Overview

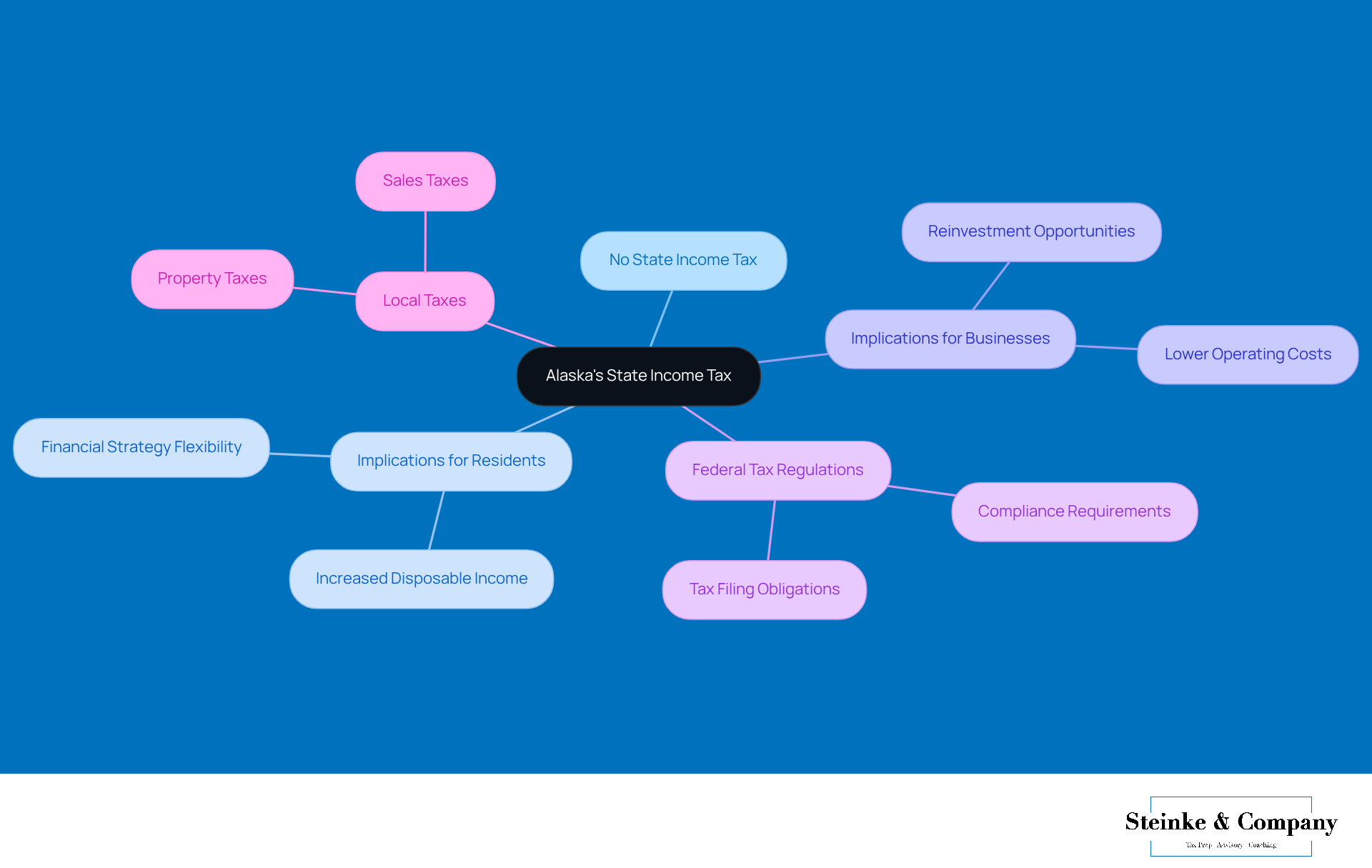

Did you know that Alaska doesn’t have a state income tax? This means that both residents and small businesses get to keep more of their hard-earned money for reinvestment and growth. Pretty neat, right? The article dives into this by explaining how the lack of a personal income tax, along with a tiered corporate tax system and local taxes, creates a unique financial landscape.

This setup can really benefit small businesses, although it does come with some regulatory challenges. It’s a mixed bag that keeps things interesting!

Introduction

Did you know that Alaska is the only U.S. state without a state income tax? This unique situation opens up some exciting opportunities for small businesses and entrepreneurs. Without a state income tax, business owners get to keep more of their hard-earned money, which can really help them grow and reinvest in their operations. But here’s the kicker: as Alaska deals with fluctuating oil revenues and local tax regulations, it raises an important question: how do these tax policies really affect the sustainability and growth of small businesses in the state?

