Overview

Did you know that health care premiums can actually be tax deductible? It's true, but there are some IRS criteria to keep in mind. For starters, these premiums need to be for qualified insurance plans and must exceed 7.5% of your adjusted gross income. Now, if you're self-employed, here's a little gem: you can deduct 100% of your premiums! Just remember, it's super important to keep track of your expenses and chat with a tax professional. They can offer personalized guidance to help you maximize those tax benefits. So, why not take a moment to explore how this could work for you?

Introduction

Navigating the complexities of health care costs can feel overwhelming, right? Especially when you start thinking about the tax implications. Health care premiums are often a big expense for individuals and self-employed folks, but they might just be your ticket to some serious tax savings.

So, the big question is: are these premiums really tax deductible? And if they are, what do you need to know? This guide is here to break it all down for you. We’ll explore the eligibility criteria, what documentation you’ll need, and the potential benefits of claiming these deductions.

By the end, you’ll be empowered to maximize your tax benefits and reduce that financial stress!

Understand Health Care Premiums and Their Tax Status

When it comes to health care costs, we're talking about the payments you make for health insurance coverage, and guess what? How you can deduct these costs can really impact your tax benefits. Generally, you can deduct these fees if they meet certain criteria set by the IRS. This includes costs for medical, dental, and long-term care insurance. So, how do you know if health care premiums are health care premiums tax deductible? Let’s break it down:

- Type of Coverage: First things first, make sure your premiums are for qualified health insurance plans. Only contributions to plans that meet IRS standards are eligible for a tax break.

- Payment Method: Did you know that how you pay your premiums can change the tax game? Premiums paid through payroll deductions might have different implications than those paid directly. For example, if your employer covers your costs, they can deduct those, but you can claim employee-covered costs on your individual tax returns.

- Filing Status: Your tax filing status plays a role too. If you’re self-employed, you can deduct 100% of your medical insurance costs from your taxable income, including those for your spouse and dependents, as long as you meet specific criteria.

According to IRS guidelines, you can only deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI). So, if your total qualifying medical expenses, including those health care premiums, go above this threshold, you can claim the excess on your tax return. For self-employed folks, this can mean a significant reduction in taxable income and some serious tax savings.

In real life, many taxpayers find these deductions super helpful. For instance, let’s say you’re a self-employed graphic artist who pays $2,000 in medical insurance costs. You could lower your taxable income and potentially save hundreds in taxes! Understanding these details is key to figuring out your eligibility for medical cost reductions and whether health care premiums are health care premiums tax deductible to maximize your tax benefits. So, take a moment to evaluate your situation—you might be pleasantly surprised!

