Overview

Hey there! Did you know that health insurance premiums can actually be deductible for small businesses? Yep, under certain conditions, they can really help lower taxable income. For self-employed folks, this means you can deduct your premiums straight from your income. And if you run a business, you can treat these costs as deductible operational expenses—just make sure you meet the IRS criteria. This can be a game changer for your financial planning and tax savings. So, why not take advantage of it?

Introduction

Hey there! If you’re a small business owner, you might have noticed that the rising costs of health insurance premiums can really put a strain on your budget. It’s a tough situation that can affect your overall financial health. But here’s a thought: understanding whether these premiums are deductible could lead to some significant tax savings. That’s a crucial lifeline, especially in today’s competitive market.

Now, here’s where it gets a bit tricky. Navigating the complexities of tax regulations and eligibility criteria can be daunting. So, let me ask you this:

- Are you fully aware of how to maximize your deductions on health insurance premiums?

- What steps can you take to ensure you’re not leaving money on the table?

Let’s dive in and explore this together!

Define Health Insurance Premiums

Medical insurance fees are those regular payments you make to your insurer to get coverage. Typically, you’ll see these billed monthly, quarterly, or yearly, depending on your policy. The cost can vary quite a bit based on a few factors, like the type of coverage you choose, the age and health of the insured individuals, and the overall risk profile of the group being insured.

