Overview

This article dives into how small businesses can manage passive loss carryover to make the most of their tax strategies. Have you ever wondered how to calculate and report those pesky passive losses? Well, it’s all about understanding IRS rules, keeping your records straight, and using Form 8582. This form is your ticket to carrying forward any unutilized deductions, which can help lower your future taxable income. So, let’s break it down together!

Introduction

Understanding the nuances of passive loss carryover can really change the game for a small business's financial strategy. This handy tax provision lets entrepreneurs carry over unused deductions from one year to the next, which can be a lifesaver when non-active ventures end up costing more than they earn. But let’s be honest—navigating the maze of IRS regulations and getting those calculations just right can be a bit tricky.

So, what can small business owners do to get a handle on this important part of tax planning and make the most of their deductions?

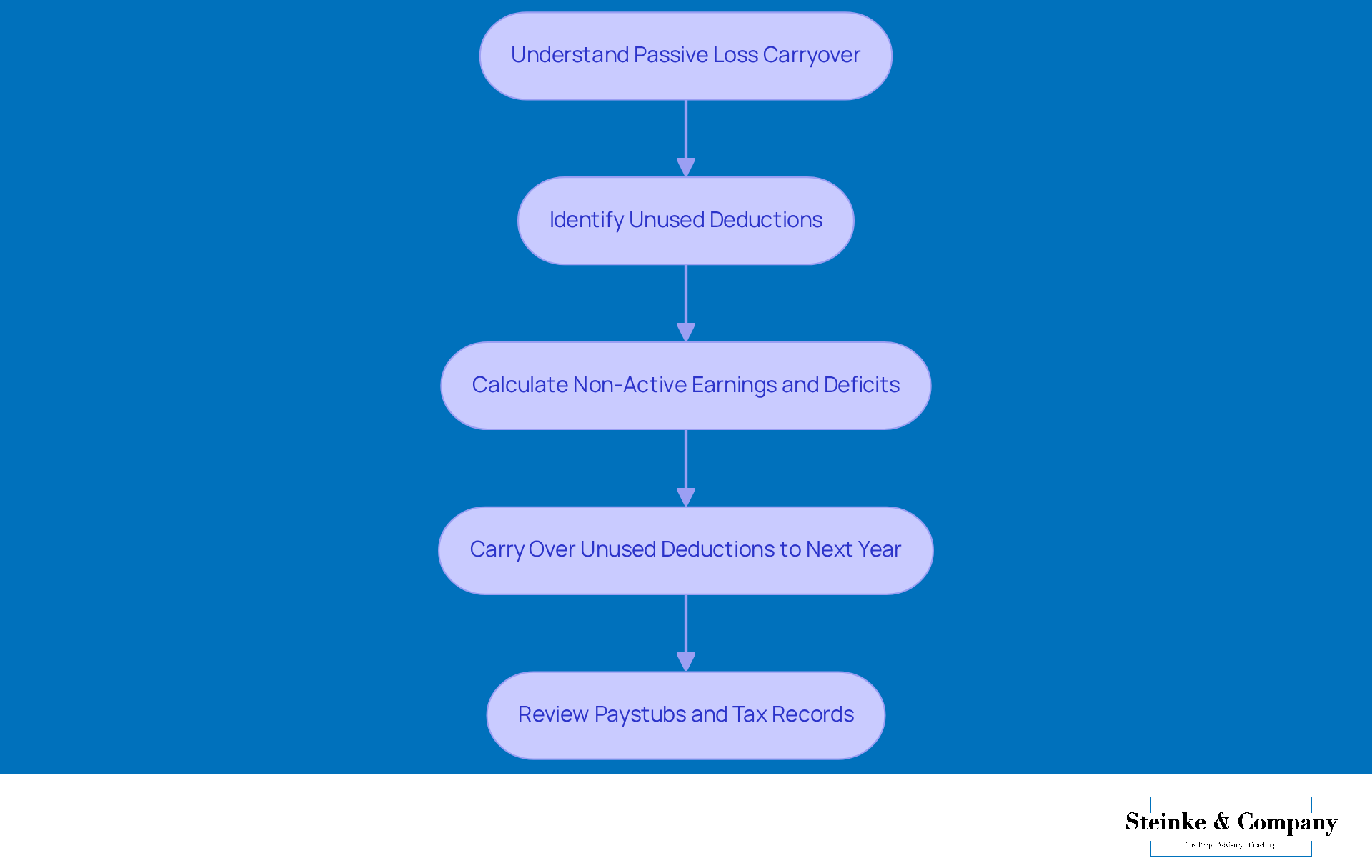

Understand Passive Loss Carryover

Unused deductions carryover is a neat little trick that allows you to transfer any unutilized deductions from one tax year to the next. This usually comes into play when a taxpayer finds themselves with more costs than earnings from non-active ventures, resulting in a passive loss carryover from sources like rental properties or limited partnerships. For instance, let’s say you have a non-active deficit of $10,000 in one year, but only $5,000 in non-active earnings. That means you can carry over the leftover $5,000 to the next tax year! Understanding this concept is super important for , as passive loss carryover helps you balance out future non-active earnings with past deficits, ultimately reducing your taxable income.