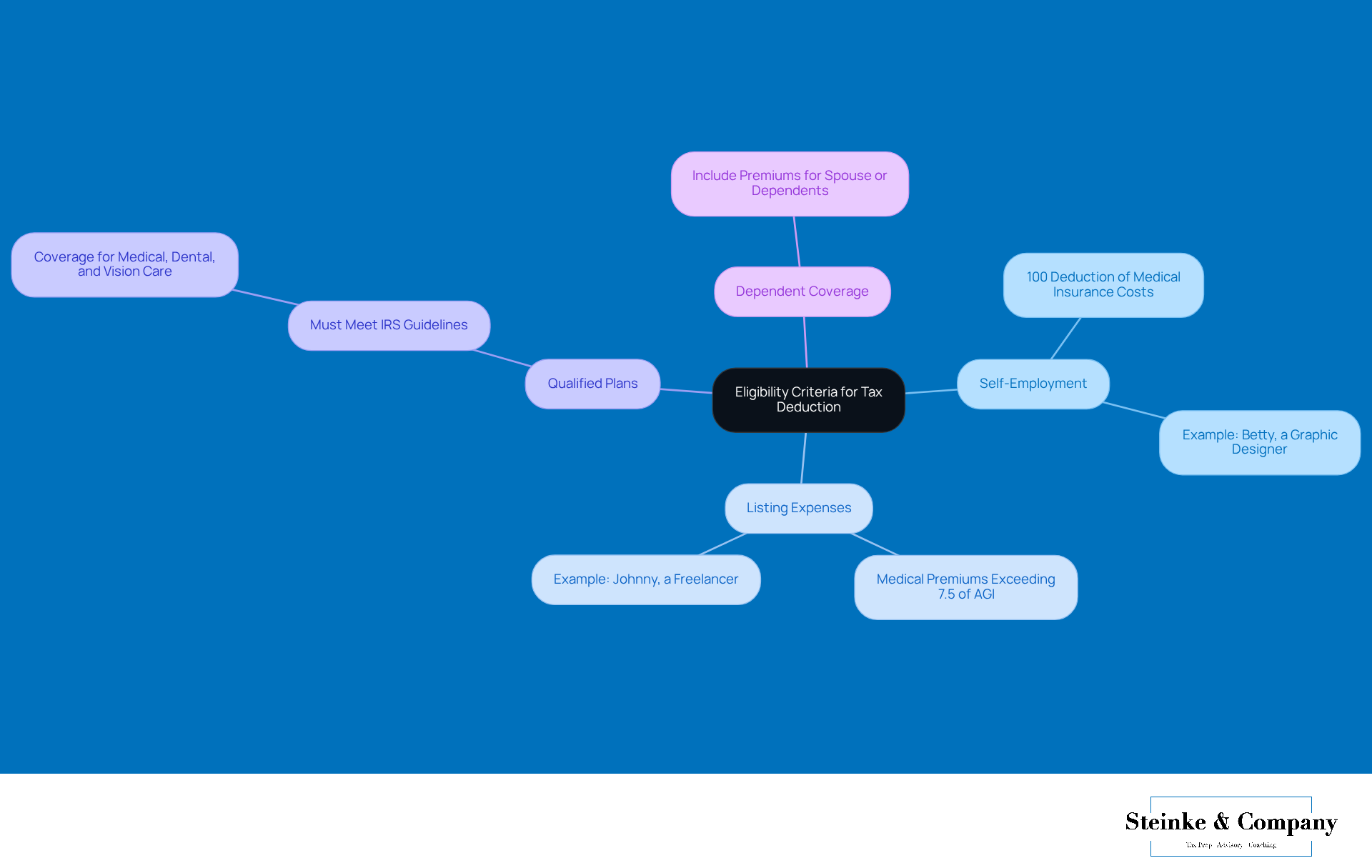

Identify Eligibility Criteria for Tax Deduction

To determine if health care premiums are tax deductible, you need to meet some specific eligibility criteria for a tax deduction. Let’s break it down:

- Self-Employment: If you’re self-employed, good news! You can subtract 100% of your from your taxable income. That’s a nice chunk of tax relief right there!

- Listing Expenses: Thinking about listing expenses on your tax return? You can include medical premiums as part of your medical costs, but only if they exceed 7.5% of your adjusted gross income (AGI), which leads to the inquiry of whether health care premiums are tax deductible.

- Qualified Plans: Make sure your insurance plan meets IRS guidelines, which usually means it covers medical, dental, and vision care.

- Dependent Coverage: Don’t forget, premiums paid for your spouse or dependents can also be included in your deductions.

For instance, take Betty, a full-time graphic designer. She’s able to deduct her medical insurance costs because her business is her main income source. Similarly, Johnny, a freelancer, reports his health insurance costs on his yearly tax return, benefiting from that self-employed exemption.

Tax consultants often emphasize how important it is to understand if health care premiums are tax deductible. By taking a closer look at these standards, you can figure out your eligibility and get ready to claim those deductions. So, why not dive in and see what you can qualify for?

