Overview

This article dives into the essential tax preparation services that small agency owners really need to tackle their tax responsibilities effectively. We’re talking about a comprehensive range of services here—think accurate tax filing, thoughtful tax planning, and ongoing support. Together, these services help agency owners minimize their liabilities, stay compliant, and ultimately boost their financial performance.

Have you ever felt overwhelmed by tax season? You’re not alone! Many agency owners find themselves juggling various responsibilities, and that’s where these services come in handy. By ensuring you have the right support, you can focus on what you do best while leaving the tax worries to the experts.

So, whether you’re looking to streamline your tax filing process or need some strategic tax planning advice, remember that these services can make a world of difference. Let’s take control of those tax responsibilities and enhance your agency’s financial health together!

Introduction

Tax season can feel like a maze for small agency owners, right? With so many responsibilities on your plate and regulations changing all the time, it’s no wonder it can be overwhelming. In this article, we’ll explore ten essential business tax preparation services that not only help take the stress out of tax filing but also empower you to boost your financial performance. As tax obligations rise and strategic planning becomes crucial, how can small businesses like yours make the most of these services to improve operational efficiency and secure a brighter financial future?

Steinke and Company: Comprehensive Tax Compliance and Preparation Services

At Steinke and Company, we get it—tax season can be a real headache, especially for small agency operators. That’s why we offer a full range of business tax preparation services designed just for you. Our meticulous approach means your tax returns are not only accurate but also submitted on time, taking a huge weight off your shoulders. This way, you can focus on what you do best while confidently staying on the right side of federal and state regulations.

Our team of seasoned professionals knows the ins and outs of tax laws, helping you navigate any complexities that come your way. We’re here to ensure you meet your obligations without worrying about penalties or interest. By applying best practices in tax preparation, we empower small agency operators like you to enhance your results and stay compliant. So, why not let us take the stress out of tax season? You deserve to without the tax-time jitters!

Business Startup Consultations: Establish Effective Financial Systems

At Steinke and Company, we’re all about helping new agency owners get their startups off the ground with specialized consultations that focus on building solid economic systems. We provide essential advice on:

- Picking the right organizational structure

- Setting up efficient accounting systems

- Understanding your tax responsibilities from day one

By laying down a strong financial foundation, new businesses can dodge the common pitfalls that often lead to cash flow headaches and regulatory issues. Did you know that in 2023, a staggering 82% of companies that failed did so because of cash flow problems? This really highlights how crucial proactive financial planning is. Plus, 29% of companies run out of funds before they even see a profit, which shows just how tough the economic landscape can be for newcomers.

Our consultations are crafted specifically for service-oriented businesses, ensuring that you’re well-equipped to launch successfully and navigate the tricky waters of financial management. And just to keep things on track, we meet 1-3 times a year to review your business tax preparation services or current records. This way, we can spot any missed opportunities and to lighten your tax burden while promoting growth. Let’s make sure you’re set up for success!

Tax Planning Services: Minimize Liabilities and Optimize Performance

At Steinke and Company, we offer tax planning services designed to help you minimize your tax liabilities while boosting your overall financial performance. We start by taking a good look at your financial situation, allowing us to craft that align with your specific goals. This proactive approach not only lightens your tax load but also improves cash flow management—something that’s super important for small agency operators like you.

We believe in empowering our clients with knowledge about available deductions, credits, and tax-saving opportunities. This way, you can make informed decisions all year round. For instance, did you know that small businesses can deduct various employee-related costs, such as salaries and benefits? This can really help lower your taxable income! Plus, by using tax-advantaged options like health savings accounts (HSAs) and defined benefit plans, you can enhance your tax efficiency even more.

Looking ahead to 2025, small agency operators are expected to face rising tax obligations, making smart tax planning more essential than ever. By timing your income recognition and expenses just right, you can optimize your financial outcomes and stay compliant with the ever-changing tax regulations. So, let’s chat about how we can make tax planning work for you!

