Overview

The Safe Harbor Election is an awesome tool for small businesses! It helps you dodge those pesky penalties for underpaying taxes and gives you a clearer picture of what to expect in your tax obligations. In this article, we’ll dive into why it’s so important, covering:

- Who’s eligible

- How to make the election

- The perks it brings, like a lower risk of penalties and easier tax planning

This ultimately helps small business owners manage their finances better. So, are you ready to learn how this can work for you?

Introduction

Navigating the complexities of tax obligations can feel pretty overwhelming for small business owners, especially with the constant worry of penalties for underpayment hanging over their heads. But here’s some good news: the Safe Harbor Election can be a real lifesaver! It offers clarity and predictability in tax planning, helping to reduce the risk of those unexpected financial burdens.

Still, even with these benefits, many business owners might not know about the eligibility criteria or the steps needed to take full advantage of it. So, what challenges could pop up when trying to master the Safe Harbor Election?

And how can small businesses make sure they’re really getting the most out of this valuable opportunity?

Let's dive in!

Define the Safe Harbor Election and Its Importance for Small Businesses

The Secure Haven Election is a great option for small businesses looking to dodge penalties related to underpayment of taxes, as long as they meet certain criteria. This election is especially important for small enterprises since it brings predictability to tax obligations, allowing owners to manage their finances with more confidence. By opting for the Secure Haven, businesses can ensure they’re following tax rules while significantly reducing the risk of unexpected tax bills.

For service-oriented businesses, which often deal with fluctuating income levels, the safe harbor election acts as a safety net against the complexities of tax calculations. It streamlines the process of figuring out tax obligations, reducing the chances of misreporting income and facing penalties. Take the de minimis safe harbor rule, for instance—it lets small businesses deduct amounts paid for tangible property up to $2,500 per invoice if they don’t have an applicable financial statement. This rule simplifies compliance by freeing minor expenses from detailed reporting.

Understanding is key for small business owners. The IRS imposes penalties when taxpayers don’t pay at least 90% of their current year’s tax liability or 100% of the previous year’s. Since October 1, 2023, the interest rate for underpayments has been 8% per year, compounded daily. This makes it crucial for companies to adjust their strategies accordingly.

Recent case studies show the benefits of the safe harbor election, as small businesses that have taken advantage of the Secure Haven provisions report better financial planning and reduced administrative hassles. The IRS understands that small enterprises often lack the resources to navigate the complicated tax landscape, which is why the Secure Passage Election is such a valuable tool for ensuring compliance and fostering growth.

In a nutshell, the Protection Election not only helps with tax compliance but also allows small business owners to focus on what they do best—running their operations—confident that they have a reliable system in place for managing their tax responsibilities while adapting to the ever-changing tax environment.

