Overview

The article titled "10 Essential Tax Advice Tips for Small Agency Owners" is all about giving practical tax advice designed just for small agency owners. It aims to help you navigate the tricky world of taxes and reduce your liabilities along the way. You'll find that:

- Strategic tax planning

- Regular financial check-ins

- Keeping accurate records

- Consulting with tax pros

are all super important. These tips are key to optimizing your tax outcomes and staying compliant with those ever-changing tax regulations.

So, whether you’re feeling overwhelmed or just looking to sharpen your tax strategy, this article has got you covered! Let’s dive into these tips and make tax season a little less daunting together.

Introduction

Navigating the intricate world of taxes can feel overwhelming for small agency owners, especially with the constant changes in regulations. But here's the good news: understanding essential tax advice is key to unlocking potential savings and avoiding compliance pitfalls.

So, what strategies can you implement to minimize your tax liabilities and maximize deductions while staying compliant with the latest laws? In this article, we'll explore ten invaluable tax tips that not only simplify complex regulations but also empower you to take control of your financial future.

Steinke and Company: Expert Tax Compliance Services for Small Businesses

Since 1974, Steinke and Company has been a cornerstone for micro and minor enterprises, providing tax advice and preparation services. Their dedicated team of Enrolled Agents and CPAs provides customized support and tax advice, helping agency owners skillfully navigate the complexities of tax regulations. They even offer essential strategies to avoid those pesky underpayment penalties on estimated taxes. By focusing on service-oriented businesses with annual revenues from $0 to $10 million, they blend expertise that reduces tax liabilities while ensuring compliance with legal requirements.

Understanding the ins and outs of is crucial for agency owners, especially with the IRS's recent hike in the interest rate for underpayments to 8% annually, compounded daily. Steinke and Company really emphasizes proactive tax advice services, guiding clients through these challenges. They offer specific strategies like safe harbor payments and the de minimis exception, which are key to dodging penalties. Plus, with recent updates in tax regulations, including changes to personal income tax brackets, it’s clear that having expert tax advice is vital for achieving financial success.

With tailored tax advice and round-the-clock access through their client portal, email, and phone, agency owners can tackle their tax responsibilities with confidence. This support lets them focus on growth and operational efficiency, thanks to services like strategy consulting and monthly accounting. So, why not take a moment to reflect on how your tax planning could benefit from a little expert help? It might just be the boost your business needs to thrive!