Business Strategy Advisory: Align Operations with Long-Term Goals

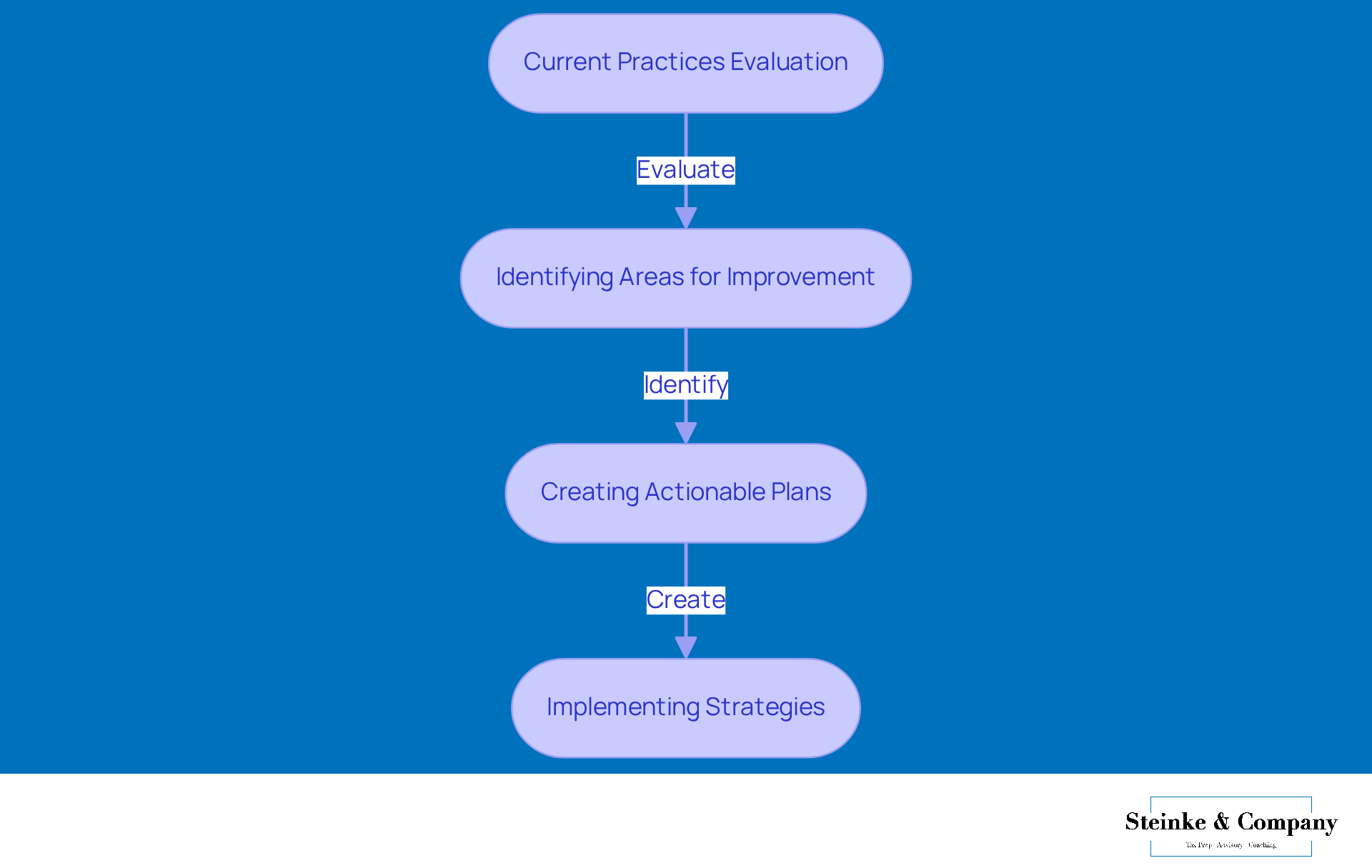

At Steinke and Company, we’re all about helping small agency owners align their operations with their long-term goals through our strategy advisory services. We kick things off with a thorough evaluation of your current practices, pinpointing areas that could use a little boost. Our advisory team works hand-in-hand with you to create actionable plans that are not just realistic but also flexible enough to adapt to the ever-changing market landscape. By fostering a strategic mindset, you’ll be better equipped to tackle challenges head-on and grab hold of those growth opportunities.

Did you know that as of 2025, only about 33% of small businesses have a formal, documented business strategy? This really highlights the need for professional guidance in this area! Strategic planning is key; it boosts your competitiveness, improves how you allocate resources, and encourages long-term thinking. With the right , you can turn those big, broad goals into specific, measurable outcomes, ensuring your operations align perfectly with your vision for success. So, are you ready to take that next step?

Monthly Accounting Services: Maintain Accurate Financial Records

At Steinke and Company, we offer monthly accounting services tailored just for small agency owners, focusing on keeping your financial records in tip-top shape. Our all-in-one service covers everything from bookkeeping to preparing financial statements and regular fiscal reviews. By keeping your records detailed and organized, you can tap into real-time financial data to make smart decisions. Did you know that 90% of small business owners feel their accountant plays a big role in their success? That really highlights how crucial professional help is when it comes to managing finances.