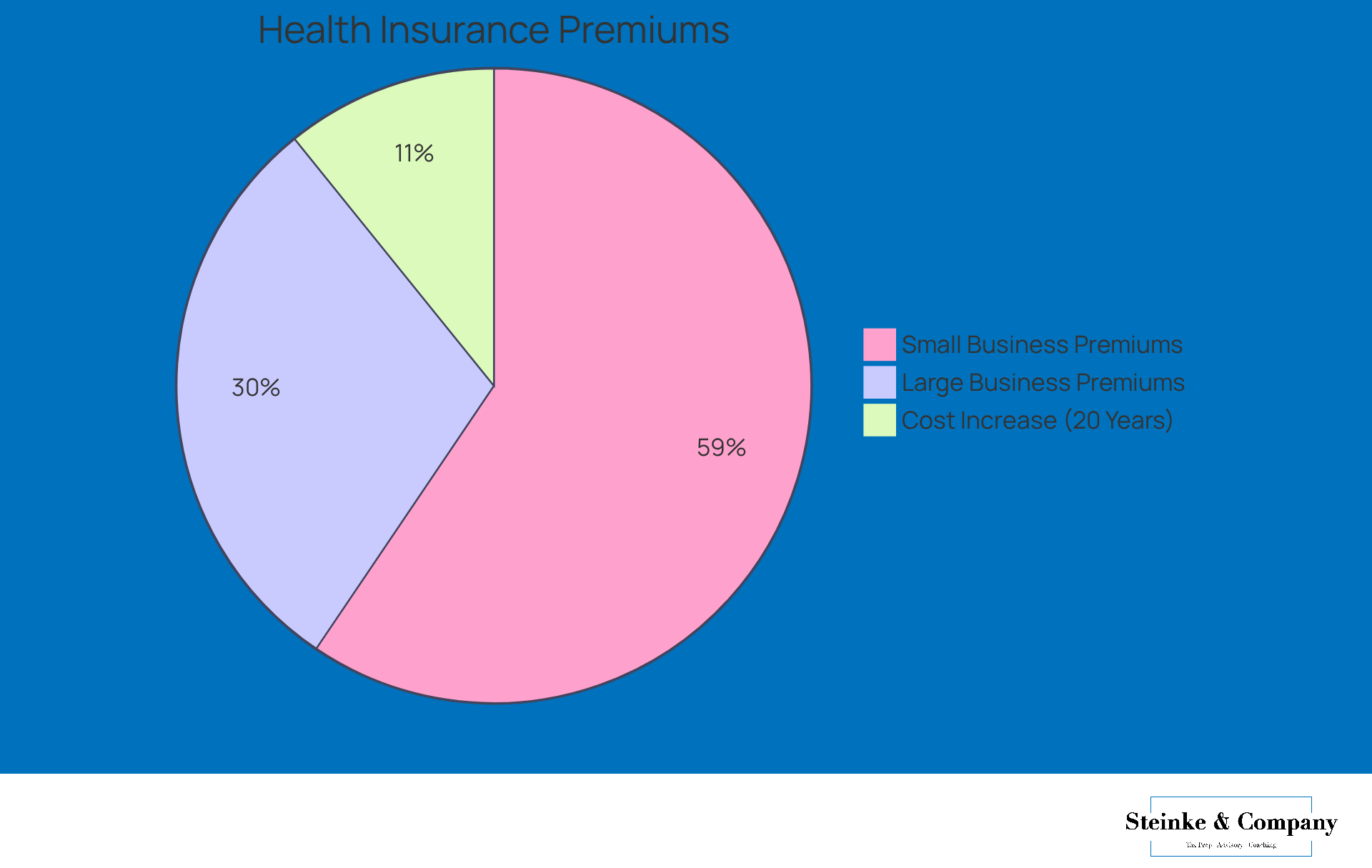

For small businesses, understanding whether health insurance premiums are deductible is crucial, as these costs can feel like a heavy load and significantly impact financial strategies and tax responsibilities. Did you know that small businesses often pay, on average, twice as much for medical coverage compared to larger companies? That can really hit profitability and operational expenses hard.

And here’s something to think about: over the past twenty years, the average cost of a single plan has skyrocketed by 120%, while family plan costs have jumped by 129% for companies with 50 or fewer employees. This really highlights why small business owners need to take a close look at their and weave these expenses into their overall financial plans. So, what are your thoughts on how these costs affect your business?

