Overview

As tax season rolls around, small business owners, it’s time to get your ducks in a row! Start by gathering those essential documents, keeping an eye on key deadlines, and implementing some strategic planning to make the most of your tax savings.

- Organizing your income and expense records is crucial—trust me, it makes a world of difference!

- Plus, understanding your tax obligations and using online tools can really streamline the filing process.

- This not only helps reduce stress but also boosts your compliance during this busy time.

So, how do you usually prepare for tax season? Let’s make it a breeze together!

Introduction

As tax season rolls around, many small business owners find themselves wrestling with the ins and outs of filing their returns. But don’t worry! Understanding the key steps to prepare can turn what seems like a mountain of paperwork into a manageable molehill.

In this article, we’ll explore the essential actions that can help streamline your tax prep—from gathering those all-important documents to meeting deadlines and steering clear of common traps. And hey, what happens when the pressure builds, and mistakes slip through the cracks? By diving into some proactive strategies, you can not only ease the stress but also unlock potential savings, making tax season feel more like an opportunity than a headache.

Gather Essential Tax Documents

Are you looking for ways on how to prepare for tax season? It’s super important to gather all those essential documents to make the submission process a breeze. Let’s dive into the key items you’ll want to collect:

- Income Documentation: Make sure to gather all your sources of income—think invoices, sales receipts, and bank statements that truly reflect what you’ve earned. Fun fact: nearly 70% of small business owners who get their income docs together before tax season say they have a way less stressful filing experience!

- Expense Receipts: Keep a solid record of all your business-related expenses. This means collecting receipts for supplies, utilities, rent, and any other operational costs you can deduct.

- Previous Tax Returns: Having last year’s tax return handy can help you spot any carryover deductions or credits, ensuring you make the most of your tax advantages.

- Bank Statements: Don’t forget to collect all your bank statements from the year. They’re crucial for , which is key for precise reporting.

- Payroll Records: If you have employees, gather those payroll records, including T4 slips and any other relevant documents, to stay compliant with tax regulations.

- Business Licenses and Permits: Lastly, make sure all your required licenses and permits are up to date and easy to find. This can save you from potential headaches during the submission process.

Organizing these documents in a dedicated folder not only streamlines your filing but also helps keep the stress levels down during tax season. By implementing these strategies for gathering your essential tax documents, you’re setting yourself up for a more efficient and effective way to understand how to prepare for tax season. Ready to tackle tax season like a pro?