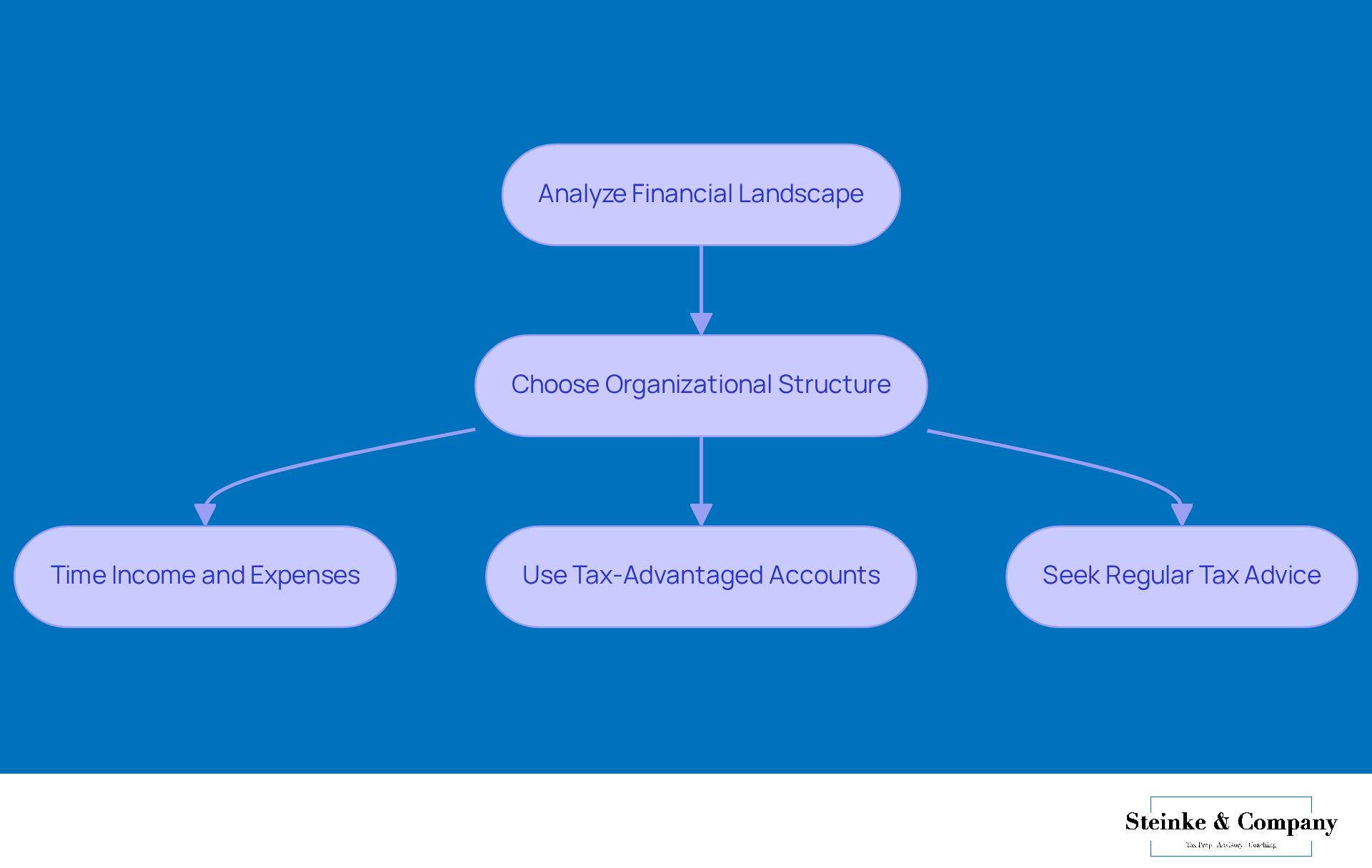

Implement Strategic Tax Planning to Minimize Liabilities

Hey there, small agency owners! Effective strategic tax advice is super important if you want to minimize those pesky tax liabilities. So, what does this process involve? Well, it starts with a good look at your company's financial landscape to spot some sweet . Think about choosing the right organizational structure—this can really pay off in terms of tax benefits. And don’t forget about timing your income and expenses just right to make the most of your tax outcomes. Using tax-advantaged accounts is another smart way to lower your taxable income.

Now, let’s talk about why regular chats with tax professionals to get tax advice are a must. With all the recent changes in tax laws, like new capital gains inclusion rates and the need for estimated tax payments, it’s crucial to stay in the loop. Being informed means you can tweak your tax strategy and seek tax advice when needed.

You know what’s trending? Small agency owners are really getting into proactive tax advice planning! By taking a good, hard look at their tax strategies and implementing effective tax advice, many companies are slashing their tax obligations. For instance, a marketing agency that revamped its operations to snag some specific tax credits managed to cut its overall tax burden by 20%. How cool is that? It just goes to show the real benefits of strategic planning.

To keep those tax liabilities down, consider seeking tax advice and making regular assessments of your business operations. This practice not only helps you spot missed opportunities but also ensures you’re making the most of all available deductions and credits. By adopting a forward-thinking approach to tax planning, you can boost your financial stability and set the stage for long-term growth. So, what are you waiting for? Let’s get planning!

Maximize Tax Deductions: Identify Eligible Expenses

If you want to make the most of your tax deductions, it’s a good idea for agency owners to put together a solid list of eligible expenses. You might be surprised at what you can deduct! Common deductions include:

- Office supplies like pens, paper, and stationery

- Travel costs, which cover everything from transportation to lodging and meals

- Marketing expenses for ads and promotional materials

- Home office costs, based on how much of your home you use for work

Keeping track of your records and receipts throughout the year is super important. It makes claiming those deductions during tax season a whole lot easier! And hey, don’t forget about the benefits of chatting with a tax professional regarding tax advice. They can provide regarding specific deductions that fit your industry, helping you snag every possible savings. As one accountant wisely put it, "Utilizing all the available deductions is essential for all business owners—just ensure you comprehend which ones are relevant to you and how they function." So, are you ready to dive into those deductions?

