Overview

Finding the right CPA for your small business? It all starts with figuring out what type of business you have, what specific services you need, and setting some clear financial goals. Think of it as a little roadmap! Understanding your unique needs and doing some solid research—like checking credentials and looking at fee structures—will really help you choose a CPA who gets your business goals and can offer the support you need for financial success. So, what’s your first step? Let’s dive in!

Introduction

Finding the right CPA can really change the game for small businesses! But let’s be honest—many entrepreneurs find themselves lost in a sea of options. This guide is here to light the way for you, helping you pick a CPA that fits your unique business needs. We’ll cover everything from the essential services you should look for to how to navigate those pesky fee structures. But with so many factors in play, how can you be sure you’re making the best choice for your financial future? Let’s dive in together!

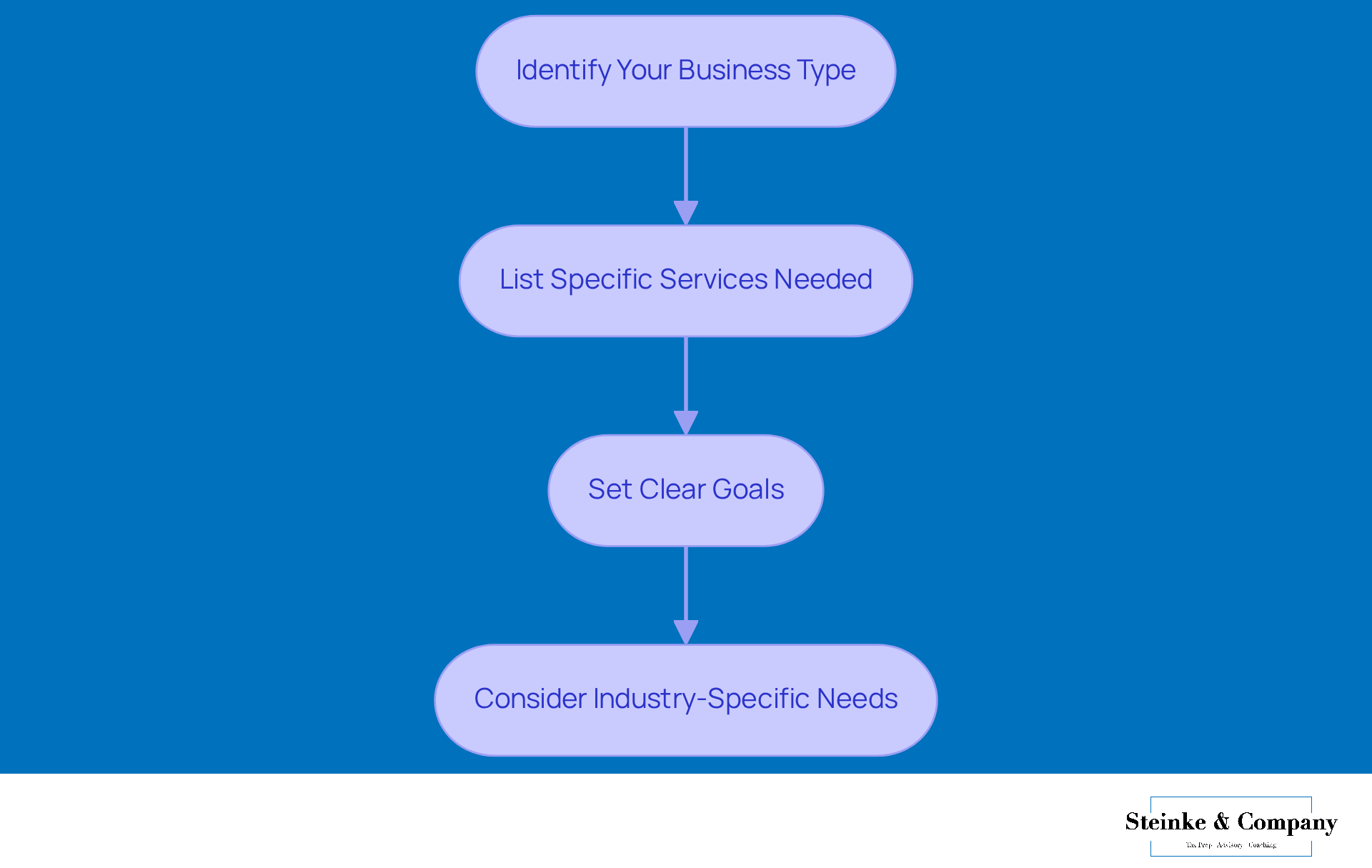

Define Your Business Needs and Goals

- Identify Your Business Type: First things first—what's your business type? Are you a sole proprietor, in a partnership, or running a corporation? This choice impacts your accounting needs. Don't worry; Steinke and Company is here to help you pick the right entity, ensuring you stay compliant and optimize your tax strategy right from the get-go.

