Overview

This article dives into the essential steps that small agencies need to take to set up their business accounts effectively.

It's super important to have dedicated business accounts—not just for financial clarity, but also for tax compliance and credibility.

We'll walk you through:

- How to choose the right account types

- How to gather all the necessary documentation

- How to manage your accounts efficiently

This will help you pave the way for long-term success, and trust me, it’s worth it!

Introduction

Building a strong financial foundation is super important for small agencies looking to thrive in today’s competitive landscape. Business accounts do more than just keep track of income and expenses; they boost your credibility and help you stay on the right side of tax regulations. But let’s be real—many agency owners find themselves scratching their heads when it comes to picking the right type of account and figuring out how to set it all up.

So, how can you make the most of business accounts to protect your finances and make your operations smoother?

Understand the Importance of Business Accounts

Setting up a business account is super important for small agencies, and here’s why:

- Monetary Clarity: Having a dedicated commercial account helps you keep a close eye on your income and expenses. It gives you a clear picture of your agency's financial health, which is key for making smart decisions and managing your cash flow like a pro.

- Tax Compliance: When you , tax prep becomes a breeze! This means you can stick to tax regulations and lower your chances of getting audited. Plus, having accurate financial records helps you spot deductible expenses and get ready for tax season without the stress.

- Operating through a business account can really boost your firm’s credibility with clients and vendors. It shows you’re committed to professionalism, which builds trust and positions your organization as a legitimate player in the market.

- Access to Financial Services: Business accounts often come with extra perks like credit lines, loans, and merchant services. These can be game-changers for your agency’s growth, allowing you to accept various payment methods and making things more convenient and secure for both you and your customers.

- Legal Protection: If your business is incorporated, having a separate account is crucial for protecting your personal assets from any business liabilities. This legal boundary is vital for keeping your personal finances safe from potential business risks.

By understanding these benefits, agency owners can level up their financial management practices, which includes setting up business accounts, paving the way for long-term success and stability. So, are you ready to take that step?

Choose the Right Type of Business Account

When you're picking a business account, it's super important to think about a few key types:

- Business Checking: This one’s a must-have for your daily transactions. It lets you handle deposits, withdrawals, and bill payments with ease. Look for options that come with low fees and easy access, so your money moves smoothly. Financial expert Sammi Caramela even points out that setting up business accounts, including a dedicated business checking account, helps keep your finances organized and compliant, giving you a clearer view of your business goals and growth.

- Business Savings Option: This option is all about saving money and earning interest. It’s great for setting aside cash for future investments or those unexpected emergencies. Think of it as your rainy day fund, helping you tackle surprise expenses while your savings grow.

- Merchant Profile: If your business accepts credit card payments, you’ll definitely need a merchant profile. It allows you to take various payment methods, making it easier for customers to pay and streamlining your payment processes. This is particularly vital for businesses that rely on e-commerce or digital transactions.

- Specialized Services: Some banks offer options tailored for specific industries or business sizes. It’s worth checking these out, as they might come with perks like lower fees or specialized services that fit your unique operational needs.

- Online Business Accounts: Don’t forget about digital banks! They often provide lower fees and handy online management tools. These accounts can be a game-changer for tech-savvy business owners, allowing seamless integration with cloud-based financial management software.

As you assess your business's transaction needs, remember that higher transaction limits usually mean higher monthly fees. And don’t overlook security features when choosing a bank, especially for online banking. Understanding the of each option can really enhance your approach to managing money when setting up business accounts. Skipping out on a dedicated business checking service could lead to legal and financial headaches, so it’s crucial to keep your personal and business finances separate.