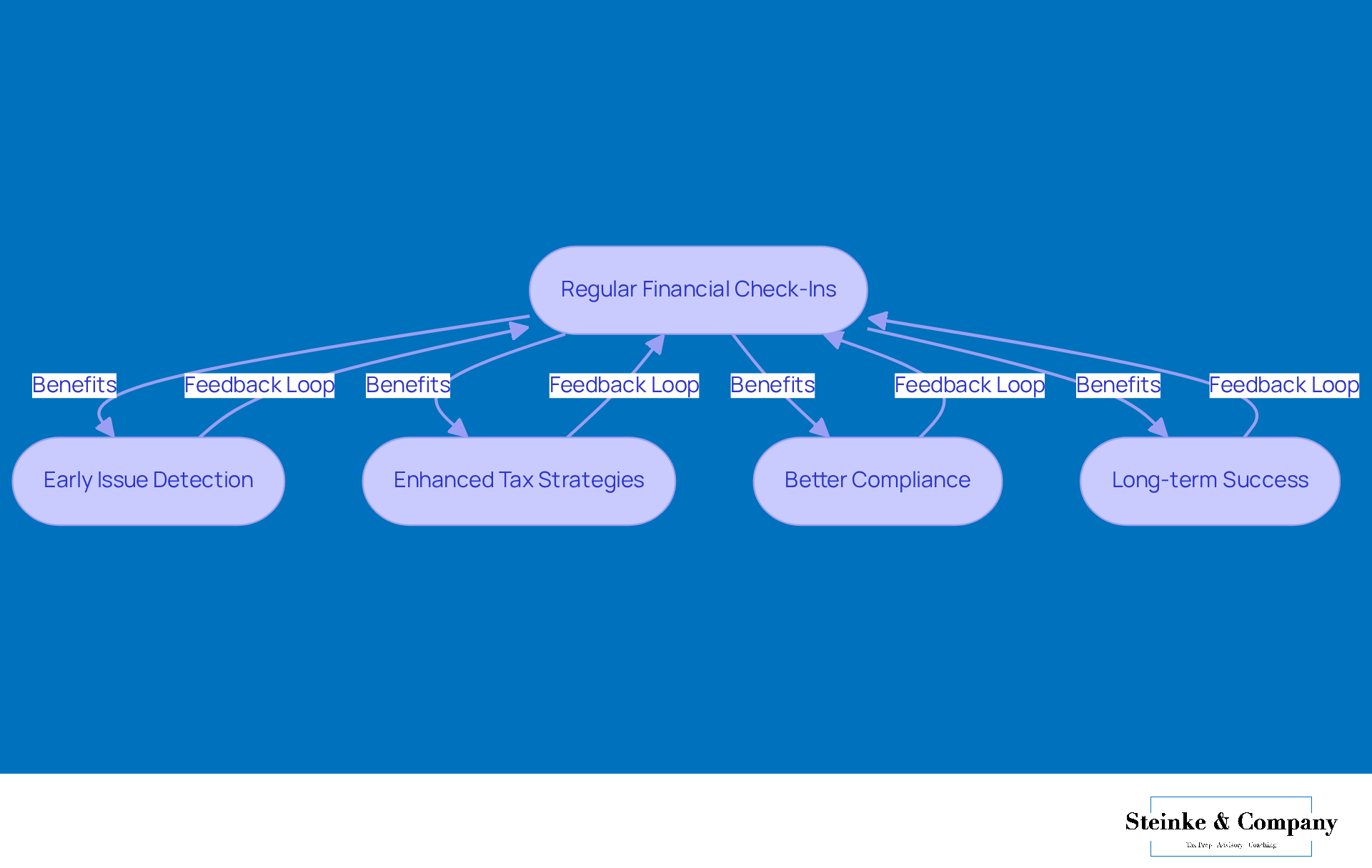

Conduct Regular Financial Check-Ins to Stay Compliant

Regular check-ins with your accountant or advisor are super important for obtaining tax advice and keeping up with tax regulations. In 2025, small agency owners are really encouraged to do these reviews often. Why? Because they give you a chance to keep an eye on your economic health. This helps you spot any discrepancies or potential issues early on, so you can tackle them before they become bigger problems.

Plus, these regular reviews can really enhance your tax advice strategies. By staying informed about your financial situation, you can prepare better for upcoming tax obligations and seek tax advice to avoid those last-minute surprises during tax season. Companies that regularly assess their finances often benefit from better tax results and can gain valuable tax advice that leads to reduced obligations.

Take a look at the case studies, and you’ll find that businesses benefiting from regular monetary evaluations have successfully navigated tricky tax environments thanks to sound tax advice. They ensure compliance while optimizing their economic strategies. As one advisor puts it, "Monitoring your business health through regular check-ins is not merely about compliance; it's about enabling your business to flourish in a competitive environment." This holistic approach to managing resources not only protects against compliance issues but also sets up small agency owners for long-term success.