Know Important Tax Deadlines

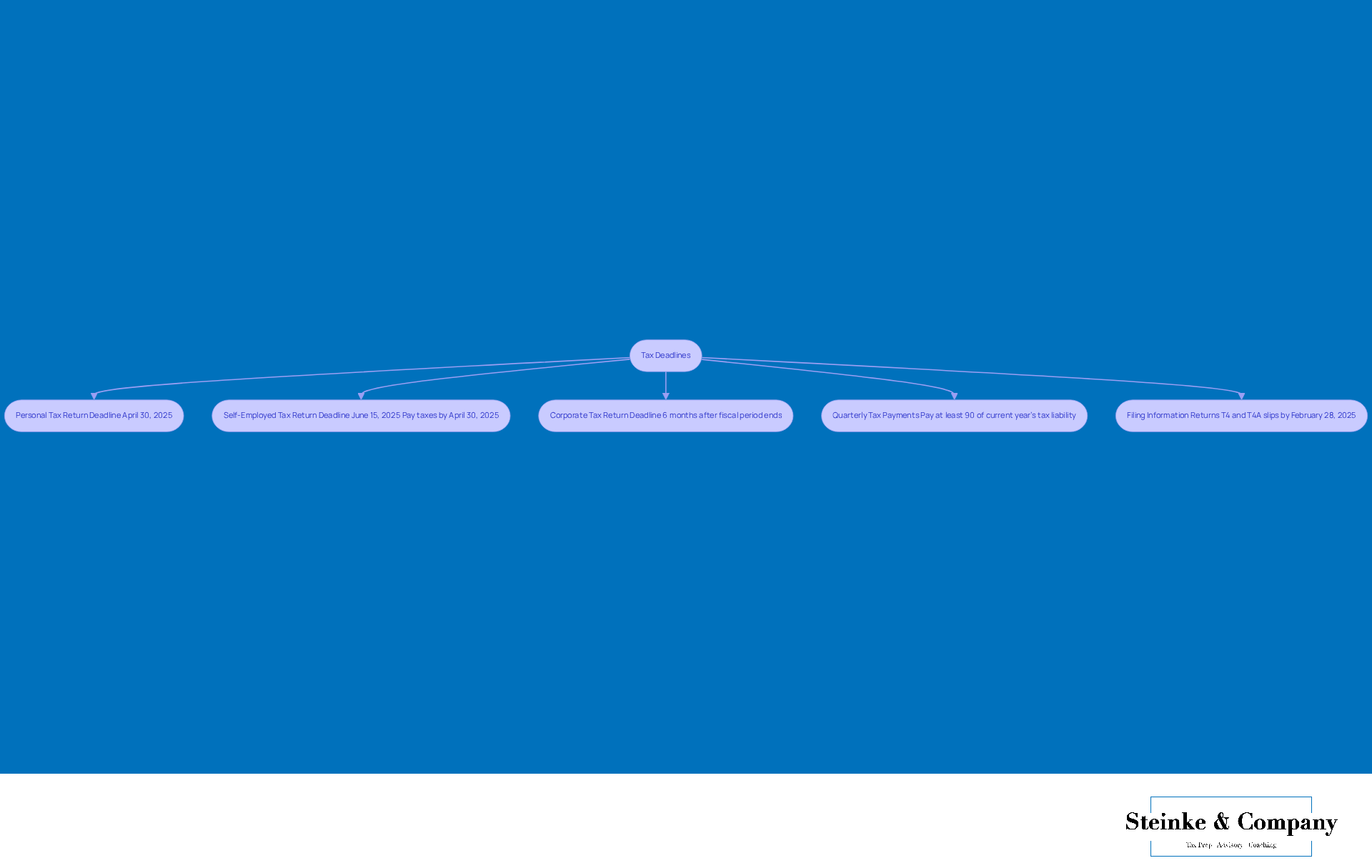

To avoid penalties, it’s super important to get familiar with these key tax deadlines:

- Personal Tax Return Deadline: If you’re an individual, including sole proprietors, mark April 30, 2025, on your calendar for filing your tax returns for the 2024 tax period.

- Self-Employed Tax Return Deadline: For all you self-employed folks, you have until June 15, 2025, to file. But remember, any taxes you owe need to be paid by April 30, 2025, to steer clear of interest charges and hefty underpayment penalties. The interest rate for underpayments is currently 8% annually, compounded daily—so, yeah, prompt payments are key!

- Corporate Tax Return Deadline: If you’re running a corporation, don’t forget to submit your T2 returns within six months after your fiscal period ends.

- Quarterly Tax Payments: Keep an eye on those quarterly estimated tax payment due dates! It’s crucial to avoid underpayment penalties, which can really mess with your cash flow. The IRS says you need to pay at least 90% of your current year’s tax liability or 100% of the previous year’s to dodge these penalties. Think about using safe harbor payments or the de minimis exception to manage your tax obligations effectively.

- Filing Information Returns: If you have employees, make sure to file those T4 and T4A slips by February 28, 2025.

Missing these deadlines can lead to some serious penalties. In fact, data shows that around 30% of small businesses face fines for late submissions simply because they weren’t aware of these important dates. To help avoid this, jot these deadlines down on your calendar and consider using to track how to prepare for tax season. Plus, filing your returns electronically can speed things up and reduce the chances of making mistakes. Oh, and if you file electronically by March 21, 2025, you should see your next Canada Carbon Rebate (CCR) payment on April 15, 2025. Setting reminders and using the resources available can really help you stay compliant and avoid those pesky penalties!