Contextualize the Role of Health Insurance Premiums for Small Businesses

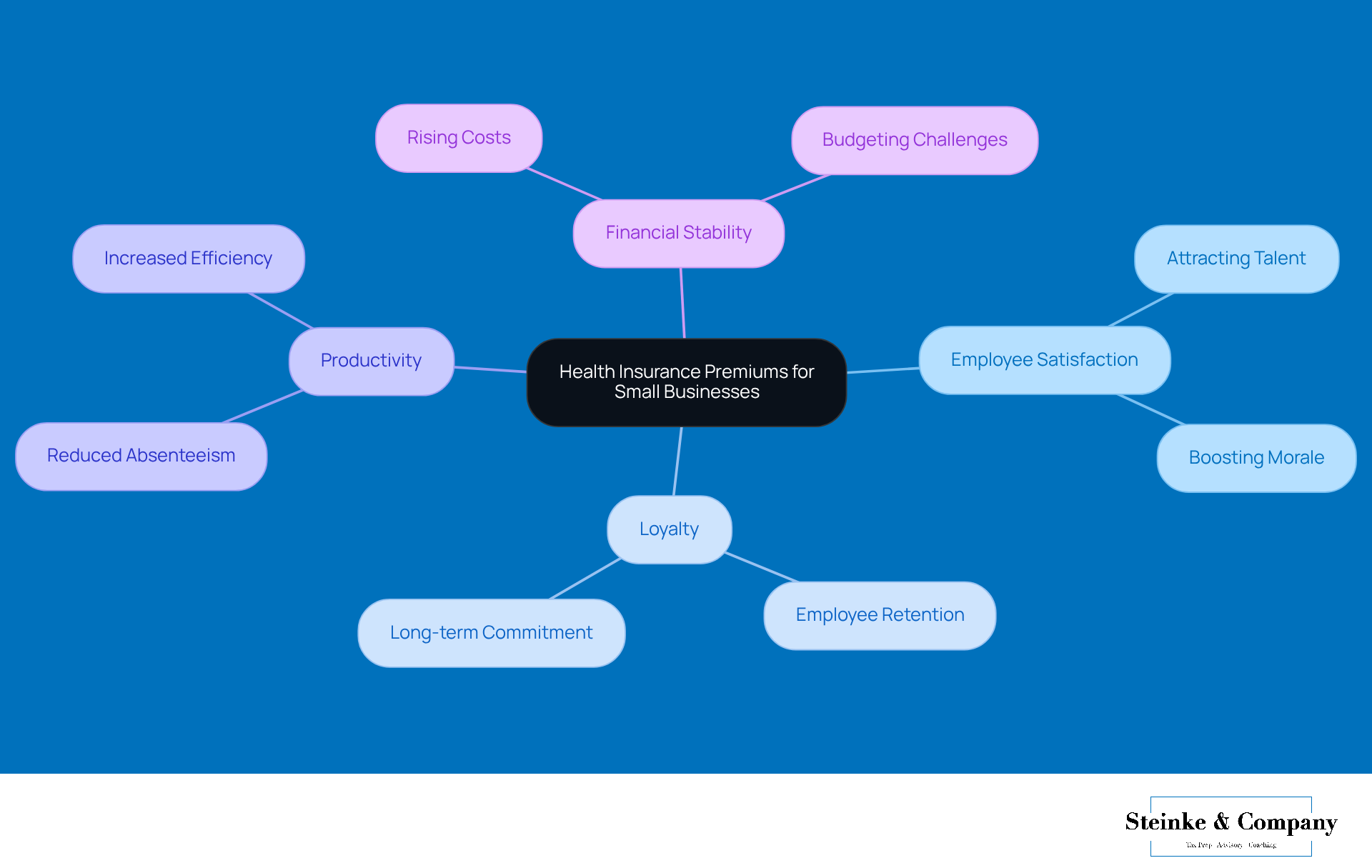

For small businesses, medical coverage premiums aren’t just another line item on the budget; they’re a key part of employee benefits packages. Think about it: providing medical coverage can really boost , making it easier to attract top talent in those competitive job markets. Plus, when employees have health coverage, they tend to be healthier, which means less absenteeism and a nice bump in productivity. But here’s the catch: the rising costs of insurance can be a tough pill to swallow for many small businesses. It takes some careful budgeting and smart planning to make sure these expenses don’t throw a wrench in financial stability.