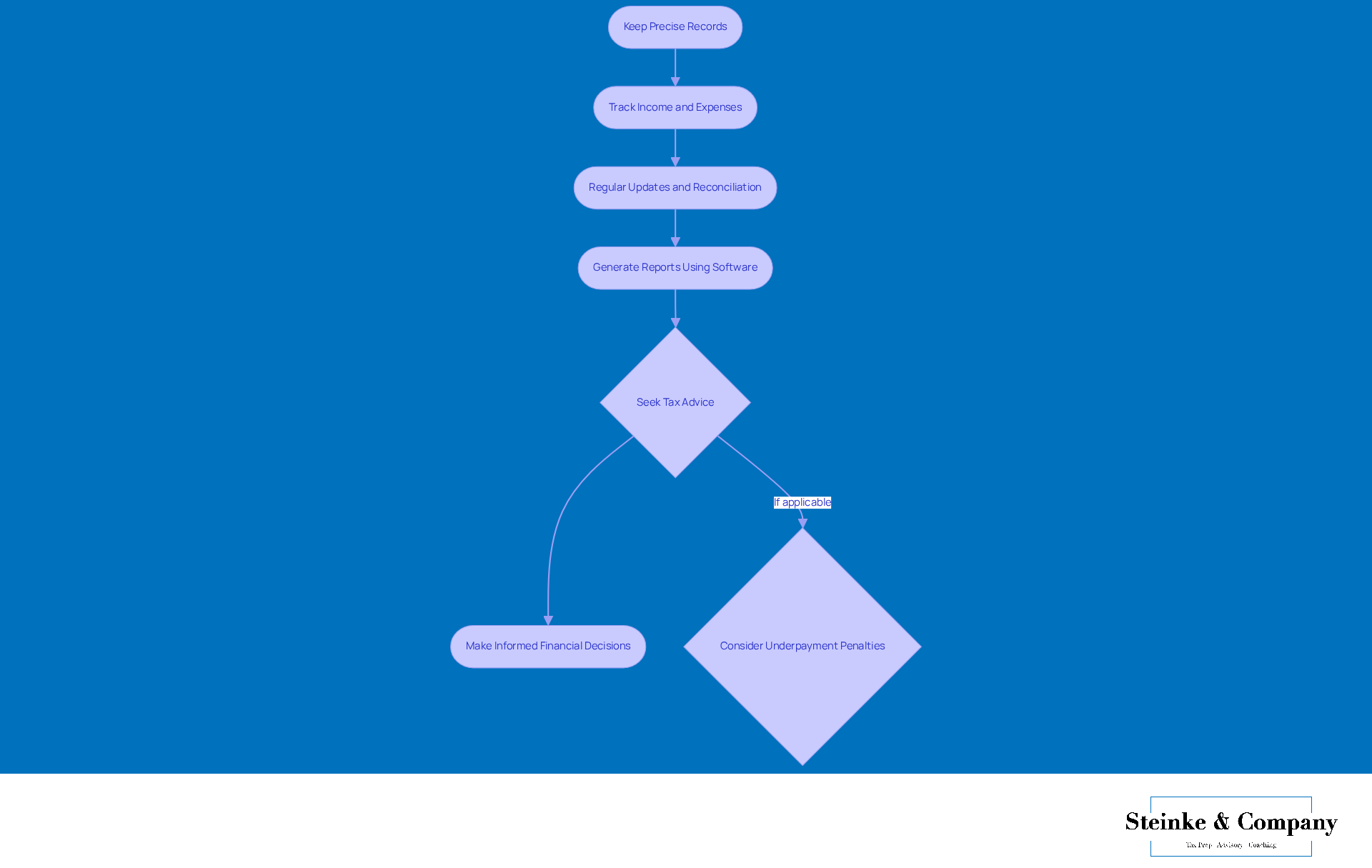

Maintain Accurate Financial Records for Seamless Tax Preparation

Keeping precise records is super important for receiving accurate tax advice and making tax prep a breeze. This means you need to keep a close eye on your income, expenses, and all those important money transactions throughout the year to prepare for tax advice. Have you thought about underpayment penalties? It’s crucial for business owners to obtain tax advice to ensure they pay at least 90% of their current year's tax bill or 100% of last year's tax to avoid those pesky IRS fees. Using can really help here; it makes generating reports easy and simplifies the whole tax filing process.

Regularly updating your accounts and reconciling them ensures all the necessary paperwork is ready when you need tax advice during tax season. This not only makes your tax prep efforts more efficient but also reduces last-minute stress when seeking tax advice. And with the recent cuts in COVID-19 tax benefits, it’s a good idea to seek tax advice and rethink your financial strategies to soften any potential impacts on your tax refunds.

By keeping your records accurate, small businesses can not only stay compliant with tax laws but also benefit from valuable tax advice regarding their financial health. This way, you can make informed decisions that benefit your business. So, how’s your record-keeping going? Let’s make sure you’re all set to receive tax advice for tax season!

Leverage Tax Software for Efficient Filing and Compliance

Using tax software really boosts the efficiency of filing your taxes and offers to help you stay on top of regulations. A lot of these programs come packed with handy features like automated calculations, e-filing options, and timely reminders for important deadlines. For example, during the 2025 tax-filing season, a whopping 93% of individual income tax returns were filed electronically. This shows a clear trend towards digital solutions that make compliance a breeze!

By jumping on the tax software bandwagon, agency owners can cut down on errors and save precious time during the hectic tax season. Plus, these programs often give you access to a treasure trove of tax resources and tax advice, which really simplifies the whole process. Tax pros highlight that automated filing not only speeds up submitting returns but also enhances the quality of tax advice by boosting accuracy. This means agency owners can spend more time focusing on their core business activities instead of getting bogged down in tax complexities.

In 2025, the perks of tax software are more apparent than ever, enabling agency owners to tackle the ins and outs of tax compliance with newfound confidence and ease. So, why not give it a try and see how it can make your life easier?