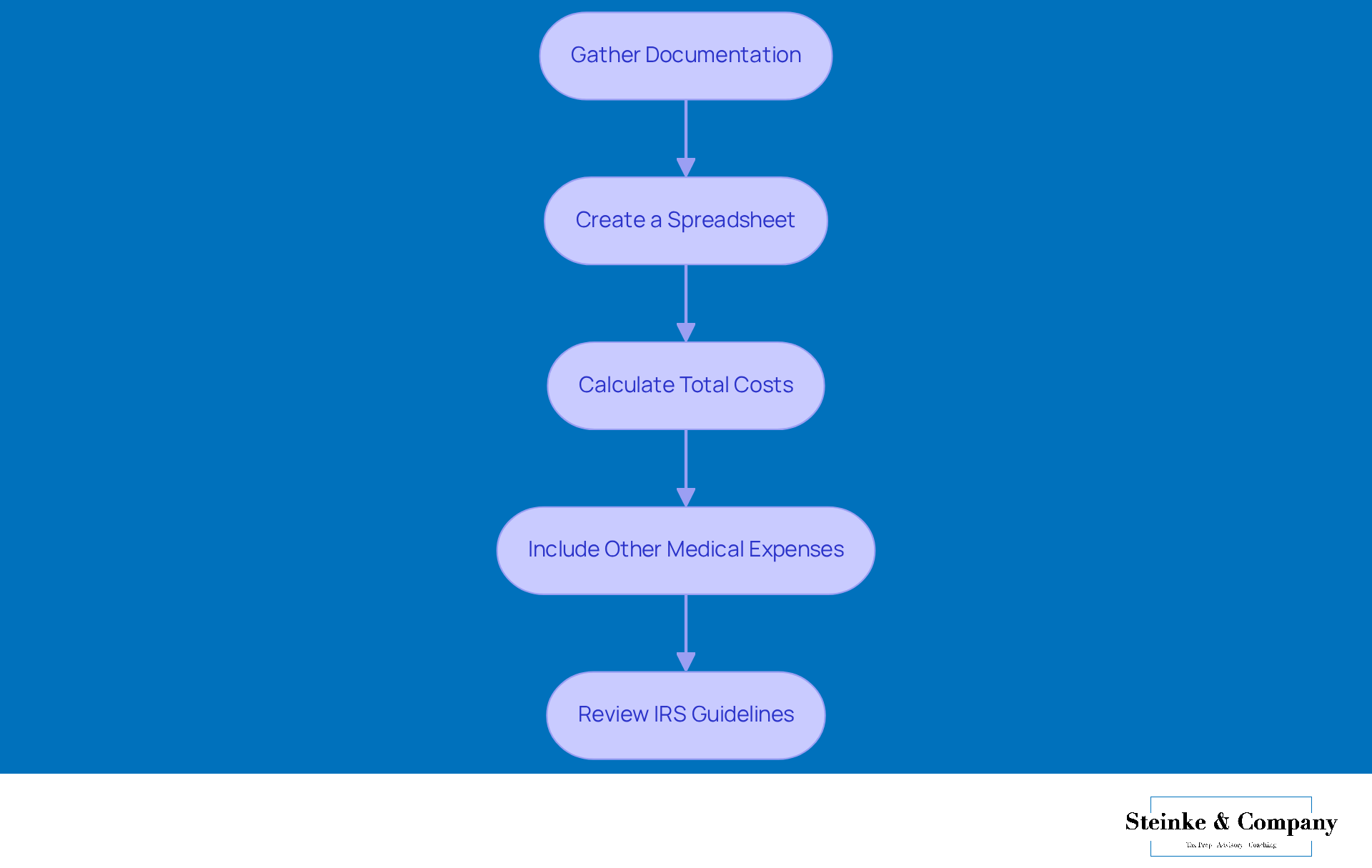

Document and Calculate Your Health Care Expenses

Keeping track of your medical care expenses is super important if you want to claim those deductions. Here’s how to get yourself ready:

- Gather Documentation: Start by collecting all the essential documents—think insurance statements, receipts for out-of-pocket expenses, and records of what you’ve paid for medical care. This will help you see the full picture of your total spending.

- Create a Spreadsheet: Why not whip up a spreadsheet to track your medical costs and other healthcare expenses throughout the year? Just add columns for the date, type of expense, amount, and any notes to keep everything neat and tidy.

- Calculate Total Costs: Time to add it all up! Calculate your total healthcare expenses for the tax year. If you’re self-employed, don’t forget that the premiums you’ve paid for yourself, your spouse, and any dependents are health care premiums tax deductible.