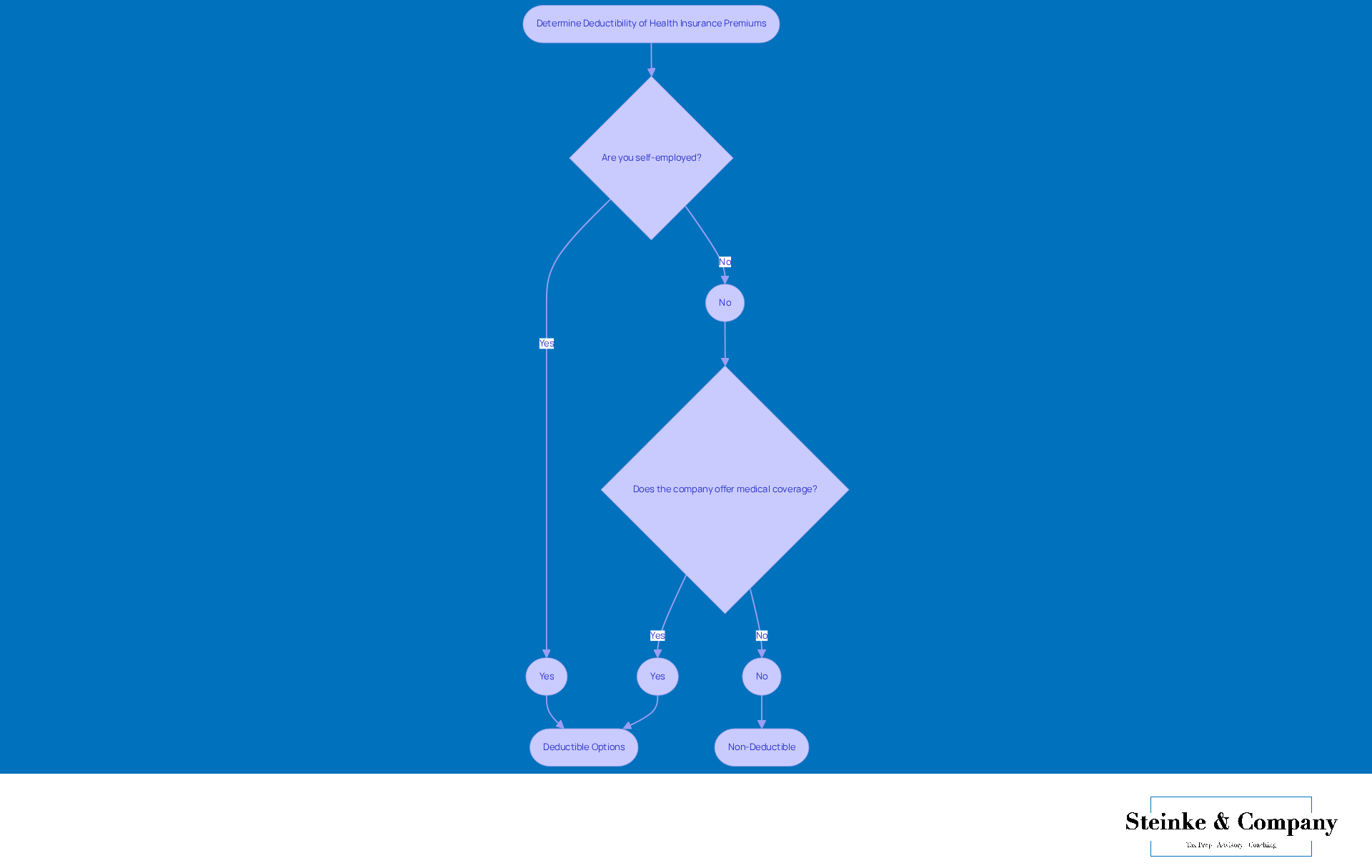

Explore Tax Deductibility of Health Insurance Premiums

For small businesses, a significant deduction can come from understanding whether health coverage costs are health insurance premiums deductible, which helps lower taxable income. If you’re self-employed, you can subtract the costs you pay for medical coverage directly from your income, as long as you understand how health insurance premiums are deductible from your main source of income. This deduction is especially handy because it helps self-employed folks understand if health insurance premiums are health insurance premiums deductible, which effectively reduces their taxable income. Plus, when a company offers medical coverage to its employees, it is important to consider whether health insurance premiums are health insurance premiums deductible, as those costs usually count as deductible operational expenses, which can lead to overall tax savings.

Now, to determine if health insurance premiums are health insurance premiums deductible, it’s crucial that the payments meet the criteria set by the tax authorities. For example, while medical coverage costs are deductible, fees for life insurance typically aren’t deductible if the company is the beneficiary. Understanding these nuances can really help small business owners and self-employed individuals determine whether while staying on the right side of current IRS regulations. So, have you checked if you’re making the most of these deductions yet?

