Overview

Did you know that Health Savings Account (HSA) contributions are tax deductible? This means you can lower your taxable income while saving for those unexpected medical expenses—if you're enrolled in a high-deductible health plan (HDHP), of course! The article dives into the eligibility requirements and the tax perks that come with HSAs, highlighting how they can be a game-changer for your financial planning and managing healthcare costs. So, why not consider how an HSA might fit into your own financial strategy?

Introduction

Health Savings Accounts (HSAs) are becoming a go-to resource for folks navigating the tricky world of healthcare expenses, especially if you're enrolled in a high-deductible health plan. They allow you to make pre-tax contributions, which not only helps you prepare financially for medical costs but also comes with some pretty sweet tax advantages that you might not even realize.

But here’s the big question: are contributions to these accounts really tax deductible? And what does that mean for you, whether you’re an individual or a small business owner?

By understanding the ins and outs of HSA contributions and their tax benefits, you could unlock some great opportunities for smarter financial planning and even greater savings down the line.

Define Health Savings Accounts and Their Contributions

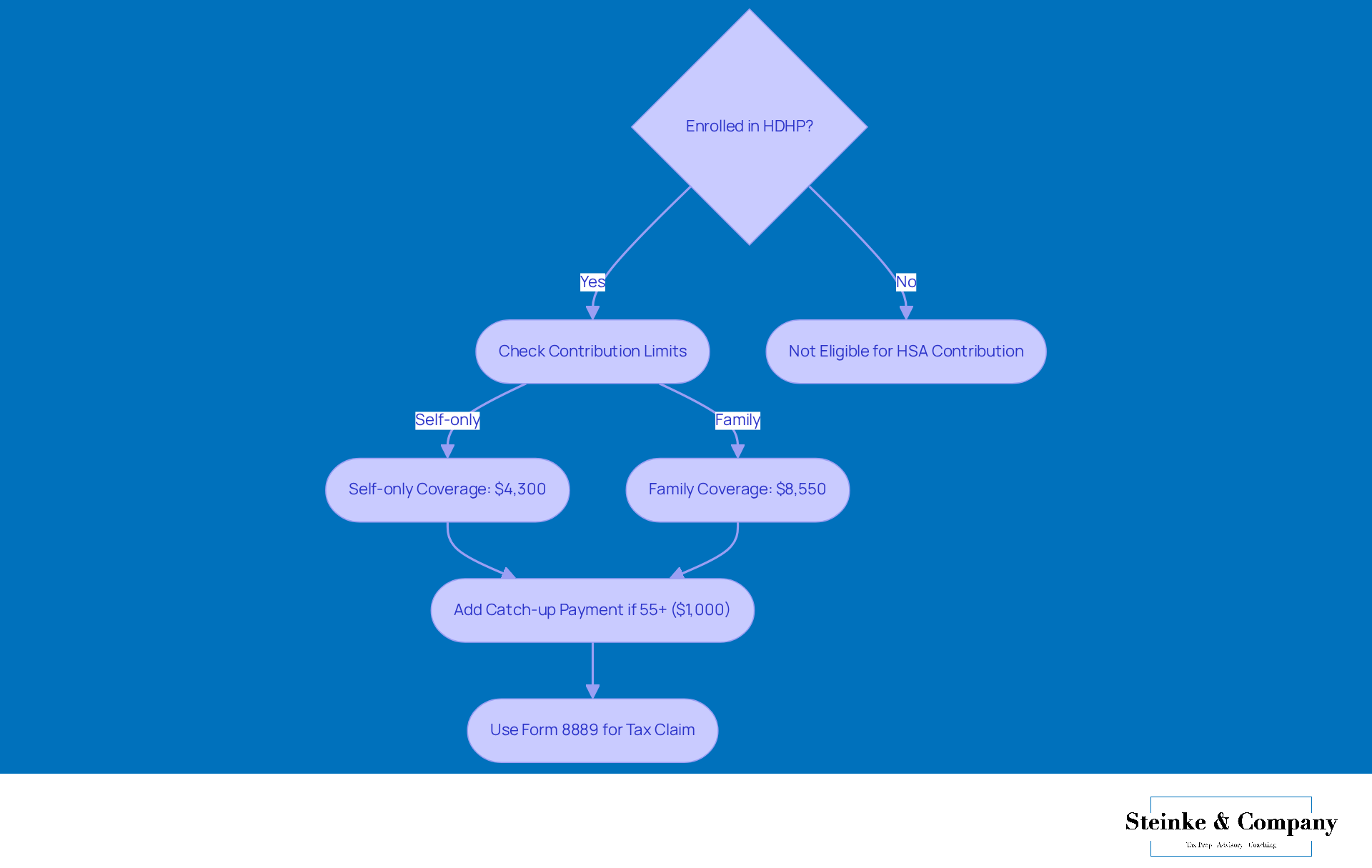

Health Savings Accounts (HSAs) are like a friendly little helper for folks enrolled in high-deductible health plans. They allow you to stash away money before taxes, which raises the question of whether health savings account contributions are health savings account contributions tax deductible, helping to lighten the load on your taxable income. Looking ahead to 2025, you can contribute up to $4,300 if you're single and $8,550 for families. That’s a pretty solid incentive to save up for those healthcare costs, right? Not only do they encourage you to be financially prepared for medical expenses, but they also provide tax benefits, leading many to wonder if health savings account contributions are health savings account contributions tax deductible, making HSAs a great option for those who qualify.

Now, let’s talk about small business owners. HSAs can really make a difference here. When employers contribute to their employees' HSAs, it boosts and helps retain talent—additionally, these contributions are health savings account contributions tax deductible for the business. And with the recent updates in HSA regulations, there’s even more flexibility in how you can use those funds, like covering direct primary care fees and certain preventive services. This can really ease the financial strain of managing chronic conditions.