- Include Other Medical Expenses: If you’re itemizing, make sure to toss in other eligible medical costs, like co-pays, prescriptions, and dental care. Just a heads up—eligible medical expenses need to exceed the lesser of 3% of your net income or a fixed annual amount set by the CRA, which is $2,759 for 2024.

- Review IRS Guidelines: It’s a great idea to get familiar with IRS Publication 502. This handy guide outlines and gives you the lowdown on how to report them. It’s a must-have resource for understanding what qualifies for those tax breaks.

By keeping a close eye on your medical expenses and calculating them carefully, you’ll be all set to claim your deductions and maximize your tax savings!

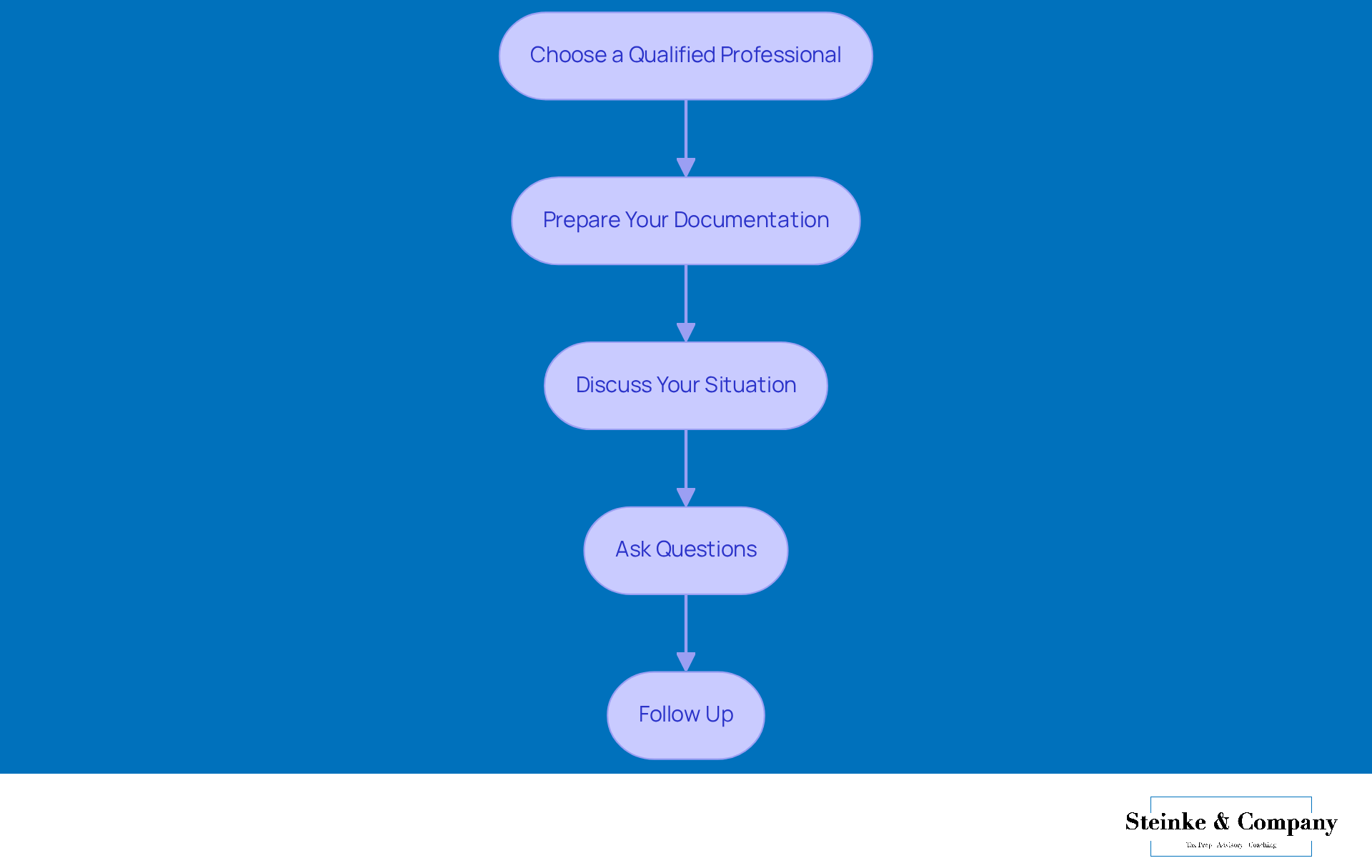

Consult a Tax Professional for Guidance

For small business owners, navigating the ins and outs of whether health care premiums are tax deductible can feel like a tough puzzle. But don’t worry—bringing in a tax professional can give you personalized guidance tailored just for your situation. Here’s how to get ready for your consultation:

- Choose a Qualified Professional: Look for a tax consultant or CPA who knows their stuff when it comes to small business tax compliance and medical expenses. Their expertise can really help you grasp the to you.

- Prepare Your Documentation: Before your meeting, gather all the relevant documents. This means having your medical care payment contributions and any extra healthcare costs from the year organized and ready to go.

- Discuss Your Situation: Be open about your financial situation—share details like your income, business structure, and any unique factors that might affect your tax benefits. This info is key for your advisor to give you tailored advice.

- Ask Questions: Don’t hold back! Inquire about whether health care premiums are tax deductible and how you can minimize your tax obligations. A proactive approach can lead to some really helpful insights.

- Follow Up: After your consultation, make sure to follow up on any recommendations from your tax professional. Putting their strategies into action can help you optimize your reductions and improve your overall tax compliance.

By seeking professional guidance, you can tackle the complexities of tax compliance with confidence and maybe even find some extra savings along the way. It’s worth noting that in 2025, a lot of small business owners are on the lookout for tax advice regarding whether health care premiums are tax deductible, which really highlights how important expert support is when managing health care premium deductions.

Conclusion

Understanding the tax deductibility of health care premiums is super important if you want to maximize your potential tax benefits. By knowing the eligibility criteria, you can figure out if your health care costs qualify for deductions. This could ultimately reduce your taxable income and save you some cash! With the right knowledge and documentation, you can navigate the sometimes tricky tax regulations and make informed decisions about your health care expenses.