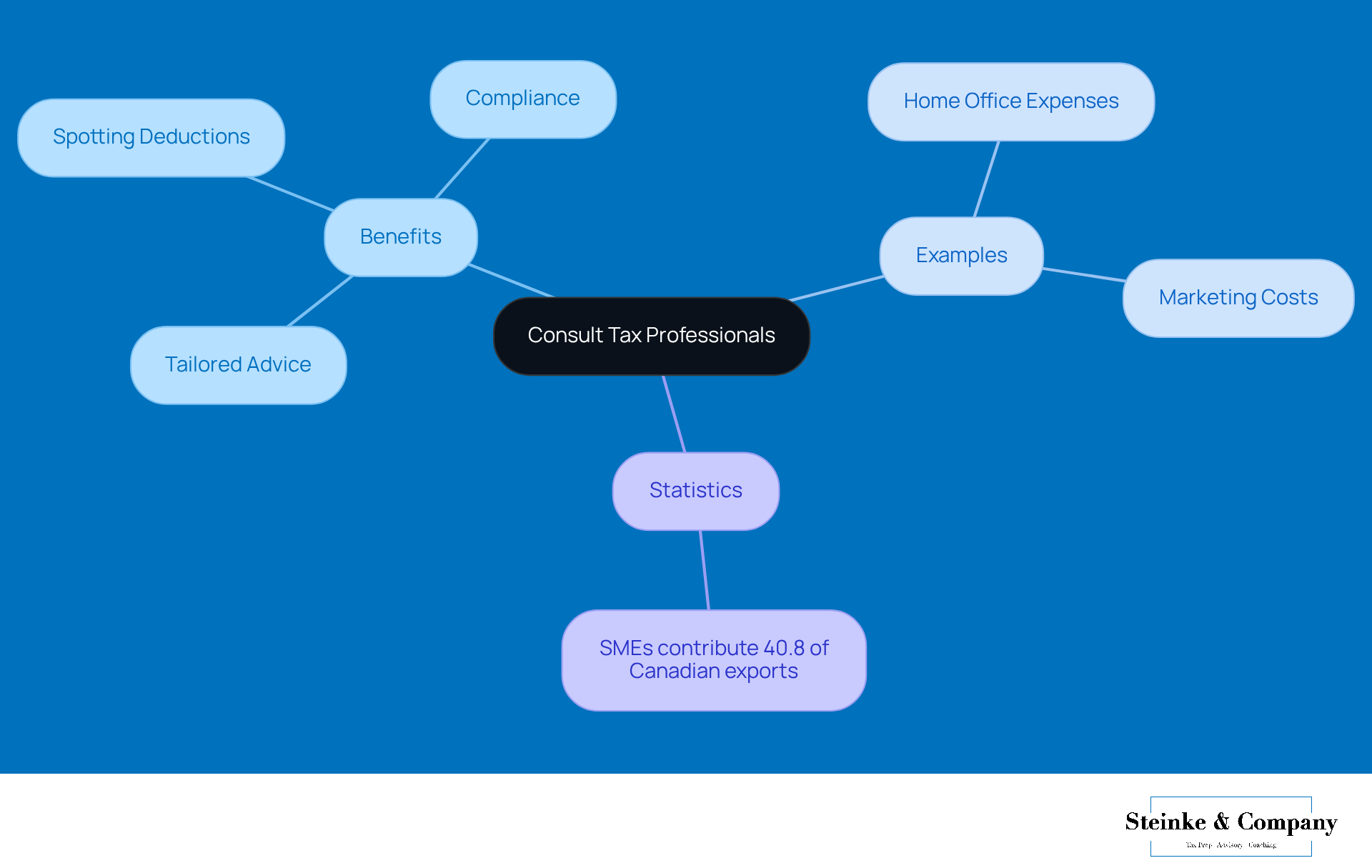

Consult Tax Professionals for Tailored Advice and Insights

Teaming up with tax experts is super important for agency owners who want to enhance their tax strategies through quality tax advice. These specialists provide tailored tax advice that fits specific models, helping you spot deductions, credits, and strategies that can really cut down on your tax bills.

For instance, small businesses can take advantage of various tax deductions, like home office expenses and marketing costs, which might be fully or partially deductible depending on how they're used. Regular check-ins not only keep agency owners in the loop about changing tax laws but also ensure compliance, giving you the confidence to tackle any complexities that come your way.

Did you know that in 2022, small and medium-sized enterprises (SMEs) made up 40.8% of the total value of Canadian exports? This really highlights how crucial is for boosting performance.

By leveraging customized tax advice, agency owners can implement strategies that not only reduce their tax burden but also encourage long-term growth and sustainability. So, why not start the conversation with a tax expert today?