Having precise financial records not only helps you make quick decisions but also lets you spot trends and potential issues before they escalate. For instance, 74% of small business owners say their cash flow problems have either stayed the same or worsened over the past year, which underscores the need for proactive financial management. Regular fiscal reviews can help identify discrepancies and unusual patterns, allowing you to take swift action that boosts your overall performance.

Successful examples of keeping financial records show that organized documentation is key to accessing funding opportunities and effectively utilizing business tax preparation services while staying compliant with tax regulations. By following best practices in accounting—like separating your personal and business finances and using reliable accounting tools—you can really improve your financial health and strategic planning. Plus, remember that you need to keep financial records for at least six years after the end of the fiscal year to meet legal requirements. is also super important; it ensures that employees know their earnings and withholdings, which directly affects their tax record retention. So, how are your financial records looking? It's worth a check-up!

Business Coaching: Enhance Operational Efficiency and Navigate Challenges

At Steinke and Company, our business coaching services are all about boosting your operational efficiency while helping you navigate various challenges. Through one-on-one sessions, our coaches work closely with entrepreneurs to pinpoint specific hurdles, set realistic goals, and craft practical strategies for improvement. This tailored approach not only fosters accountability but also promotes proactive problem-solving, leading to better organizational outcomes.

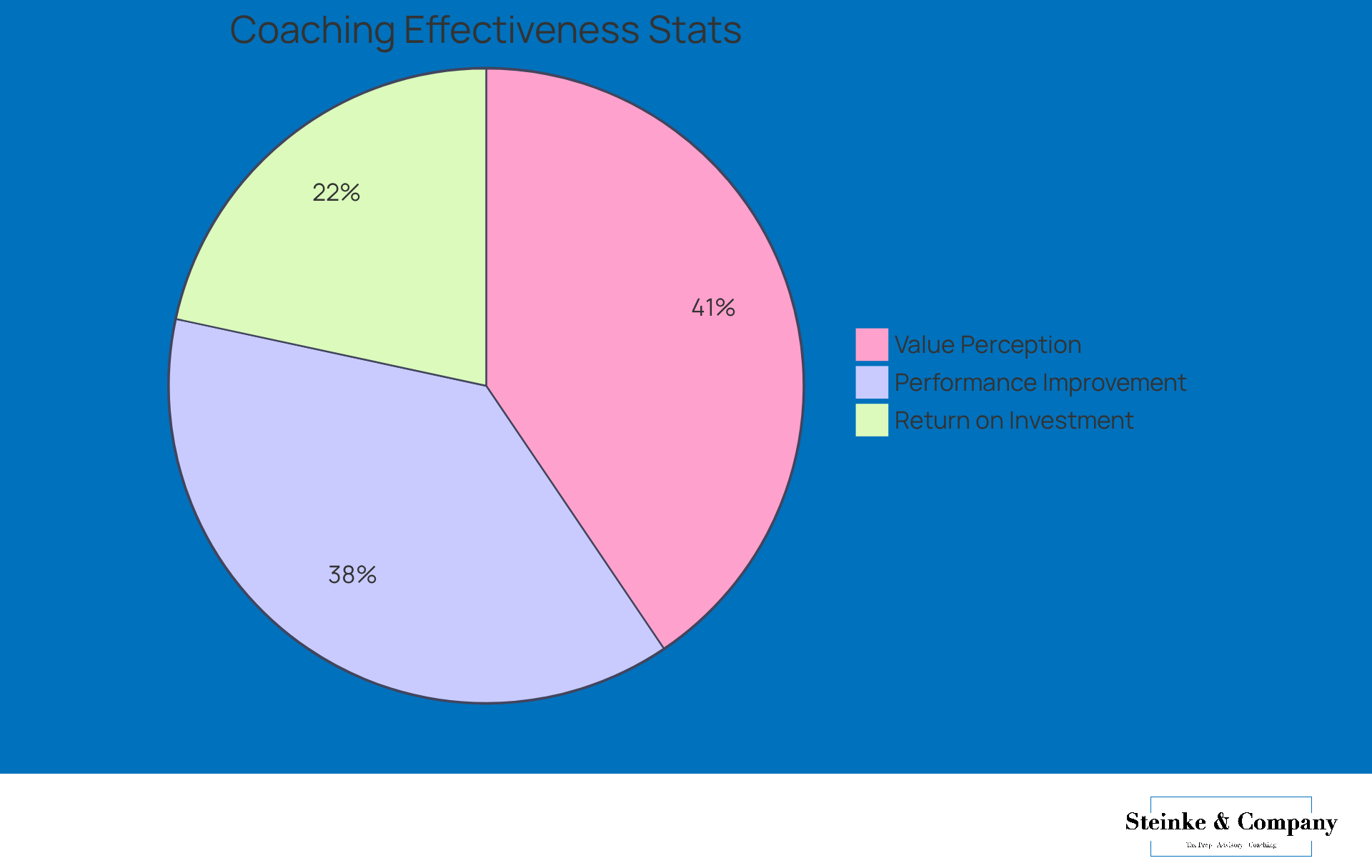

You'll find that our coaches bring valuable insights to the table, helping you with your professional aspirations. This alignment can create a more fulfilling and productive work environment. Did you know that research shows 70% of coachees see improvements in their work performance and communication? Plus, 75% of coaching clients feel that the value they gain from coaching far outweighs the time and money they invest.

And here’s something to consider: businesses that invest in coaching often report an impressive return on investment, averaging 3 to 5 times their initial spending. Companies with strong coaching cultures even enjoy a 21% higher engagement rate. So, if you're a small agency leader looking for sustainable growth and operational excellence, coaching could be a strategic move for you.

To truly make the most of coaching, it’s important for small agency leaders to dive into the process. Set clear goals and stay open to feedback—after all, that’s where the magic happens!

