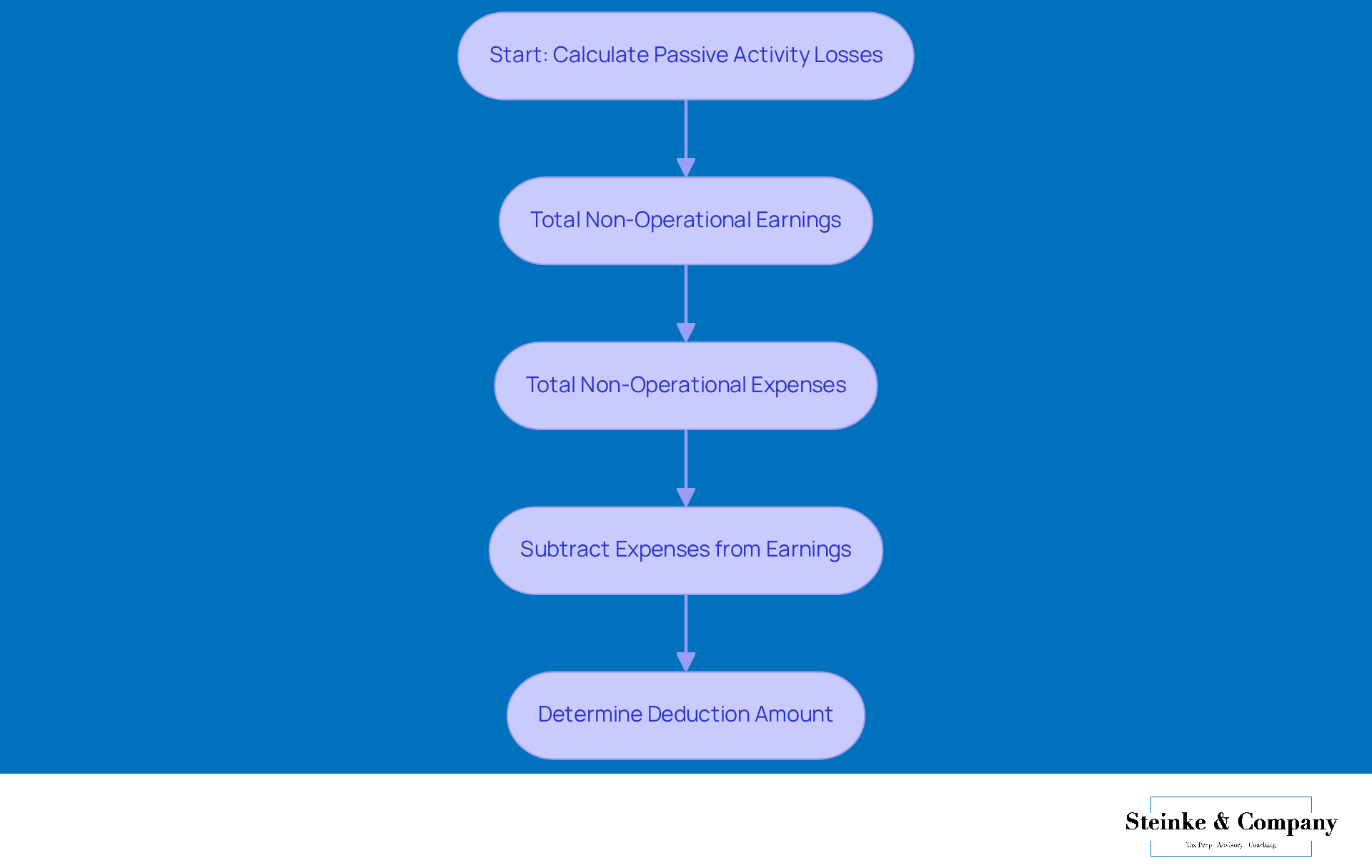

Calculating Passive Activity Losses: Methods and Considerations

Figuring out non-operational financial deficits is pretty straightforward! You just need to subtract your total non-operational expenses from your total non-operational earnings. This calculation is key for determining how much you can deduct on your tax returns. As a small business owner, it’s wise to think about things like depreciation, interest expenses, and other deductions that the IRS allows. This way, you can and avoid any surprises come tax season.