Don’t forget that it’s important to know if health savings account contributions are tax deductible! HSAs offer the chance for tax-free growth on your investments, although it seems only a handful of account holders are taking advantage of that. This presents a great opportunity for greater awareness and use of HSAs as a wealth-building tool, especially for underrepresented groups. As healthcare financing evolves, HSAs continue to be a vital asset for individuals and small business owners navigating the tricky waters of medical expenses while maximizing their tax benefits.

Examine Tax Deductibility of HSA Contributions

Did you know that health savings account contributions are tax deductible? That’s right! This means you can lower your taxable income, especially since health savings account contributions are tax deductible, which is a pretty sweet deal. This deduction applies not just to what you put in but also to whether the contributions from your employer are health savings account contributions tax deductible. Just keep in mind that to snag this deduction, you need to be enrolled in a high-deductible health plan (HDHP) that meets certain criteria. In 2025, about 50% of larger employers—those with 200 or more employees—were offering HSA-qualified HDHPs. It’s clear that more folks are getting on board with employer-sponsored health benefits!

Now, here’s something to watch out for: if you go over the annual funding limits, you could face a 6% excise tax on the excess amount. Yikes! For 2025, those limits are set at:

- $4,300 for self-only coverage

- $8,550 for family coverage

And if you're 55 or older, you can add an extra $1,000 as a catch-up payment, which really helps boost your savings for medical expenses.

When it comes time to do your taxes, you can claim the by checking if health savings account contributions are tax deductible using Form 8889. This handy form details both your payments and distributions. It’s super important for making sure you’re following the rules and maximizing the tax benefits of your health savings account. Understanding these tax implications is key for smart financial planning, especially if you’re taking advantage of employer contributions to your HSAs. So, are you ready to make the most of your HSA?

Identify Eligibility Requirements for HSA Contributions

If you're looking to contribute to a Health Savings Account (HSA), there are a few eligibility criteria you need to keep in mind. First off, you’ve got to be enrolled in a high-deductible health plan (HDHP). For 2025, that means your deductible needs to be at least:

- $1,650 for self-only coverage

- $3,300 for family coverage

Also, it's important to note that you can't be enrolled in Medicare or be claimed as a dependent on someone else's tax return.