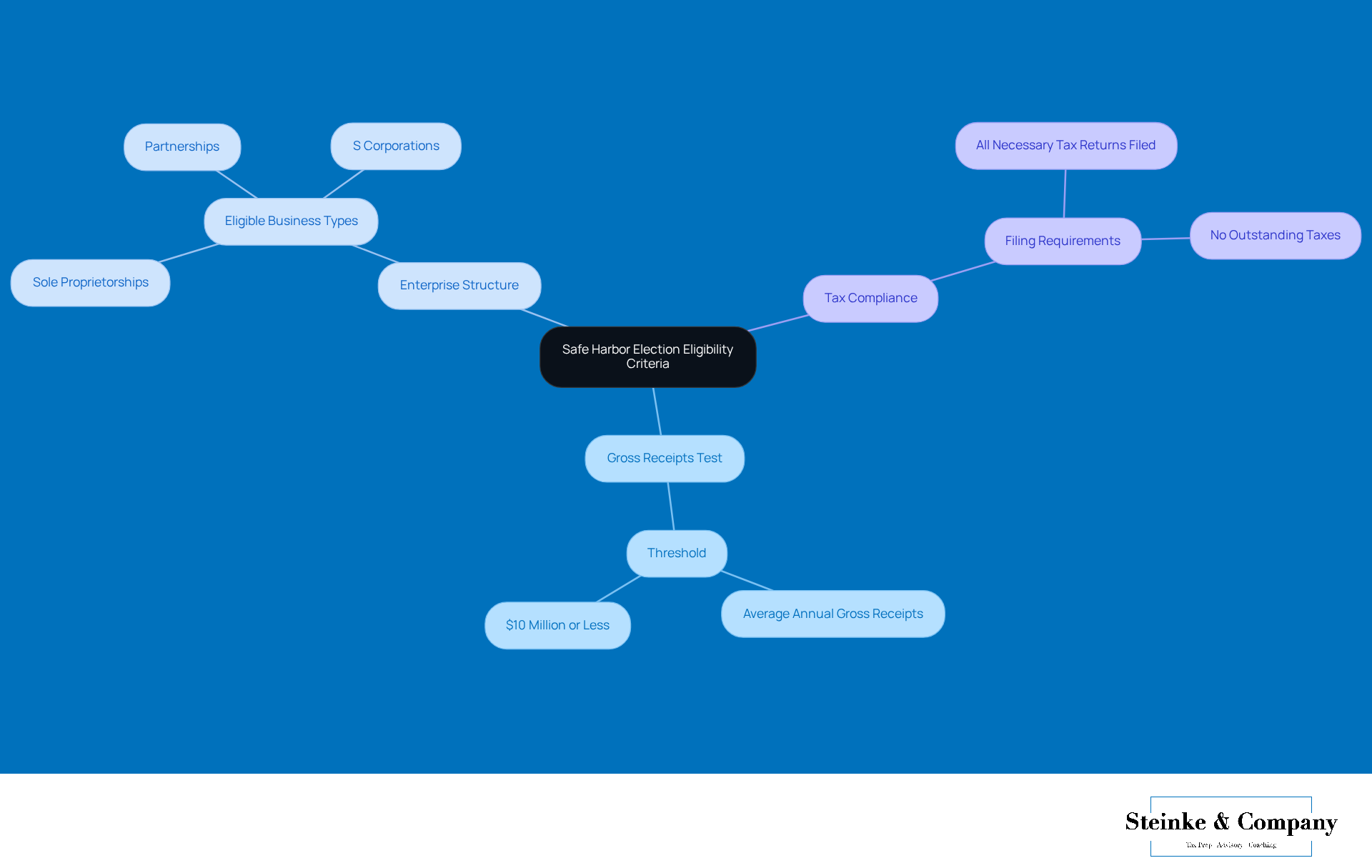

Identify Eligibility Criteria and Key Thresholds for the Safe Harbor Election

If you're a small business owner aiming to qualify for the safe harbor election, there are specific eligibility criteria you’ll want to keep in mind. First up is the Gross Receipts Test: your business needs to have average annual gross receipts of $10 million or less over the last three tax years. This threshold is super important, as it aligns with IRS guidelines aimed at supporting smaller enterprises.

Next, let’s talk about Enterprise Structure. The great news is that this safe harbor election is available for a variety of business types, including sole proprietorships, partnerships, and S corporations. This means a wide range of small businesses can take advantage of it!

Now, don’t forget about Tax Compliance. It’s crucial that your company has filed all necessary tax returns and taken care of any outstanding taxes. If you’re not compliant, you could miss out on these protective provisions, which might lead to penalties and increased tax obligations.

is key for small business owners. After all, about 99.9% of firms in the U.S. fall into the small business category, making it essential to comply with these guidelines for your financial stability and growth. So, why not take a moment to review your eligibility? It could make a big difference!

