Overview

This article dives into the world of 401(k) withdrawal tax rates and what they mean for you. We’re particularly shining a light on the tax consequences of early withdrawals and the key differences between Traditional and Roth 401(k) plans. So, here’s the scoop: when you take money out of a Traditional 401(k), it’s taxed as regular income. But with a Roth 401(k), you might just hit the jackpot—withdrawals can be tax-free if you meet certain conditions! This really underscores the importance of strategic planning to keep your tax liabilities in check and steer clear of those pesky penalties, especially if you’re a small business owner.

Have you thought about how these tax implications could affect your retirement planning? It’s crucial to stay informed and make decisions that work best for your financial future!

Introduction

Navigating the world of 401(k) withdrawals can feel a bit like wandering through a complicated maze, especially when you start thinking about the tax implications involved. It’s super important to understand how these withdrawals are taxed, especially if you're planning for retirement, since it can really affect your long-term financial health.

But what if an unexpected situation pops up, and you need to make an early withdrawal? The potential penalties and tax consequences can leave you scratching your head, wondering if you’re making the right choice.

In this article, we’ll dive into the nitty-gritty of 401(k) withdrawal tax rates. We’ll explore how they differ between Traditional and Roth accounts, what early withdrawals mean for you, and some strategies to help you optimize your retirement savings while keeping those pesky tax burdens to a minimum.

Explore the Basics of 401(k) Withdrawals and Taxation

A 401(k) plan is basically a retirement savings account that lets you stash away some of your paycheck before taxes come into play.

Now, when it comes to taking money out, it's super important to know that the IRS has some specific rules and tax implications related to the 401k withdrawal tax rate.

Typically, you can start pulling funds from your 401(k) without any penalties once you hit age 59½.

But if you decide to take money out before then, watch out! You might face a 10% , along with the usual income tax determined by the 401k withdrawal tax rate.

Understanding these basics can really help small business owners plan their exit strategies better and dodge those pesky penalties.

So, what do you think? Are you ready to dive into your retirement planning?

