Overview

Did you know that health insurance premiums might just be deductible on your taxes? It’s true! But whether you can take advantage of this perk depends on a few factors, like your business structure, income level, and the type of coverage you have.

In this article, we’ll walk you through the steps to figure out if you’re eligible and how to claim those deductions. Remember, keeping good documentation and using the right tax forms is key to maximizing those potential tax benefits!

Introduction

Navigating the complexities of health insurance costs can feel like a real maze for small business owners, right? Especially when you start digging into the tax implications. But here’s the good news: the potential for tax deductions on health insurance premiums is a golden opportunity to ease some of that financial stress.

Now, the catch is that eligibility for these deductions depends on a few factors, like your business structure and income level.

So, what steps can you take to make sure you’re maximizing those health insurance premiums for tax benefits? And let’s not forget about the common pitfalls that you’ll want to steer clear of along the way!

Understand Health Insurance Premiums and Their Tax Implications

Health insurance costs can feel like a hefty weight for small business owners, right? These payments are for health coverage, and they can really add up. But here’s a silver lining: it’s worth considering whether health insurance premiums are deductible on taxes, which can help lighten your overall tax load. Just keep in mind that whether health insurance premiums are deductible on taxes depends on a few factors, such as your business type and your income level. Understanding these details is the first step in when it comes to medical coverage. So, how are you handling your health insurance costs?