Tax Preparation Software: Streamline Your Filing Process

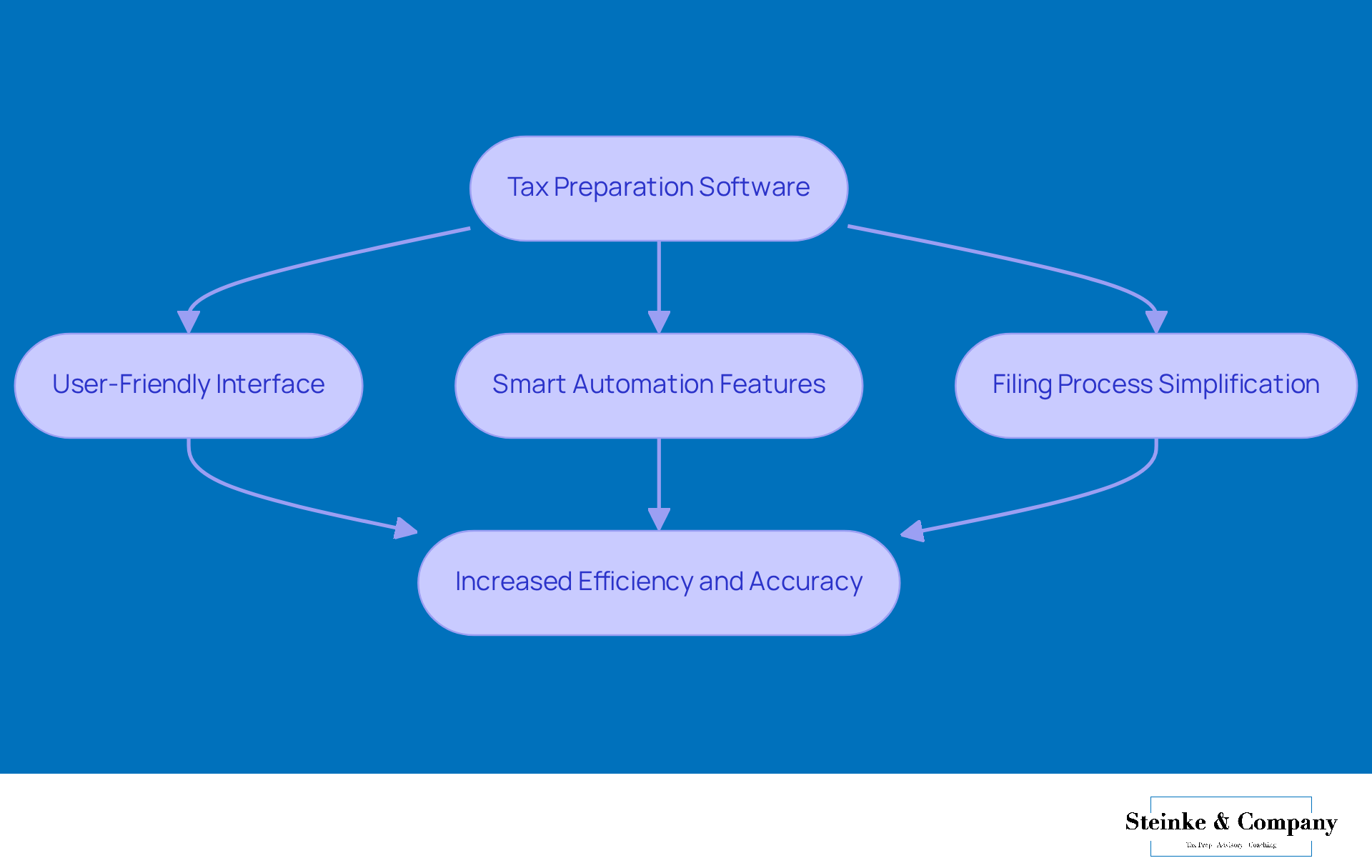

At Steinke and Company, we’re all about offering business tax preparation services to make tax season a breeze for small agency operators. We believe that tax preparation software is a game-changer, helping you simplify your filing processes. With and smart automation features, these tools take the headache out of data entry and calculations. Imagine this: in 2025, businesses using advanced tax software could cut their preparation time by as much as 50%! That’s a huge win, right?

By embracing this technology, agency owners can not only reduce the chances of making mistakes but also boost their overall efficiency during the busy tax season. Plus, we’re here to help you choose the perfect software tailored to your unique needs, ensuring you can file your taxes both quickly and accurately. This smart approach to business tax preparation services is crucial for managing compliance complexities while allowing you to focus on growing your business. So, why not take the plunge and see how technology can work for you?