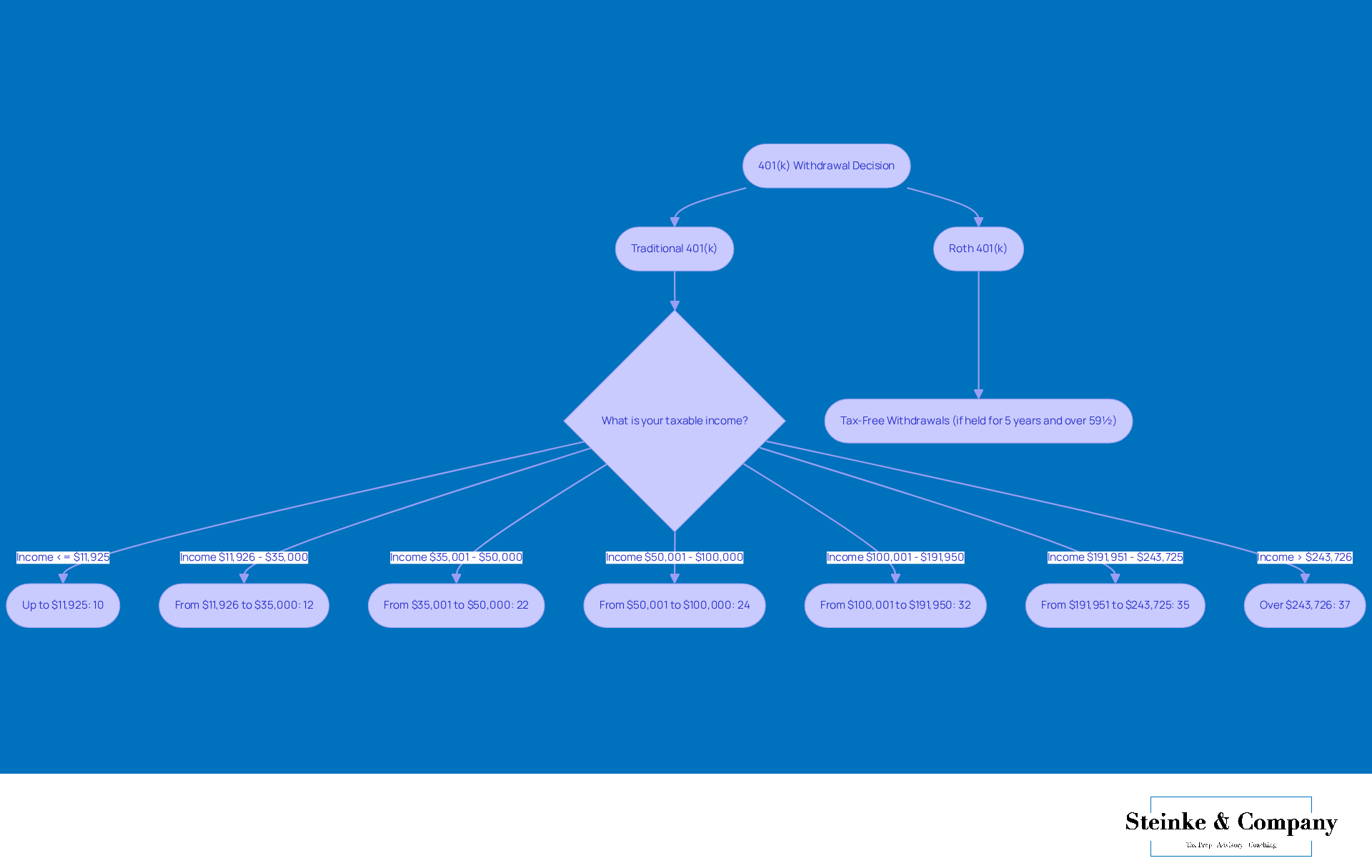

Differentiate Between Traditional and Roth 401(k) Tax Structures

Conventional 401(k) plans allow you to contribute before taxes, deferring the 401k withdrawal tax rate until you start taking distributions in your later years. On the flip side, Roth 401(k) contributions come from after-tax dollars, allowing for tax-free withdrawals later, as long as you meet certain conditions. This distinction is super important for small business owners because it directly impacts their tax obligations down the road. For example, if you think you’ll be in a higher tax bracket after you retire, opting for a Roth 401(k) could be a smart move since it locks in your current tax rate.

Experts suggest that younger entrepreneurs, who expect to see their earnings grow, might find the Roth option particularly beneficial for their long-term savings. Plus, there’s the added flexibility of Roth 401(k)s: starting in 2024, they won’t have required minimum distributions (RMDs), giving you greater control over your financial planning. Understanding these nuances can really empower small business owners to make that align with their financial goals.

And don’t forget to consider the tax implications of other retirement income sources, like Social Security benefits and employer pensions—these can significantly affect your total retirement earnings. By planning withdrawals strategically and understanding the implications of the 401k withdrawal tax rate, small business owners can optimize their after-tax earnings and avoid potential underpayment penalties. So, what are your thoughts on the best retirement strategy for your situation?

Understand the Tax Rates on 401(k) Withdrawals

When you take money out of a Traditional 401(k), it is taxed according to the , similar to regular income. This means the tax you pay depends on your current tax rate, which can change based on how much you earn in a year. For instance, in 2025, federal tax rates range from 10% to 37%. If you’re a single filer with a taxable income of $35,000, you’d pay 10% on the first $11,925 and then 12% on the rest up to $35,000. On the flip side, if you have a Roth 401(k), your withdrawals could be tax-free—provided you’ve held the account for at least five years and you’re over 59½.

Understanding the current IRS tax brackets is super important for wisely planning your 401k withdrawal tax rate. By choosing the right time to take out money, you might be able to lower your tax bill. Tax pros often recommend looking at your total income and tax situation when deciding how much to withdraw. And if you’re a small business owner, don’t forget to check out Health Savings Accounts (HSAs). They’re a great way to save for retirement, allowing for tax-deductible contributions and tax-free growth, which can really boost your after-tax earnings.

The 401k withdrawal tax rate on distributions can vary quite a bit, so it’s a smart move to chat with a tax advisor. They can help you come up with a personalized strategy that fits your financial goals.

