Overview

So, you’re on the hunt for the perfect tax planning advisor for your business? Great choice! Let’s break down four essential steps that can really help you make the right pick.

-

Experience: You want someone with solid experience. Why? Because navigating the world of taxes can be a bit like trying to find your way through a maze—having a seasoned guide makes all the difference!

-

Communication Skills: Communication skills are key. You need an advisor who can explain complex tax stuff in a way that actually makes sense. Think of it as having a conversation over coffee instead of a lecture in a stuffy classroom.

-

Proactive Approach: A proactive approach is also important. You want someone who doesn’t just react to changes but anticipates them. It’s like having a chess player who’s always thinking three moves ahead!

-

Personalized Service: Lastly, personalized service is a must. Your business is unique, and your advisor should treat it that way. They should take the time to understand your specific needs and tailor their strategies accordingly. After all, a one-size-fits-all approach rarely fits anyone well.

In short, look for experience, good communication, a proactive mindset, and a personal touch. These qualities will not only help you navigate tax complexities but also foster a collaborative relationship that boosts your business’s financial health. So, what do you think? Ready to find that perfect advisor?

Introduction

Navigating the complex world of tax planning can feel pretty overwhelming for business owners, right? But here's the thing: it’s also your ticket to unlocking some serious financial benefits. Working with a skilled tax planning advisor not only helps you minimize liabilities and stay compliant, but it also empowers you to make informed decisions that can really drive your business forward.

So, with so many options out there, how do you find the right advisor who truly gets your unique needs and goals?

