Overview

This article shares four essential steps that small businesses can follow to tackle their tax organizer effectively:

- Gather all the necessary documents.

- Review your financial data—this is where the magic happens!

- Identify those deductions and income sources that can really make a difference.

- Double-check everything to ensure accuracy in the submission process.

Trust me, these steps will help make your tax filing experience as smooth as possible!

Introduction

Navigating the complexities of tax preparation can feel like a real challenge for small business owners, especially when it comes to getting those essential financial documents in order. But here’s the good news: a well-structured tax organizer not only makes the filing process easier, but it also helps you maximize your potential deductions. That means you can keep more of your hard-earned profits!

Now, with so many details to juggle—from income sources to major financial events—you might wonder, how can you tackle this crucial task without feeling completely overwhelmed?

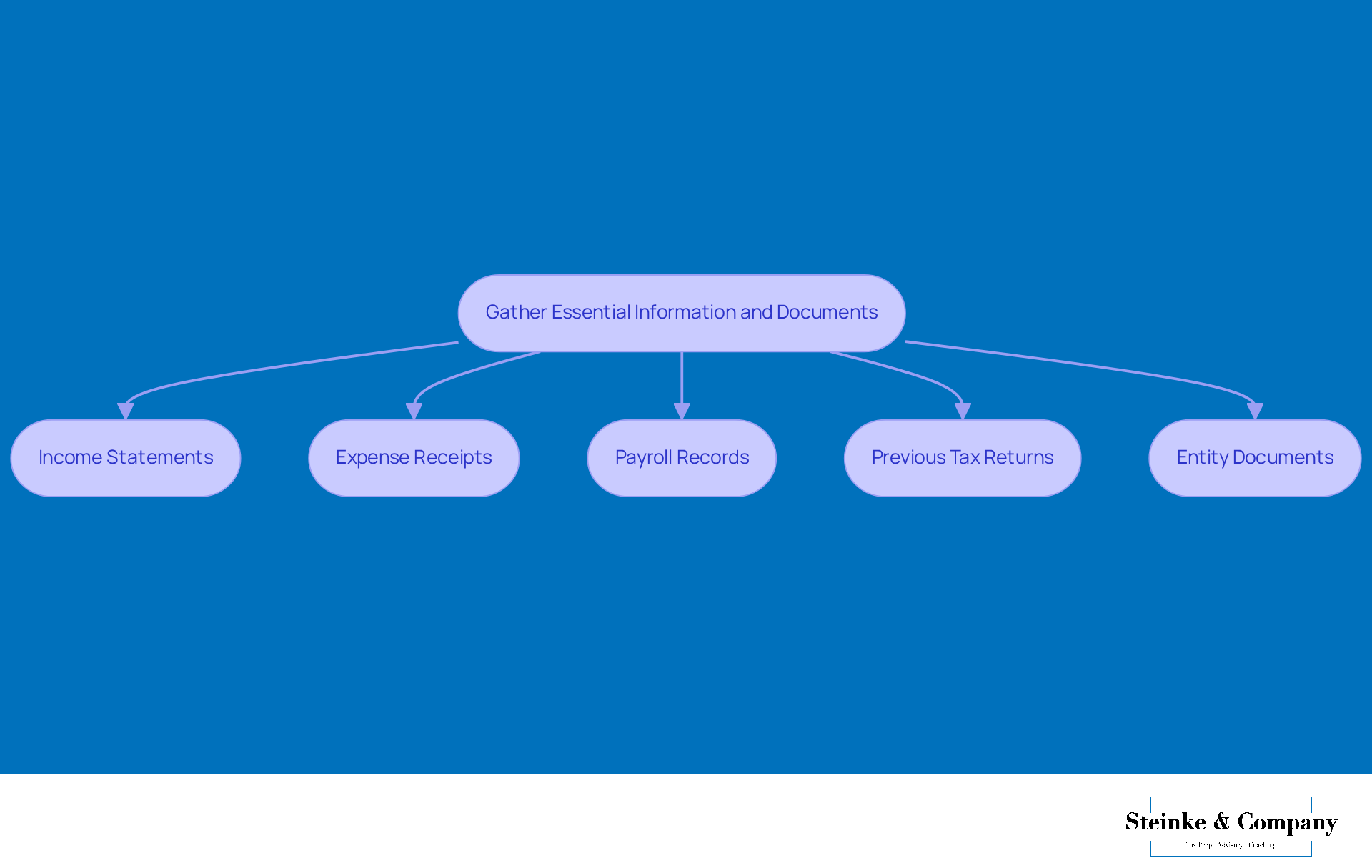

Gather Essential Information and Documents

Let's kick things off by gathering all those important documents related to your company's financial activities from last year. Here’s what you’ll need:

- Income Statements: Make sure to collect all records of income received, including invoices and bank statements.

- Expense Receipts: Don’t forget to compile receipts for all business-related expenses, like supplies, utilities, and travel costs.

- Payroll Records: If you’ve got employees, ensure you have their payroll records and any related tax forms at the ready.

- Previous Tax Returns: Your tax return from last year can be a handy reference point.

- Entity Documents: Keep your registration and any relevant licenses close by.

Organizing these documents in a dedicated folder or digital file will make completing your tax organizer much easier. Fun fact: 71% of small business owners still rely on pen and paper or spreadsheets for financial management, which can lead to a few more mistakes than we’d like. By taking a systematic approach with a tax organizer to organizing your documents, you can boost accuracy and efficiency in your tax prep for the upcoming season. Trust me, it’ll !

Review Prior Year Data and Major Financial Events

Take a moment to dive into your financial data from last year. Let’s focus on a few key areas that can really make a difference:

- Income Trends: How has your income changed compared to last year? Understanding these trends is super important for anticipating any potential . A shift in income can really impact what you owe!