Now, if you’re feeling a bit overwhelmed, don’t worry! Steinke and Company is here to help with expert tax preparation and planning services. They can take care of filing both your business and personal returns, making the whole process smoother and more accurate. Plus, this proactive approach helps small agency owners dodge budgeting pitfalls that could hurt their overall business success. So, why not reach out and see how they can assist you?

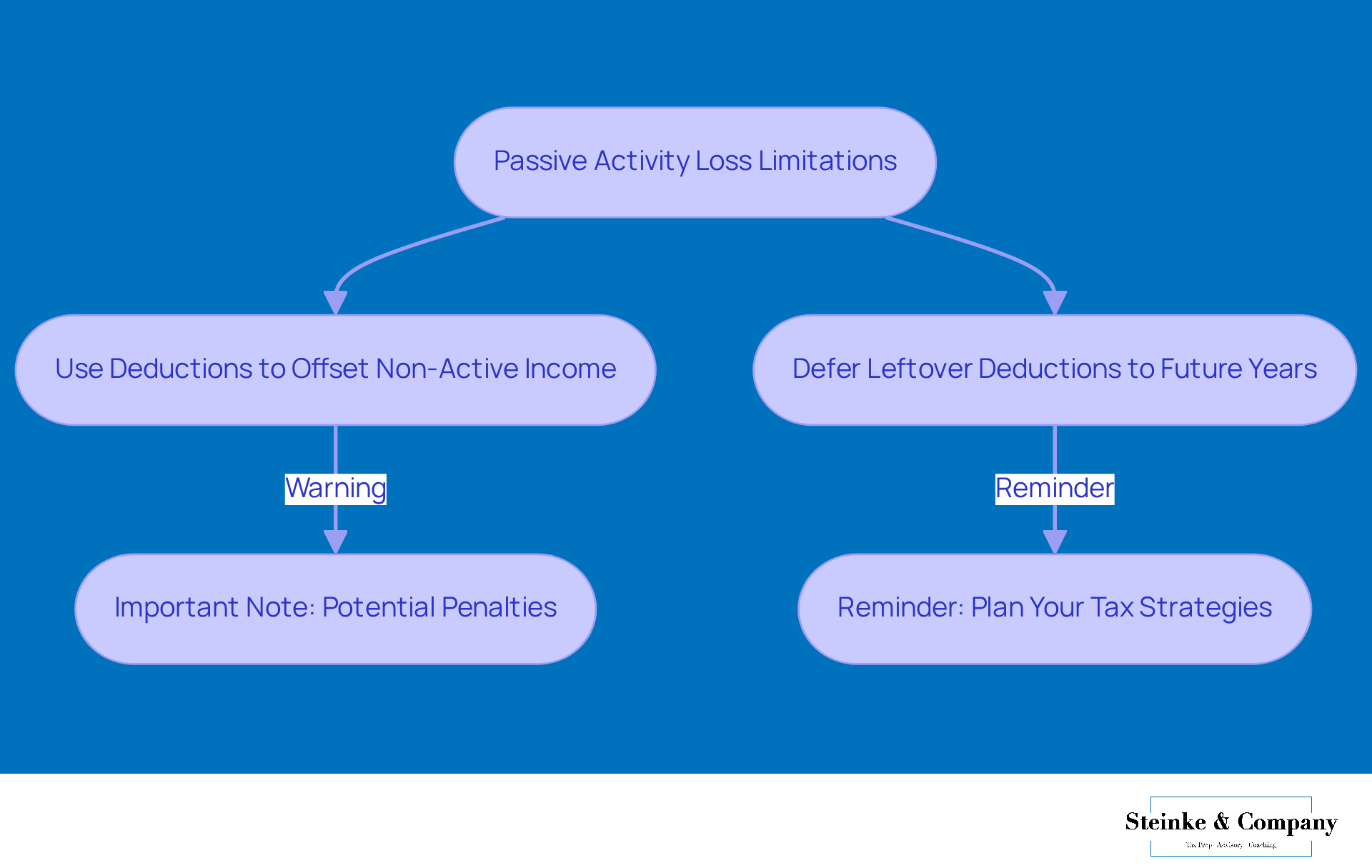

Passive Activity Loss Limitations: What Small Business Owners Need to Know

Did you know that passive engagement deficits come with some specific restrictions? These limitations can really affect how they interact with other forms of income. Typically, you can only use deductions to , and any leftover deductions? They get deferred to future tax years. So, if you're a small business owner, it's super important to keep these rules in mind as you plan your tax strategies. This way, you can steer clear of any potential penalties down the line!