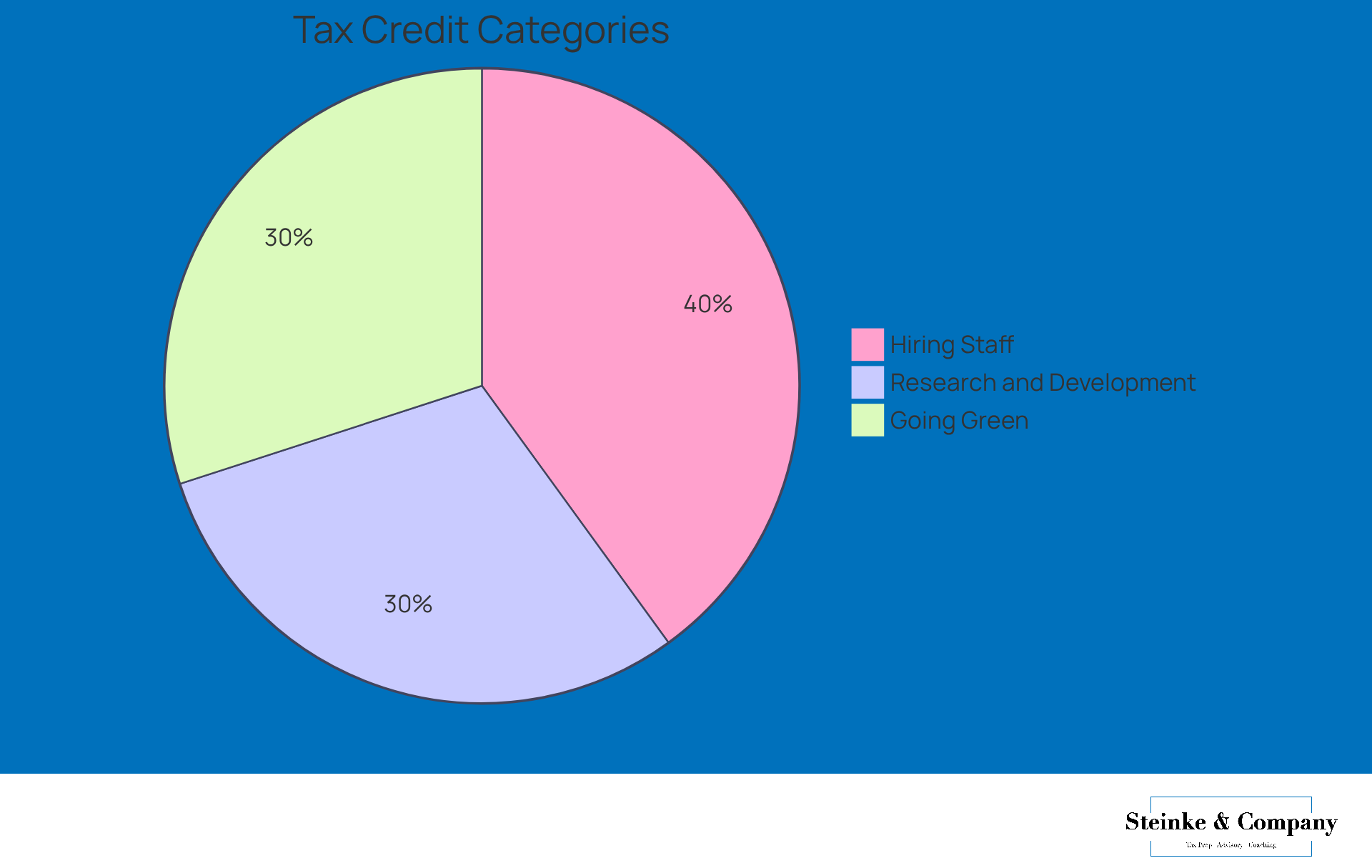

Explore Available Tax Credits to Reduce Your Tax Burden

Have you ever thought about how investigating available tax credits could be a game-changer for agency owners looking to lighten their tax load? It turns out that nearly 80% of small businesses might just qualify for a variety of federal and provincial tax incentives. These incentives can be for:

- Hiring staff

- Diving into research and development

- Going green with environmentally friendly technologies

By keeping yourself in the loop about these opportunities and knowing the eligibility criteria, you can unlock some serious savings!

For example, companies that have taken advantage of tax credits for employee training have seen their overall tax liabilities drop by as much as 30%. Pretty impressive, right? That’s why chatting with a tax expert for tax advice is a smart move. They can offer tax advice to help you pinpoint specific credits that are relevant to your business and ensure you meet all the requirements. This way, you can and really make the most of what’s out there!

