Overview

This article dives into the key steps that small business owners should take to get a handle on Pass-Through Entity Tax (PTET). It’s all about how PTET can really lighten your tax load and make filing a breeze! But here’s the catch: it’s super important to keep yourself updated on the specific rules in your state and chat with tax pros. They can help you make the most of your financial strategies. So, ready to tackle PTET and make your tax season smoother?

Introduction

Navigating the complex world of small business taxation can often feel overwhelming, right? With tax regulations constantly changing, it’s no wonder many business owners find themselves scratching their heads. But here’s something that could be a game changer: the Pass-Through Entity Tax (PTET). This nifty strategy allows certain businesses to pay taxes at the entity level, sidestepping the federal SALT deduction cap limitations.

In this article, we’ll explore the essential steps small business owners can take to master PTET. We’ll dive into its benefits, eligibility requirements, and implementation strategies. But remember, with potential savings come challenges—how can business owners effectively balance these to optimize their tax planning? Let’s find out together!

Define Pass-Through Entity Tax (PTET) and Its Importance for Small Businesses

The ptet tax is a smart tax strategy that allows certain organizations, including partnerships and S corporations, to pay local taxes at the entity level instead of passing those responsibilities on to individual owners. This can be a game-changer for small businesses, especially with the $10,000 cap on state and local tax (SALT) deductions imposed by federal tax law. By opting for the PTET tax, business owners can significantly reduce their overall tax burden, simplify their tax filing process, and improve cash flow management.

For instance, businesses that have jumped on board with this program often report greater deductions, with some owners noticing a drop in their taxable income by as much as $14,000! This not only eases immediate tax pressures but also supports . Plus, choosing this election can lead to a federal tax credit for state taxes paid, which helps lower the overall tax load. Just remember, to snag that credit, owners need to report these state taxes on their individual tax returns.

As the tax landscape evolves, understanding the ptet tax is crucial for small businesses looking to navigate their tax obligations effectively and reap the benefits available. Recent discussions among tax pros underscore the importance of the ptet tax strategy for small enterprises, emphasizing that it should definitely be on the radar for tax planning in 2025 and beyond. So, have you considered how PTET might work for your business?