These guidelines are designed to ensure that HSAs are used by folks who are through high-deductible plans. It’s all about promoting smart financial planning for those medical costs! Looking ahead to 2025, it’s expected that millions of people will benefit from health savings accounts, which shows a growing trend in managing healthcare costs. So, are you ready to take charge of your health expenses?

Highlight Benefits of HSA Contributions

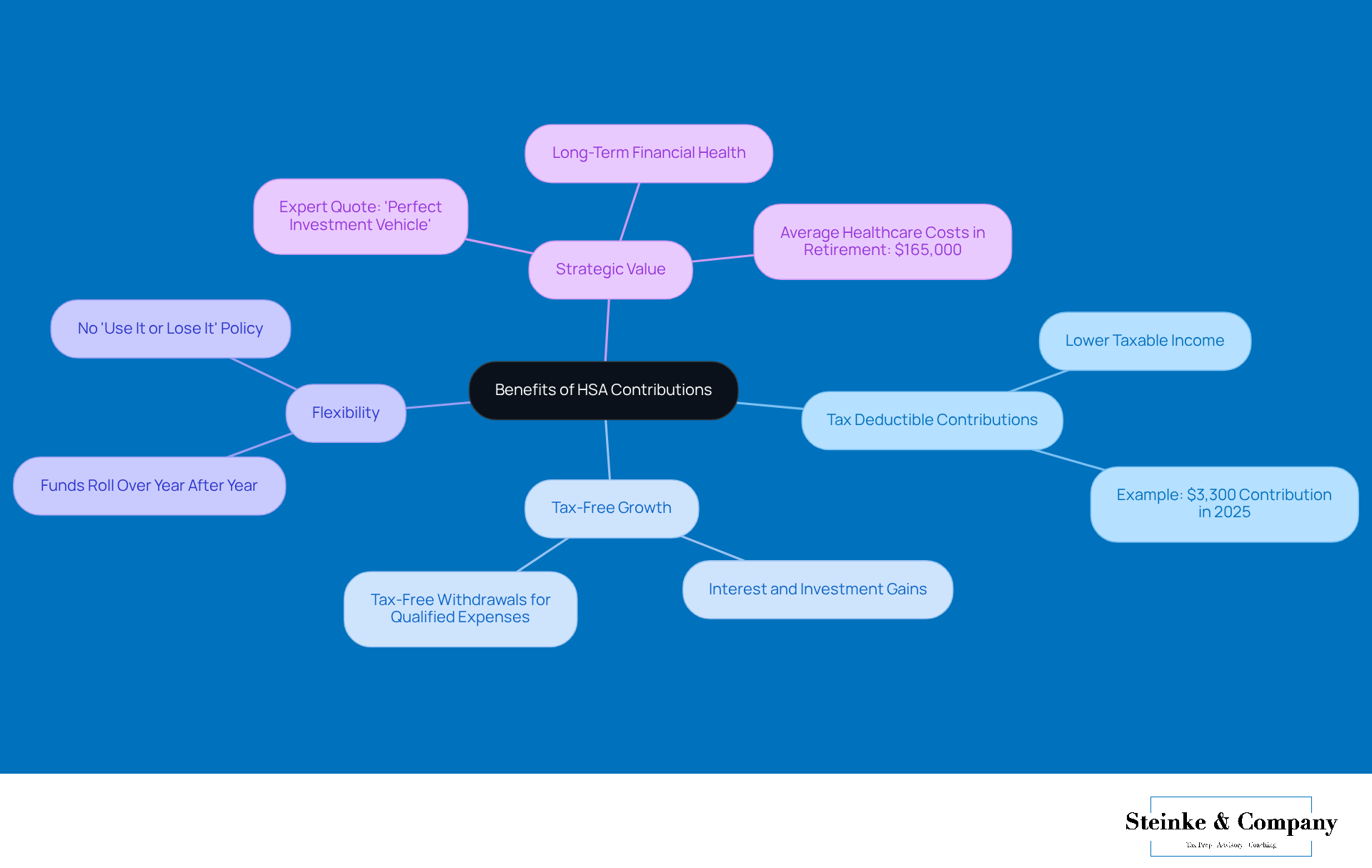

Contributing to a Health Savings Account (HSA) comes with a bunch of financial perks, making it a key player in managing healthcare costs. First off, it is important to note that health savings account contributions are tax deductible. This means you can lower your taxable income, which can lead to a smaller tax bill overall. For example, in 2025, you can put away up to $3,300 into your health savings accounts—talk about some serious tax savings! Plus, the money in your HSA grows tax-free, so any interest or investment gains aren’t taxed as long as you use them for qualified medical expenses.

Another great thing about HSAs is their flexibility. Any unused funds roll over year after year, so you can build up savings for future healthcare needs without worrying about a 'use it or lose it' scenario, which is often the case with flexible spending accounts. The fact that health savings account contributions are tax deductible, along with tax-free growth and tax-free withdrawals for qualified expenses, makes HSAs a fantastic option for small agency owners looking to manage healthcare costs smartly.

Financial experts really highlight the strategic value of health savings accounts. Lee Baker, the founder of Apex Financial Services, puts it nicely: "an HSA is a perfect investment vehicle, if we dare say there is such an animal." This perspective shows that HSAs aren’t just about saving; they can also . Considering that the average 65-year-old is expected to rack up around $165,000 in healthcare costs during retirement, using HSAs for tax-efficient savings is incredibly important. By tapping into these accounts, small agency owners can fine-tune their financial strategies while gearing up for future healthcare expenses.

Conclusion

Health Savings Accounts (HSAs) offer a fantastic way for individuals and small business owners to tackle healthcare costs while reaping some pretty significant tax benefits. The beauty of HSAs lies in their tax-deductible contributions, which can help lower your taxable income and set you up for those unexpected medical expenses. With more employers rolling out high-deductible health plans, the chance to make the most of these accounts is becoming more and more relevant.