Maximize Tax Savings with Strategic Planning

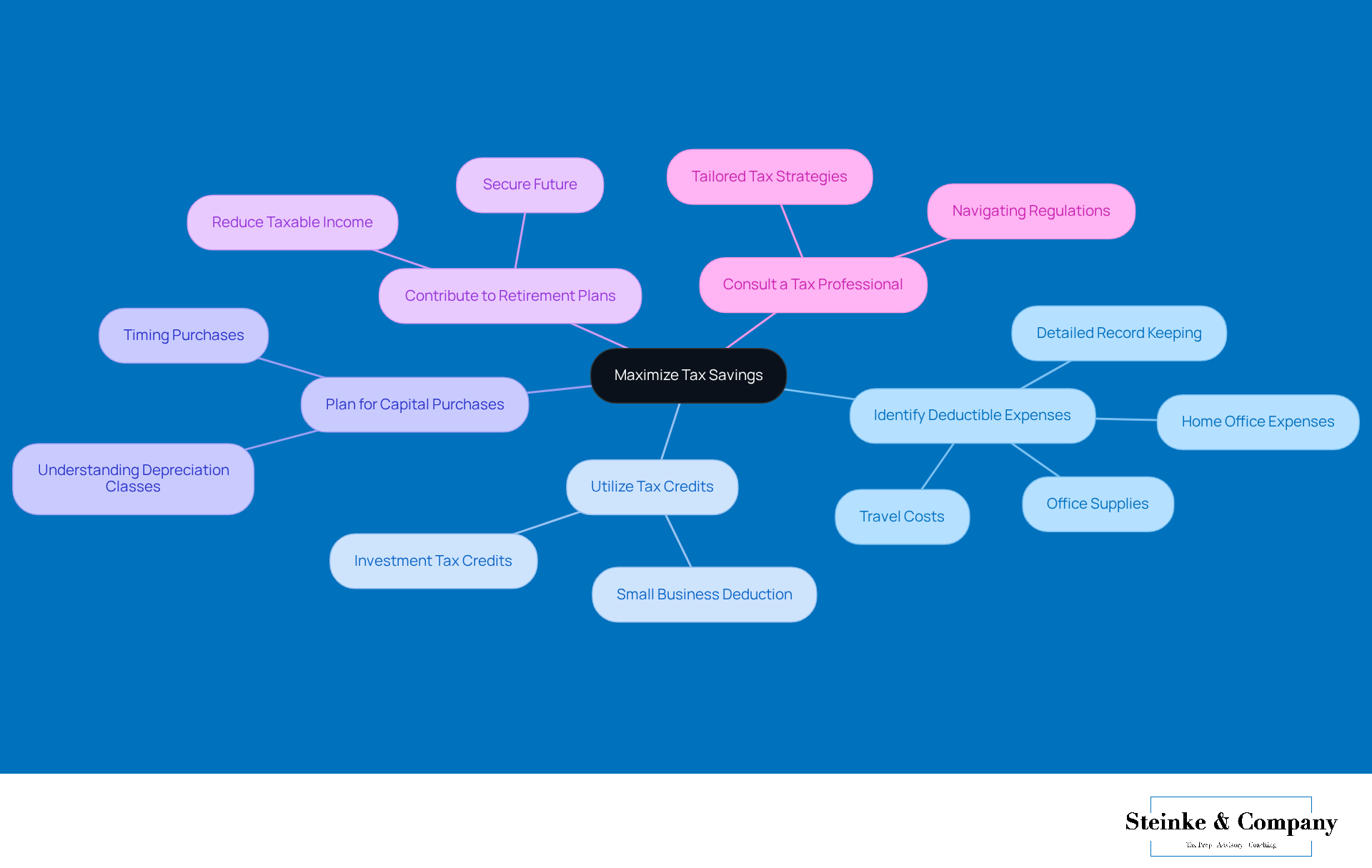

To maximize your tax savings, let’s explore some strategic planning tips that can really make a difference:

- Identify Deductible Expenses: First off, get to know those common deductible expenses like office supplies, travel costs, and home office expenses. Keeping detailed records is super important for backing up these deductions, which can seriously lower your taxable income.

- Utilize Tax Credits: Have you looked into the your business might qualify for? Things like the Small Business Deduction or investment tax credits can lead to substantial savings, so be sure to take advantage of them whenever you can.

- Plan for Capital Purchases: If you’re thinking about buying equipment or making big investments, timing those purchases right can help you maximize your depreciation deductions. Understanding the different classes of depreciable properties and their rates will really help you optimize your tax position.

- Contribute to Retirement Plans: Don’t forget about your future! Contributing to retirement plans not only helps you secure your future but also reduces your taxable income. It’s a win-win, making retirement planning a key part of your tax strategy.

- Consult a Tax Professional: Finally, chatting with a tax advisor can uncover more tax-saving opportunities tailored to your specific situation. Their expertise can help you navigate the complex regulations and make informed decisions.

By applying these strategies consistently throughout the year, you will understand how to prepare for tax season, which can lead to substantial tax savings and boost your financial health. So, why not start today?