Outline Eligibility Requirements and Election Process for PTET

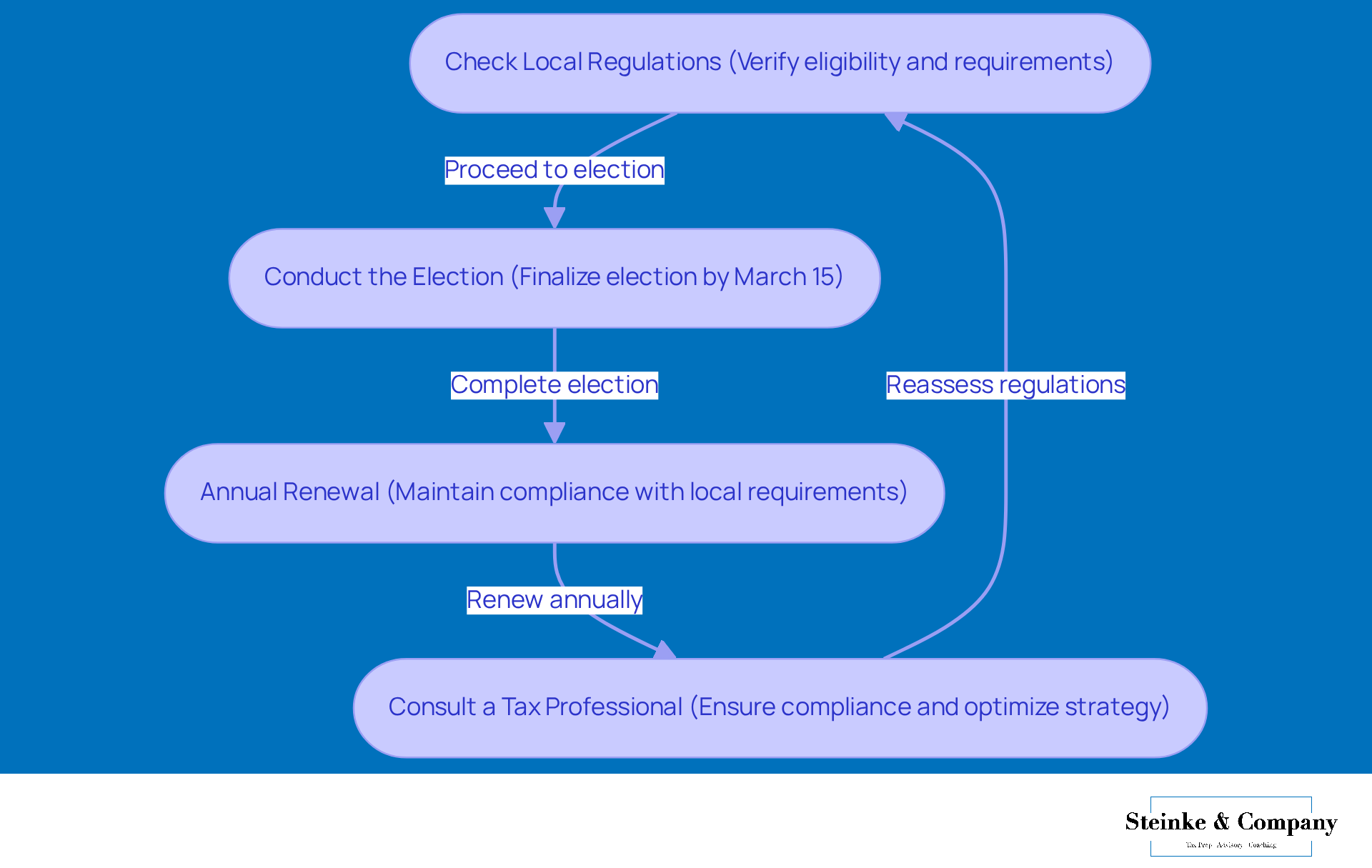

To qualify for the , your business typically needs to be structured as a partnership or an S corporation and operate in a jurisdiction that provides this tax option. The election process typically includes a few key steps:

- Check Local Regulations: First, see if your area allows this program and get to know the specific eligibility requirements.

- Conduct the Election: Most places will want you to finalize the election by a certain deadline, often March 15 of the tax year. You can usually handle this through the tax authority's website or by sending in a particular form.

- Annual Renewal: Some regions ask for an annual renewal of the election, so it's important to keep up with your area's requirements.

- [Consult a Tax Professional](https://steinkeandcompany.com): Given the complexities involved, chatting with a tax professional can really help ensure you’re compliant and making the most of your tax strategy.

As of 2025, many regions have introduced alternatives to ptet tax, which can provide significant tax savings for small businesses. For instance, companies that navigate the election process smoothly can dodge double taxation and take advantage of state-level deductions. Plus, working with tax specialists can further enhance the strategic benefits of the tax election, helping owners maximize their tax perks while staying compliant with local rules.

Evaluate Benefits and Challenges of Electing PTET

Choosing the Pass-Through Entity Tax (PTET) can be a game-changer for [small business owners](https://blog.steinkeandcompany.com/are-hsa-contributions-deductible-key-insights-for-small-business-owners), and here’s why:

- Tax Savings: By deciding to pay state taxes at the entity level, business owners can dodge that pesky SALT deduction cap, which has been a real headache for high earners. This smart move can lead to a .

- Simplified Filing: The program makes filing a breeze! Companies can report taxes at the entity level instead of on individual returns, cutting down the complexity and time spent on tax prep.

- Cash Flow Management: Paying taxes at the entity level can boost cash flow for owners. They might not need to stash away as much for personal [tax obligations](https://blog.steinkeandcompany.com/4-steps-to-choose-the-right-tax-planning-advisor-for-your-business), freeing up resources to better distribute within the organization.

But, hold on—there are some challenges to keep in mind:

- State-Specific Regulations: Each state has its own rules about PTET, which can make compliance a bit tricky. Business owners need to stay in the loop about these variations to avoid any potential pitfalls.

- Increased [Administrative Burden](https://blog.steinkeandcompany.com/10-essential-questions-for-hiring-a-tax-associate): Implementing the program might mean more paperwork and filing duties, requiring extra time and resources from small business owners.