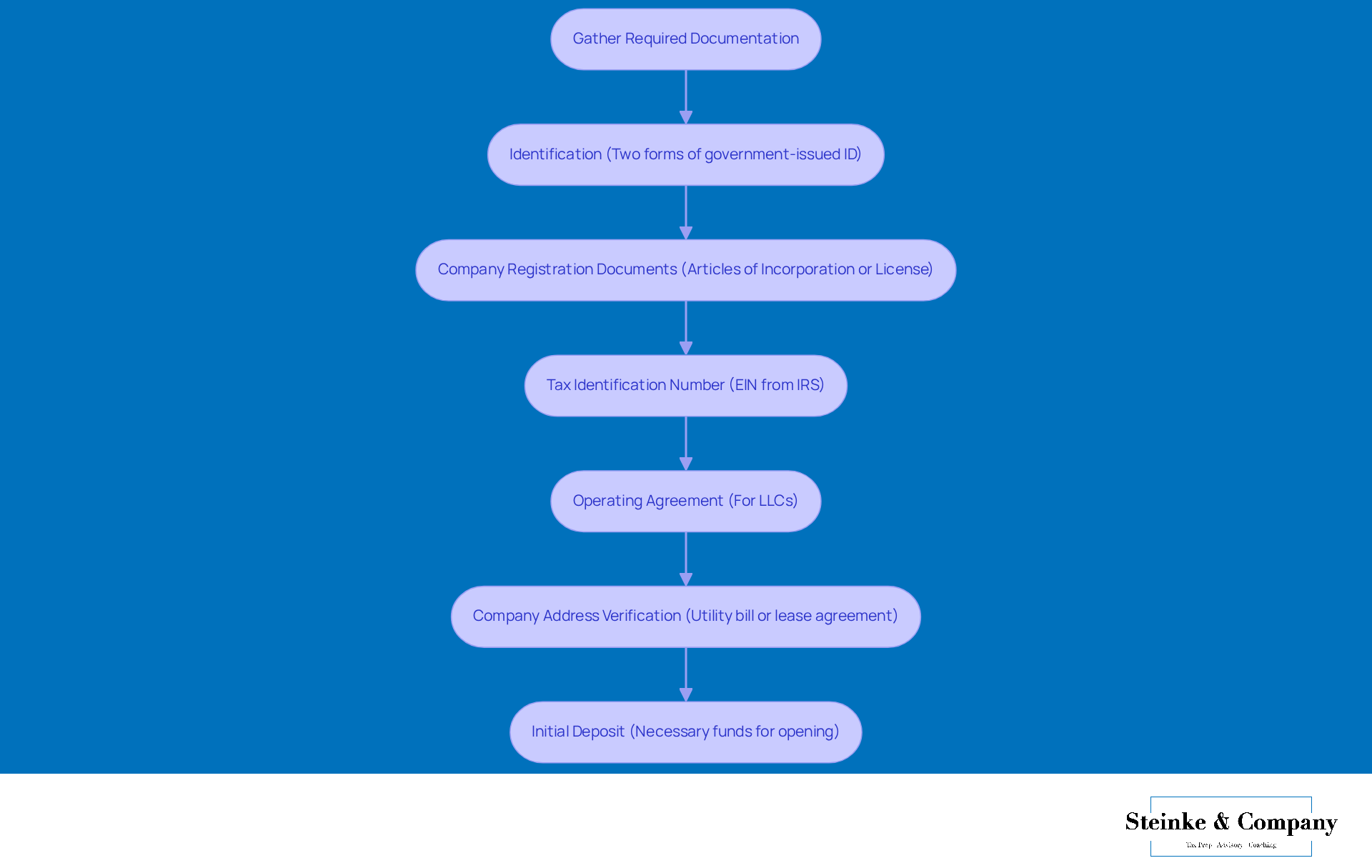

Gather Required Documentation for Setup

To successfully open business accounts, it’s essential to gather a few key documents. Let’s break it down:

- Identification: You’ll need two forms of government-issued ID (think driver’s license or passport) for all account signers to verify identity. Just make sure everything is original, current, valid, legible, and in good shape.

- Company Registration Documents: Don’t forget proof of your enterprise’s legal structure, like Articles of Incorporation or a License. These are crucial for establishing your legitimacy.

- Tax Identification Number: If applicable, grab that from the IRS. This number is vital for tax reporting and helps prevent identity theft. As Levi King, co-founder and CEO of Nav, puts it, "If you’re a sole proprietor, you will need an EIN, your Social Security number, and a driver’s license or passport."

- Operating Agreement: If your business is set up as an LLC, include an operating agreement that outlines how you’ll manage things.

- Company Address Verification: You’ll need to submit a utility bill or lease agreement that confirms your company address. This is important for meeting banking requirements.

- Initial Deposit: Lastly, be ready with the necessary funds, as some banks require an initial deposit to kick things off.

Before you receive that first payment for your products or services, setting up business accounts with your financial institution is key. Having these documents ready will not only simplify the process of setting up business accounts but also help you avoid unnecessary delays, allowing you to focus on growth and operations. Plus, keeping your personal and professional finances separate can really protect your funds, as highlighted in the case study on 'Protecting Funds with a Professional Bank Account.