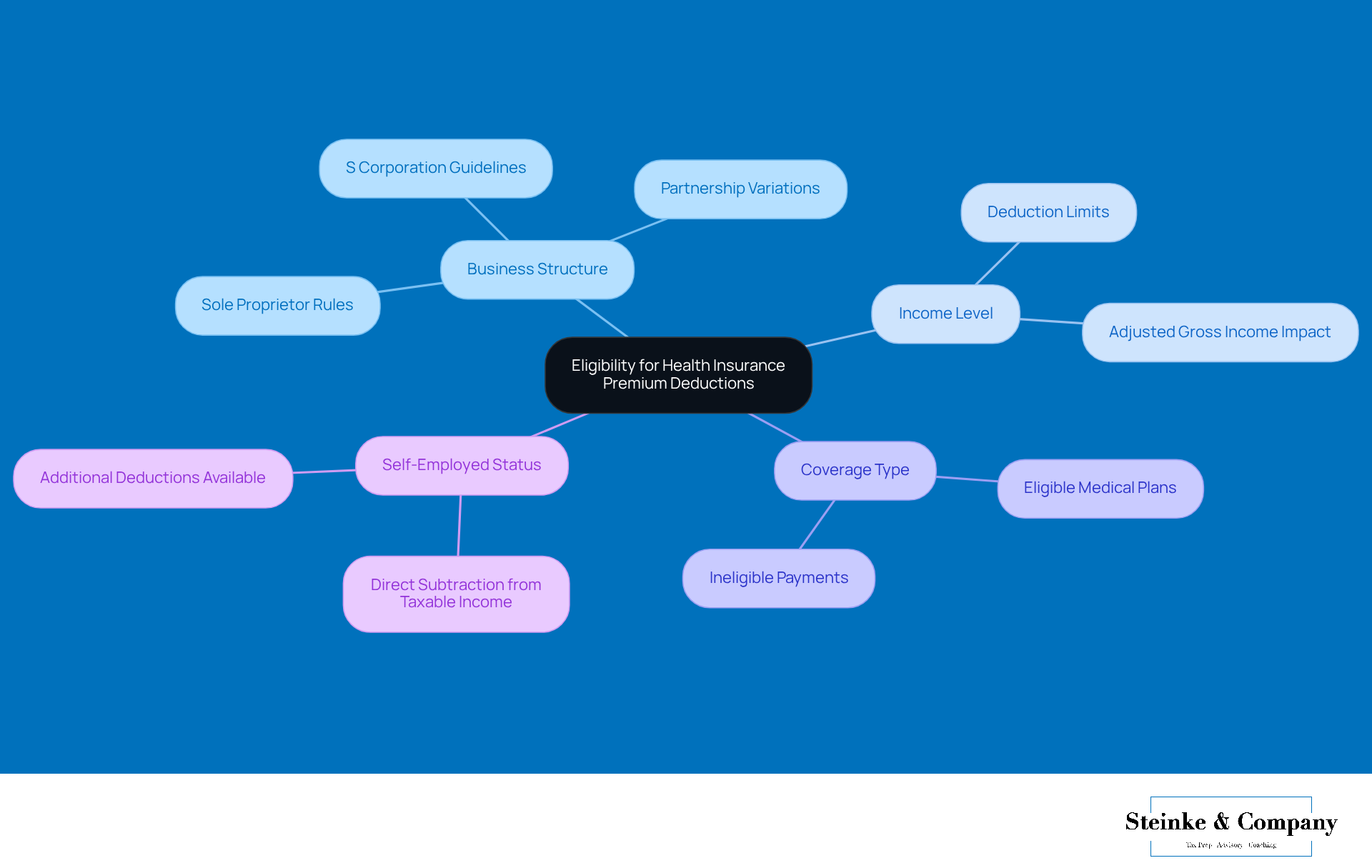

Evaluate Eligibility for Deducting Health Insurance Premiums

When it comes to figuring out if you can subtract those medical coverage costs, let’s break down a few key points together:

- Business Structure: If you’re a sole proprietor, part of a partnership, or running an S corporation, just know that the rules for deductions can vary a bit.

- Income Level: Your adjusted gross income (AGI) plays a role too—it can affect how much you can deduct.

- Coverage Type: Make sure the payments you’ve made are for eligible medical plans.

- Self-Employed Status: If you’re self-employed, good news! You might be able to right from your taxable income.

Take a moment to review these factors closely; they’ll help you assess your eligibility and determine if health insurance premiums are deductible on taxes to maximize your deductions!

