Overview

This article dives into decoding Box 12a on the W-2 form, which is super important for small business owners to grasp their tax responsibilities tied to different types of compensation and benefits. Understanding the codes in Box 12a is crucial because they can really impact your tax filings and compliance. We’ll walk you through the process step-by-step and point out some common pitfalls along the way, making sure you’re well-equipped to tackle this task!

Introduction

Understanding the nuances of the W-2 form is crucial for small business owners, especially when it comes to the often-overlooked Box 12. This section, particularly Code 12a, contains important details about various types of compensation and benefits that can really affect your tax obligations. As tax regulations get more complicated, being able to interpret these codes accurately can make all the difference between staying compliant and facing costly penalties.

So, what challenges might pop up when trying to decode these codes? And how can small business owners navigate them effectively to ensure their financial health? Let’s dive in!

Understand the W-2 Form and Box 12 Overview

The W-2 form, or Wage and Tax Statement, is super important for both employers and employees. It's the document that employers need to give to their workers and the IRS, detailing how much an employee earned over the year and how much tax was taken out of their paychecks.

Now, let’s talk about 12a on the W-2 form—it’s pretty special! This box is packed with symbols that give extra info about compensation and benefits. You can find up to four entries here:

- 12a on W-2 form

- 12b

- 12c

- 12d

Each pointing to different types of income or deductions. Understanding these codes is crucial for filing your taxes accurately and staying in line with IRS rules, especially since there are now due to misreporting.

For instance, Box 12 might show contributions to retirement plans, uncollected levies, or other benefits that affect how much tax you owe. Did you know that around 90% of employers hand out W-2 forms? That makes it really important for small business owners to get familiar with Box 12 to manage tax responsibilities smoothly and steer clear of any hefty fines.

Experts agree that getting Box 12 right can help avoid mistakes that lead to underpayment penalties, boosting your overall compliance and financial health. As Judge Learned Hand famously said, no one should feel pressured to pay more taxes than they legally have to, which really highlights the need to grasp the ins and outs of tax reporting and keep accurate records to make tax compliance a breeze.

Explore the Significance of Code 12a on the W-2 Form

The covers various types of compensation and benefits, such as uncollected Social Security tax on tips and contributions to retirement plans. For small business owners, getting a handle on 12a on W-2 form is super important since it directly impacts the tax responsibilities for both employers and employees. For instance, if the 12a on the W-2 form shows uncollected Social Security tax, employees need to keep this in mind when filing their tax returns, which might lead to some extra tax responsibilities. Plus, contributions listed under 12a on W-2 form could qualify for tax deductions, providing a nice financial perk for everyone involved. So, understanding Regulation 12a is key for crafting a successful tax strategy and ensuring that small businesses manage their tax obligations effectively.