- Potential Cash Flow Implications: Depending on the organization’s income, the upfront tax payment required by the program could put a strain on cash flow, especially for smaller entities that often run on tight margins.

As small businesses navigate these complexities in 2025, it’s crucial to find the right balance between the benefits and challenges of this tax structure for effective tax planning and financial management. So, what do you think? Are you ready to dive into the world of PTET?

Implement PTET in Your Tax Planning Strategy

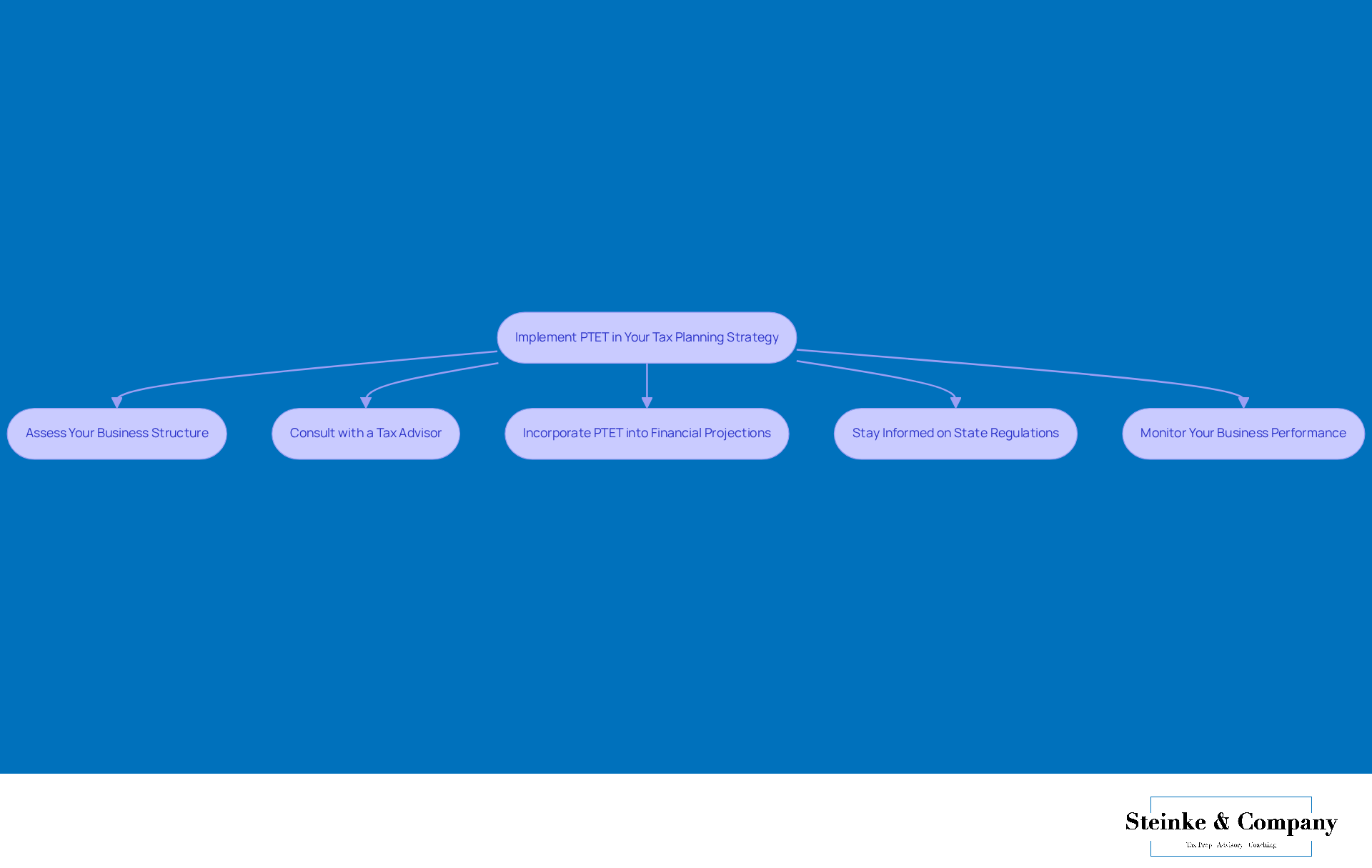

To effectively weave the [Pass-Through Entity Tax](https://harness.co/articles/ptet-guide-tax-savings-small-business) (PTET) into your tax planning strategy, let’s break it down into some essential steps that make it easy to follow:

- Assess Your Business Structure: First things first, take a good look at your business structure. Does it qualify for the program based on your state’s specific regulations? This is a crucial starting point.