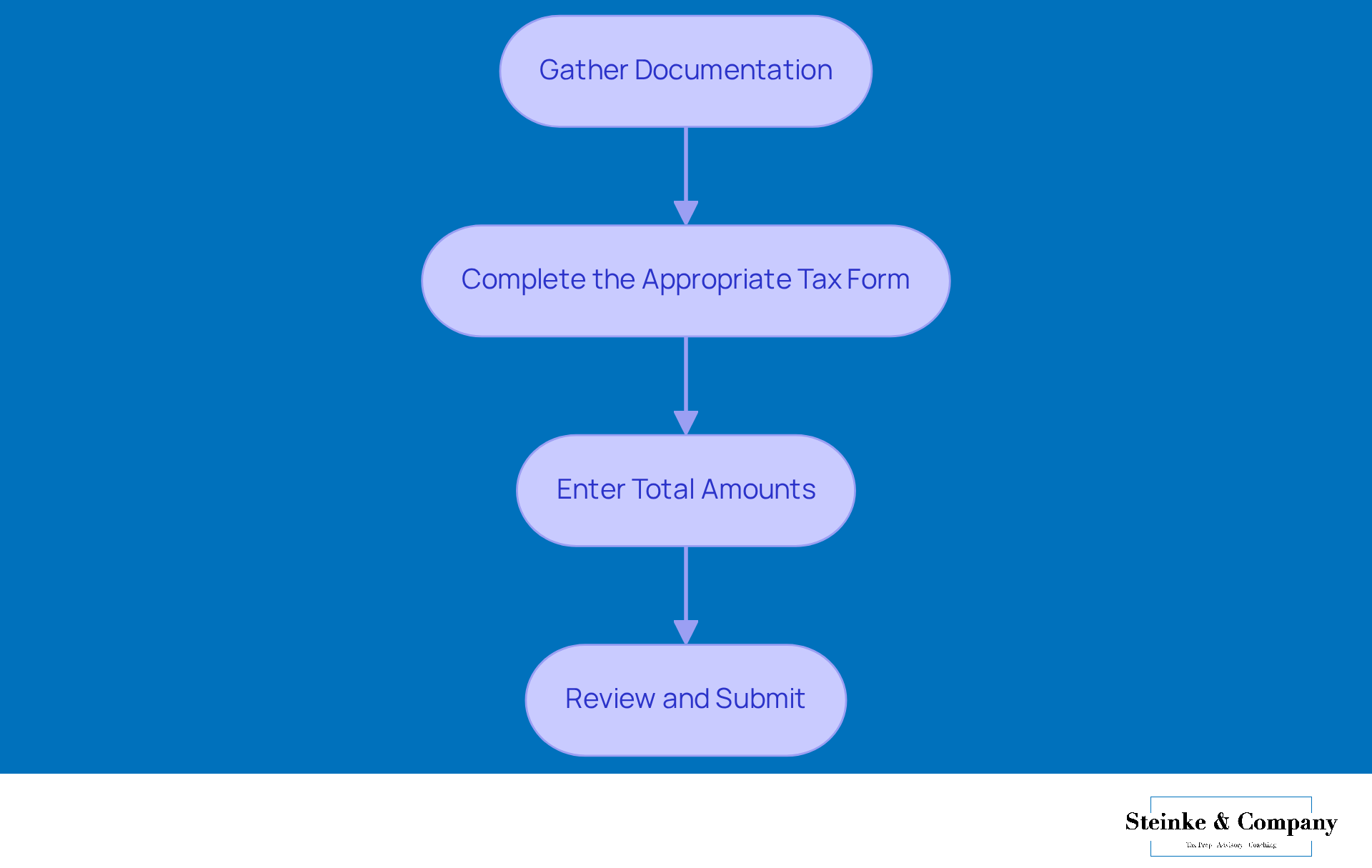

Claim Health Insurance Premium Deductions on Your Tax Return

Do you want to know if health insurance premiums are deductible on taxes for your medical coverage costs on your tax return? Here’s how you can do it in a few simple steps!

- Gather Documentation: Start by collecting all the important documents you’ll need, like statement records and proof of payment. It’s a good idea to hang onto these records for at least three years after your tax return's due date, since that’s the general statute of limitations for the IRS.

- Complete the Appropriate Tax Form: If you’re self-employed, you’ll want to use IRS Form 1040 along with Schedule 1 to report your deductions. And if you have a Health Savings Account (HSA), don’t forget that contributions to this account can be deducted too, leading to the consideration of whether health insurance premiums are deductible on taxes, which gives you some extra tax benefits!

- Enter Total Amounts: On Schedule 1, make sure to report the total medical coverage costs you’ve paid in the right section. If you’re eligible for an HSA, remember to include any contributions you’ve made, as these can help even more.

- Review and Submit: Finally, take a moment to double-check your entries for accuracy before submitting your tax return by the deadline. And keep copies of all your documentation for your records—you’ll thank yourself later!