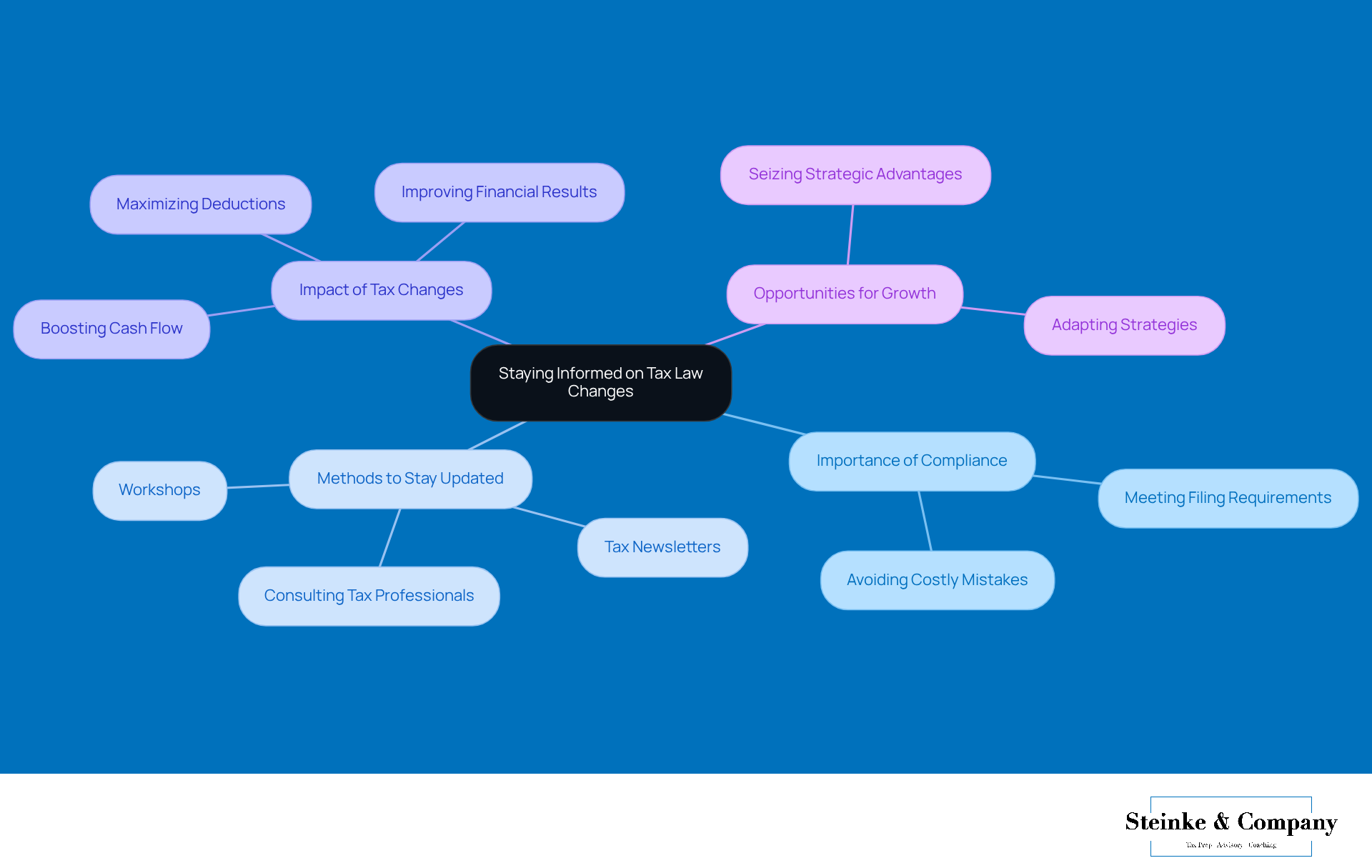

Stay Informed on Tax Law Changes Affecting Your Business

For small agency owners, staying in the loop about tax law changes is super important for keeping things compliant and optimizing their tax advice. Tax laws change all the time, and these updates can really impact deductions, credits, and filing requirements. So, how can you stay current? Engaging with tax newsletters, joining workshops, and chatting with tax pros are all great ways to keep up with what’s relevant. This not only helps you adapt your strategies but also cuts down on the risk of costly mistakes.

The impact of tax law changes can be huge. Just think about it: companies that have successfully navigated recent tax updates often report better financial results. By tweaking their tax strategies in response to new regulations, these businesses have managed to maximize deductions and boost cash flow.

Tax professionals often stress that understanding these changes isn’t just about compliance; it’s also about seizing opportunities for growth through tax advice. As one expert put it, "Small businesses that proactively adapt to tax law changes can turn potential challenges into strategic advantages."

So, in a nutshell, by prioritizing tax education and staying alert to legislative changes, agency owners can set themselves up for success in this ever-evolving economic landscape. What steps are you taking to stay informed?