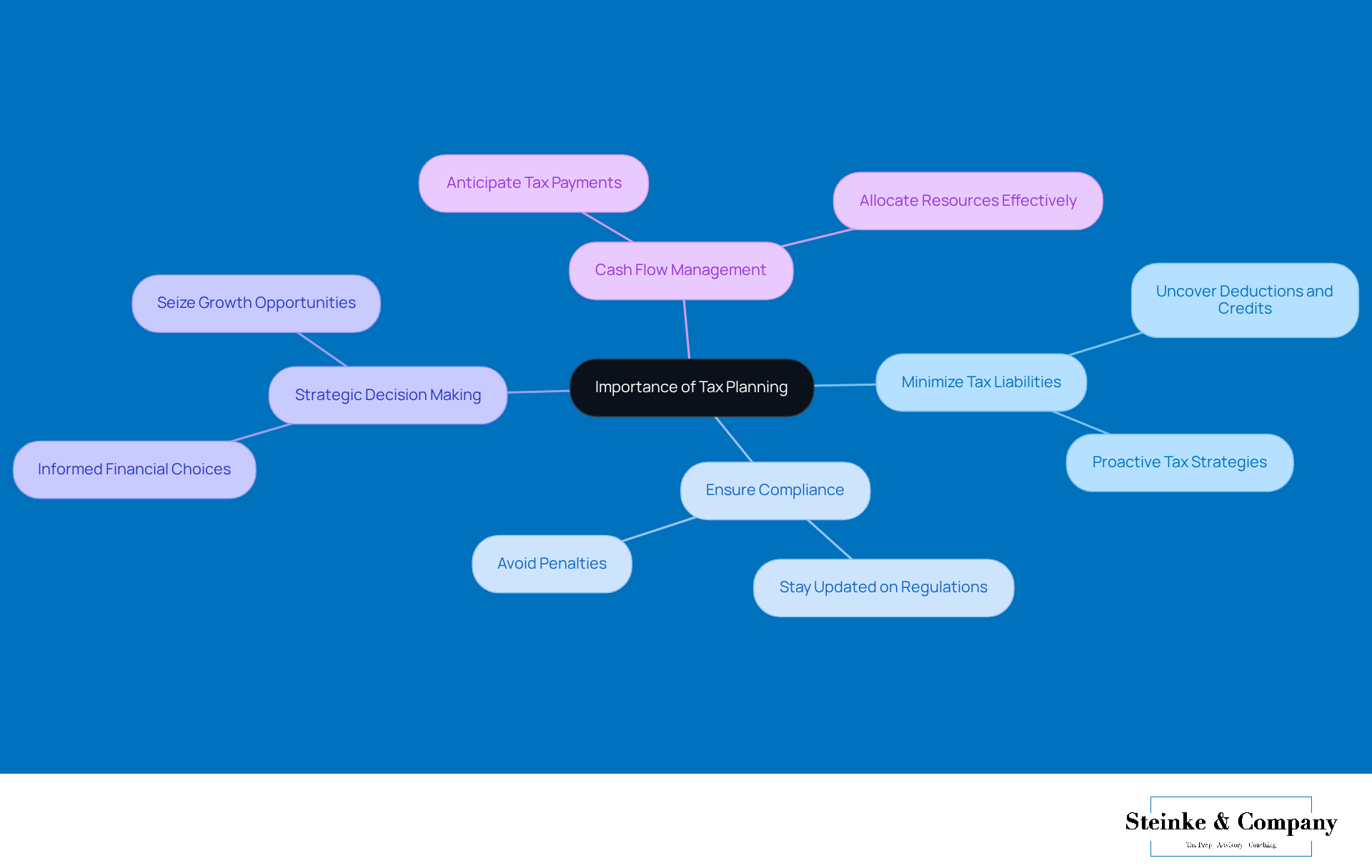

Understand the Importance of Tax Planning for Your Business

Tax organization is super important and an ongoing journey that really impacts your company's financial health. When you recognize its significance, you open the door to some fantastic benefits:

- Minimize Tax Liabilities: With smart tax planning, you can uncover deductions and credits that might lower your taxable income and save you a lot. For instance, small businesses that collaborate with a tax planning advisor to be proactive with their tax strategies can cut down their tax burden by spotting those missed deductions, which can add up to thousands of dollars each year!

- Ensure Compliance: Keeping up with tax regulations is key to staying compliant and avoiding those pesky penalties and legal troubles. If you don’t comply, the penalties can actually exceed the savings from deductions, which is why being proactive is a must.

- Strategic Decision Making: Knowing your tax obligations helps you make informed choices about investments, expansions, and other financial moves. Companies that weave the guidance of a tax planning advisor into their strategies are in a better spot to seize growth opportunities without getting hit with unexpected tax bills.

- Cash Flow Management: A solid tax strategy lets you anticipate tax payments, which means you can manage your cash flow better. By predicting your tax responsibilities, businesses can allocate resources more effectively, ensuring they have the funds ready when tax time rolls around.

In a nutshell, understanding the importance of tax management with the help of a tax planning advisor equips you with the tools to navigate the complexities of tax laws. This knowledge empowers you to make strategic decisions that enhance your company's long-term success. So, why not take a closer look at your tax strategy today?