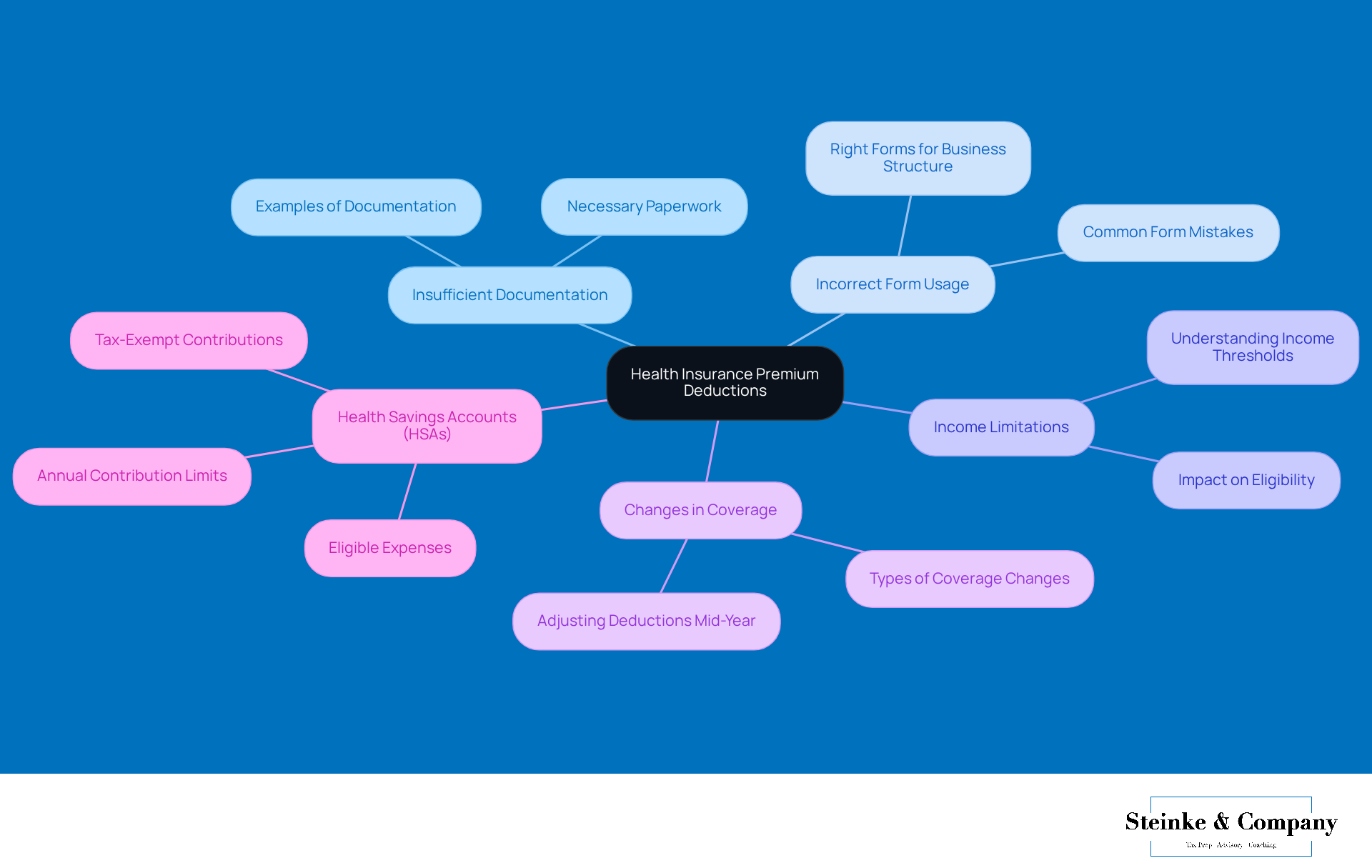

Troubleshoot Common Issues with Health Insurance Premium Deductions

When requesting premium deductions, a few common hiccups might arise regarding whether on taxes. First off, Insufficient Documentation can be a real stumbling block. Make sure you have all the necessary paperwork handy to back up your claims. Then there's the issue of Incorrect Form Usage—double-check that you’re using the right forms for your business structure. Don’t forget about Income Limitations; it’s important to know those income thresholds that could impact your eligibility. And if there are any Changes in Coverage—like if your medical insurance shifts mid-year—be sure to adjust your deductions accordingly.

Now, let’s not overlook the perks of Health Savings Accounts (HSAs). They can be a fantastic tool for managing medical expenses while maximizing your tax benefits. If you have a high-deductible medical plan, HSAs let you save for those medical costs with tax-exempt contributions and withdrawals for eligible expenses. If you’re eligible, you can contribute up to the annual limit, which can really boost your financial planning and retirement savings.

If you run into any issues with health insurance premiums deductible on taxes or HSAs, don’t hesitate to reach out to a tax professional. They can provide personalized help tailored just for you!

Conclusion

Understanding the deductibility of health insurance premiums can really lighten the financial load for small business owners. By navigating the twists and turns of eligibility criteria and tax implications, you might just find a way to lower your taxable income and maximize those deductions. It all starts with recognizing how your business structure, income level, and the type of coverage you have can affect your ability to deduct these expenses.

So, what are the essential steps for claiming those health insurance premium deductions? Well, it involves:

- Gathering your documentation

- Filling out the right tax forms

- Double-checking everything before you hit submit

We also touched on common pitfalls, like:

- Not having enough documentation

- Using the wrong forms

Plus, don’t forget the perks of Health Savings Accounts (HSAs) that can help boost your tax benefits even further.

Ultimately, being in the know about the tax implications of health insurance premiums is key to managing your finances effectively. Taking proactive steps—like chatting with a tax professional and getting a grip on the eligibility requirements—can really empower you as a small business owner. By doing this, you’re not just easing your tax burdens; you’re also paving the way for a stronger financial future. So, why not take those steps today?

Frequently Asked Questions

What are health insurance premiums?

Health insurance premiums are payments made for health coverage, which can accumulate significantly for small business owners.

Are health insurance premiums deductible on taxes?

Yes, health insurance premiums can be deductible on taxes, but this depends on factors such as your business type and income level.

Why is it important to understand the deductibility of health insurance premiums?

Understanding whether health insurance premiums are deductible can help lighten your overall tax load and manage your tax responsibilities related to medical coverage.

What factors influence the deductibility of health insurance premiums?

The deductibility of health insurance premiums is influenced by your business type and your income level.