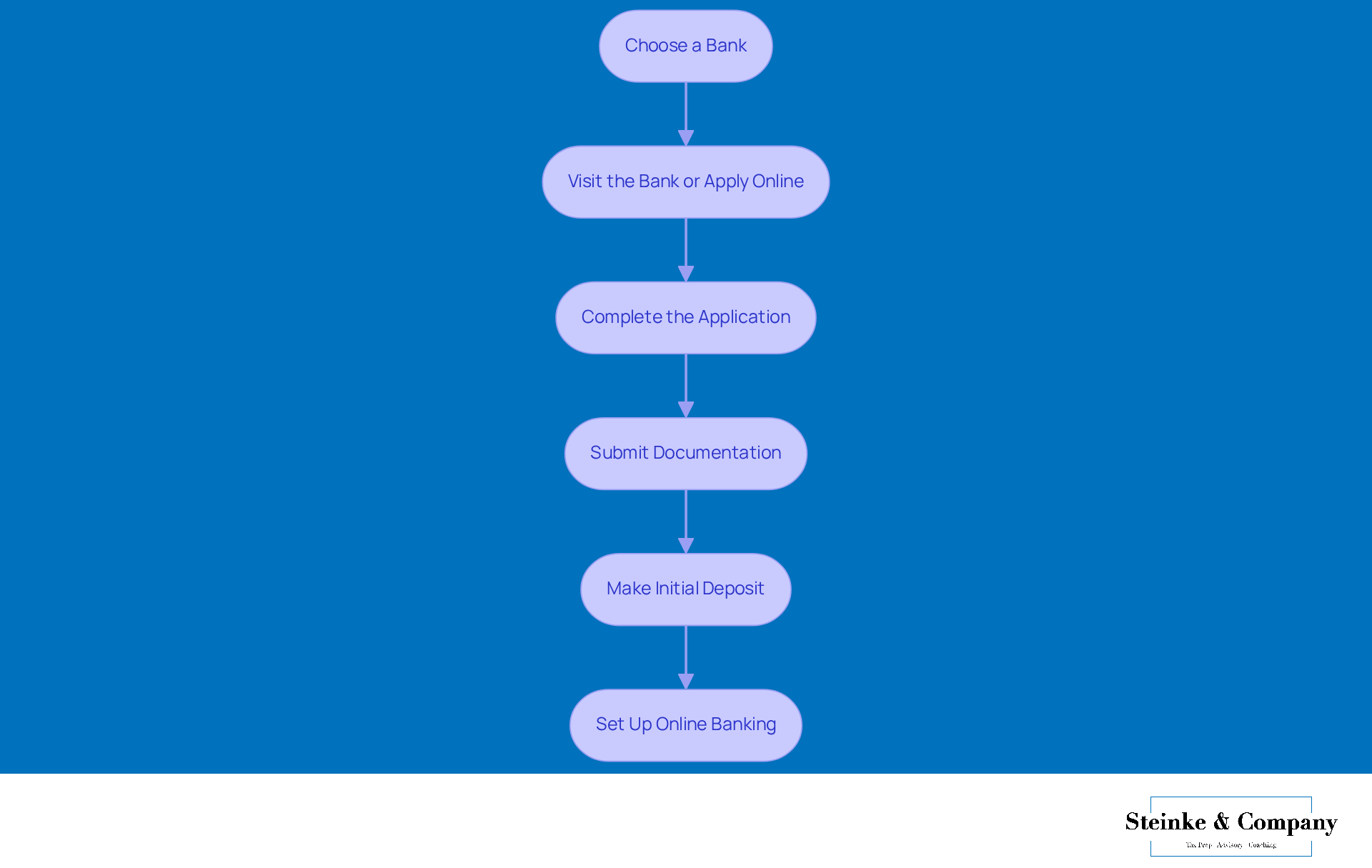

Open Your Business Account

Ready for setting up business accounts? Let’s walk through some essential steps together:

- Choose a Bank: Start by doing a bit of research to find a bank that fits your agency's needs. Think about things like fees, services, and how well it integrates with your accounting tools. Comparing banks is key to picking the best fit for your financial goals.

- Visit the Bank or : Depending on what your chosen bank offers, you can either pop into a local branch or handle the application process online. Just make sure you have all the necessary documents ready to go.

- Complete the Application: When filling out the application form, be sure to provide detailed information about your business and its owners. This step is super important for a smooth approval process.

- Submit Documentation: Hand over the required documents to the bank representative or upload them online as needed. Common documents include your legal business name, Employer Identification Number (EIN), and proof of your business address.

- Make Initial Deposit: To activate your account, you’ll need to fund it with the required initial deposit. This amount can vary by bank, so check the specific requirements beforehand. For instance, some banks might have monthly fees ranging from $6 to $125 CAD, depending on the services you choose.