- Major Purchases: Did you acquire any significant assets this past year? If so, they might qualify for depreciation deductions. Keeping track of these purchases can lead to some nice tax savings down the line.

- Changes in Business Structure: If you’ve made a shift in your business—like moving from a sole proprietorship to an LLC—take note of how that affects your tax responsibilities. Different structures can come with different tax implications that might change your overall strategy.

- Financial Statements: It’s a good idea to review your balance sheet and profit and loss statements closely. Are there any discrepancies or notable changes? This little analysis will help ensure your financial records are spot on.

Also, don’t forget to document any major financial events that popped up during the year. These will be extremely important when you’re completing your tax organizer. Regular financial check-ins can save you from chaos during tax season and give you a clearer picture of your organization’s financial health. So, how about making this a habit?

Identify Deductions and Income Sources

In this step, let’s focus on identifying all those potential deductions and income sources to really optimize your tax preparation:

Deductions: Here are some common deductions for small businesses that you might find helpful:

- Home office expenses: If you’ve got a part of your home that’s just for business, you can deduct a portion of your mortgage interest, utilities, and property taxes.

- Work-related travel and meals: Costs you rack up while traveling for work, including meals, can be partially deducted. Just remember, meals usually allow for a 50% deduction.

- Professional fees: Expenses for hiring experts, like accountants and legal consultants, are completely deductible since they’re essential for running your business.

- Marketing and advertising expenses: Investments in advertising, including those online campaigns, are fully deductible, helping to lower your taxable profits.

- Equipment and supplies: Any necessary equipment and supplies you purchase can be deducted, with certain items qualifying for 100% bonus depreciation under new legislation.

Income Sources: Don’t forget to account for all your income streams, like:

- Sales revenue: This is the income you generate from selling your products or services, and it’s usually your primary source of revenue.

- Service fees: Charges for services you provide play a significant role in your overall revenue as well.

- Interest earnings: Any interest you earn from business accounts or investments should definitely be included.

- Grants or subsidies: Financial assistance from government programs can also be a source of revenue.