- List Specific Services Needed: Next up, think about what services you really need from a CPA. Is it tax preparation, bookkeeping, or maybe fiscal planning? Our comprehensive offerings have you covered with expert tax compliance and preparation services, including a cpa near me for small business, guaranteeing accuracy and legal compliance while keeping those tax season surprises at bay.

- Set Clear Goals: Now, let’s talk goals! What are your short-term and long-term monetary aspirations? Revenue targets? Expansion plans? Defining these will assist you in finding the right CPA near me for small business. With Steinke and Company, you can focus on proactive tax planning services that align with your growth objectives, laying a solid foundation for long-term success.

- Consider Industry-Specific Needs: If you're in a specialized industry, take note of any unique accounting needs that might require a CPA with relevant experience. Understanding the differences among cash, accrual, and hybrid is crucial for your business's success. Our team is ready to assist you in selecting the method that fits your unique requirements perfectly.

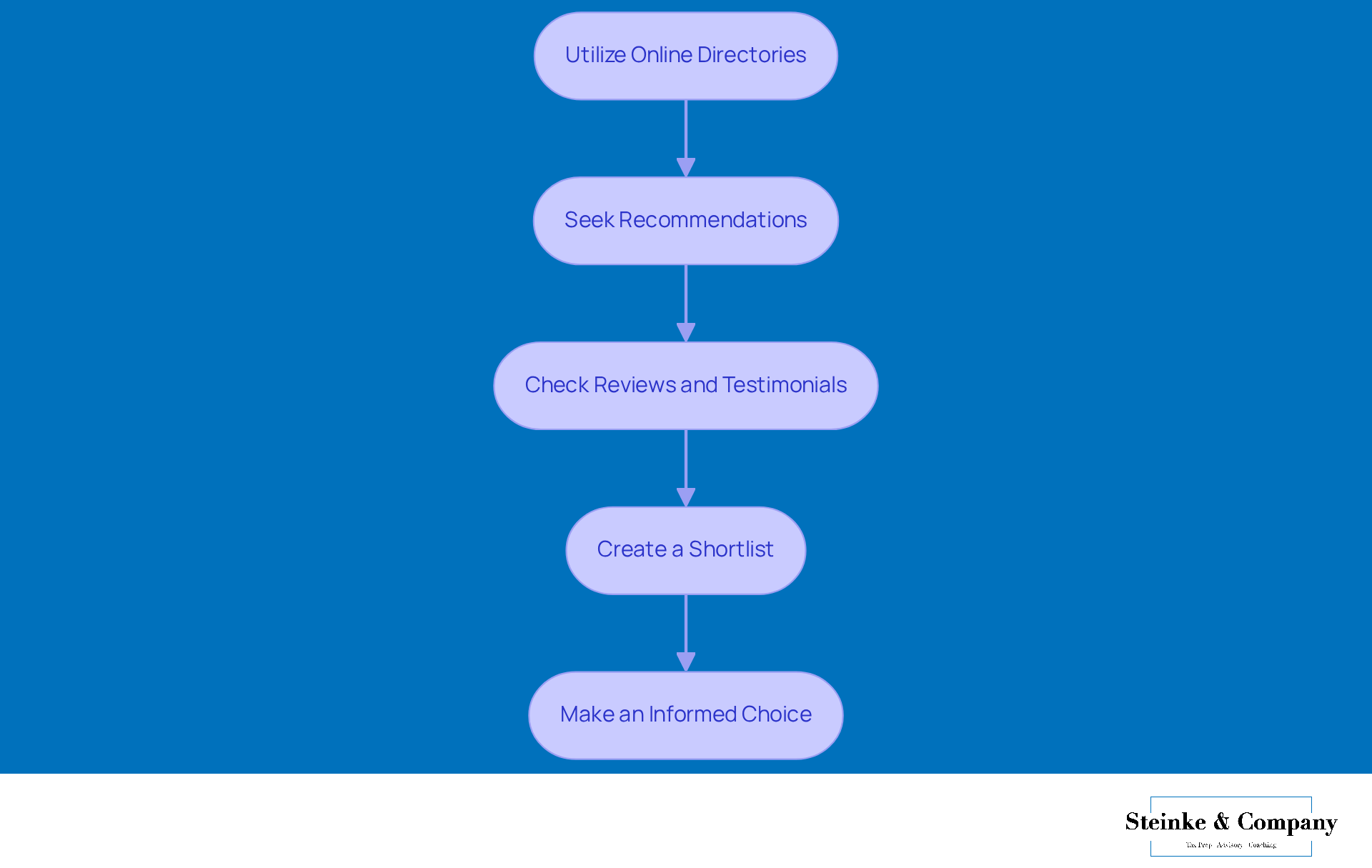

Research and Evaluate CPA Candidates

- Utilize online directories to find a CPA near me for small business, including resources like CPAverify.org or local CPA association directories that can help you locate licensed accountants. These platforms are great for ensuring you're looking at qualified professionals, which is super important for your organization's financial health.

- Seek Recommendations: Reach out to your network and ask other entrepreneurs or industry pals for referrals to CPAs they trust. Did you know that over 80% of small businesses rely on referrals when choosing a CPA near me for small business? That really shows how valuable personal recommendations can be! As one small business owner shared, 'Finding a CPA near me for small business through a trusted referral made all the difference in my firm's financial management.'

- Check Reviews and Testimonials: Dive into online feedback and endorsements to see what other clients have experienced with potential accountants. This can give you a real sense of a CPA's responsiveness and expertise—both key factors in your decision-making. One entrepreneur noted, "Reading reviews helped me avoid a CPA who had a reputation for poor communication."

- Create a Shortlist: After doing your research, put together a shortlist of potential CPAs who meet your needs and have the right experience. This focused approach will make your selection process smoother and help you make a well-informed choice. Wrap up your research by considering how each candidate can , setting the stage for the next steps in your CPA selection journey.