So, what should you keep in mind? First off, make sure your health care premiums are tied to qualified plans. Also, think about how your payment methods and filing status can impact your deductibility. If you're self-employed, you’re in luck—you can deduct 100% of your medical insurance costs! Plus, keeping detailed records and chatting with tax professionals can really help clarify things in this complex area of tax law.

In the end, understanding health care premium deductions is crucial. Taking proactive steps to evaluate your eligibility, keeping accurate documentation, and seeking professional advice can lead to some serious tax savings. As tax laws change, staying informed and prepared will empower you and other small business owners to make the most of your health care expenses in the years to come. So, why not take a moment to review your situation? You might be surprised at what you find!

Frequently Asked Questions

What are health care premiums?

Health care premiums are the payments you make for health insurance coverage.

Can I deduct health care premiums on my taxes?

Yes, you can generally deduct health care premiums if they meet certain criteria set by the IRS, including costs for medical, dental, and long-term care insurance.

What criteria must health care premiums meet to be tax deductible?

Health care premiums must be for qualified health insurance plans that meet IRS standards to be eligible for a tax break.

Does the method of payment for health care premiums affect their tax deductibility?

Yes, the method of payment can affect tax implications. Premiums paid through payroll deductions may have different implications compared to those paid directly.

How does my tax filing status affect the deductibility of health care premiums?

If you are self-employed, you can deduct 100% of your medical insurance costs from your taxable income, including those for your spouse and dependents, provided you meet specific criteria.

Is there a threshold for deducting medical expenses, including health care premiums?

Yes, according to IRS guidelines, you can only deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI).

Can self-employed individuals benefit significantly from deducting health care premiums?

Yes, self-employed individuals can see a significant reduction in taxable income by deducting their medical insurance costs, which can lead to substantial tax savings.

Can you provide an example of how health care premium deductions work?

For instance, a self-employed graphic artist who pays $2,000 in medical insurance costs could lower their taxable income and potentially save hundreds in taxes.