Creating a checklist of these deductions and income sources can help ensure you capture everything when completing your tax organizer. This proactive approach could lead to some nice tax savings and improved cash flow for your business, especially considering the reduced COVID-19 tax benefits that might affect your total tax refund. Plus, it’s super important to understand your tax obligations to avoid any underpayment penalties, which can pop up if you don’t meet IRS requirements for estimated tax payments. Think about strategies like and the de minimis exception to help mitigate these risks.

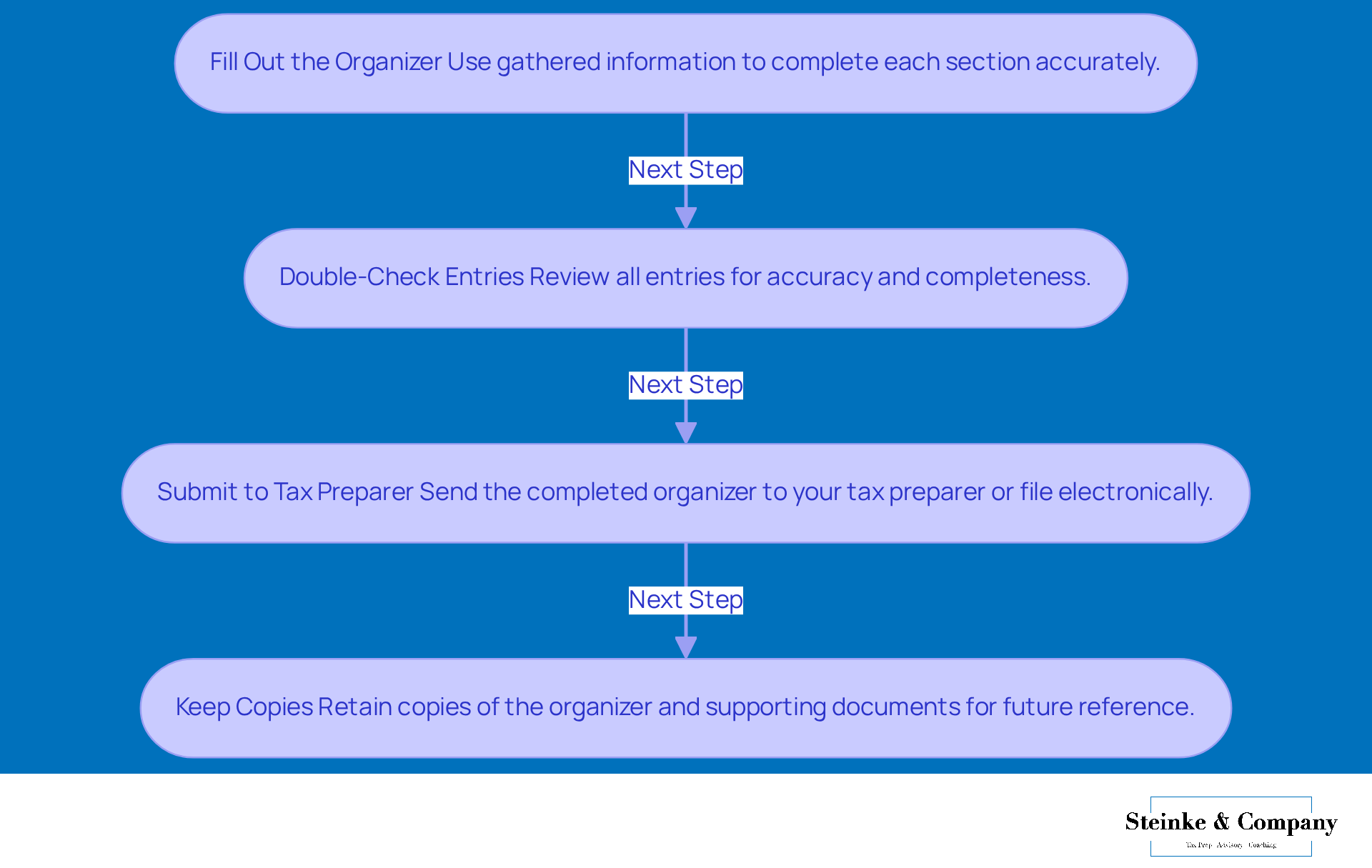

Complete and Submit Your Tax Organizer

Completing your tax organizer is a crucial step to ensure your tax filing proceeds without any issues. Let’s dive into how to do it effectively:

- Fill Out the Organizer: Use the information you've gathered to accurately complete each section of the tax organizer. Precision is key here; even the smallest errors can lead to big headaches later on. Did you know that 41% of small and medium-sized businesses are unhappy with their accountants because they get reactive support instead of proactive? This really highlights the need for thoroughness in your submissions. Understanding the can also help you declare your earnings and withholdings accurately.

- Double-Check Entries: After you’ve filled out the organizer, take a moment to meticulously review all your entries. Make sure every source of income and all expenses are reported accurately. Common mistakes include misreporting earnings or forgetting allowances, which can cost you potential tax savings. A case study showed that businesses that keep a close eye on expenses—like vehicle mileage and home office costs—can snag substantial tax deductions. And don’t forget, keeping accurate records of your paystub info is crucial for verifying your income and ensuring the right amounts are withheld, helping you avoid complications during tax season.

Once you feel confident about the accuracy of your entries, go ahead and submit your tax organizer to your tax preparer, or file it electronically if you’re managing your taxes on your own. Fun fact: about 70% of small businesses choose to outsource their tax prep because they recognize the complexities involved. This really underscores how important accuracy is in your submissions—after all, it directly affects how smoothly the tax preparation process goes.

- Keep Copies: Make sure to keep copies of your completed organizer along with all supporting documents. This practice not only helps with future tax filings but also protects you in case of audits, which impact around 642,603 businesses each year. Generally, it’s a good idea to keep your tax records for at least three years after filing, but longer if your situation calls for it.

By following these steps, you’ll have effectively completed your tax organizer, which will set you up for a seamless tax filing experience!

Conclusion

Organizing tax information is super important for small businesses looking to make tax prep a breeze and save some cash. By following these simple steps—gathering necessary documents, reviewing past financial data, spotting deductions, and completing the tax organizer—small business owners can tackle the complexities of tax season with confidence and clarity.

Let’s dive into some key insights from this guide. First off, collecting essential documents like income statements, expense receipts, and payroll records is crucial for accurate tax filing. Plus, taking a look at last year’s data can help you spot trends and significant financial events that might affect your tax obligations. And don’t forget about recognizing potential deductions and income sources; this not only optimizes your tax prep but also protects you from underpayment penalties.

In the end, taking a proactive approach to tax organization can lead to some serious benefits for small businesses. By embracing these best practices, you can enjoy a smoother tax filing experience, lower the risk of errors, and maybe even boost your financial outcomes. So, as you gear up for this tax season, remember that these strategies not only prepare you for now but also help cultivate a habit of financial diligence that can lead to greater success down the road.

Frequently Asked Questions

What essential documents do I need to gather for my company's financial activities from last year?

You will need to gather Income Statements, Expense Receipts, Payroll Records, Previous Tax Returns, and Entity Documents.

What should I include in the Income Statements?

Collect all records of income received, including invoices and bank statements.

What types of expenses should I document with receipts?

Document all business-related expenses, such as supplies, utilities, and travel costs.

Why are Payroll Records important?

Payroll Records are important if you have employees, as they include their payroll information and any related tax forms.

How can my Previous Tax Returns be useful?

Your tax return from last year can serve as a handy reference point for your current tax preparation.

What are Entity Documents?

Entity Documents are your company's registration and any relevant licenses that you need to keep on hand.

How should I organize these documents for tax preparation?

Organizing these documents in a dedicated folder or digital file will make completing your tax organizer much easier.

What is the benefit of using a tax organizer for document management?

Using a tax organizer can boost accuracy and efficiency in your tax preparation, reducing the likelihood of mistakes that can occur with pen and paper or spreadsheets.