Audit Support Services: Ensure Compliance and Prepare for Audits

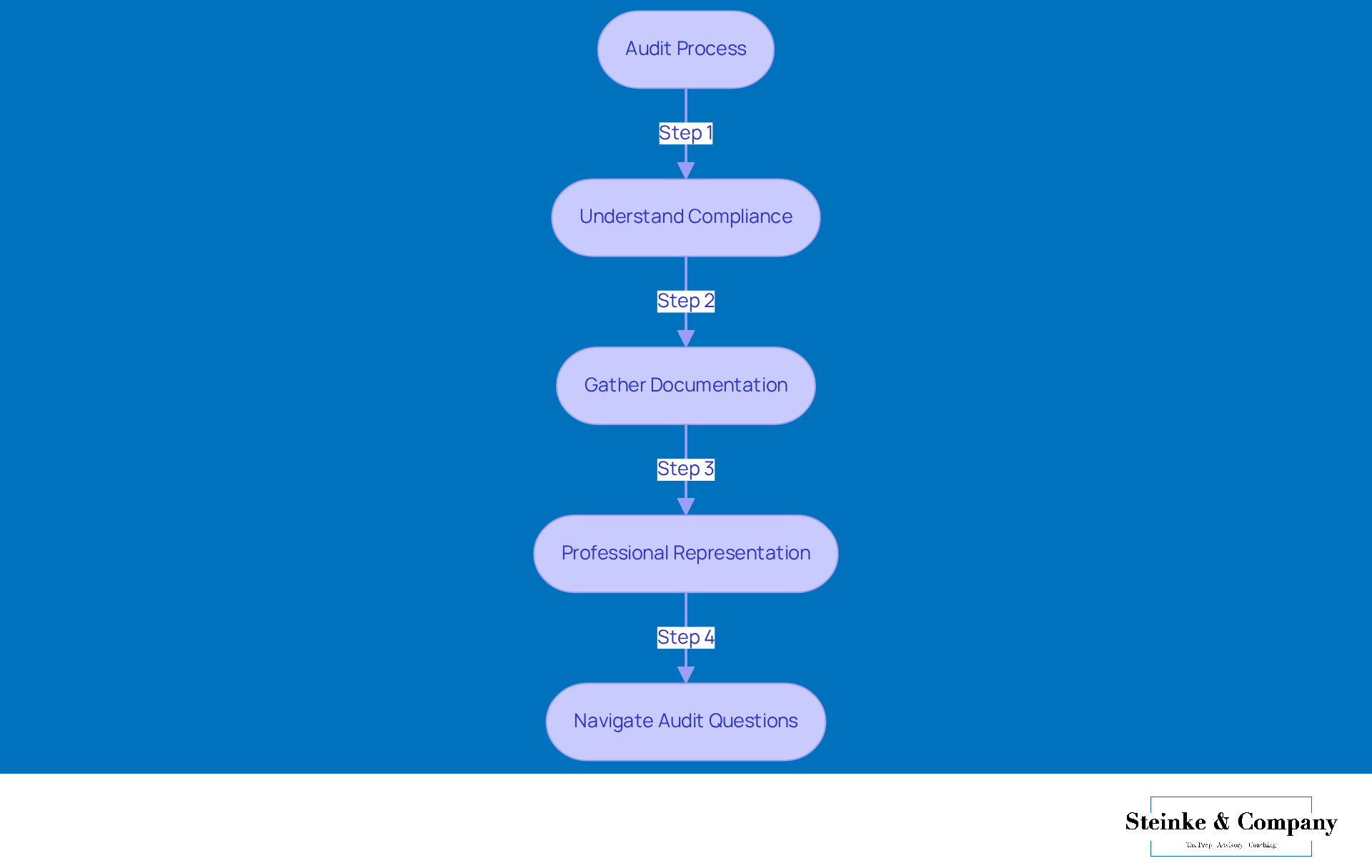

At Steinke and Company, we understand the unique challenges that small agency operators face, especially when it comes to audits. That’s why we offer tailored audit support services designed to help you stay compliant and prepare efficiently. Our service dives deep into your monetary records, helps you gather all the necessary documentation, and provides [professional representation throughout the audit process](https://blog.steinkeandcompany.com/how-to-find-agi-on-your-w-2-form-a-step-by-step-guide).

We’re here to guide you through the maze of . This way, you can tackle any questions from tax authorities with confidence. By taking this proactive approach, we not only help reduce the risk of penalties but also make the whole audit experience feel a lot less daunting. After all, navigating an audit should be a process you can handle with assurance and clarity!

