Overview

This article is your go-to guide for small taxpayers looking to get a handle on the Safe Harbor Election. It’s a neat little provision that lets eligible businesses deduct certain repair and maintenance expenses right off the bat, instead of capitalizing them.

We’ll walk you through the benefits, who qualifies, and the step-by-step process to elect this option. You’ll see just how much it can simplify your tax reporting and boost your cash flow, making tax season a whole lot easier on your wallet!

Introduction

Navigating the complexities of tax regulations can feel pretty overwhelming for small business owners, right? Especially when it comes to maximizing deductions and minimizing those pesky liabilities. But here’s some good news: the Safe Harbor Election for small taxpayers is a fantastic way to simplify tax reporting while reaping immediate financial benefits.

You might be asking yourself: what exactly does this election mean for you, and how can you use it to improve your financial management? Don’t worry, we’ve got you covered! This guide dives into the essentials of the Safe Harbor Election, exploring its benefits and laying out a clear, step-by-step process for small businesses to take full advantage of this great tax provision.

Understand the Safe Harbor Election Basics

Hey there! Let’s discuss the safe harbor election for small taxpayers. This nifty provision allows eligible small businesses to utilize the safe harbor election for small taxpayers, simplifying their tax reporting by deducting certain expenses without having to capitalize them. If your business has gross receipts of $10 million or less, the safe harbor election for small taxpayers could be a game changer for you! Instead of treating repair and maintenance costs as capital expenditures that need to be depreciated over time, you can deduct them directly. How great is that? It can really lighten the load during tax season and give you some immediate tax relief.

Now, to qualify, you’ll need to meet some specific criteria set by the IRS. This includes:

- Keeping proper accounting records

- Making sure your expenses fit within the defined limits

Understanding these basics is super important for small business owners who want to and utilize the safe harbor election for small taxpayers to make financial reporting a breeze. So, why not take a closer look at how this could work for you?