Diving into the complexities of Alaska's tax landscape shows us that there are some significant perks, but also a few challenges that small business owners need to navigate. It’s a balancing act, and understanding how to manage these aspects can make all the difference for entrepreneurs looking to thrive in the Last Frontier.

Define Alaska's State Income Tax: Key Concepts and Implications

One of the reasons Alaska stands out among U.S. regions is that it does not impose a state income tax on individuals or businesses. This means that residents and small business owners aren’t required to at the local level, leading to the question: does Alaska have state income tax? How cool is that? It can really shape financial strategies and impact operating costs!

However, even though the question of does Alaska have state income tax is answered with a no, businesses still need to follow federal tax regulations and might be responsible for local taxes, like property and sales taxes set by municipalities. The absence of a state income tax in Alaska can be a real boon for small businesses, allowing them to keep more of their profits for reinvestment and growth. Isn’t that a great opportunity for entrepreneurs?

Explore the History and Current Status of Alaska's State Income Tax

Alaska's history with taxation goes way back to 1949 when a personal tax was briefly put in place to tackle some budget issues. But guess what? That tax was scrapped in 1979, leading to the question, does Alaska have state income tax, as it has proudly stood out as one of the few places without a personal earnings tax? The decision to skip a regional tax has been influenced by a few key factors, like the state's reliance on oil revenues and the Permanent Fund Dividend, which shares a slice of oil profits with residents. As we look ahead to 2025, Alaska is still without a regional tax, focusing instead on corporate earnings taxes and local levies to bring in revenue.

Now, there's an interesting debate happening about whether Alaska has a revenue problem, a spending problem, or maybe a bit of both. This conversation is crucial to understanding the current financial scene, especially as the state grapples with the challenge of with those ever-changing oil prices and production slowdowns. Take a look at some case studies, and you’ll see how businesses have adapted to Alaska's unique tax environment since the earnings tax was abolished. For instance, many small businesses have taken advantage of the absence of a personal tax to reinvest their earnings into growth and development, showcasing their agility in navigating financial hurdles.

Experts weigh in, noting that the choice to eliminate the income tax in 1979 was all about boosting economic growth and luring in new residents, leading to the question: does Alaska have state income tax? But as oil revenues dip, the government is feeling the heat to rethink its revenue strategies. Bruce Tangeman makes an important point, asking, 'Does Alaska have a revenue issue or a spending issue?' This ongoing discussion really underscores the need for a balanced approach to fiscal sustainability. And with the Alaska Supreme Court ruling that the Permanent Fund Dividend (PFD) counts as expenditures, the tax implications for both residents and businesses are getting a bit more complicated. So, what do you think? How should Alaska navigate these challenges moving forward?

Identify Key Characteristics of Alaska's Tax System for Small Businesses

Did you know that understanding whether Alaska has state income tax can be a real game-changer for small businesses? One of the biggest perks is that, when considering whether Alaska has state income tax, the answer is no, meaning there’s no state earnings tax! But hold on—there’s a tiered corporate tax that ranges from 0.0% to 9.4%, depending on how much a company earns. So, as your business grows, you might find yourself facing higher tax rates, which can definitely impact your financial planning and profitability.

Now, while there’s no statewide sales tax to worry about, local jurisdictions have the power to impose their own sales taxes. This can lead to quite a bit of variability across the state. If you’re running a small business that operates in different areas, keeping track of all these local rates can be tricky. It’s super important to stay on top of your local tax responsibilities to avoid any penalties and ensure you’re complying with regulations.

And let’s not forget about property taxes, which can vary based on the type of business and its assets. This really highlights the need for careful tax planning and compliance strategies. Plus, small business owners should keep an eye out for underpayment penalties that can sneak up on you if your estimated tax payments fall short. The IRS requires that at least 90% of your current year’s tax liability be paid throughout the year, so understanding these requirements is key. Utilizing strategies like safe harbor payments and the de minimis exception can help you dodge those pesky penalties.

As President Biden pointed out in 2021, the corporate tax environment is shifting, and it’s crucial for small businesses to adapt their tax strategies to stay ahead. With the , now’s the time for small business owners to reassess their tax strategies. Optimizing your financial outcomes and ensuring compliance is more important than ever!

Analyze the Implications of Alaska's Tax Policies on Small Business Operations

You know, one of the great perks of doing business in Alaska is that does Alaska have is not a concern. This really helps small business owners keep more of their hard-earned profits for reinvestment. It's especially handy for service-oriented businesses that often work with tight profit margins. Just think about it: many small enterprises in Alaska have successfully poured their profits back into growing their operations, improving services, and hiring more staff, all of which helps boost the local economy.

