Overview

Let’s talk about W-2 Box 12 Code AA, shall we? This little code is all about those designated Roth contributions under a 401(k) plan, and it’s super important for small business owners when it comes to their tax strategies. Understanding and reporting this code correctly can really pay off, leading to tax-free growth for your employees and better retirement planning. But watch out! If there are mistakes in reporting, it could lead to compliance headaches and financial penalties down the line.

So, why should you care? Because getting it right means not only helping your employees save for the future but also keeping your business on the right side of the taxman. It’s all about making the most of those contributions and ensuring everyone benefits. Remember, a little knowledge goes a long way in avoiding those pesky compliance issues, so don’t hesitate to dive into the details. Your business and your team will thank you!

Introduction

Navigating the complexities of W-2 Box 12 codes can feel overwhelming for small business owners, but getting a grip on these codes is key to optimizing your tax strategies and staying compliant.

Take Code AA, for instance. It’s pretty significant because it represents designated Roth payments. These payments are made with after-tax dollars, yet they offer the exciting potential for tax-free growth when you hit retirement.

The tricky part? Accurately reporting these contributions to dodge those costly mistakes that could affect both your business operations and your employees' benefits.

So, how can you, as a small business owner, master the ins and outs of W-2 Box 12 codes? Let’s dive in and explore how to leverage their advantages while steering clear of common pitfalls!