Outline the Steps to Elect the Safe Harbor and Maintain Compliance

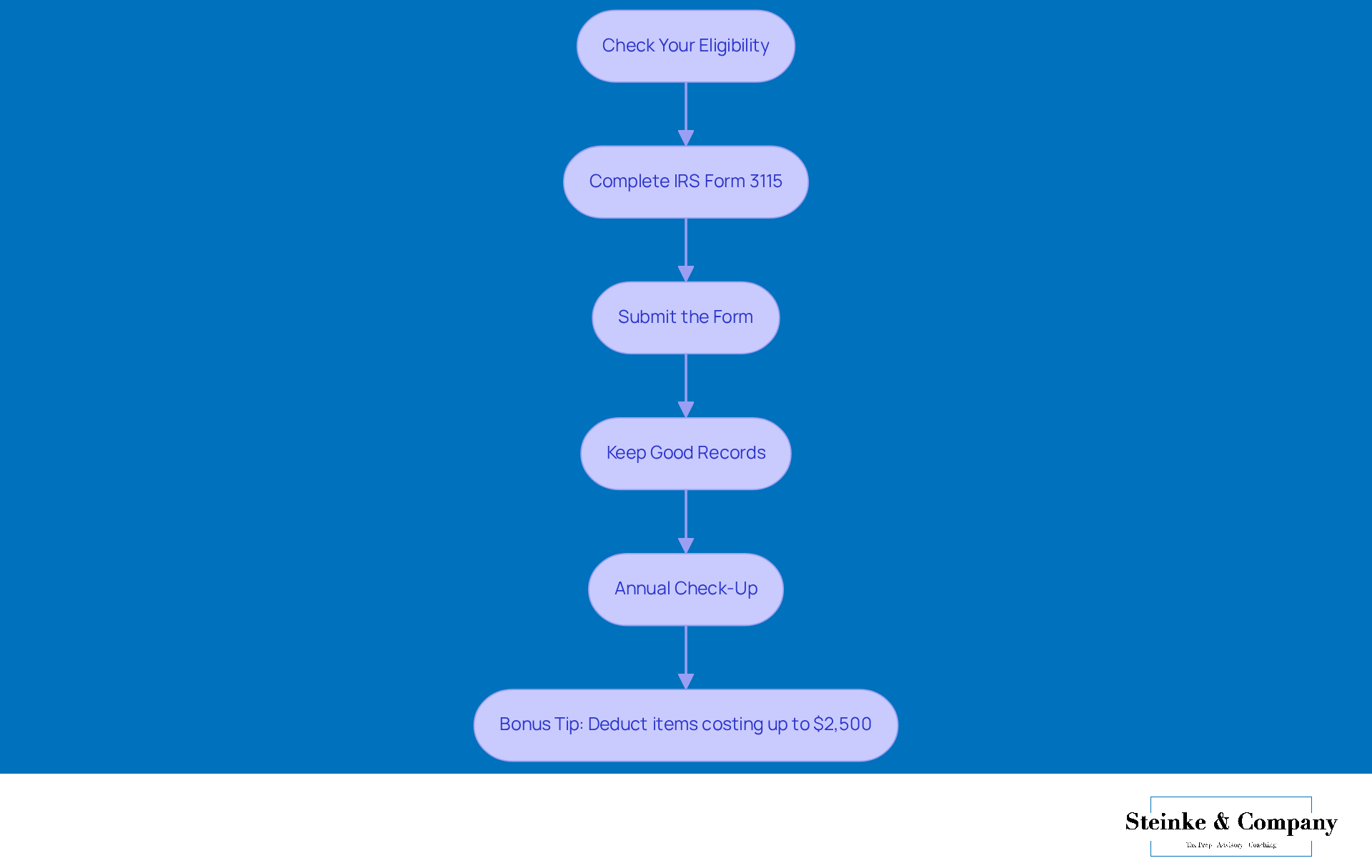

Are you interested in the safe harbor election? Here’s how you can do it in a few simple steps:

- Check Your Eligibility: First things first, make sure your business meets the eligibility requirements for the secure refuge election. It’s important to start off on the right foot!

- Complete IRS Form 3115: Next, fill out Form 3115. This form is your ticket to changing your accounting method so you can deduct those depreciable assets.

- Submit the Form: Don’t forget to file Form 3115 with your tax return for the year you’re making the election. Just make sure you get it in by the due date of your return!

- Keep Good Records: It’s crucial to maintain thorough records of your income and expenses. This includes documentation of your gross receipts and the calculations you used to confirm your eligibility.

- Annual Check-Up: Lastly, take a moment each year to reevaluate your eligibility. This way, you can ensure you’re still in line with the , especially if your business situation changes.

And here’s a little bonus tip: you can deduct the full amount for items costing up to $2,500 in the year you incur the expense under the de minimis safe harbor election. This can really help out small business owners by making accounting a bit easier. For some practical insights, check out the case study on the safe harbor election for small taxpayers. It’s a great example of how small business owners can leverage this election to enhance their tax strategies!