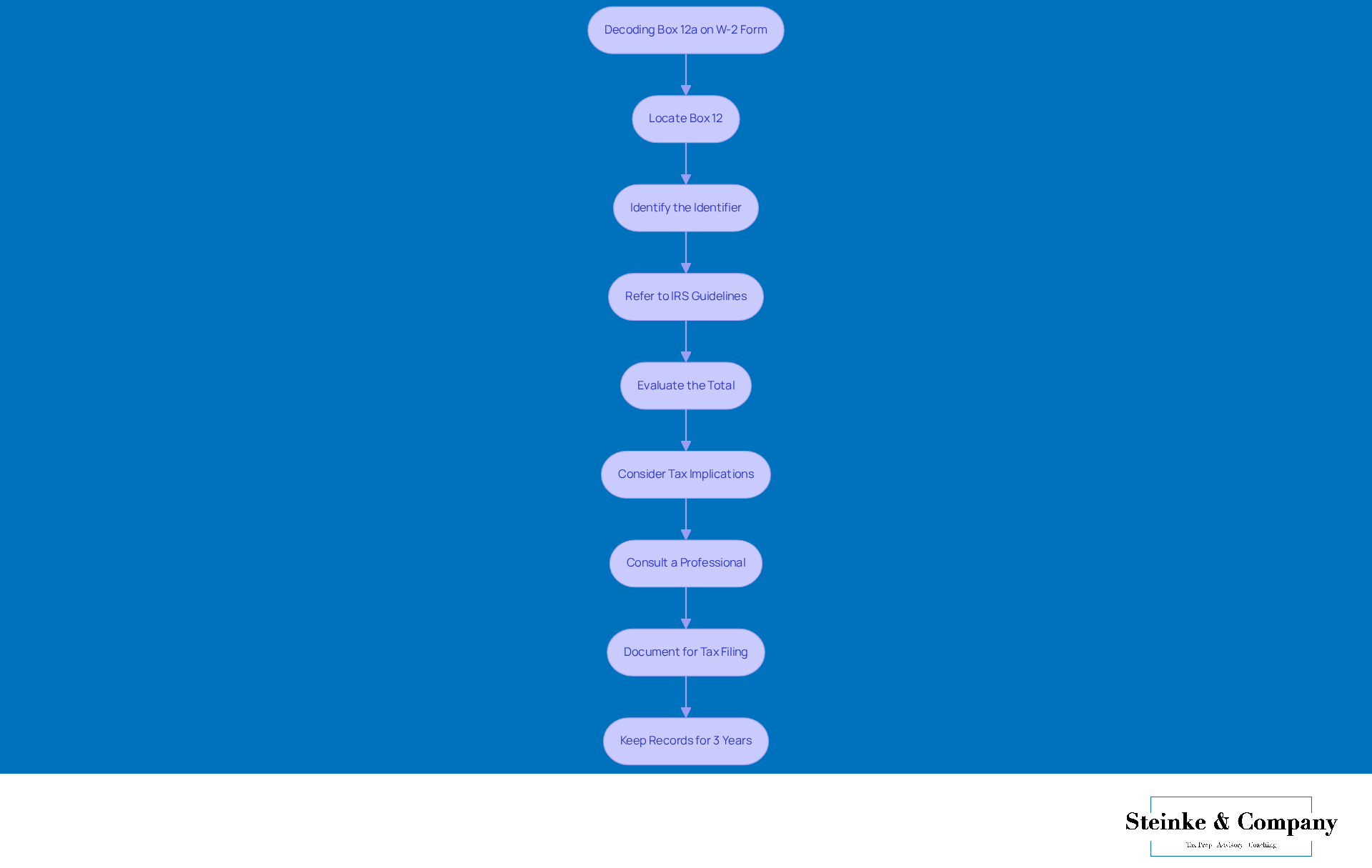

Decode Code 12a: Step-by-Step Instructions

Are you decoding 12a on w2 form from your W-2 form? Let’s break it down together!

First up, Locate Box 12: This box is usually found towards the bottom of your W-2 form. Easy enough, right?

Next, identify the identifier by looking for the entry labeled '12a on w2 form'. You’ll see a letter and a sum there. For example, if you spot a 'D', that means you’re looking at elective deferrals to a 401(k) plan.

Now, Refer to : It’s a good idea to check out IRS guidelines or a trusted tax resource to get the scoop on what that specific regulation means. Just so you know, Code 'D' refers to contributions to a 401(k) plan, which are pre-tax and can help lower your taxable income.

Then, Evaluate the Total: Jot down the amount next to that identifier—this shows your total contributions or deductions linked to it.

Don’t forget to Consider Tax Implications: Think about how this regulation and amount play into your overall tax situation. Contributions to a retirement plan might snag you some tax deductions. But keep in mind, Box 12 can include both taxable and non-taxable items, which can affect your tax calculations differently. Understanding your paystub and the deductions listed can really help you avoid underpayment penalties and keep your tax compliance in check.

If all this sounds a bit too complex, it’s totally fine to Consult a Professional: Tax reporting can be tricky, so getting advice from a qualified professional is always a smart move. Misreading Box 12 codes can lead to tax reporting errors, and having an expert on your side can help ensure you get it right.

Finally, make sure to Document for Tax Filing: When you’re prepping your tax return, accurately note this info. It’s crucial for reporting your income and deductions correctly. And if Box 12 is empty with no related items, feel free to move on to Box 13.