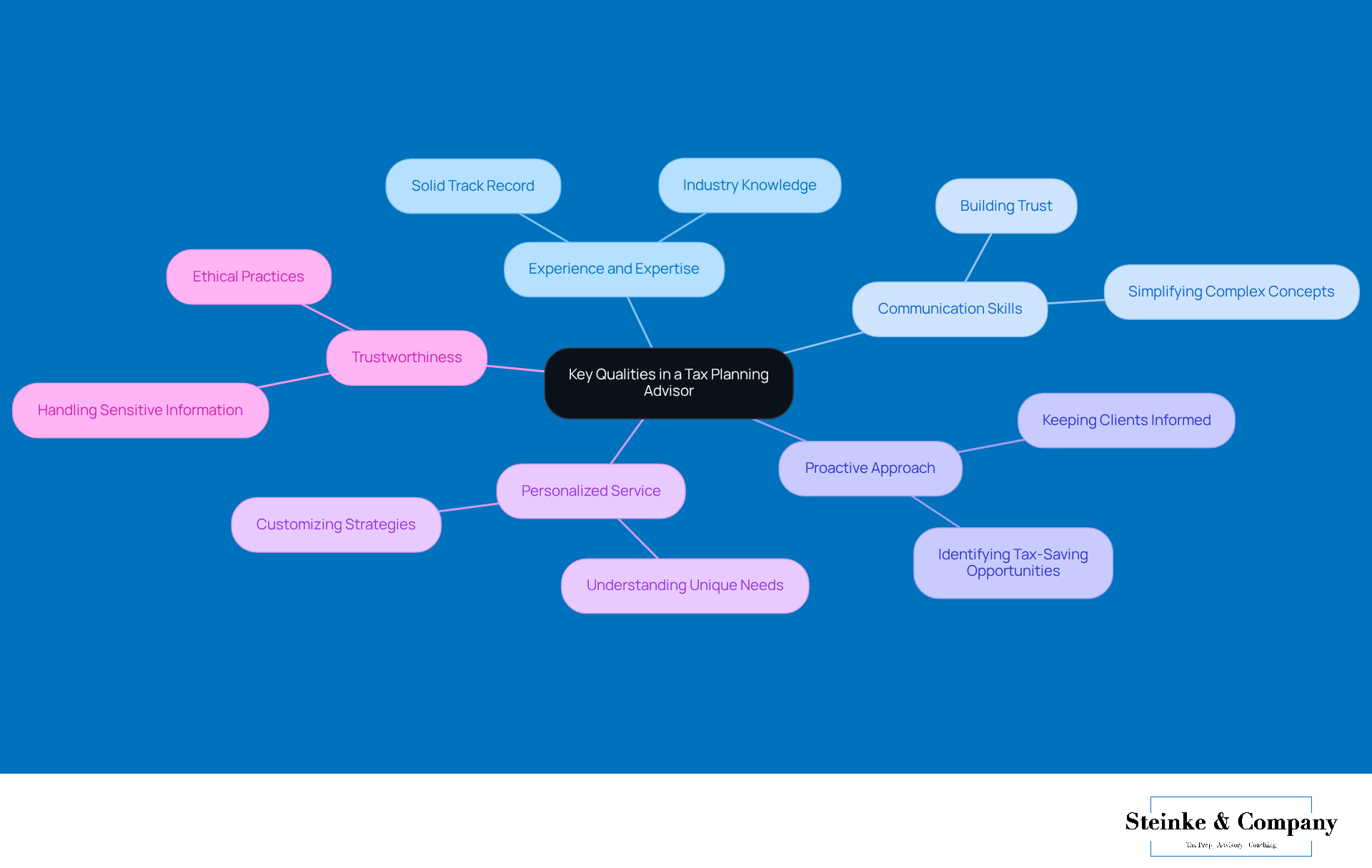

Identify Key Qualities in a Tax Planning Advisor

When you're on the hunt for a tax planning advisor, there are a few key qualities you definitely want to keep in mind:

- Experience and Expertise: Look for advisors who have a solid track record in tax planning, particularly for businesses like yours. Their experience can really make a difference in your tax strategy and compliance.

- Communication Skills: You want someone who can break down those complex tax concepts into bite-sized pieces, making sure you understand your options. Clear communication builds trust and helps ease any worries you might have about tax matters.

- Proactive Approach: Choose an advisor who’s always on the lookout for tax-saving opportunities and keeps you in the loop about changes in tax laws. This proactive mindset can lead to some serious savings and better financial management.

- Personalized Service: Your consultant should take the time to really get to know your business and its unique needs, customizing their services to fit your specific goals and challenges.

- Trustworthiness: Since tax strategy involves sensitive financial information, it’s crucial to work with someone you can trust to handle your data responsibly and ethically.

By focusing on these qualities, you'll narrow down your options and find a tax planning advisor who can provide the support you need for your tax planning. So, what are you waiting for? Start your search today!