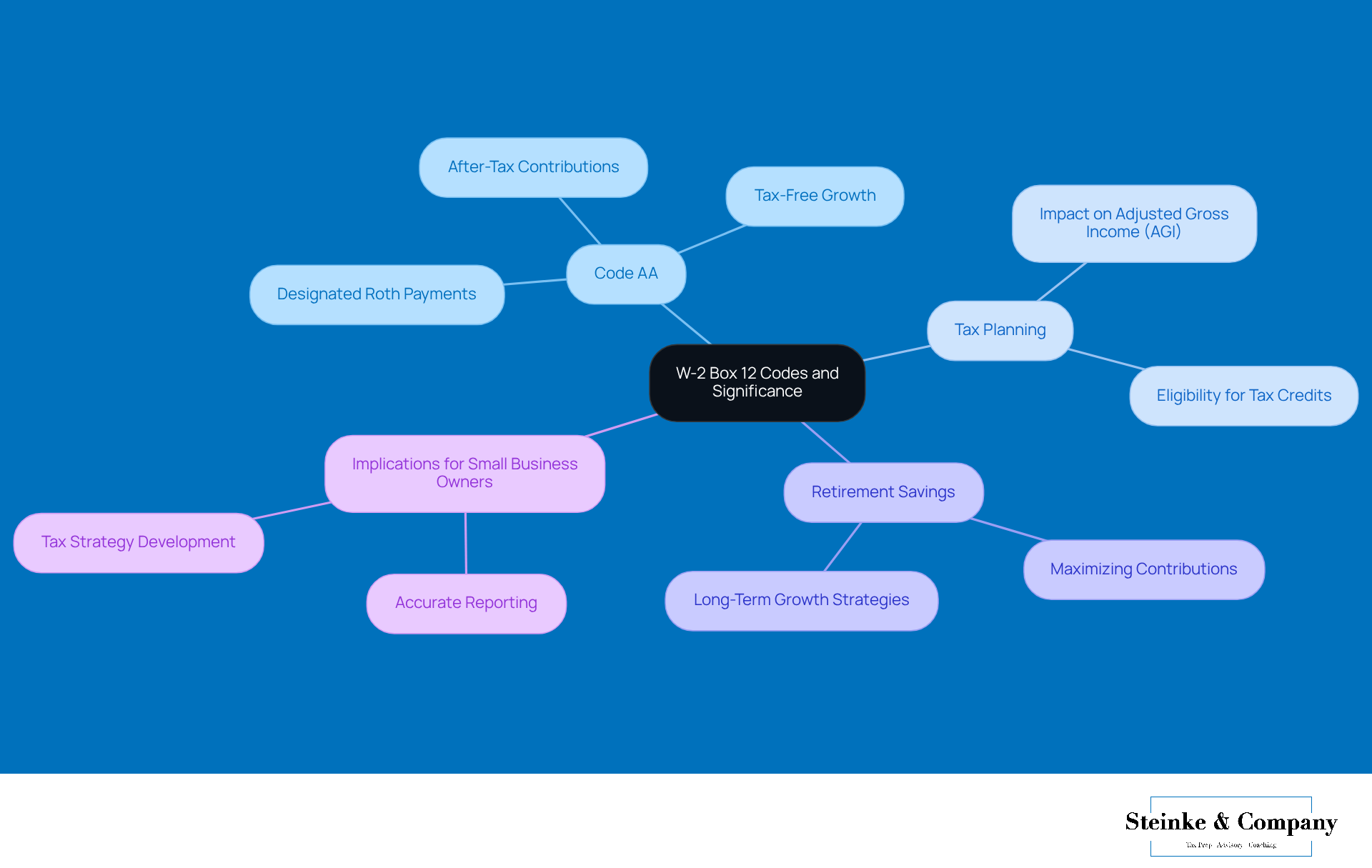

Define W-2 Box 12 Codes and the Significance of Code AA

W-2 Box 12 is a key part of the W-2 form that lays out different kinds of for employees. Each code in this box corresponds to specific types of income or deductions that can really impact how much tax you owe. For instance, the term 'AA on W2' refers to 'Designated Roth payments under a section 401(k) plan.' These contributions are made after-tax, which means they can grow tax-free. This presents a fantastic chance for tax planning and maximizing your retirement savings.

Understanding these regulations is super important for accurate tax submissions and making the most of potential tax benefits for both employers and employees. For small business owners, the implications of these rules go beyond just personal tax filings; they can shape overall business tax strategies. For example, amounts reported as aa on w2 can affect your adjusted gross income (AGI), which in turn impacts eligibility for various tax credits and deductions. Plus, the differences in taxation from state to state can complicate retirement income planning, since some states don’t tax certain retirement benefits while others do.

Let’s look at some real-life examples to see why these codes matter. Imagine a small business owner who accurately reports their Roth contributions; they can enjoy tax-free growth, which boosts their retirement savings strategy. This is particularly relevant today, given the varied taxation landscape retirees face, including federal and state taxes on retirement income. On the flip side, if someone misinterprets Box 12 codes, it could lead to incorrect tax reporting, resulting in potential liabilities or missed opportunities for tax savings. So, having a solid grasp of the designations aa on w2 Box 12 is crucial for small business owners looking to improve their tax situations. As Kristal Sepulveda, a CPA, puts it, 'Box 12 on the Form W-2 serves as a critical information hub, detailing various special compensations and deductions.' Staying updated on these codes is essential, especially with the tax reforms coming in H.R. 1, which will affect the 2025 filing season.

Interpret the AA Code: Implications for Taxable Income and Retirement Plans

So, Code AA is all about those payments you make to a Roth 401(k) plan, right? These are done with after-tax dollars. Now, while they won't lower your taxable income this year, they do allow for tax-free withdrawals when you retire—provided you meet certain conditions.

For small business owners, getting a grip on this regulation is super important because it affects how they report employee contributions on W-2 forms and shapes their overall tax strategy. Plus, employees get to enjoy tax-free growth on their investments, which makes this retirement savings option even more attractive.

This knowledge can really looking to up their retirement planning game. By leveraging the advantages of Roth 401(k) payments, they can boost employee engagement and retention. How cool is that?