For small agency owners, it’s crucial to regularly review your paystubs and keep your tax records in check. This practice not only ensures you’re getting the right compensation but also helps you see exactly where your money is going, which can really influence your financial strategy. By digging into your paystub details—like wages, taxes, and deductions—you can get a clearer picture of your financial health. Plus, keeping detailed records of your income and expenses boosts your ability to apply those unused deductions effectively, leading to potential tax savings for your business. So, have you checked your paystubs lately?

Review Rules and Limitations

Before diving into passive loss carryover, let’s take a moment to understand the rules and limitations that come along with it:

- Material Participation: Only losses from activities where you’re not actively involved are considered inactive. If you’re putting in the work, those losses may not qualify for carryover.

- Earnings Restrictions: Inactive losses can only offset inactive income. If your non-active losses exceed your non-active earnings, the excess losses will be classified as a passive loss carryover and will roll over to the next period.

- Form 8582: To report those non-active losses and figure out what deductions you can take, you’ll need to fill out IRS Form 8582. This form details your earnings and losses from non-active activities and helps this year.

- Deferred Losses: If you don’t use your inactive deductions in the current year, don’t worry—your passive loss carryover can be carried forward indefinitely until you have enough inactive income to offset them.

Important Considerations:

- Keep detailed records of all your passive activities and losses. It’ll save you a headache later!

- And hey, don’t hesitate to consult with a tax professional to make sure you’re on the right side of IRS regulations. They can really help clarify things for you!