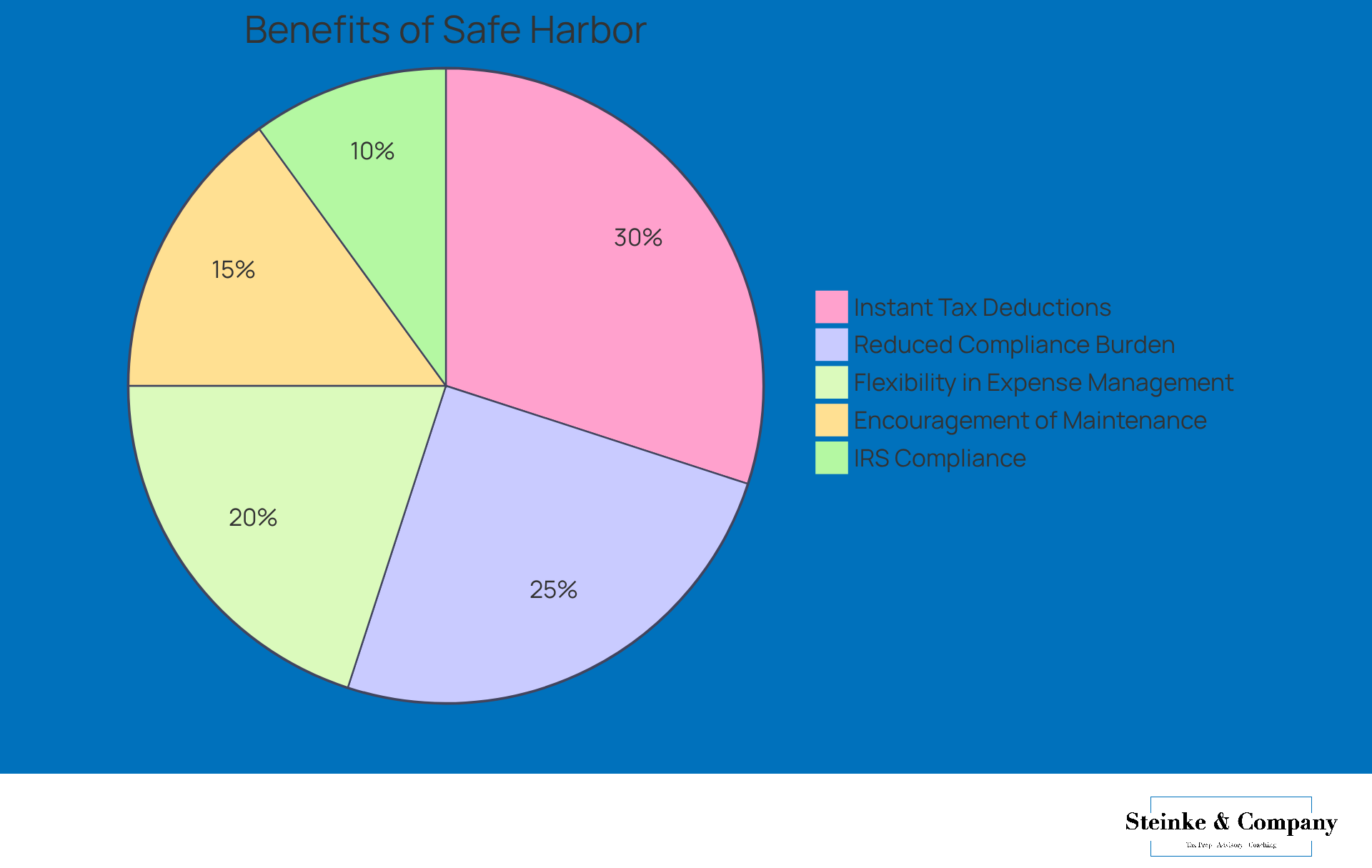

Explore Benefits of the Safe Harbor Election for Small Taxpayers

The Safe Harbor Election brings several great perks for small taxpayers:

- Instant Tax Deductions: This option lets businesses deduct repair and maintenance costs in the year they happen, giving you immediate tax savings that can really boost cash flow. For example, small businesses can deduct up to $2,500 per item or invoice if they don’t have an applicable financial statement, or up to $5,000 if they do. That’s a pretty significant financial benefit! Plus, this method can lower your taxable income in the purchase year, saving you time and hassle in tracking small fixed assets.

- Reduced Compliance Burden: Let’s face it, dealing with complicated tax rules can be overwhelming for small businesses. The safe harbor election for small taxpayers simplifies the reporting process, minimizing the need for extensive record-keeping and documentation that is typically required for capitalizing expenses. This streamlined approach lightens the administrative load, allowing you to focus more on growing your business.

- Flexibility in Expense Management: With the safe harbor election for small taxpayers, business owners can make choices about repairs and maintenance without worrying about the long-term effects of capitalizing those costs. This flexibility supports quick financial decision-making, enabling you to respond swiftly to your operational needs.

- Encouragement of Maintenance and Upgrades: The ability to deduct expenses right away encourages businesses to invest in necessary repairs and improvements. This proactive approach not only but also enhances service quality, ultimately benefiting your bottom line. As seen in various case studies, organizations using the de minimis safe harbor can streamline accounting across multiple properties or entities.

- By choosing the safe harbor election for small taxpayers, businesses can ensure they’re in line with IRS regulations, significantly lowering the risk of audits or penalties for incorrect expense reporting. This alignment is key for maintaining a strong financial standing. While it’s not mandatory for those without an Applicable Financial Statement (AFS), having a written capitalization policy can further solidify your tax position.

All in all, these benefits help small business owners manage their finances more effectively while staying compliant with tax rules, paving the way for a more sustainable model. As Carey Heyman, Managing Principal of Industry, puts it, "Need help evaluating whether this election is right for your portfolio? CLA’s real estate professionals can guide you through the decision and help implement it consistently across your properties.