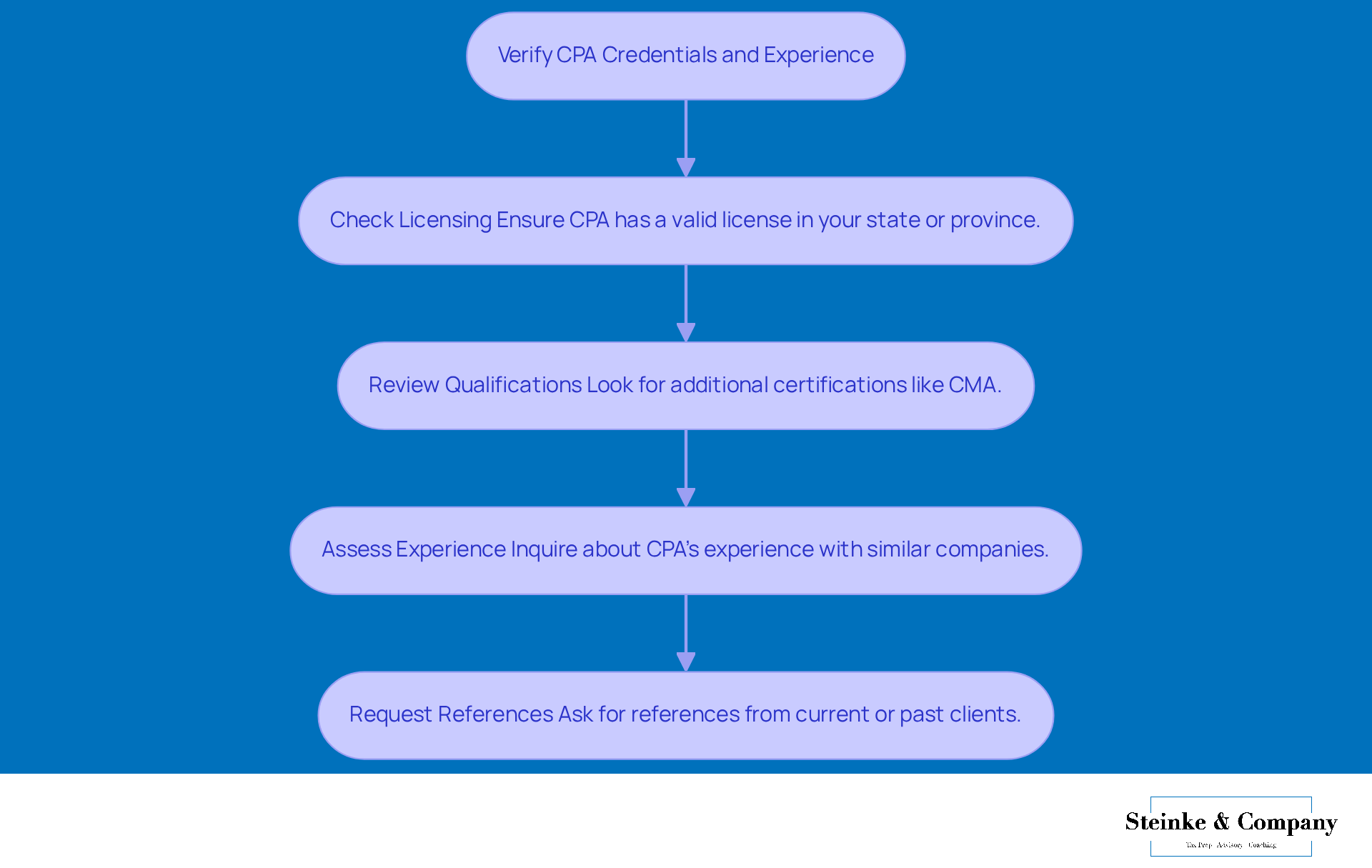

Verify Credentials and Professional Experience

- Check Licensing: First things first, make sure your CPA has a valid license in your state or province. A quick visit to the website of the relevant regulatory body will do the trick. This step is crucial for staying in line with local laws and standards.

- Review Qualifications: Next up, take a look at any additional certifications they might have. For instance, the Certified Management Accountant (CMA) designation can be a great fit for your organizational needs. It’s worth noting that many CPAs near me for small business go the extra mile to earn more certifications, which can really boost their expertise in areas important for small businesses like yours.

- Assess Experience: Don’t forget to ask about the CPA’s experience with companies similar to yours. Knowing the types of services they’ve provided can give you a good idea of how well they can meet your specific needs.

- Request References: Finally, it’s a good idea to ask for references from current or past clients. This will give you into how a CPA near me for small business works, their effectiveness, and how they’ve helped other small businesses succeed.

So, what do you think? Are you ready to find the right CPA for your needs?