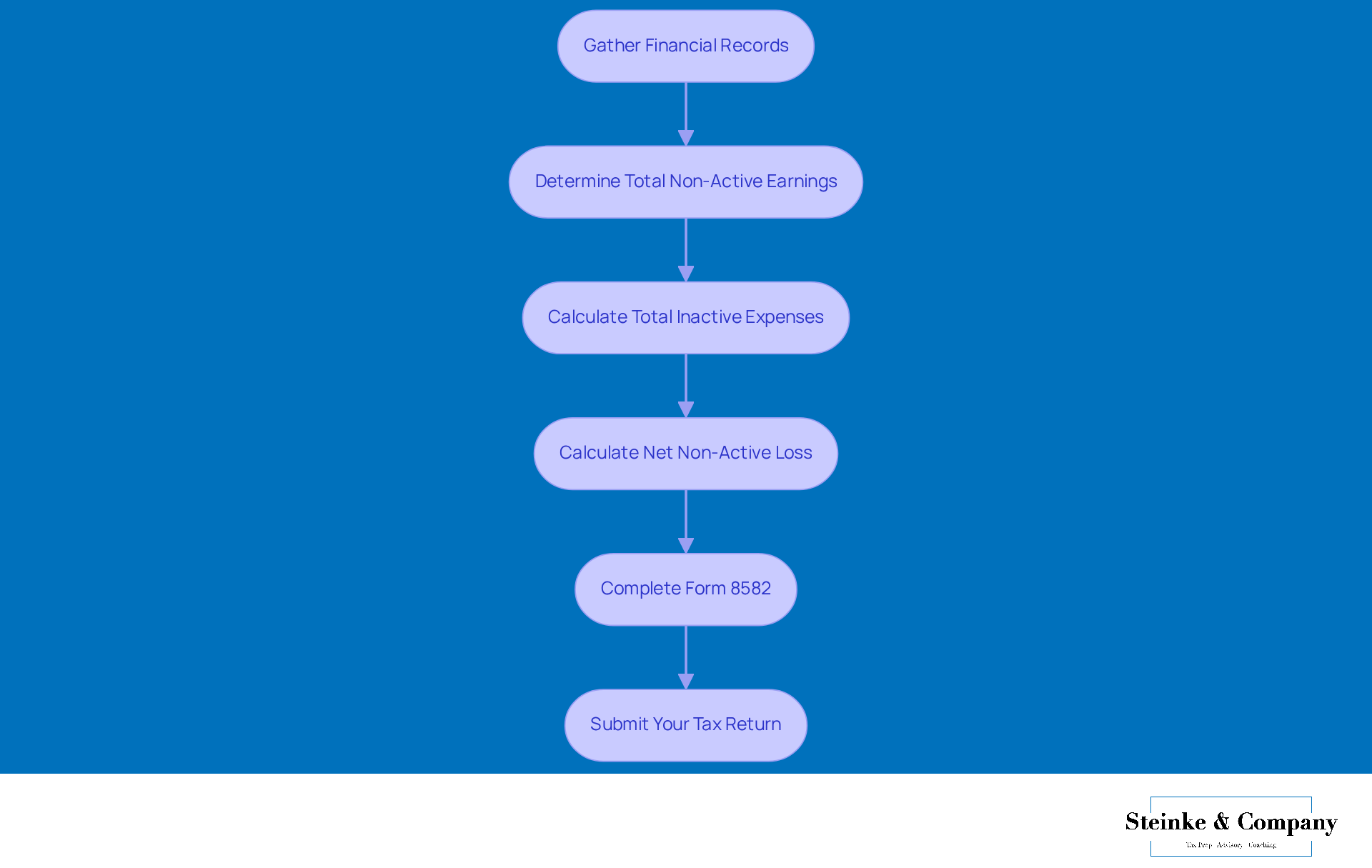

Calculate and Report Passive Losses

To accurately calculate and report passive losses, let’s walk through some essential steps together:

- Gather Financial Records: Start by collecting all your relevant financial documents. This includes your earnings statements, expense reports, and any paperwork related to your .

- Determine Total Non-Active Earnings: Next, calculate your total revenue from non-active activities. This might include rental earnings, dividends from limited partnerships, and other non-active sources of income.

- Calculate Total Inactive Expenses: Now, sum up all the expenses tied to those inactive activities. Think about property management fees, maintenance costs, and depreciation.

- Calculate Net Non-Active Loss: Time to see how it all adds up! Subtract your total non-active earnings from your total non-active expenses. If your costs are higher than your earnings, you’ve got a negative outcome on your hands.

- For example, if your investment income is $5,000 and your expenses hit $10,000, you’re looking at a net income deficit of $5,000.

- Complete Form 8582: It’s time to report your non-active financial setbacks on IRS Form 8582. This form is crucial for figuring out how much of your inactive deficit, as well as any passive loss carryover, can be deducted this tax year and how much you’ll carry forward.

- Submit Your Tax Return: Don’t forget to attach Form 8582 to your tax return. This ensures that your inactive expenses are recorded accurately.

Tips:

- Remember to double-check your calculations! Statistics show that small businesses often stumble over tax return errors related to passive losses.

- Keep copies of all forms and documentation on hand. This will support your claims and make your life a lot easier down the road.