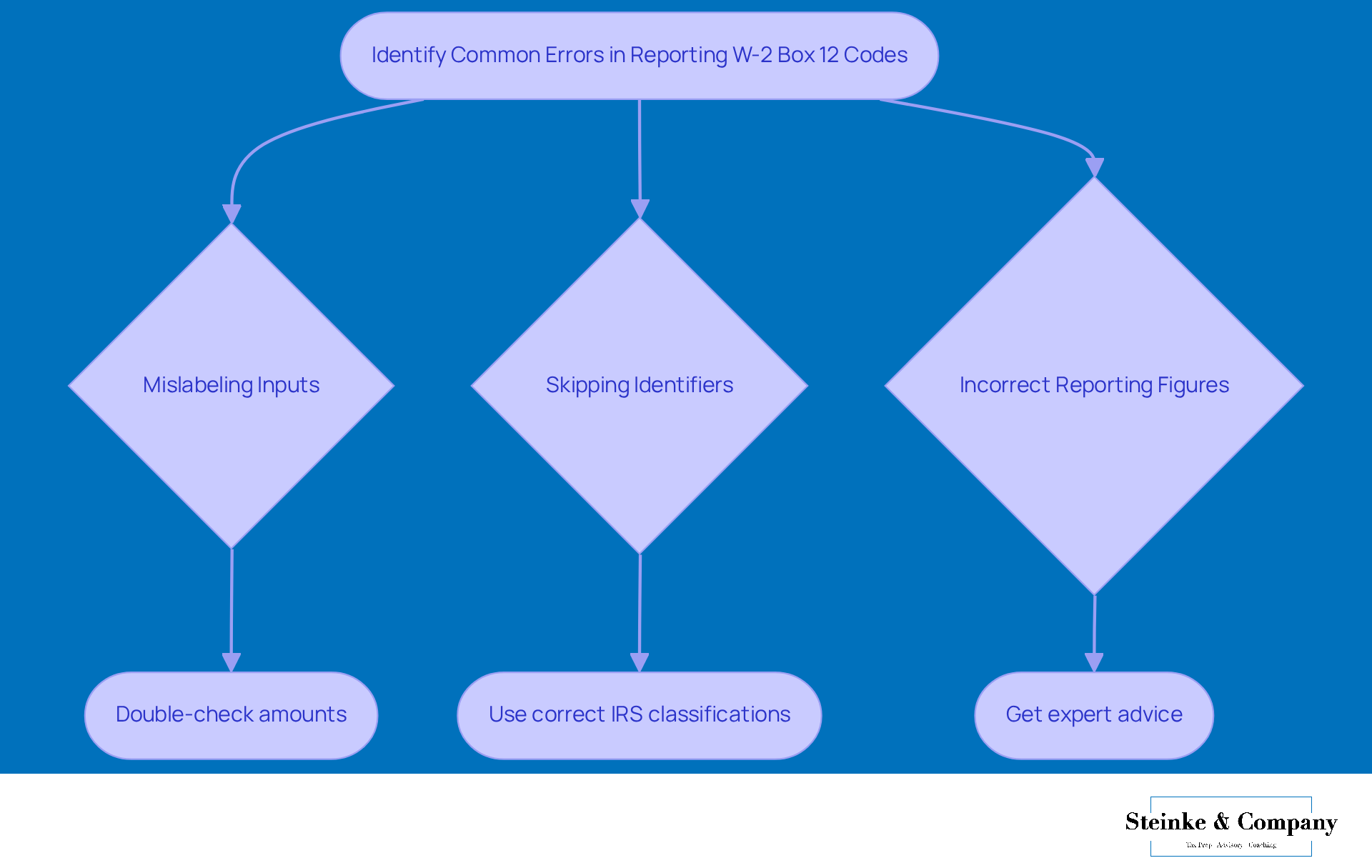

Identify Common Errors in Reporting W-2 Box 12 Codes, Especially Code AA

Frequent mistakes in reporting W-2 Box 12 designations, especially aa on W-2, can lead to some serious compliance headaches for small businesses. You might find that mislabeling inputs, skipping essential identifiers, or reporting figures incorrectly are common pitfalls. For instance, it's easy to confuse Roth 401(k) inputs, which should be reported as aa on W-2, with traditional 401(k) inputs that go in different sections. Plus, some employers mistakenly report total payments instead of the specific amounts for each worker, which can create inconsistencies and even result in fines.

To steer clear of these issues, it’s super important for employers to against their payroll records and make sure they’re using the right classifications according to IRS guidelines. Did you know that small businesses often face penalties for misreporting W-2 forms? Fines can soar up to $1,113,000 for significant errors! Take, for example, a business that faced a $270 penalty for each incorrect Form W-2 due to mistakes in Box 12, Code DD. This really highlights the need for careful reporting.