- Set Up Online Banking: Once your account is set up, take a moment to establish online banking. This will make it easy to access and manage your finances, which is crucial for keeping track of your income and expenses.

By following these steps, you’ll be well on your way to setting up business accounts that will help you manage your agency’s finances with clarity and organization. A solid professional profile not only simplifies money management but also enhances your credibility with clients and suppliers, paving the way for future growth. As finance writer Erin Lansdown highlights, having a commercial bank service is essential for handling taxes and staying compliant with financial regulations.

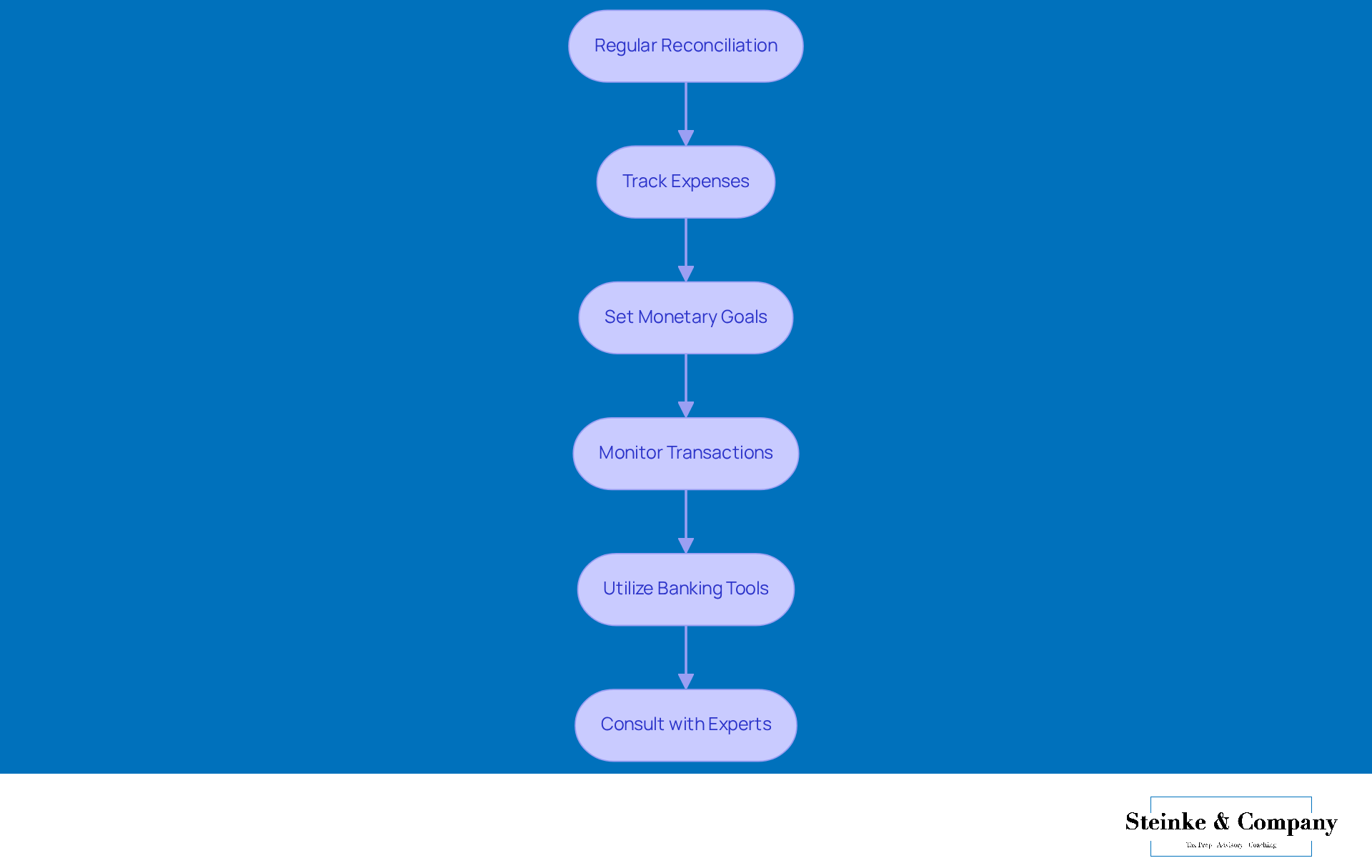

Manage Your Business Account Effectively

To manage your business account effectively, let’s chat about some strategies that can really help you out:

- Regular Reconciliation: How often do you check your bank statements against your accounting records? Monthly reconciliation is key! It not only guarantees accuracy but also helps you spot discrepancies early on—think of it as a preventive measure against tax audit headaches. Plus, it doesn’t take much time, making it a practical habit for busy agency owners like you.