Avoid Common Tax Preparation Mistakes

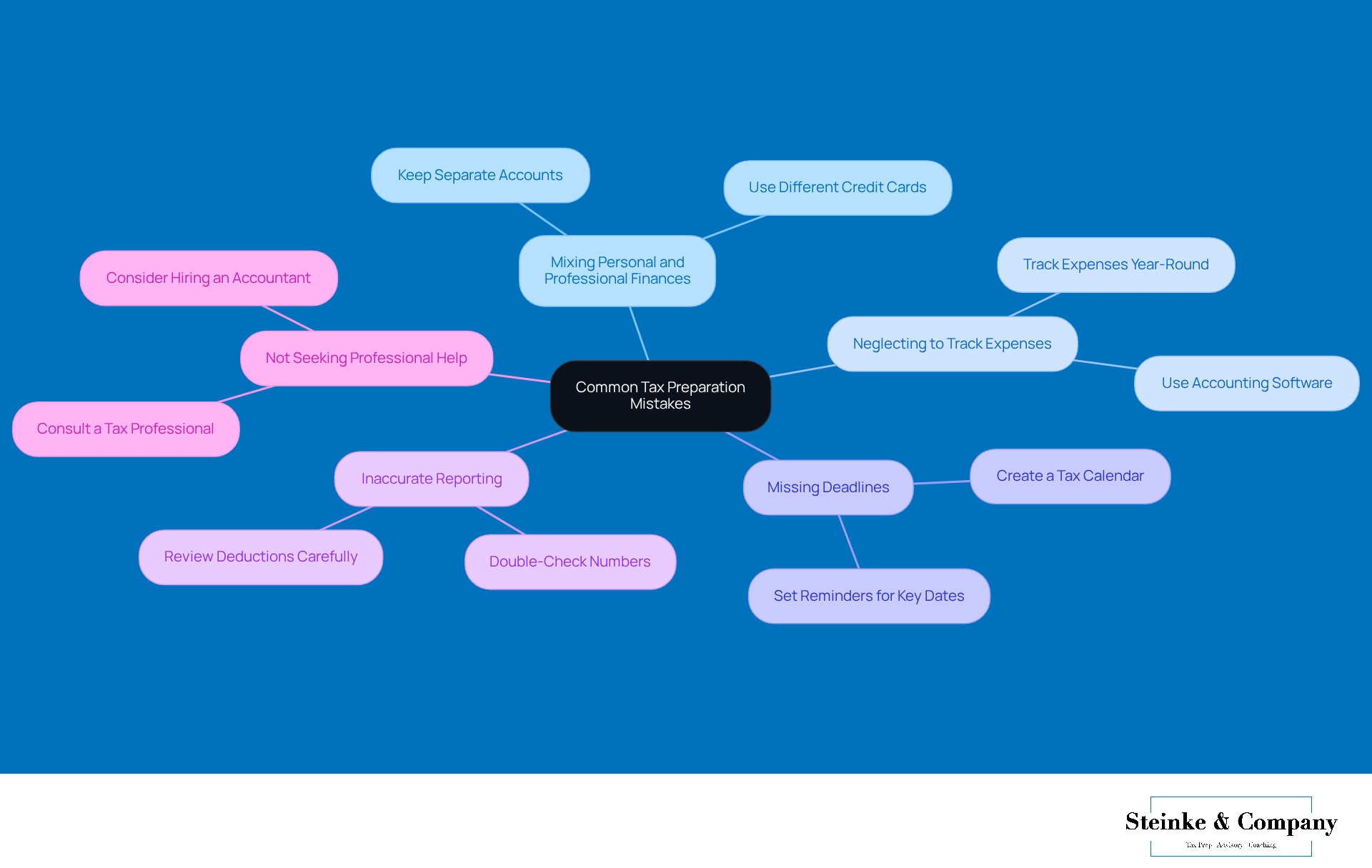

To make your tax preparation process a breeze, let’s steer clear of these common mistakes:

- Combining Personal and Professional Finances: Did you know that about 30% of small businesses mix their personal and professional finances? This can lead to some serious headaches if you don't know how to prepare for tax season. To keep things simple and avoid confusion, it’s best to have separate bank accounts and credit cards for your business and personal expenses.

- Neglecting to Track Expenses: If you’re not keeping tabs on all your business expenses, you might be leaving money on the table. Make it easier on yourself by using accounting software or apps to track your expenses throughout the year. This way, you can ensure every eligible deduction is accounted for.