Oh, and here’s a little tip: keep your tax records for at least three years after filing. This is super important for any potential audits or discrepancies. By following these steps, small business owners can decode the information found in 12a on the W2 form and really grasp its implications for their tax filings, which is a big step towards financial stability and compliance!

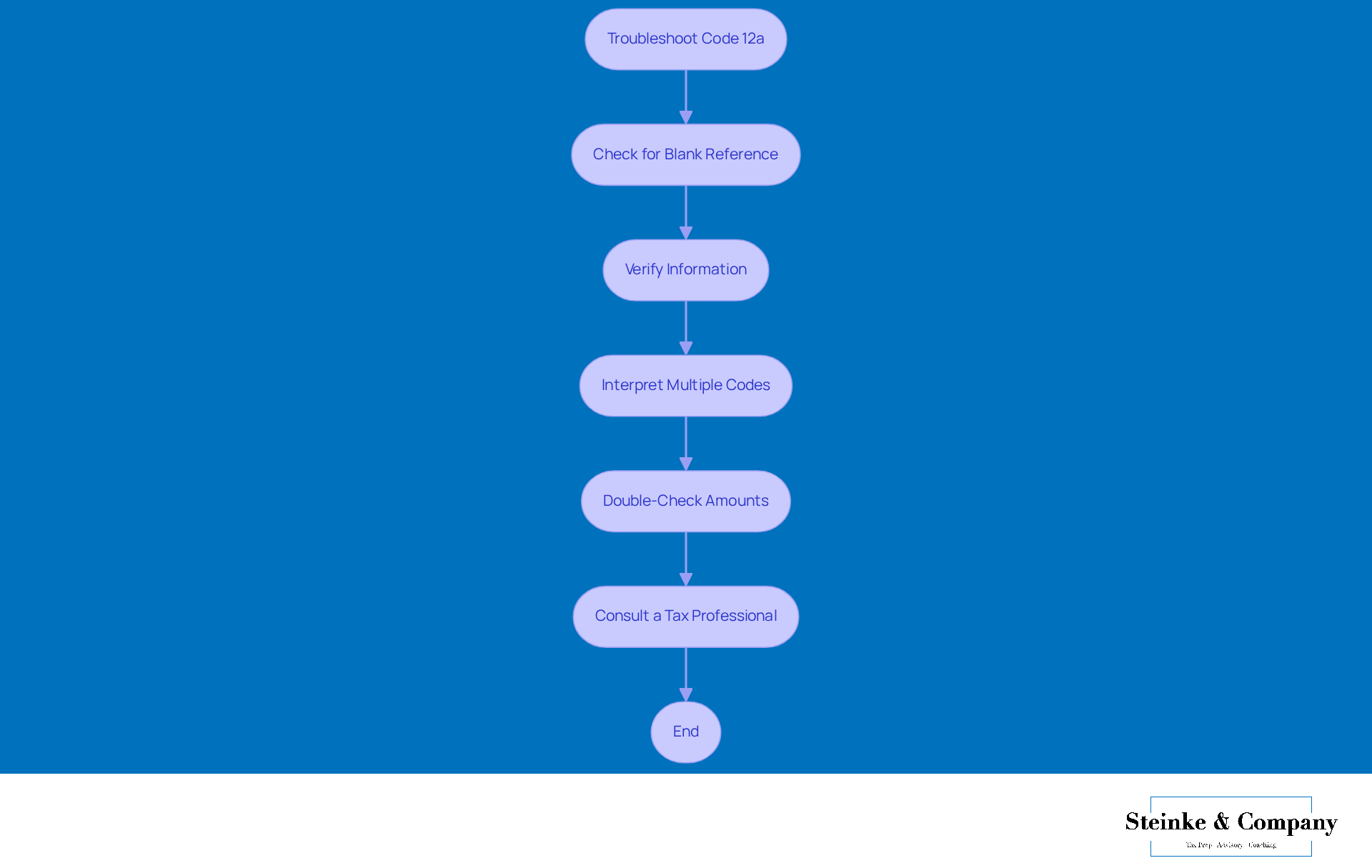

Troubleshoot Common Issues When Decoding Code 12a

When you're looking at 12a on the W-2 form, small business owners can run into a few common hiccups. Let’s go through some troubleshooting tips together:

- If the 12a on the W2 form is blank or doesn't have a reference, it's a good idea to check in with your employer for clarification. They might have left it out by mistake, and you’ll need this info for accurate tax reporting.