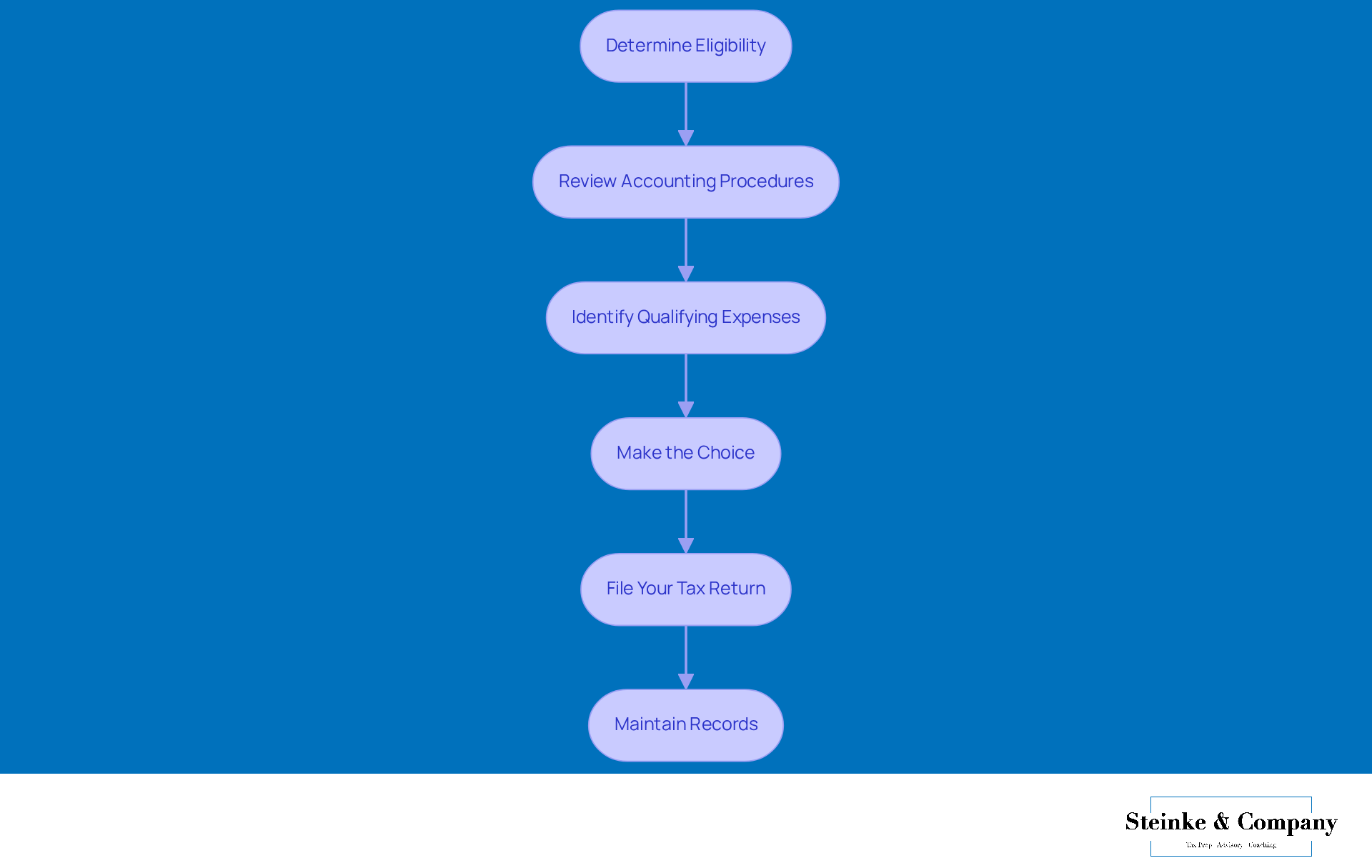

Follow Steps to Elect the Safe Harbor

Are you ready to elect the safe harbor election for small taxpayers? Let’s walk through the steps together:

- Determine Eligibility: First things first, make sure your business qualifies as a small taxpayer. This means having of $10 million or less for the last three tax years. Simple enough, right?

- Review Accounting Procedures: Next, it’s time to set up some written accounting procedures. These should clearly show that qualifying expenses are treated as deductible in the year they’re incurred. This documentation is super important for compliance, so don’t skip it!

- Identify Qualifying Expenses: Take a good look at your expenses. Which ones meet the criteria for the Election? Think about repairs and maintenance costs that don’t significantly enhance the property. Got it?

- Make the Choice: Now, to select the Secure Haven, you’ll need to include a statement with your tax return for the year you want to make this choice. This statement should express your intent to choose the secure refuge and confirm that you meet the eligibility criteria. Easy peasy!

- File Your Tax Return: Time to submit your tax return! Just make sure all necessary documentation is included. If you’re filing electronically, follow the detailed guidelines from your tax software to include the Protection Election.

- Maintain Records: Finally, keep thorough records of all expenses claimed under the Protected Election. The IRS might ask for this info if they come knocking for an audit. Having solid documentation will help you handle any potential audits and know your rights as a taxpayer.

By following these steps, small business owners can easily make the safe harbor election for small taxpayers and enjoy the benefits while staying compliant with IRS regulations. So, why not get started today?

Conclusion

The safe harbor election for small taxpayers is a fantastic opportunity for eligible businesses to simplify tax reporting and enjoy some immediate financial perks. By letting small businesses deduct certain repair and maintenance costs in the year they’re incurred, this provision takes the pressure off capitalizing expenses, which can really boost cash flow and operational efficiency.

Throughout the article, we’ve shared key insights about:

- Who qualifies

- The benefits of using the safe harbor election

- The easy steps to make this choice

From instant tax deductions to less hassle with compliance and more flexibility in managing expenses, the advantages are pretty clear. Plus, sticking to IRS regulations helps minimize the risk of audits or penalties, which highlights the importance of good documentation and record-keeping.

So, small business owners, why not explore the safe harbor election for small taxpayers? It’s a smart move to optimize your financial management. By getting to know the process and taking advantage of the benefits we’ve discussed, you can enhance your operational efficiency and stay compliant with tax regulations. Embracing this election not only encourages a proactive approach to your financial health but also sets your business up for sustainable growth in the future.

Frequently Asked Questions

What is the safe harbor election for small taxpayers?

The safe harbor election for small taxpayers allows eligible small businesses to simplify their tax reporting by deducting certain expenses without having to capitalize them.

Who is eligible for the safe harbor election?

To be eligible, a business must have gross receipts of $10 million or less and meet specific criteria set by the IRS.

What are the benefits of utilizing the safe harbor election?

The main benefit is that businesses can deduct repair and maintenance costs directly instead of treating them as capital expenditures that need to be depreciated over time, providing immediate tax relief.

What criteria must be met to qualify for the safe harbor election?

Businesses must keep proper accounting records and ensure their expenses fit within the defined limits set by the IRS.

How can the safe harbor election impact tax season for small business owners?

It can lighten the load during tax season by simplifying financial reporting and allowing for direct deductions, which can improve the overall tax situation for small business owners.