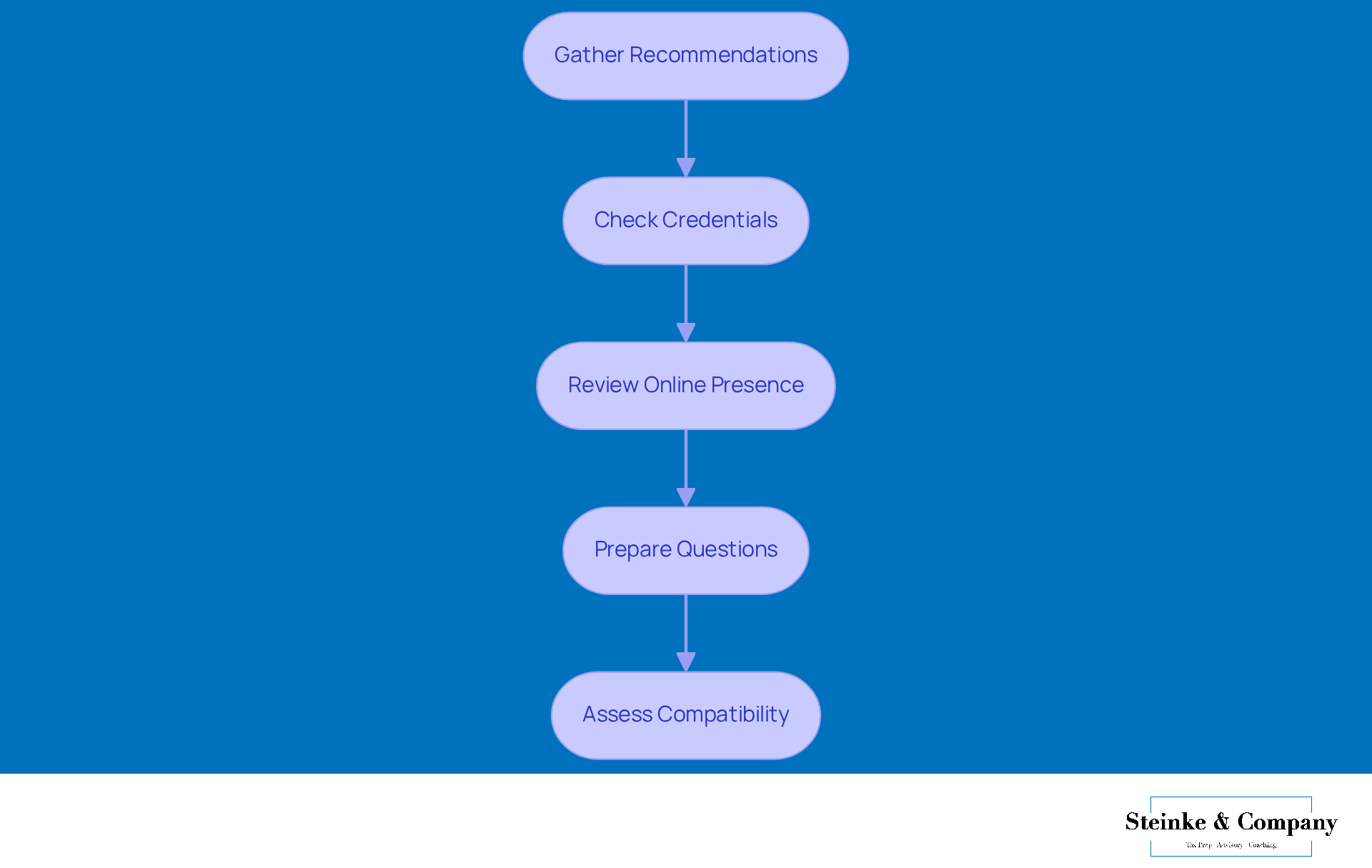

Research and Interview Potential Advisors

If you're looking to research and interview potential tax planning advisors, here are some essential steps to follow:

- Gather Recommendations: First things first, ask around! Reach out to fellow business owners, accountants, or financial consultants for referrals. Personal recommendations often offer valuable insights into a consultant's skills and trustworthiness.

- Check Credentials: Next up, take a moment to verify the consultant's qualifications. Look for certifications like CPA (Certified Public Accountant) or Enrolled Agent. These credentials are key—they show a professional level of expertise and commitment to industry standards. Fun fact: there are over 665,000 actively licensed CPAs in the U.S., which really highlights the strength of this profession.