Evaluate the Benefits and Limitations of the Safe Harbor Election for Tax Planning

The Safe Harbor Election has some great perks for small businesses, and here’s what you need to know:

- Reduced Risk of Penalties: By sticking to Safe Harbor guidelines, businesses can dodge those pesky penalties that come with underpaying taxes. Did you know that companies using protective strategies see a significant drop in penalty assessments? This can really help with financial stability. Plus, with the current interest rate for underpayments sitting at 8% per year, compounded daily, staying compliant is key for your financial health.

- Simplified Tax Planning: Knowing what to expect with your tax obligations under the safe harbor election makes budgeting a whole lot easier. This predictability lets you allocate resources more efficiently. Understanding IRS requirements—like paying at least 90% of this year’s tax or 100% of last year’s—can really help small business owners navigate their tax responsibilities more smoothly.

- The safe harbor election provides businesses with the flexibility to change their income reporting methods without facing immediate penalties, which is a nice aspect of tax management.

But hold on! There are some limitations to keep in mind:

- Potential for Higher Taxes: Sometimes, choosing Safe Harbor might actually lead to higher overall tax bills compared to other methods. It’s worth weighing the long-term financial impact before making a decision.

- Complexity in Compliance: Keeping up with regulatory requirements means you'll need careful record-keeping and annual evaluations, which can take a toll on smaller businesses.

- Eligibility Constraints: Not every business qualifies for Safe Harbor, so it might not be an option for everyone.

Understanding these factors is super important for small business owners, especially when preparing for a . It helps you make informed choices about your tax planning strategies, so you can enjoy the benefits while effectively navigating any limitations. What are your thoughts on using Safe Harbor for your business?

Conclusion

The Safe Harbor Election is a fantastic tool for small businesses, providing a way to lessen the risks tied to tax underpayment while boosting financial predictability. By getting to know and using this election, small business owners can tackle the complexities of tax obligations with more confidence, ensuring compliance and lowering the chances of unexpected penalties.

Throughout this article, we’ve highlighted some key insights, like the eligibility criteria businesses need to meet, such as the Gross Receipts Test, and the importance of staying tax compliant. We’ve also laid out a clear, step-by-step process for electing the Safe Harbor, stressing how crucial thorough record-keeping and annual evaluations are. Plus, we balanced the benefits—like reduced penalties and simpler tax planning—with potential limitations, so business owners can make the best decisions.

In the end, leveraging the Safe Harbor Election can really make a difference for a small business’s financial health and operational focus. We encourage small business owners to take proactive steps in checking their eligibility and understanding what this election means for them. By doing this, they can navigate the tax landscape more effectively, allowing them to focus on what truly matters—growing their business.

Frequently Asked Questions

What is the Safe Harbor Election?

The Safe Harbor Election is an option for small businesses to avoid penalties related to underpayment of taxes, providing predictability in tax obligations and allowing owners to manage their finances more confidently.

Why is the Safe Harbor Election important for small businesses?

It is important because it reduces the risk of unexpected tax bills, simplifies tax calculations, and helps ensure compliance with tax rules, which is especially beneficial for service-oriented businesses with fluctuating income levels.

How does the de minimis safe harbor rule work?

The de minimis safe harbor rule allows small businesses to deduct amounts paid for tangible property up to $2,500 per invoice without needing an applicable financial statement, simplifying compliance by exempting minor expenses from detailed reporting.

What are the underpayment penalties imposed by the IRS?

The IRS imposes penalties when taxpayers do not pay at least 90% of their current year's tax liability or 100% of the previous year's liability. As of October 1, 2023, the interest rate for underpayments is 8% per year, compounded daily.

What benefits have small businesses reported from utilizing the Safe Harbor Election?

Small businesses that have utilized the Safe Harbor provisions report better financial planning and reduced administrative hassles, which helps them focus on their operations while ensuring compliance with tax obligations.

How does the Safe Harbor Election support small business growth?

The Safe Harbor Election supports growth by providing a reliable system for managing tax responsibilities, allowing small business owners to concentrate on running their operations without the added stress of navigating complex tax issues.