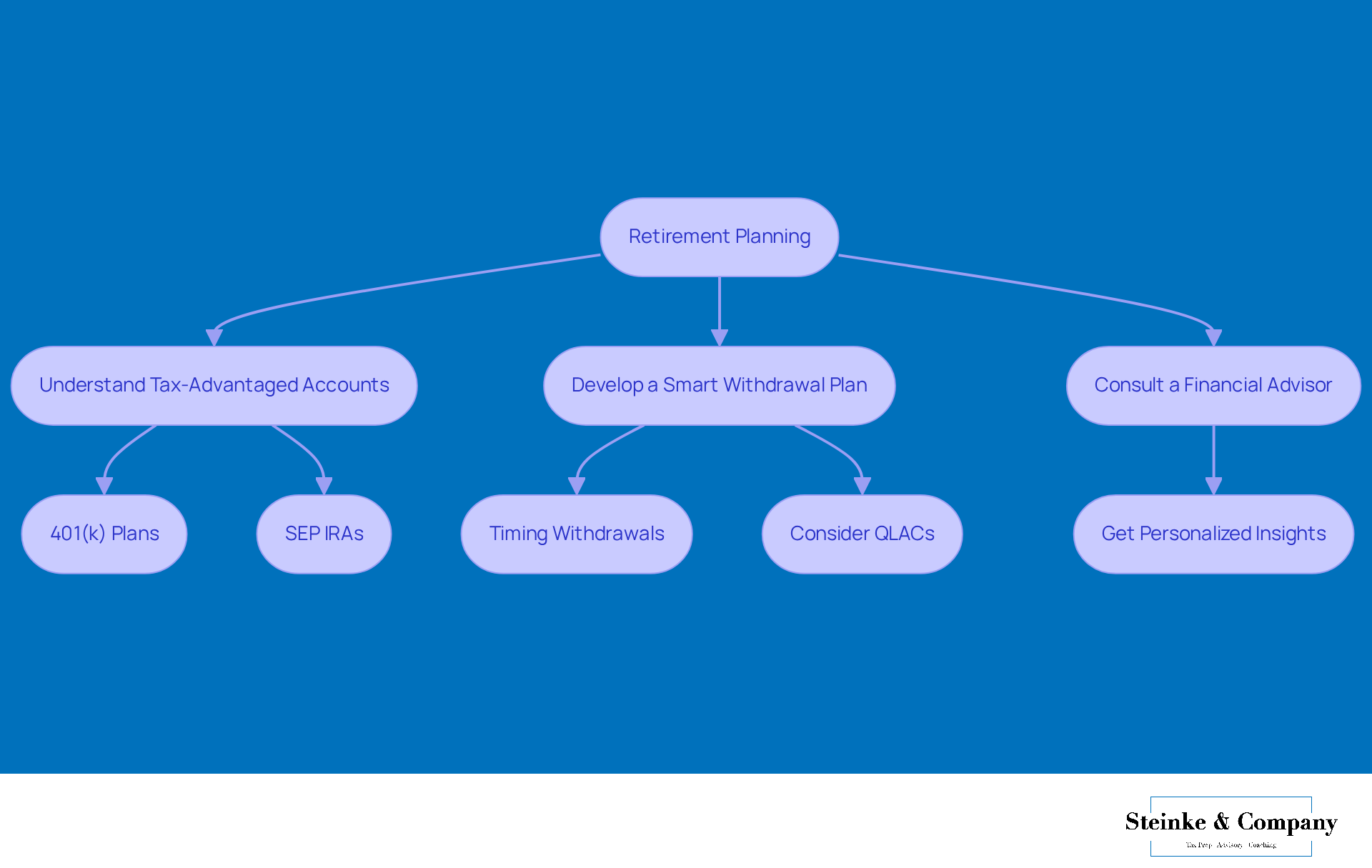

Plan for Retirement: Understand Tax Implications and Strategies

Effective retirement planning for agency owners really hinges on understanding the tax advice related to your savings and investment strategies. By utilizing tax-advantaged accounts like 401(k) plans and SEP IRAs, you can unlock some serious tax benefits. This means higher contribution limits and tax-deferred growth. For example, in 2025, a 401(k) allows contributions of up to $23,500, plus an extra catch-up contribution for those aged 50 and older. That makes it a powerful tool for building your retirement savings.

But there's more to it! Developing a smart withdrawal plan is key to minimizing tax liabilities during retirement. This means timing your withdrawals to take advantage of those lower tax brackets and being mindful of required minimum distributions (RMDs). A great option here is qualified longevity annuity contracts (QLACs), which can help defer RMDs and effectively lighten your tax load in retirement.

Alongside these strategies, it’s super important to grasp the significance of fiscal planning and tax advice. This can help small agency owners steer clear of common pitfalls, like , which can lead to costly penalties. By keeping a close eye on your tax obligations throughout the year, you can ensure you're meeting IRS requirements and avoiding unnecessary financial stress. Plus, consulting with a financial advisor can provide personalized insights and tax advice for crafting a comprehensive retirement plan that aligns with your long-term goals while optimizing tax efficiency.

As Shawn Plummer, a licensed Retirement Planner, puts it, "Understanding your options and planning ahead is essential for securing a stable economic future." And with more than two-thirds of business owners planning to retire in the next two years, tapping into those tax-advantaged accounts is crucial for boosting financial security and ensuring a sustainable retirement income. By embracing these strategies, small agency owners can confidently navigate the complexities of retirement planning.

Conclusion

Navigating the complexities of tax regulations is super important for small agency owners who want to achieve financial success. Throughout this article, we've highlighted how strategic tax planning, expert advice, and meticulous record-keeping can help minimize tax liabilities and steer clear of penalties. By tapping into the expertise of tax professionals and using advanced tax software, agency owners can simplify their tax processes and really focus on growth.

Key strategies like:

- Identifying eligible deductions

- Having regular financial check-ins

- Staying updated on changing tax laws

are essential for keeping compliant and optimizing tax outcomes. Plus, exploring available tax credits can lead to some significant savings, allowing businesses to reinvest in their operations. The case studies and statistics we've shared really emphasize the tangible benefits of proactive tax management.

So, small agency owners, it’s time to take charge of your tax planning! Seeking expert guidance will help you navigate the ever-evolving tax landscape. By proactively managing your tax responsibilities, you not only safeguard against compliance issues but also position your business for long-term growth and sustainability. Embracing these practices can empower you to unlock your full potential, ensuring a prosperous future. What are you waiting for? Let’s get started!

Frequently Asked Questions

What services does Steinke and Company provide for small businesses?

Steinke and Company offers tax advice and preparation services specifically tailored for micro and minor enterprises, helping them navigate tax regulations and avoid underpayment penalties.

Who are the professionals at Steinke and Company?

The team at Steinke and Company consists of Enrolled Agents and Certified Public Accountants (CPAs) who provide customized support and tax advice.

What is the significance of understanding underpayment penalties?

Understanding underpayment penalties is crucial for agency owners, especially with the IRS's recent increase in the interest rate for underpayments to 8% annually, compounded daily.

What strategies does Steinke and Company recommend to avoid underpayment penalties?

They recommend strategies such as safe harbor payments and the de minimis exception to help clients avoid underpayment penalties.

How does Steinke and Company support agency owners in managing their tax responsibilities?

They provide tailored tax advice, round-the-clock access through a client portal, email, and phone, enabling agency owners to focus on growth and operational efficiency.

What is strategic tax planning and why is it important?

Strategic tax planning involves reviewing a company's financial landscape to identify opportunities for tax savings, which is essential for minimizing tax liabilities.

How can choosing the right organizational structure benefit tax outcomes?

Selecting the appropriate organizational structure can provide significant tax benefits, contributing to overall tax savings.

Why is it important to have regular discussions with tax professionals?

Regular discussions with tax professionals are vital due to the frequent changes in tax laws, helping businesses stay informed and adjust their tax strategies accordingly.

What are some common tax deductions for agency owners?

Common deductions include office supplies, travel costs, marketing expenses, and home office costs based on the proportion of home used for work.

How can agency owners maximize their tax deductions?

Agency owners can maximize their tax deductions by keeping detailed records of eligible expenses and consulting with tax professionals to identify specific deductions relevant to their industry.