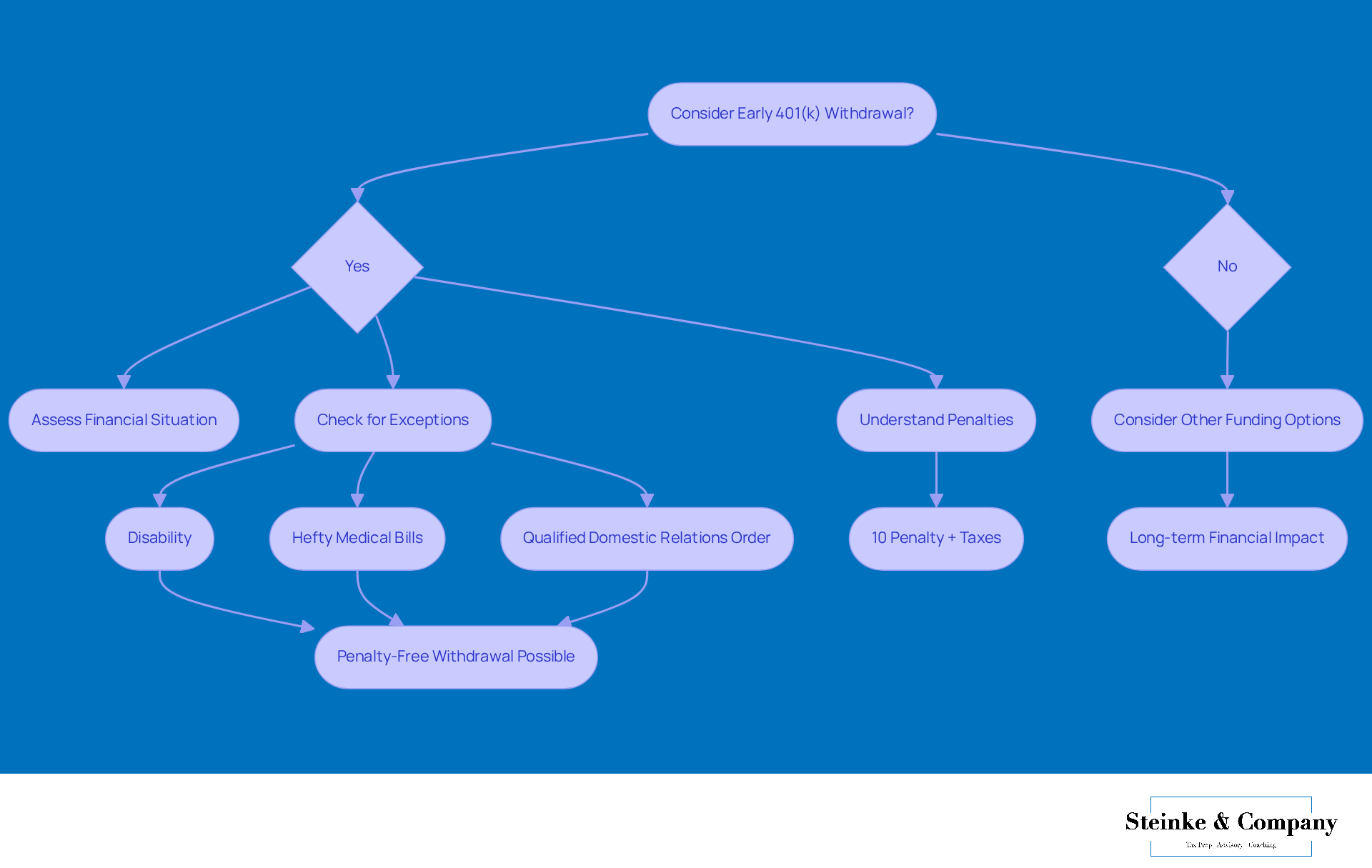

Assess the Implications of Early 401(k) Withdrawals

Withdrawing funds from your 401(k) before you reach 59½ typically results in a 10% early exit penalty, and you will be responsible for the on the amount you withdraw. But don't worry—there are some exceptions that can help you dodge that penalty! Situations like:

- Disability

- Hefty medical bills

- A qualified domestic relations order

might just save you. For example, if you find yourself facing significant medical expenses, you could qualify for a penalty-free withdrawal, as long as you need the money to cover those costs.

Before you dive into your savings for the future, it's super important to take a good look at your financial situation and explore other funding options. The long-term effects of pulling out money early can be pretty serious, and it might put your financial stability at risk down the line. Financial advisors often stress the importance of thoroughly evaluating your circumstances because withdrawing funds can lead to a lasting dip in your savings for the future. Plus, getting a handle on the tax implications of different retirement income sources, including the 401k withdrawal tax rate, as well as Health Savings Accounts (HSAs) and other retirement vehicles, can really help you maximize your after-tax income. By weighing all your options and considering their tax impacts, you can make smarter choices that align with your financial goals.

Conclusion

Understanding the nuances of 401(k) withdrawal tax rates is super important for effective retirement planning. The impact of taking money out of these accounts can really affect your financial stability, especially if you're a small business owner. By getting a handle on the differences between Traditional and Roth 401(k) plans, you can make informed decisions that align with your long-term financial goals and possibly lower your tax burdens.

Key insights from the article point out that timing and strategy matter a lot when you're thinking about withdrawals. Factors like your age, the type of 401(k) account you have, and your current income levels play a big role in figuring out the overall tax consequences. Plus, being aware of early withdrawal penalties and exemptions can help you navigate your options more effectively, ensuring that you protect your retirement savings.

Ultimately, the choices around 401(k) withdrawals need some careful thought and planning. Chatting with financial advisors and taking a close look at your financial situation can lead to smarter choices that boost your after-tax income. By staying in the loop about current tax rates and implications, you can optimize your retirement strategies and pave the way for a more stable financial future.

Frequently Asked Questions

What is a 401(k) plan?

A 401(k) plan is a retirement savings account that allows you to save a portion of your paycheck before taxes are deducted.

When can I start withdrawing funds from my 401(k) without penalties?

You can start withdrawing funds from your 401(k) without any penalties once you reach age 59½.

What happens if I withdraw money from my 401(k) before age 59½?

If you withdraw money from your 401(k) before age 59½, you may incur a 10% early withdrawal penalty in addition to the regular income tax based on the 401(k) withdrawal tax rate.

Why is it important to understand 401(k) withdrawal rules and taxation?

Understanding the rules and tax implications of 401(k) withdrawals can help small business owners plan their exit strategies effectively and avoid unnecessary penalties.