Employers should also consider getting expert advice on what happens when W-2 Box 12 contributions are misclassified, as these errors related to aa on W-2 can impact employees' tax liabilities and retirement plan participation. By setting up thorough review processes and using payroll software that meets IRS requirements, small businesses can greatly reduce the chances of making mistakes in W-2 Box 12 reporting. So, let’s keep those numbers straight and avoid the headaches!

Guide to Accurate Reporting and Strategic Use of W-2 Box 12 Codes

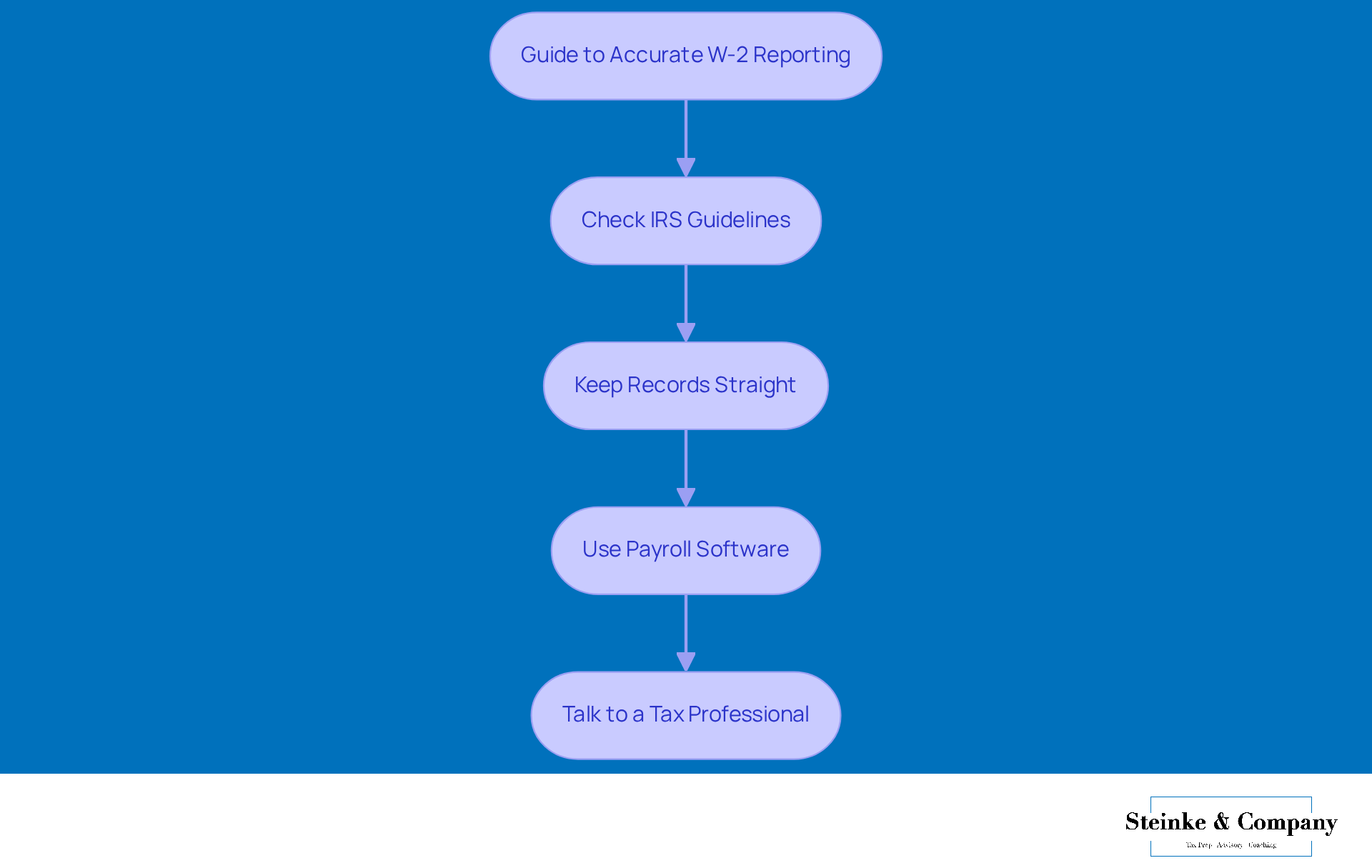

If you're a small business owner looking to nail down those W-2 Box 12 identifiers, here are some friendly tips to help you out:

- Check Out IRS Guidelines: Make sure you're in the loop with the latest IRS instructions for Form W-2, especially when it comes to those Box 12 codes. Staying updated is key to keeping everything compliant.