But it’s not all smooth sailing. Small business owners also have to deal with regional taxes and corporate earnings, which can complicate things a bit. In Alaska, the corporate income tax ranges from 0% to 9.4%, and companies need to file their corporate tax returns just 30 days after their federal ones. Plus, local municipalities can add their own taxes, with rates that can really vary. For instance, the max local sales tax rate is 7.5%, leading to an average combined state and local sales tax rate of 1.76%. Quite a mix, right?

These local tax responsibilities can definitely throw a wrench in the works for small business owners, especially when it comes to budgeting and planning. And let’s not forget about the fluctuating oil revenues that play a big role in Alaska's economy; they can really affect how consumers spend and how much businesses invest. So, it’s crucial for small business owners to stay on their toes and be ready to adapt their strategies to manage their tax duties and respond to the economic climate. By understanding these dynamics, small enterprises can set themselves up for sustainable growth, particularly in relation to whether Alaska does have state income tax in its unique tax landscape.

Considerations for Small Business Owners in Alaska

If you're a small business owner in Alaska, one important thing to think about is whether Alaska has state income tax. First off, staying in the loop about local tax rates and regulations is key, especially since they can change quite a bit from one municipality to another. It’s a good idea to chat with a tax professional who knows the ins and outs of Alaska's tax scene, particularly to understand if Alaska has state income tax; they can offer some great insights and help you stay compliant.

Also, make sure your employees are getting paid correctly and that the right taxes are being deducted. This attention to detail not only builds trust but also helps you dodge any potential tax headaches down the line. And don't forget about your financial records! Keeping accurate records, including copies of tax returns and supporting documents for at least three years, is crucial for compliance and can make the stress of an a bit more manageable.

It’s also wise to regularly review your tax obligations, including understanding if Alaska has state income tax, and take advantage of any available deductions and credits. For instance, the Small Business Tax Deduction lets you deduct up to 20% of your qualified business income. This can really help you avoid surprises come tax season and fine-tune your financial strategies. So, why not take a moment to reflect on your current tax practices? You might just find a few areas to improve!

Conclusion

Alaska's unique position as a state without a state income tax is a real game-changer for small businesses! It allows them to keep more of their hard-earned money for growth and development. This lack of a personal income tax not only creates a welcoming environment for entrepreneurs but also shapes how folks plan their finances across the state. By getting to know the ins and outs of Alaska's tax system, small business owners can navigate their fiscal responsibilities more easily and make the most of this tax structure.

As we wrap up, some key points have popped up, like:

- The historical context of Alaska's tax policies

- The impact of local taxation

- The importance of staying on top of compliance with varying local rates

The tiered corporate tax system and the possibility of local sales taxes add some layers of complexity that need careful planning. Plus, with fluctuating oil revenues and ongoing debates about the state’s revenue strategies, being adaptable in business operations is more crucial than ever.

So, what does this all mean for small business owners in Alaska? It’s a good idea to take a proactive approach in assessing your tax strategies and keep an ear to the ground for any changes in local tax regulations. Embracing a solid understanding of the tax landscape can lead to better financial outcomes and sustainable growth. As Alaska keeps evolving economically, being able to adapt to these unique tax policies will be key to achieving long-term success in the state's vibrant business environment.

Frequently Asked Questions

Does Alaska have a state income tax?

No, Alaska does not impose a state income tax on individuals or businesses.

What are the implications of not having a state income tax in Alaska?

The absence of a state income tax allows residents and small business owners to keep more of their income, which can positively impact financial strategies and operating costs for businesses.

Are there any taxes that businesses in Alaska still need to pay?

Yes, while there is no state income tax, businesses must still comply with federal tax regulations and may be responsible for local taxes, such as property and sales taxes set by municipalities.

What historical changes have occurred regarding Alaska's income tax?

Alaska briefly implemented a personal income tax in 1949 to address budget issues, but it was abolished in 1979. Since then, Alaska has remained one of the few places without a personal earnings tax.

What factors influenced Alaska's decision to eliminate the income tax?

The decision was influenced by the state's reliance on oil revenues and the Permanent Fund Dividend, which distributes a portion of oil profits to residents.

What challenges is Alaska facing regarding its revenue and spending?

Alaska is currently debating whether it has a revenue problem, a spending problem, or a combination of both, particularly as it deals with fluctuating oil prices and production slowdowns.

How have businesses adapted to Alaska's tax environment since the income tax was abolished?

Many small businesses have taken advantage of the lack of a personal tax by reinvesting their earnings into growth and development, demonstrating their ability to navigate financial challenges.

What recent legal ruling has complicated tax implications for residents and businesses in Alaska?

The Alaska Supreme Court ruled that the Permanent Fund Dividend (PFD) counts as expenditures, adding complexity to tax implications for both residents and businesses.