Detail Methods for Claiming Health Insurance Premiums

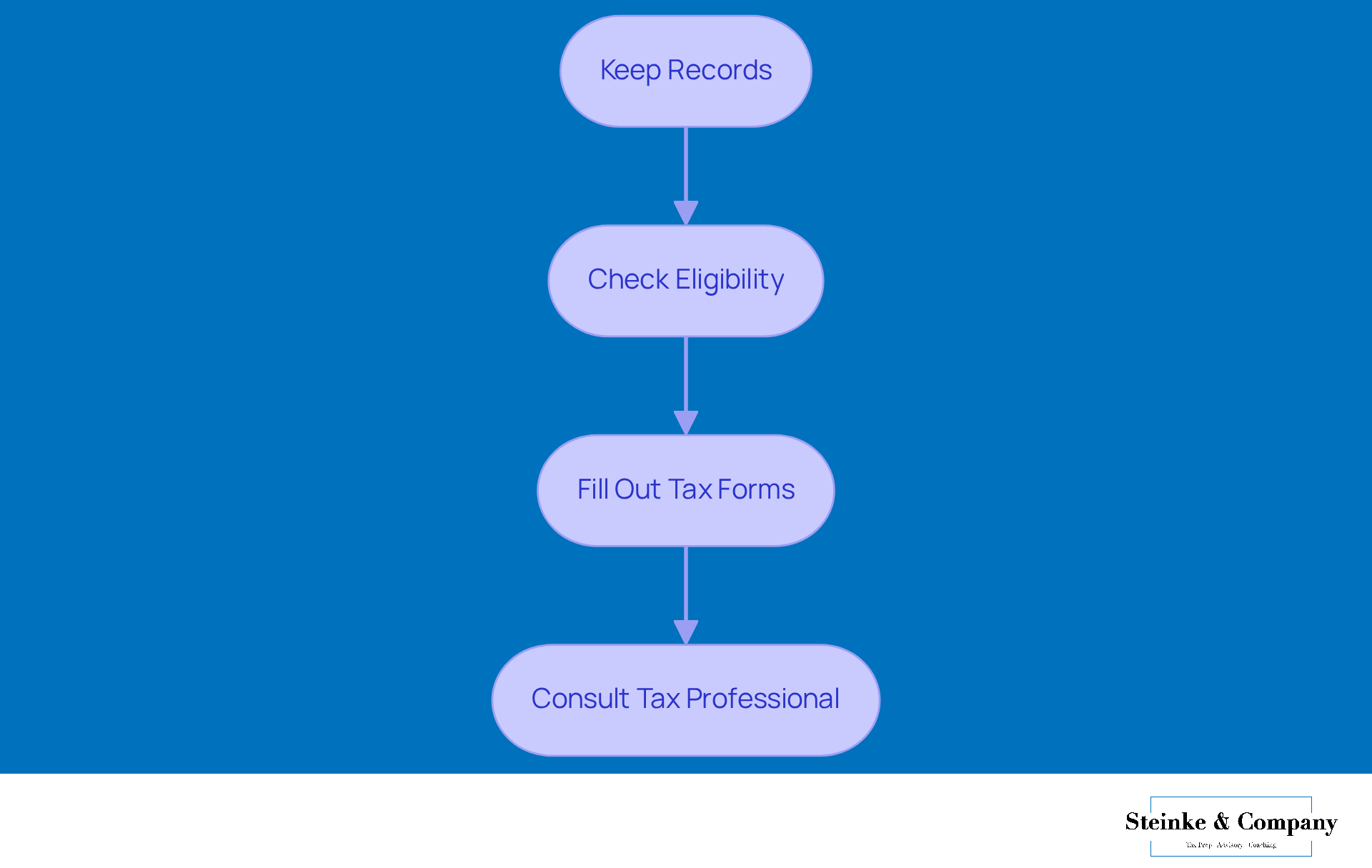

If you're a small business owner looking to claim health insurance costs as a deduction, here’s a friendly guide to help you through the process:

- Keep Those Records Straight: It’s super important to maintain clear records of all your payment submissions—think invoices and receipts. These little documents are your proof of expenses!

- Check Your Eligibility: Make sure your payments meet the criteria for deductible expenses according to current tax regulations. A key point to remember is that your insurance costs need to exceed 7.5% of your adjusted gross income (AGI) to qualify for a deduction.

- Fill Out the Right Tax Forms: For self-employed folks, this usually means reporting your payments on Schedule C (Form 1040) in the U.S. or the equivalent form in Canada.

- Talk to a Tax Pro: Tax laws can be a bit tricky, so getting advice from a tax professional can really help you stay compliant and .

By following these steps, you can effectively lower your taxable income, which might just lighten your tax load and boost your financial health. Just remember to avoid common pitfalls like not keeping enough documentation or failing to check if health insurance premiums are deductible—those can cost you valuable deductions! And hey, there are plenty of small businesses out there that have nailed their record-keeping for health insurance deductions, proving that a little diligence goes a long way in achieving better financial results.

Conclusion

Understanding the deductibility of health insurance premiums is super important for small businesses trying to navigate their financial landscape. These premiums aren’t just expenses; they’re a strategic investment in your employees' well-being and the overall sustainability of your business. By recognizing the potential tax benefits tied to these costs, you can make informed decisions that not only boost your financial health but also enhance what you offer to your employees.

In this article, we’ve touched on some key points, like the significant difference in insurance costs between small businesses and larger companies, how health insurance positively impacts employee satisfaction and productivity, and the valuable tax deductions available for self-employed individuals and businesses. We’ve also laid out some practical steps for claiming these deductions, stressing the importance of keeping meticulous records and consulting with tax professionals to stay compliant with IRS guidelines.

Ultimately, the implications of health insurance premiums go beyond just numbers on a balance sheet; they really shape the core of your small business's operational strategy. As costs keep climbing, it’s crucial for you, as a small business owner, to actively seek out all available deductions and think about the long-term benefits of offering comprehensive health coverage. By doing so, you not only secure financial advantages but also nurture a healthier, more committed workforce, highlighting just how vital health insurance is in the small business ecosystem.

Frequently Asked Questions

What are health insurance premiums?

Health insurance premiums are regular payments made to an insurer to obtain coverage. They are typically billed monthly, quarterly, or yearly, depending on the policy.

What factors influence the cost of health insurance premiums?

The cost of health insurance premiums can vary based on several factors, including the type of coverage chosen, the age and health of the insured individuals, and the overall risk profile of the group being insured.

Why is it important for small businesses to understand health insurance premiums?

Understanding health insurance premiums is crucial for small businesses because these costs can significantly impact financial strategies and tax responsibilities. Small businesses often face higher premiums compared to larger companies.

How do health insurance premiums for small businesses compare to those for larger companies?

Small businesses often pay, on average, twice as much for medical coverage compared to larger companies, which can greatly affect profitability and operational expenses.

What has been the trend in health insurance premium costs over the past twenty years for small businesses?

Over the past twenty years, the average cost of a single health insurance plan has increased by 120%, while family plan costs have risen by 129% for companies with 50 or fewer employees.