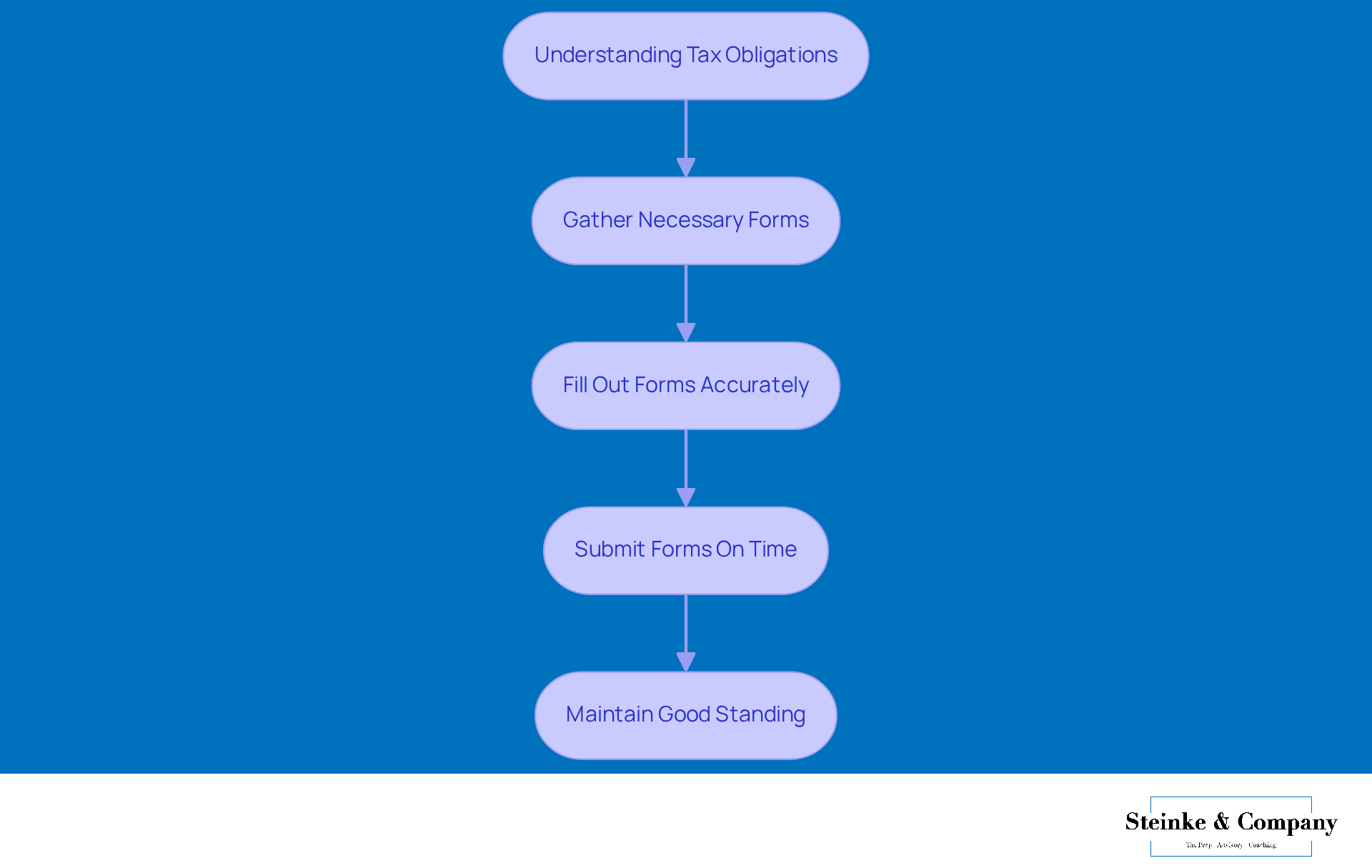

Accurate Tax Filing: Avoid Penalties and Maintain Good Standing

At Steinke and Company, we really understand how crucial it is to utilize our business tax preparation services to file your taxes accurately. Not only does it help you dodge those pesky penalties, but it also keeps you in good standing with the tax folks. We’re here to support you every step of the way, making sure you understand what forms you need to fill out and submit—accurately and on time.

By focusing on getting it right, you can avoid those expensive mistakes that might lead to audits or penalties. With our deep , we provide business tax preparation services that empower you with the info you need to tackle your tax obligations confidently. Think of it as a proactive approach to managing your taxes that not only keeps you compliant but also boosts your overall financial health.

So, why not take that step with us? Let’s work together to make tax season a little less daunting and a lot more manageable!