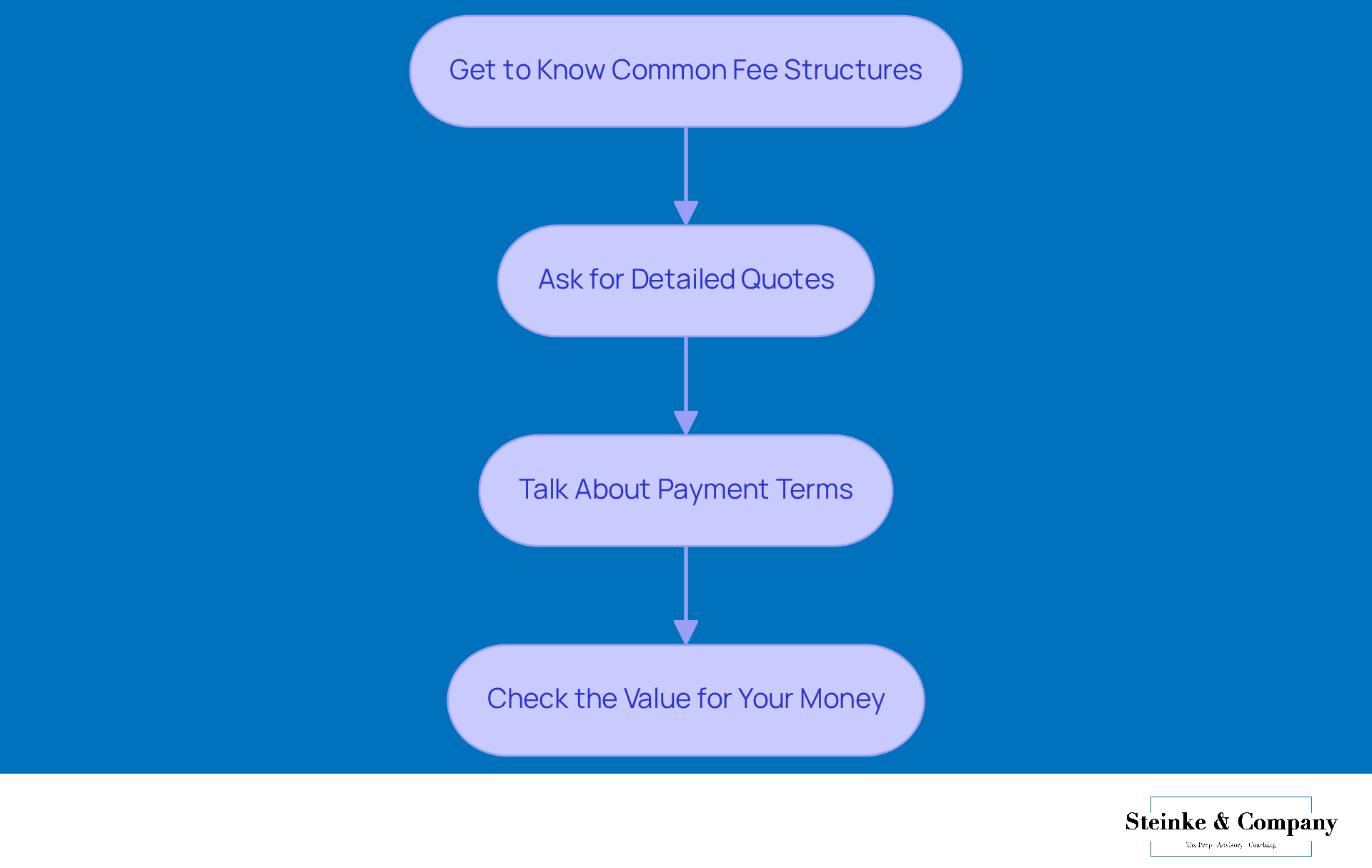

Understand Fee Structures and Costs

- Get to Know Common Fee Structures: It's a good idea to familiarize yourself with the different fee structures accountants use, like hourly rates, flat fees, or retainer agreements. By understanding these options, you'll be better equipped to anticipate costs and find a structure that fits your budget and needs.

- Ask for Detailed Quotes: When you're reaching out to potential CPAs, don’t hesitate to ask for that lay out their fees for specific services. This kind of transparency makes it easier to compare costs and helps you make informed decisions based on what you truly need.

- Talk About Payment Terms: Make sure to clarify payment terms right from the start. Ask when payments are due and if there might be any extra costs that could pop up during your engagement. This way, you’ll know exactly what your financial commitments will look like.

- Check the Value for Your Money: Take a moment to assess whether the services provided are worth the fees being charged. Ensure that the CPA near me for small business offers expertise and support that justify the investment, as having quality guidance can really make a difference for your business's financial health.

Conclusion

Finding the right CPA for your small business is a big deal—it can really shape your financial health and help you grow strategically. By figuring out what your specific business needs and goals are, doing your homework, and checking out the qualifications of potential candidates, you can make sure you pick a CPA who fits your unique situation. This thoughtful approach not only helps with compliance and efficiency but also sets your business up for long-term success.

The article highlights some key insights:

- It’s crucial to define your business type and goals.

- Explore different service offerings.

- Think about any industry-specific needs when you’re on the hunt for a CPA.

- Use online resources, get personal referrals, and check out client reviews to speed up the evaluation process.