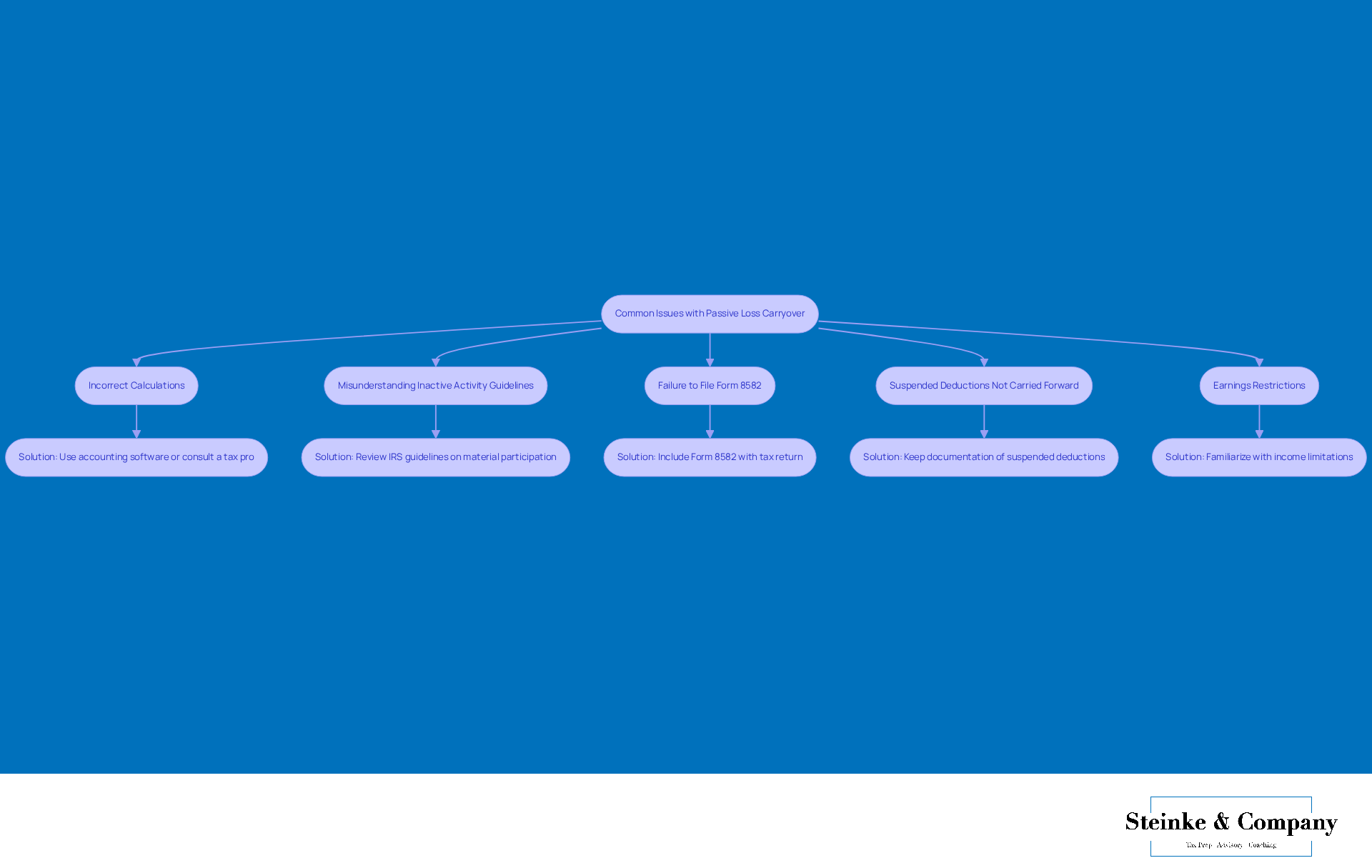

Troubleshoot Common Issues

When it comes to passive loss carryover, small business owners often run into a few common hiccups:

- Incorrect Calculations: It's super important to make sure all your calculations are spot on. Double-check those income and expense numbers to steer clear of any reporting errors.

- Solution: Consider using accounting software or chatting with a tax pro to verify your calculations.

- Misunderstanding Inactive Activity Guidelines: A lot of folks mix up with active involvement, leading to some confusion about expense classifications.

- Solution: Take a moment to review the IRS guidelines on material participation to get a clearer picture of what qualifies as non-active.

- Failure to file Form 8582 can lead to missing out on passive loss carryover deductions.

- Solution: Always make sure to include Form 8582 with your tax return if you have passive reductions to report.

- Suspended Deductions Not Carried Forward: Some taxpayers might miss transferring those suspended deductions to future tax years, affecting their passive loss carryover.

- Solution: Keep thorough documentation of all your suspended setbacks and make sure they’re reported in the following tax years.

- Earnings Restrictions: It’s easy to overlook that inactive losses can only offset inactive earnings.

- Solution: Get familiar with the income limitations and plan ahead to make the most of your deductions.

Final Thoughts:

- Don’t forget to regularly review your passive activities and losses to keep yourself updated on your tax situation. It’s a smart move!

Conclusion

Understanding and managing passive loss carryover is super important for small businesses that want to optimize their tax strategies. By tapping into those unused deductions from previous years, businesses can really cut down their taxable income and boost their financial health. This guide has given you a solid overview of the process, highlighting how crucial it is to keep detailed records and stick to IRS guidelines.

We’ve covered some key insights, like:

- Why it’s essential to grasp material participation rules

- The need to fill out IRS Form 8582 correctly

- The common mistakes to dodge when calculating and reporting passive losses

Each step we’ve outlined is designed to help small business owners navigate the complexities of passive loss carryover with confidence, ensuring they get the most out of their potential tax savings.

But remember, passive loss carryover is more than just tax deductions; it's a smart way to manage your finances. Small business owners should stay informed, regularly check in on their financial activities, and don’t hesitate to seek professional advice when necessary. This way, you can protect your interests and set yourself up for greater success in the ever-changing world of business finance.

Frequently Asked Questions

What is passive loss carryover?

Passive loss carryover allows taxpayers to transfer unused deductions from one tax year to the next, particularly when they have more costs than earnings from non-active ventures, such as rental properties or limited partnerships.

How does passive loss carryover work?

If a taxpayer has a non-active deficit in one year, any leftover losses after offsetting non-active earnings can be carried over to the next tax year. For example, if there is a $10,000 deficit and $5,000 in earnings, the remaining $5,000 can be used in the following year.

Why is understanding passive loss carryover important?

Understanding passive loss carryover is crucial for effective tax strategies as it helps balance future non-active earnings with past deficits, ultimately reducing taxable income.

What should small agency owners do regarding their paystubs and tax records?

Small agency owners should regularly review their paystubs and keep their tax records organized to ensure proper compensation and to understand their financial situation better.

How can reviewing paystub details impact financial strategy?

By examining details like wages, taxes, and deductions on paystubs, individuals can gain insights into their financial health, which can influence their overall financial strategy and tax planning.

What is the benefit of keeping detailed records of income and expenses?

Keeping detailed records of income and expenses enhances the ability to apply unused deductions effectively, potentially leading to tax savings for a business.