Exceptions to Passive Activity Loss Rules: Identifying Opportunities

Hey there! Did you know there are some important exclusions in the non-active income regulations that relate to the passive activity loss rules, which small business owners like you should be aware of? For instance, real estate pros might get some special perks that let them deduct non-active financial losses from their non-passive income under the passive activity loss rules. Pretty neat, right?

But that's not all! Certain rental activities can also qualify for exceptions under the passive activity loss rules, providing you with more flexibility when it comes to tax planning. It’s all about spotting these opportunities, and trust me, they can lead to some . So, keep your eyes peeled and take advantage of what’s out there!

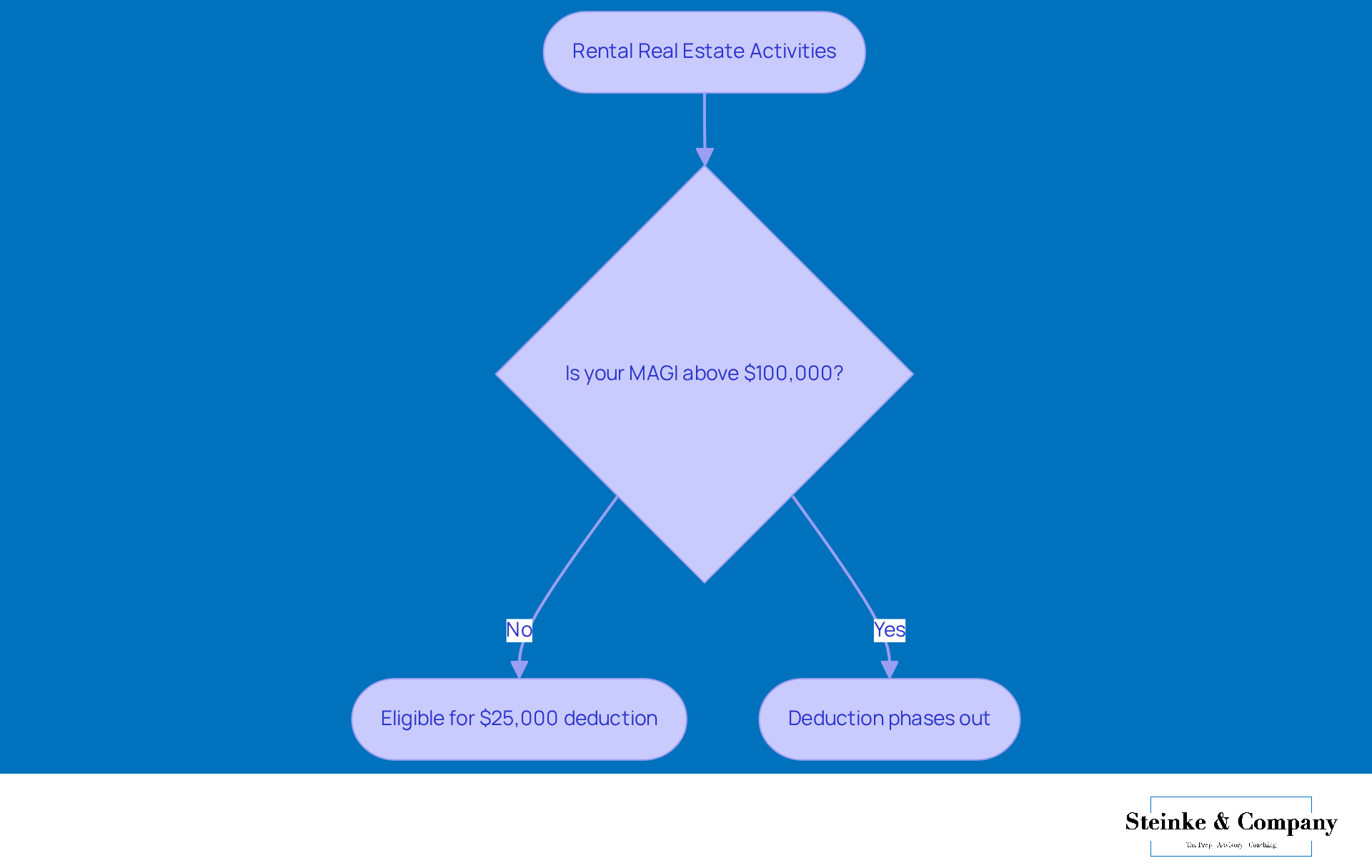

Special Allowance for Rental Real Estate Activities: Key Insights

Did you know that the IRS offers a unique deduction for rental real estate activities? Under the passive activity loss rules, eligible taxpayers can subtract up to $25,000 of non-active expenditures from their non-passive income. However, this allowance starts to phase out for modified adjusted gross incomes (MAGI) above $100,000. So, it’s really important for rental property owners to understand how the passive activity loss rules affect their income levels and eligibility. Understanding this can help small business owners in real estate make the most of their !