As we dive into this topic, let’s highlight some key insights:

- The eligibility requirements for HSAs

- The tax deductibility of contributions

- The many perks that come with these accounts

Looking ahead to 2025, there are contribution limits in place, plus a little extra for those aged 55 and older. HSAs really shine as a smart financial tool. And let’s not forget the flexibility they offer—think tax-free growth and the ability to roll over unused funds—making them even more appealing for long-term healthcare planning.

With healthcare costs on the rise and the need for strategic financial planning becoming increasingly important, embracing HSAs can really empower you to take control of your health expenses. By getting a grip on the tax implications and benefits of HSA contributions, you can make informed choices that not only boost your financial health but also prepare you for future medical needs. Engaging with HSAs isn’t just about saving; it’s a proactive step toward securing a financially stable future as we navigate the ever-growing demands of healthcare.

Frequently Asked Questions

What are Health Savings Accounts (HSAs)?

Health Savings Accounts (HSAs) are savings accounts for individuals enrolled in high-deductible health plans that allow them to set aside money before taxes to cover healthcare costs.

Are contributions to HSAs tax deductible?

Yes, contributions to HSAs are tax deductible, which helps reduce your taxable income.

What are the contribution limits for HSAs in 2025?

In 2025, individuals can contribute up to $4,300 if single and up to $8,550 for families.

How do HSAs benefit small business owners?

HSAs can enhance job satisfaction and employee retention when employers contribute to their employees' HSAs, and these contributions are also tax deductible for the business.

What recent updates have been made regarding HSA regulations?

Recent updates provide more flexibility in using HSA funds, allowing them to cover direct primary care fees and certain preventive services.

How do HSAs contribute to tax-free growth?

HSAs offer the opportunity for tax-free growth on investments, although many account holders are not fully utilizing this benefit.

Why is there a need for greater awareness of HSAs?

Increased awareness of HSAs can help individuals, especially from underrepresented groups, use them as a wealth-building tool while managing healthcare expenses and maximizing tax benefits.