- Understand fee structures—knowing what you’re getting into financially is super important.

Each step in this journey is vital for building a solid partnership with a CPA who can offer valuable insights and guidance.

In the end, putting in the time and effort to find a qualified CPA can bring huge benefits to your small business. This process isn’t just about crunching numbers; it’s about creating a relationship that fosters growth and stability. By focusing on these steps, you can confidently navigate your financial landscape and work towards achieving your dreams.

Frequently Asked Questions

What should I consider when defining my business needs and goals?

You should identify your business type, list specific services needed, set clear short-term and long-term goals, and consider any industry-specific needs that may require specialized accounting services.

How does my business type affect my accounting needs?

Your business type—whether a sole proprietor, partnership, or corporation—impacts your accounting requirements. It is essential to choose the right entity to ensure compliance and optimize your tax strategy.

What services might I need from a CPA?

You may need services such as tax preparation, bookkeeping, or fiscal planning. It's important to identify which specific services align with your business needs.

Why is it important to set clear goals for my business?

Setting clear short-term and long-term monetary goals, such as revenue targets and expansion plans, helps you find the right CPA and ensures that your accounting strategies align with your growth objectives.

What are industry-specific accounting needs?

Industry-specific needs refer to unique accounting requirements that may arise in specialized fields. It's crucial to consider these needs when selecting a CPA with relevant experience.

What accounting methods should I understand for my business?

You should understand the differences among cash, accrual, and hybrid accounting techniques, as selecting the appropriate method is vital for your business's success.