- Review Online Presence: Now, let’s dive into the digital world. Check out the professional's online reputation by looking at reviews, testimonials, and case studies that showcase their expertise and client satisfaction. A solid online presence can give you confidence in their abilities and past successes.

- Prepare Questions: Before the interview, whip up a list of targeted questions. Focus on their experience, their strategy for tax management, and how they stay updated with tax regulations. This will help you and adaptability in the ever-changing tax landscape.

- Assess Compatibility: During the interview, pay attention to whether the consultant's communication style and values mesh well with your company's philosophy. A good fit in these areas can lead to a productive and trusting relationship.

By thoroughly investigating and chatting with potential consultants, you can make an informed choice that aligns with your goals and ensures effective tax management.

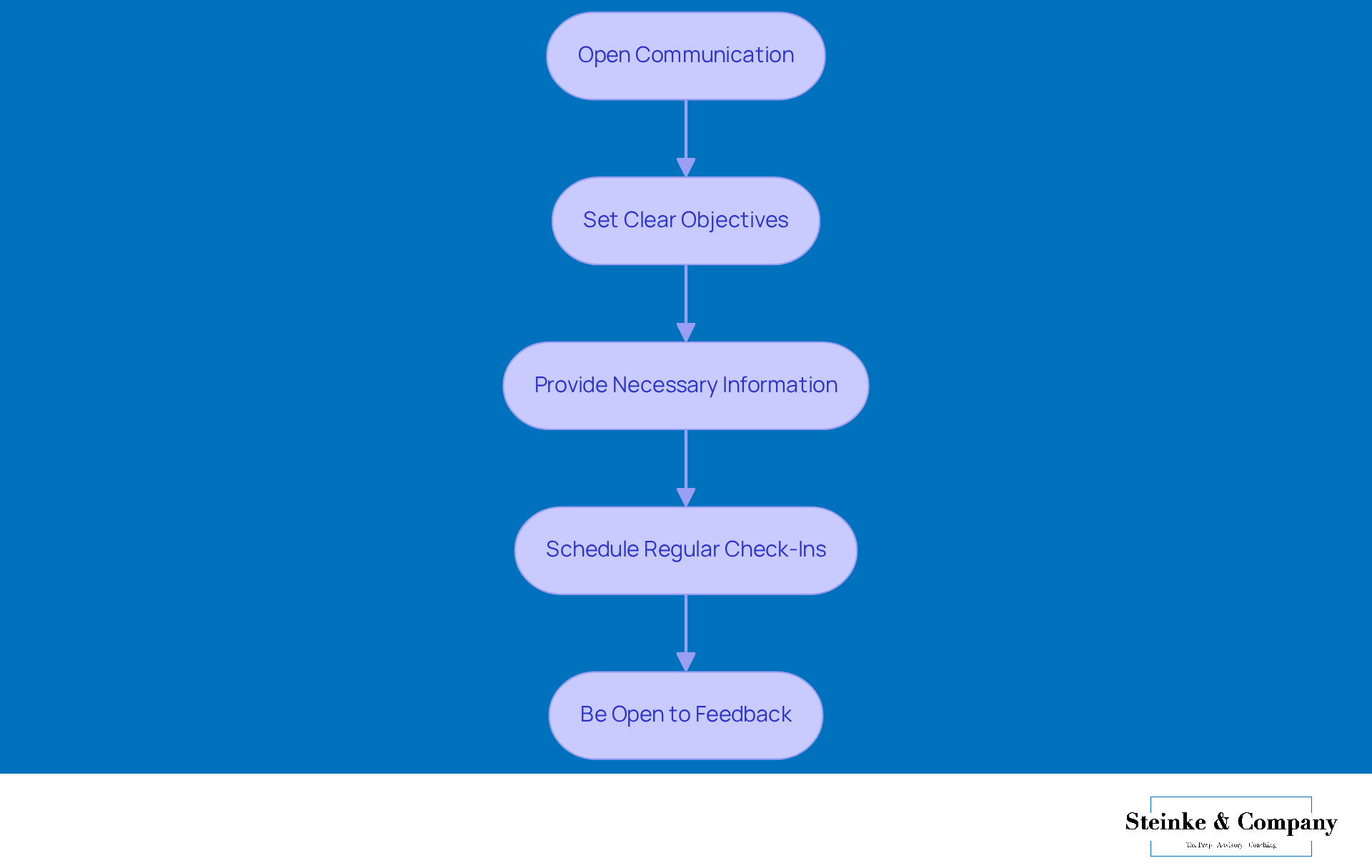

Establish a Collaborative Relationship with Your Advisor

Once you've chosen a tax planning advisor, it's important to focus on building a collaborative relationship.