- Incorrect Information: If you feel the details don’t match your understanding of your pay or benefits, take a moment to compare it with IRS guidelines. If it seems off, reach out to your employer to get it sorted out.

- Confusion Over Multiple Codes: If you see multiple entries in Box 12 (like 12a, 12b, etc.), make sure you’re interpreting each code correctly. Each one could represent different benefits or deductions, so it’s worth checking the IRS documentation for clarity.

- Discrepancies in Amounts: If the amount reported looks incorrect, double-check it against your pay stubs or other financial records. If you still see discrepancies, don’t hesitate to consult your employer or a tax professional for help.

- Understanding Tax Implications: Unsure how the code impacts your tax situation? It might be a good idea to chat with a tax professional. They can give you insights on how to .

Did you know that about 70% of small business owners turn to tax pros for W-2 issues? That really highlights the value of getting expert help when navigating these complexities. As the Accountor CPA Team puts it, "Hiring an accountant for taxes is a great way to help yourself out, and it provides more benefits that you may not have known about." By being aware of these common issues and knowing how to tackle them, small business owners can accurately decode the information related to 12a on W-2 form and stay compliant with tax regulations. Plus, understanding strategies like safe harbor payments and the de minimis exception can help you dodge unnecessary underpayment penalties and optimize your tax compliance. Just remember, the last day for employers to send W-2s to employees is January 31st. So, it’s super important to review your W-2 promptly after you get it to avoid any potential penalties and audits.

Conclusion

Understanding the ins and outs of the W-2 form, especially Box 12 and its various codes, is super important for small business owners who want to handle their tax responsibilities like pros. Take Code 12a, for example—it’s a key player when it comes to compensation and benefits that can really impact your tax obligations. By getting a grip on this section, you’ll not only stay compliant with IRS regulations but also dodge those pesky penalties that come from misreporting.

In this article, we’ve shared some handy tips on how to spot and make sense of the info in Box 12a. We talked about the importance of recognizing specific codes and what they mean for your tax filings. And let’s not forget—when in doubt, consulting IRS guidelines and getting some professional advice is always a smart move. We also tackled common hiccups like discrepancies or blank entries, highlighting just how crucial accuracy is in tax reporting.

But here’s the thing: understanding Code 12a on the W-2 form isn’t just about checking boxes for compliance. It’s a game-changer for optimizing your financial health and tax strategy as a small business. By taking proactive steps to decode this info, you’re not only reducing the risk of underpayment penalties but also empowering yourself to make savvy financial decisions. Staying on top of the details in tax reporting can lead to a smoother tax season and give you greater peace of mind when it comes to managing your business finances. So, let’s keep the conversation going—what steps will you take to ensure your tax reporting is on point this year?

Frequently Asked Questions

What is the W-2 form?

The W-2 form, or Wage and Tax Statement, is a document that employers provide to their employees and the IRS, detailing how much an employee earned over the year and how much tax was withheld from their paychecks.

What is Box 12 on the W-2 form?

Box 12 on the W-2 form contains codes that provide additional information about compensation and benefits. It can include up to four entries that indicate different types of income or deductions.

Why is it important to understand Box 12?

Understanding Box 12 is crucial for accurately filing taxes and complying with IRS rules, as it can affect the amount of tax owed. Misreporting can lead to tougher penalties for underpayment.

What types of information might Box 12 include?

Box 12 might show contributions to retirement plans, uncollected levies, or other benefits that can influence tax liability.

How common is the use of W-2 forms among employers?

Approximately 90% of employers distribute W-2 forms, making it essential for small business owners to understand Box 12 to manage their tax responsibilities effectively.

What experts say about the importance of getting Box 12 right?

Experts agree that correctly reporting Box 12 can help avoid mistakes leading to underpayment penalties, thereby improving overall compliance and financial health.