- [Consult with a Tax Advisor](https://steinkeandcompany.com): Next up, it’s a smart move to chat with a tax professional. They can help you analyze the potential tax savings and implications of opting for this elective ptet tax program tailored to your unique situation. Seriously, upgrading to a qualified tax advisor is highly recommended for your current tax planning needs.

- Incorporate Pass-Through Entity Tax into Financial Projections: Don’t forget to adjust your financial forecasts! Make sure they reflect the [tax implications of electing this option](https://forbes.com/sites/davidrae/2025/02/25/ptet-tax-strategy-2025-deadline-coming-for-california-business-owners), including any anticipated changes in cash flow. Keep in mind that the [SALT cap limits deductions](https://mgocpa.com/perspective/salt-cap-ptet-tax-strategy-2025) to $10,000, which could significantly increase your federal tax obligations. This strategy could really pay off!

- Stay Informed on State Regulations: It’s also important to stay on top of state tax laws and related regulations. This helps you ensure compliance and enhances your tax strategy. Understanding state-specific is key to avoiding any compliance issues.

- Monitor Your Business Performance: Lastly, regularly keep an eye on your business income and expenses. This will help you evaluate the ongoing benefits of ptet tax and make any necessary adjustments. Plus, managing your estimated tax payments is essential to dodge underpayment penalties. By grasping IRS requirements and utilizing strategies like safe harbor payments and the de minimis exception, you can effectively manage your tax liability throughout the year. And don’t forget to mark those specific payment deadlines, like the June 15 deadline for California, to keep your tax obligations in check.

Conclusion

Understanding and leveraging the Pass-Through Entity Tax (PTET) can be a game-changer for small business owners looking to optimize their tax liabilities. By opting to pay taxes at the entity level, businesses can sidestep the limitations of the SALT deduction cap, which can ultimately lighten their overall tax burden and improve cash flow management. This approach not only makes tax filing easier but also opens up possibilities for federal tax credits, making it an attractive option for savvy entrepreneurs.

Throughout this article, we’ve shared some key insights about the eligibility requirements and the election process for PTET. It’s super important to consult with tax professionals to ensure compliance and maximize those benefits. We discussed the perks—like significant tax savings and simplified filing—as well as the challenges, such as state-specific regulations and the potential for more administrative work. Recognizing these factors is essential for small business owners as they navigate the complexities of tax planning.

Given the ever-changing tax landscape, it’s crucial for small business owners to actively think about integrating PTET into their financial strategies. Staying in the loop about local regulations, chatting with tax advisors, and keeping an eye on business performance are all vital steps for effective implementation. Embracing the PTET approach can empower small businesses to take charge of their tax obligations, leading to better financial management and long-term growth. So, why wait? Consider how PTET can work for your business and set the stage for a more secure financial future.

Frequently Asked Questions

What is Pass-Through Entity Tax (PTET)?

PTET is a tax strategy that allows certain organizations, such as partnerships and S corporations, to pay local taxes at the entity level instead of passing those responsibilities on to individual owners.

Why is PTET important for small businesses?

PTET is important for small businesses because it can significantly reduce their overall tax burden, simplify the tax filing process, and improve cash flow management, especially in light of the $10,000 cap on state and local tax (SALT) deductions imposed by federal tax law.

How can PTET affect a business's taxable income?

Businesses that utilize PTET often report greater deductions, with some owners experiencing a reduction in their taxable income by as much as $14,000, which can ease immediate tax pressures and support long-term financial planning.

Does choosing PTET provide any additional tax benefits?

Yes, opting for PTET can lead to a federal tax credit for state taxes paid, which helps lower the overall tax load. However, owners need to report these state taxes on their individual tax returns to receive the credit.

Why should small businesses consider PTET in their tax planning?

Understanding PTET is crucial for small businesses as it can help them navigate their tax obligations effectively and take advantage of available benefits, making it an important consideration for tax planning in 2025 and beyond.