- Open Communication: Regular chats are a must! Keeping the lines of communication open helps you discuss any changes in your business or tax situation. This ongoing dialogue ensures your tax strategies stay relevant and effective, adapting to the ever-evolving landscape of your business.

- Set Clear Objectives: Team up with your consultant to nail down specific tax-related goals. Whether you're looking to , ensure compliance, or plan for future growth, having clear objectives will steer your strategy in the right direction.

- Provide Necessary Information: Transparency is key here. Make sure to share all relevant financial information with your consultant so they can craft customized tax strategies that fit your unique circumstances.

- Schedule Regular Check-Ins: Establish a routine for check-ins to review your tax situation and tweak strategies as needed. Regular assessments can help spot missed opportunities and keep your approach effective.

- Be Open to Feedback: Listen actively to your mentor's recommendations and be willing to adjust your strategies based on their expertise. This openness fosters a productive partnership that can lead to better financial outcomes.

By nurturing a cooperative relationship with your tax advisor, you can significantly boost the effectiveness of your tax strategies, setting your business up for sustained financial success. Did you know that nearly 70% of high-net-worth clients prioritize reducing taxes? This highlights just how crucial effective communication and strategic planning are in reaching your financial goals.

Conclusion

Choosing the right tax planning advisor is super important for any business looking to boost its financial health. When you understand the value of tax planning, you can tap into a bunch of benefits—like lowering tax liabilities, staying compliant, and making smart strategic choices. A good advisor not only helps untangle the complexities of tax regulations but also plays a big role in your business's long-term success.

In this article, we shared some key insights on what to look for in a tax planning advisor. Think experience, communication skills, and a proactive mindset. We also talked about the process of researching and interviewing potential advisors. It’s all about gathering recommendations, checking credentials, and making sure you’re a good fit. Plus, building a collaborative relationship with your chosen advisor is crucial for ongoing success, keeping your tax strategies relevant and effective.

To wrap things up, the impact of smart tax planning on business growth is huge! By taking the time to find the right advisor and nurturing a strong working relationship, you can not only navigate the tricky waters of tax laws but also set yourself up for lasting financial success. Embracing proactive tax strategies and keeping the lines of communication open will empower you to grab opportunities and reduce risks, ultimately paving the way for a bright and prosperous future.

Frequently Asked Questions

Why is tax planning important for businesses?

Tax planning is crucial for businesses as it impacts their financial health by minimizing tax liabilities, ensuring compliance with regulations, aiding in strategic decision-making, and improving cash flow management.

How can tax planning minimize tax liabilities?

Smart tax planning helps uncover deductions and credits that can lower taxable income, potentially saving businesses thousands of dollars each year when they work with a tax planning advisor.

What are the compliance benefits of tax planning?

Effective tax planning ensures that businesses stay compliant with tax regulations, helping them avoid penalties and legal issues that could exceed the savings from deductions.

How does tax planning assist in strategic decision-making?

By understanding tax obligations, businesses can make informed choices regarding investments, expansions, and other financial decisions, allowing them to seize growth opportunities without facing unexpected tax bills.

In what way does tax planning improve cash flow management?

A solid tax strategy helps businesses anticipate tax payments, enabling better cash flow management by allowing them to allocate resources effectively and ensure funds are available when tax payments are due.

What role does a tax planning advisor play in a business's tax strategy?

A tax planning advisor provides guidance to navigate complex tax laws, helping businesses identify opportunities for savings and make strategic decisions that contribute to long-term success.