Carrying Over Passive Losses: Strategies for Small Business Owners

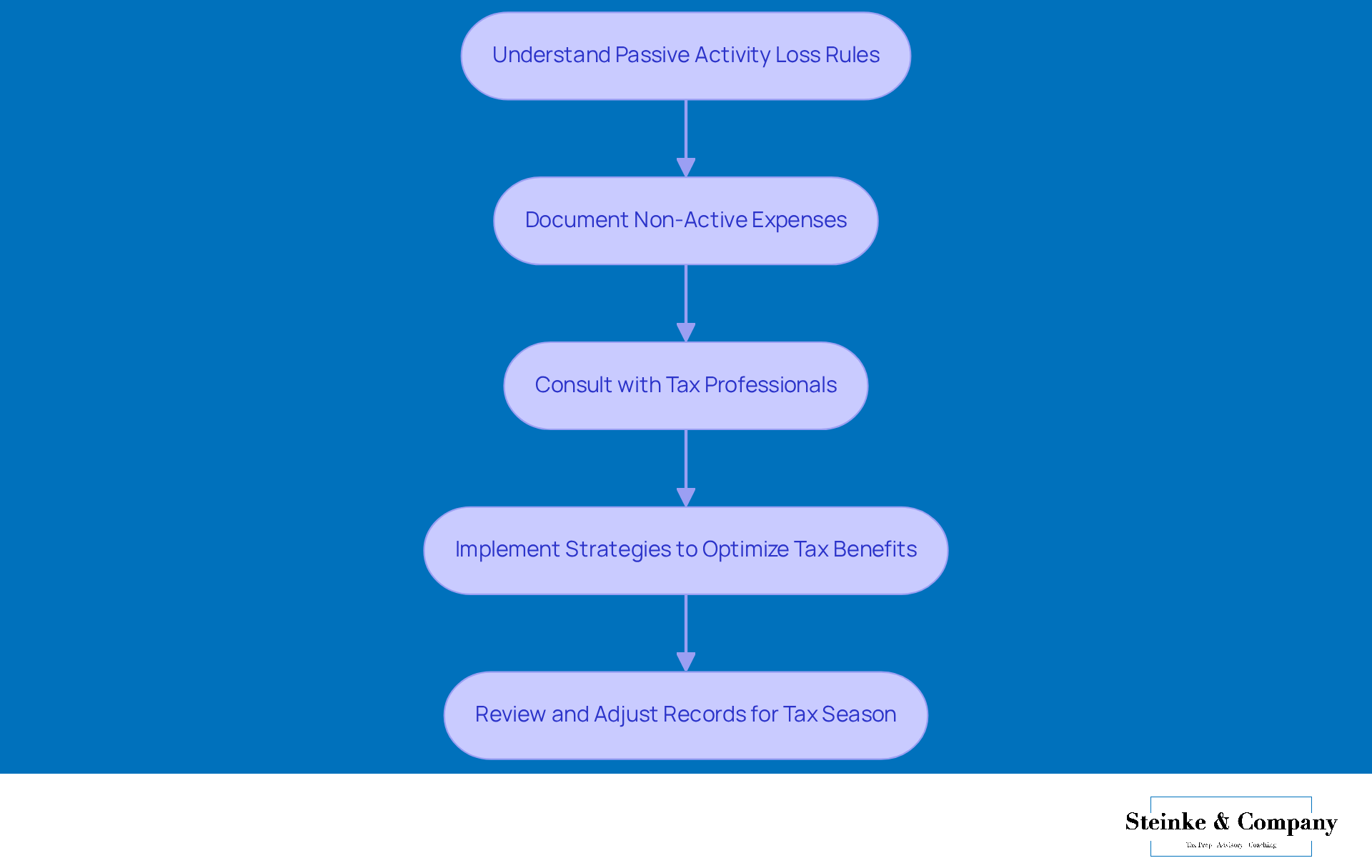

Hey there, small business owners! Did you know that under passive activity loss rules, you can strategically carry over those unutilized deficits to future tax years? When your deficits exceed this year's inactive income, the passive activity loss rules enable you to use those deficits against future non-active income, which can really . To make the most of these carryovers, it’s super important to keep detailed records of your non-active expenses. This means jotting down all relevant expenses and income tied to your rental properties or other non-active ventures.