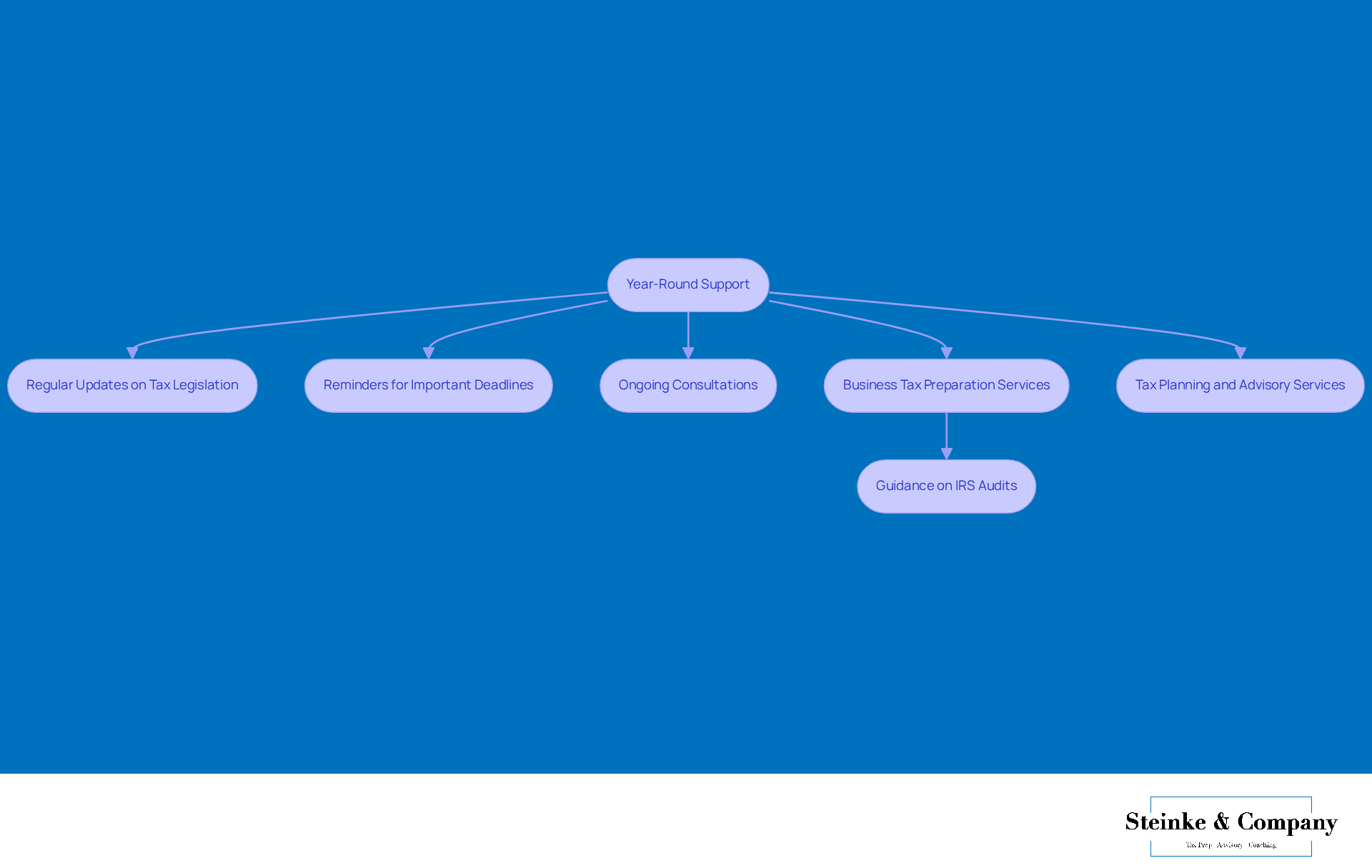

Year-Round Support: Stay Informed About Tax Changes and Compliance

At Steinke and Company, we’re all about helping small agency operators stay on top of tax changes and compliance requirements year-round. We provide regular updates on tax legislation, send reminders for important deadlines, and offer ongoing consultations to tackle any questions or concerns you might have. With our continuous support, you’ll be well-prepared to navigate the ever-changing tax landscape, reducing the risk of non-compliance and boosting your business stability.

But that’s not all! Our expert business tax preparation services are designed to empower small agency owners like you. We help you understand your rights during IRS audits, minimize stress, and show you how to navigate the process effectively. Plus, we guide you in implementing essential strategies to avoid underpayment penalties on estimated taxes, so you can meet your obligations without the financial headaches.

With our , Steinke and Company is here to help you reduce your tax burden and foster growth. So, are you ready to take the next step in your tax journey with us?

Conclusion

Navigating the complexities of tax preparation can feel like a daunting task for small agency owners, but guess what? Comprehensive services can really lighten that load! At Steinke and Company, we offer a suite of essential tax preparation services tailored just for small businesses. This means accurate filings, strategic planning, and ongoing support are all part of the package. By tapping into these services, agency operators can zero in on what they do best while staying compliant and keeping their financial health in check.

In this article, we’ve highlighted key services like:

- Business startup consultations

- Tax planning

- Monthly accounting

- Audit support

as vital ingredients for success. Each of these services is crucial for setting up effective financial systems, minimizing tax liabilities, and boosting operational efficiency. Plus, we can’t stress enough how important accurate record-keeping and proactive financial management are, especially given the challenges small businesses face in today’s economic climate.