- Keep Your Records Straight: It's super important to maintain accurate records of your employees' contributions to retirement plans and other compensation. Trust me, categorizing those amounts correctly will save you a headache later!

- Use Payroll Software: Have you thought about ? It can automate the calculation and reporting of contributions, which really cuts down on human error. Fun fact: over 70% of small businesses are now using payroll software to make their W-2 reporting a breeze.

- Talk to a Tax Professional: Don’t hesitate to reach out to a tax advisor or accountant to review your W-2 filings. They can help ensure you’re following all the regulations and even optimize your tax benefits. For example, a family-owned business I know recently switched to an integrated payroll solution, and it not only simplified their reporting but also boosted their accuracy and efficiency.

By following these steps, you can effectively manage your W-2 reporting and understand the importance of aa on w2 to take full advantage of those Box 12 codes. So, what are you waiting for? Let's get started!

Conclusion

Getting to grips with the ins and outs of W-2 Box 12 codes, especially Code AA, is super important for small business owners looking to fine-tune their tax strategies and boost retirement planning. This code represents designated Roth contributions, which, while they don’t lower your taxable income right now, allow for tax-free withdrawals during retirement—if you meet certain conditions, of course. By mastering these codes, you can unlock some serious benefits for both your business and your employees.

Throughout this article, we’ve highlighted some key insights, like how crucial accurate reporting is to dodge compliance headaches and pesky penalties. We also touched on common mistakes when reporting W-2 Box 12 codes, emphasizing the need for careful attention to detail—after all, misclassifications can affect tax liabilities and retirement plan participation. Plus, leveraging payroll software and chatting with tax pros are great practices to ensure you’re on the right track with compliance and accuracy.

In the end, understanding W-2 Box 12 codes is about more than just checking off boxes for compliance; it’s about empowering small business owners to make smart decisions that can boost employee engagement and retention. By focusing on accurate reporting and staying in the loop about tax regulations, you can not only protect yourself from costly blunders but also set your business up for long-term financial success. So, embrace this knowledge—it’s a proactive step toward mastering the complexities of tax reporting and maximizing the perks of retirement contributions!

Frequently Asked Questions

What is W-2 Box 12?

W-2 Box 12 is a section on the W-2 form that outlines different types of compensation and benefits for employees. Each code in this box corresponds to specific income or deductions that can affect tax liabilities.

What does the code 'AA' on a W-2 form signify?

The code 'AA' on a W-2 form refers to 'Designated Roth payments under a section 401(k) plan.' These contributions are made after-tax, allowing them to grow tax-free.

Why is it important to understand W-2 Box 12 codes?

Understanding W-2 Box 12 codes is crucial for accurate tax submissions and maximizing potential tax benefits for both employers and employees. Misinterpretation can lead to incorrect tax reporting and possible liabilities.

How can W-2 Box 12 codes impact small business owners?

For small business owners, W-2 Box 12 codes can influence overall business tax strategies, affect adjusted gross income (AGI), and impact eligibility for various tax credits and deductions.

What are the implications of misreporting Box 12 codes?

Misreporting Box 12 codes can result in incorrect tax filings, leading to potential liabilities or missed opportunities for tax savings.

How do state tax laws affect retirement income planning related to W-2 Box 12 codes?

The differences in state taxation can complicate retirement income planning, as some states do not tax certain retirement benefits while others do, impacting the overall retirement strategy.

What is the significance of staying updated on W-2 Box 12 codes?

Staying updated on W-2 Box 12 codes is essential, especially with upcoming tax reforms, as they can affect tax filing and planning for future tax years.