Also, don’t forget to chat with tax professionals! They can help you navigate those tricky IRS regulations and ensure you’re compliant. Plus, their expert guidance can uncover opportunities to maximize your tax benefits. By following these tips, you can enhance your financial management and potentially lower your overall tax liabilities. So, why not start keeping those records today? It could make a big difference come tax season!

Understanding the At-Risk Rule for Passive Losses: Implications for Business Owners

Did you know that the at-risk regulation limits the total of non-active deductions you can claim to the amount you’ve invested in your activity? For instance, if you’ve put $50,000 into a rental property, you can only deduct expenses up to that amount. It’s super important for small business owners to grasp this rule so they can accurately figure out their tax liabilities and stay on the right side of IRS regulations. So, keep this in mind as you !

Income Limits for Passive Losses: Essential Guidelines for Small Business Owners

Hey there, small business owners! Let’s chat about something super important—those income thresholds related to the passive activity loss rules that can affect your ability to deduct non-active expenses. So, here’s the deal:

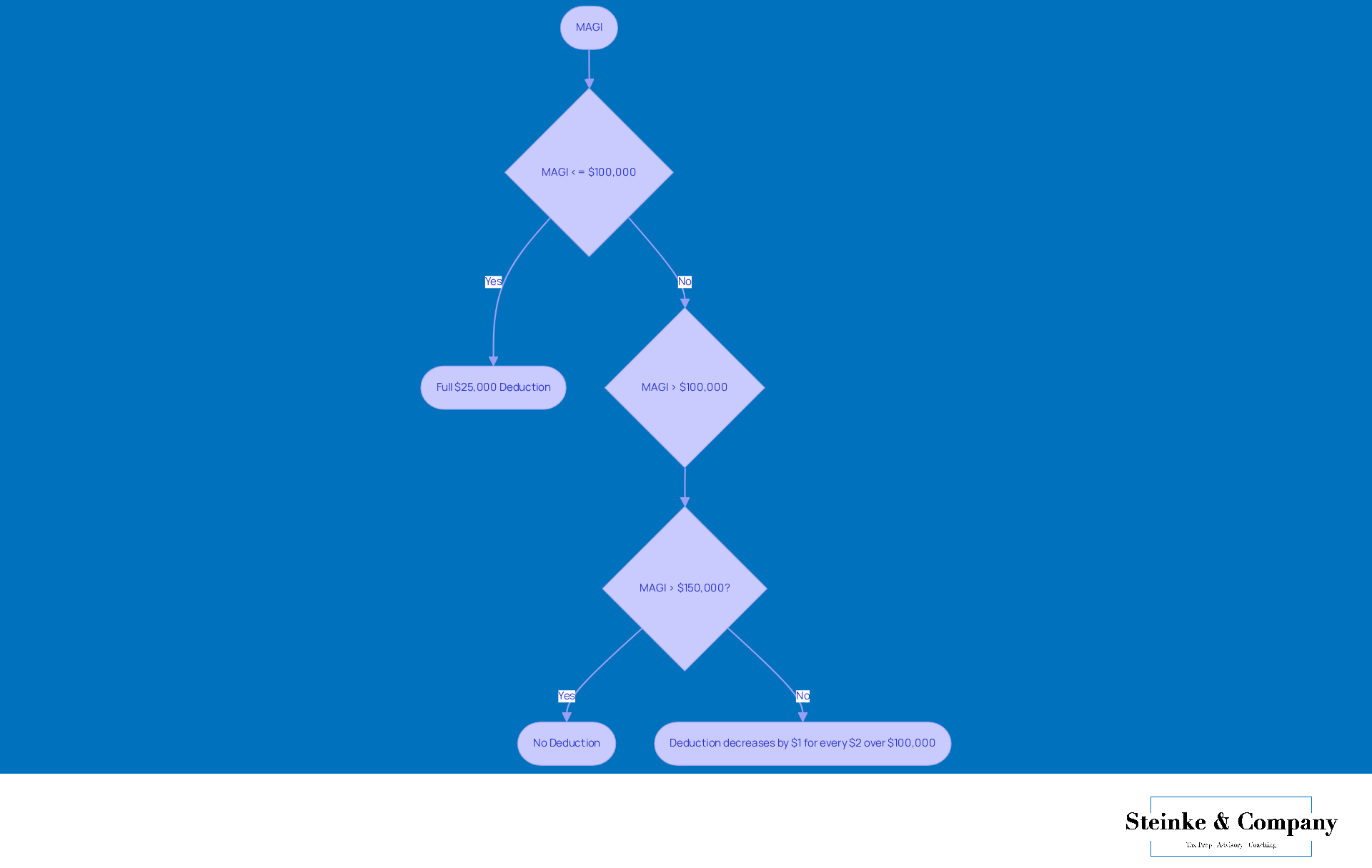

- The $25,000 non-active deduction limit starts to shrink if your modified adjusted gross income (MAGI) goes over $100,000, and it completely disappears at $150,000.

- For every $2 you earn above that $100,000 mark, you lose $1 of your deduction.

- For example, if your MAGI hits $110,000, your deduction drops to $20,000.

Knowing these thresholds is crucial for smart tax planning and maximizing your deductions while considering the passive activity loss rules.

And as Thomas Castelli puts it, 'The $25,000 non-active deduction isn’t merely a luxury.' It’s a serious tax strategy for small and mid-sized real estate investors! Plus, don’t forget that you can combine non-active losses from different rental properties. Nate Sosa highlights this by saying, 'You can merge non-active deficits from multiple rental properties when determining your overall deficit for the year.'

By keeping your rental income under that $150,000 limit and actively managing your properties, you can utilize this deduction to offset paper losses, such as depreciation, in accordance with the passive activity loss rules, even if your properties are producing positive cash flow.

Oh, and here’s something else to keep in mind: if you can’t use all your passive losses in a given year, the passive activity loss rules dictate that they turn into suspended losses that you can carry forward to future years. This gives you even more down the line. So, stay on top of these details and make the most of your deductions!

Conclusion