- Track Expenses: Are you using accounting software like QuickBooks or FreshBooks? If not, it’s time to start! Categorizing and tracking your expenses can streamline your tax prep and give you better oversight of your cash flow. Keeping tabs on your income and expenses is vital for managing your money effectively, especially to dodge underpayment penalties. Remember, you need to meet IRS requirements, which means paying at least 90% of your current year’s tax obligation or 100% of last year’s.

- Set Monetary Goals: What are your financial goals? Setting both short-term and long-term objectives for your agency can really steer your efforts. Use your business resources to help reach these goals, ensuring your financial activities align with your overall strategy. Sure, budgets might not be the most exciting topic, but they’re crucial for cash flow management and preparing for any tax liabilities.

- Monitor Transactions: When was the last time you reviewed your account transactions? Regularly checking for unauthorized charges or errors can save you from monetary losses and keep your records accurate. Plus, it helps you catch any missed transactions that need recording, which is essential for staying compliant and prepping for IRS audits.

- Utilize Banking Tools: Have you explored online banking tools and apps? They can make managing your finances a breeze! Features like budgeting tools and alerts for low balances keep you in the loop about your financial situation. These tools can automate routine tasks and provide you with better monetary insights, which is super helpful for your overall economic strategy and tax compliance.

- Consult with Experts: Do you chat with advisors or accountants regularly? Their insights can be invaluable for and ensuring you’re on track with tax regulations. A skilled bookkeeper can keep your records accurate and up to date, making collaboration with CPAs and financial strategists smoother. This is crucial for avoiding costly penalties and enhancing your tax compliance. And don’t forget about the de minimis exception—if your total tax liability minus your withholdings and credits is less than $1,000, you won’t face underpayment penalties.

By applying these management strategies, you can keep your agency’s financial health in check and set the stage for growth. And remember, having cash reserves to support your business for three to six months is key to weathering financial challenges.

Conclusion

Setting up business accounts is a key step for small agencies aiming to boost their financial management and operational efficiency. By creating dedicated accounts, agency owners can gain clearer insights into their finances, ensure they’re on the right side of tax regulations, and enhance their professional credibility. Plus, they’ll unlock access to valuable financial services and legal protections.

Let’s break it down: the article walks you through five essential steps for setting up business accounts. You’ll learn:

- Why these accounts matter

- How to choose the right type

- What documents you’ll need

- The process of opening the account

- Tips for managing it effectively

Each step is crafted to help agency owners build a solid financial foundation that streamlines operations and supports growth and stability.

In short, having a business account is super important. It gives small agencies the power to manage their finances with confidence, setting the stage for long-term success. By following these steps and adopting smart management strategies, agency owners can keep their financial health in check, allowing them to focus on what really counts—growing their business and serving their clients. So, are you ready to take that next step?

Frequently Asked Questions

Why is it important to set up a business account for small agencies?

Setting up a business account is important for small agencies because it provides monetary clarity, aids in tax compliance, boosts credibility with clients, offers access to financial services, and provides legal protection for personal assets.

How does a business account help with financial management?

A business account helps keep track of income and expenses, providing a clear picture of the agency's financial health, which is essential for making informed decisions and managing cash flow effectively.

What are the tax benefits of having a separate business account?

A separate business account simplifies tax preparation, helps comply with tax regulations, reduces the chances of audits, and allows for easier identification of deductible expenses.

How can a business account enhance credibility?

Operating through a business account demonstrates professionalism to clients and vendors, building trust and positioning the agency as a legitimate business in the market.

What additional financial services can a business account provide?

Business accounts often come with perks such as credit lines, loans, and merchant services, which can facilitate growth and allow for various payment methods.

What legal protections does a business account offer?

If a business is incorporated, having a separate account protects personal assets from business liabilities, maintaining a legal boundary that safeguards personal finances.

What types of business accounts should I consider?

Consider a business checking account for daily transactions, a business savings option for future investments, a merchant profile for credit card payments, specialized services for specific needs, and online business accounts for lower fees and convenient management.

Why is a business checking account essential?

A business checking account is essential for handling deposits, withdrawals, and bill payments efficiently, helping keep finances organized and compliant.

What is the purpose of a business savings account?

A business savings account is for setting aside cash, earning interest, and providing a financial cushion for future investments or unexpected expenses.

What should I look for when choosing a business account?

When choosing a business account, look for low fees, easy access, security features, and options that meet your specific transaction needs, considering that higher transaction limits may come with higher monthly fees.