- Missing Deadlines: Staying organized is key! You don’t want to face late fees or penalties, so make a calendar with all the important tax deadlines. Keeping your tax obligations on track can save you a lot of stress.

- Inaccurate Reporting: Always double-check your numbers to make sure your income and deductions are reported accurately. Mistakes here can lead to discrepancies that might trigger audits or penalties, and nobody wants that!

- Not : If your tax situation feels a bit overwhelming, don’t hesitate to bring in a tax professional. Their expertise can help you stay compliant and optimize your tax strategy, ultimately saving you both time and money.

By keeping an eye on these common pitfalls, you can understand how to prepare for tax season more smoothly and reduce the stress that often comes with it.

Utilize Online Tools for Efficient Filing

To boost your tax filing efficiency, why not tap into some ?

- Tax Preparation Software: Think about using platforms like H&R Block. They come with user-friendly interfaces and tailored support for small business tax submissions. These tools make the process smoother, helping you snag those deductions and cut down on errors.

- Accounting Software: Programs like QuickBooks or FreshBooks are lifesavers for keeping your finances in check all year round. They make tracking income and expenses a breeze, so tax season feels a lot less intimidating.

- Document Management Tools: Consider using cloud storage options like Google Drive or Dropbox to keep your tax documents organized and secure. This way, you’ll have easy access and won’t have to worry about losing important files.

- Expense Tracking Apps: Apps like Expensify or Receipt Bank can really simplify how you keep tabs on your expenses. They help you categorize everything, making your reporting much more accurate.

- Online Tax Calculators: Don’t forget to check out online tools to gauge your tax obligations. They can help you plan ahead and avoid any surprises when it’s time to file.

By weaving these tools into your routine on how to prepare for tax season, you can save time, reduce mistakes, and enjoy a smoother filing experience. So, what are you waiting for? Let’s make tax season a little less taxing!

Conclusion

As tax season rolls around, small business owners have a fantastic chance to turn what can feel like a daunting task into a smooth process. By getting a grip on the essential steps for tax preparation—like gathering those all-important documents, keeping track of deadlines, and planning strategically—business owners can tackle this time of year with confidence and ease.

So, what are the key actions to take? Start by:

- Collecting your income documentation and expense receipts.

- Keeping an eye on tax deadlines.

- Maximizing your deductions.

- Steering clear of common mistakes.

- Using online tools and software to amp up your efficiency.

In a nutshell, proactive tax preparation isn’t just about ticking boxes for compliance; it’s about laying the groundwork for financial success. By taking these steps seriously, small business owners can ease their stress, reduce errors, and ultimately unlock some significant savings. So, why not embrace these strategies today? They’ll help pave the way for a smoother tax season and a more prosperous future for your business!

Frequently Asked Questions

What essential tax documents should I gather for tax season?

You should gather income documentation (invoices, sales receipts, bank statements), expense receipts (for business-related expenses), previous tax returns, bank statements, payroll records (if you have employees), and business licenses and permits.

Why is it important to collect previous tax returns?

Having last year’s tax return can help you identify any carryover deductions or credits, allowing you to maximize your tax advantages.

What are the key deadlines for filing personal tax returns?

The deadline for filing personal tax returns is April 30, 2025, for the 2024 tax period.

What is the deadline for self-employed individuals to file their tax returns?

Self-employed individuals must file their tax returns by June 15, 2025, but any taxes owed must be paid by April 30, 2025, to avoid interest charges and penalties.

When should corporate tax returns be submitted?

Corporate tax returns (T2 returns) must be submitted within six months after the end of the fiscal period.

What are quarterly tax payments, and why are they important?

Quarterly tax payments are estimated tax payments due throughout the year. It’s crucial to pay at least 90% of the current year’s tax liability or 100% of the previous year’s to avoid underpayment penalties.

When are T4 and T4A slips due if I have employees?

T4 and T4A slips must be filed by February 28, 2025.

What are the consequences of missing tax deadlines?

Missing tax deadlines can lead to serious penalties, with around 30% of small businesses facing fines for late submissions due to a lack of awareness of these dates.

How can I stay organized and avoid penalties during tax season?

You can stay organized by marking key deadlines on your calendar, using digital tools or apps to track important dates, and filing your returns electronically to speed up the process and reduce mistakes.