Understanding and navigating the passive activity loss rules is super important for small business owners who want to optimize their tax strategies. These regulations can really impact your financial outcomes, so it’s essential to know how non-active income and losses play into your overall tax liabilities. By staying informed and compliant, you can leverage these rules to your advantage, ultimately boosting your financial health.

This article highlights some key insights, like the importance of accurate record-keeping, what qualifies as participation in passive activities, and how to calculate passive losses. It also touches on limitations and exceptions that can create valuable opportunities for tax savings, especially for those involved in rental real estate. Plus, working with tax professionals can help streamline this process and uncover even more strategies for managing passive activity losses effectively.

So, small business owners, take proactive steps to understand and apply these passive activity loss rules. Not only will you ensure compliance, but you’ll also position yourself to maximize deductions and minimize liabilities. As tax regulations change, staying updated and seeking expert guidance will be key to navigating these complexities and achieving long-term financial success. Ready to dive in and make the most of it?

Frequently Asked Questions

What is the focus of Steinke and Company?

Steinke and Company specializes in helping small business owners navigate non-operating expense regulations, particularly in service-oriented businesses, by offering tailored strategies for compliance and maximizing tax benefits.

Why is understanding passive activity loss rules important for small business owners?

Understanding passive activity loss rules is crucial as it can significantly impact a business's ability to maximize deductions and minimize tax liabilities, ultimately affecting financial outcomes.

What are passive activity losses?

Passive activity losses are losses from activities in which the taxpayer is not actively involved, and these losses can only offset income from other non-active ventures.

What criteria must be met to qualify for participation in passive activities?

To qualify for participation in passive activities, business owners must meet specific IRS standards, which assess their level of involvement in the activity, often measured through tests like the material participation test.

How long should small business owners keep their income tax records?

Small business owners should generally keep their income tax records for at least three years after the return's due date. If the original return was filed late, the filing date becomes important. Records may need to be kept for up to six years if more than 25% of gross income was omitted.

Why is it important to maintain accurate records related to passive activity loss rules?

Maintaining accurate records is essential for compliance and strengthens claims related to passive activity loss deductions, ensuring that all necessary documentation is available in case of an IRS inquiry.