So, what’s the takeaway? Investing in professional tax preparation services not only takes the stress out of tax season but also sets small agency owners up for long-term success. By staying in the loop about tax changes and putting effective strategies into action, businesses can confidently navigate the financial landscape. Embracing these essential services isn’t just a smart move; it’s a necessary step toward achieving sustainable growth and operational excellence. Let’s make tax time a breeze together!

Frequently Asked Questions

What tax services does Steinke and Company offer?

Steinke and Company offers a full range of business tax preparation services, ensuring accurate and timely submission of tax returns for small agency operators.

How does Steinke and Company help new agency owners?

They provide specialized consultations focusing on building effective financial systems, including advice on organizational structure, accounting systems, and tax responsibilities.

Why is proactive financial planning important for new businesses?

Proactive financial planning helps new businesses avoid cash flow problems and regulatory issues, which are common pitfalls that can lead to failure.

How often does Steinke and Company meet with clients to review their tax preparation services?

They meet with clients 1-3 times a year to review business tax preparation services and current records.

What is the goal of Steinke and Company's tax planning services?

The goal is to help clients minimize tax liabilities while enhancing overall financial performance through personalized tax strategies.

What types of deductions and credits can small businesses take advantage of?

Small businesses can deduct various employee-related costs, such as salaries and benefits, and utilize tax-advantaged options like health savings accounts (HSAs) and defined benefit plans.

Why is tax planning becoming more essential for small agency operators?

Rising tax obligations expected by 2025 make it crucial for small agency operators to engage in smart tax planning to optimize financial outcomes and maintain compliance with changing regulations.