Overview

Finding the right accounting services for your business can feel a bit overwhelming, right? Start by figuring out exactly what your specific accounting needs are. Once you have that down, dive into researching local firms that fit the bill. This article walks you through a straightforward approach:

- Check out their qualifications.

- Gather some client reviews.

- Schedule consultations.

This way, you can choose an accountant who really gets your financial goals and knows the ins and outs of your industry.

Introduction

Finding the right accounting firm can be a game-changer for any business, but let’s be honest—many entrepreneurs find this process a bit overwhelming. By getting a clear picture of your financial needs and checking out local options, you can team up with a partner who not only ticks the compliance boxes but also helps you grow. But with so many firms out there claiming to be the best, how do you cut through the noise and find a reliable accountant that’s right for you?

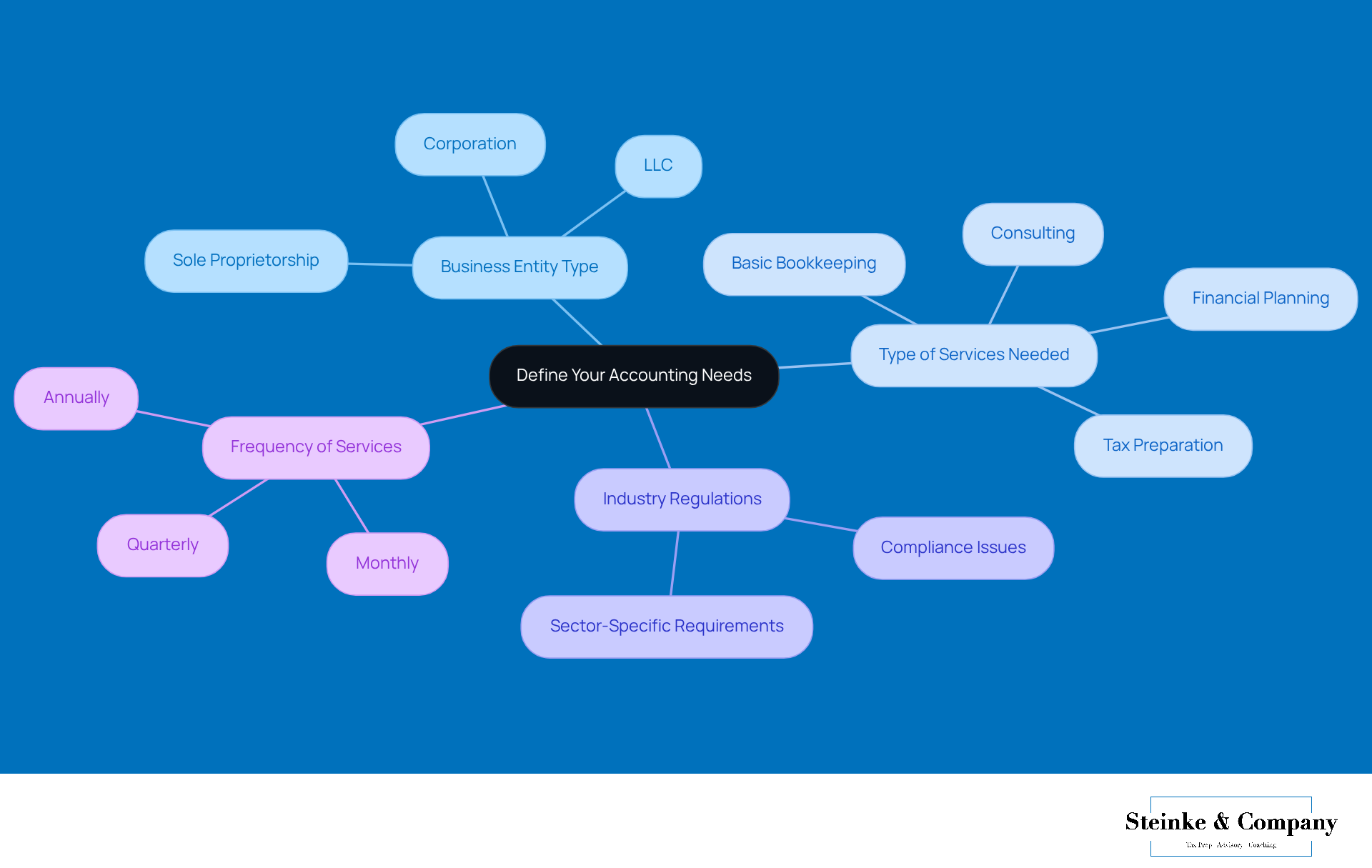

Define Your Accounting Needs

To kick things off, take a moment to really evaluate your organization's unique financial needs. Ask yourself a few key questions:

- What type of business entity are you running (like a sole proprietorship, LLC, or corporation)? Knowing your entity type is super important because it shapes your tax responsibilities and financial needs.

- Do you just need basic bookkeeping and tax prep, or are you looking for more in-depth services like financial planning and consulting? Many small businesses struggle with their financial practices, so understanding the nuances of financial estimates is vital for effective management.

- Are there specific industry regulations or compliance issues your business must follow? Different sectors come with their own set of requirements that can heavily impact your financial practices, and being aware of these can help you dodge risks of material misstatement.

- How often will you need financial services—monthly, quarterly, or annually? Regular check-ins can help you spot missed opportunities and stay compliant with changing tax laws.

Also, think about the possibility of IRS audits and the need to keep accurate records. If you haven’t been diligent with your record-keeping, remember that during an audit, it’ll be on you to prove that you deserve any deductions you’ve claimed. So, jot down your answers to create a clear outline of your needs. This outline will serve as a handy guide during your search for a practice, helping you find a partner that aligns with your and operational requirements.

Research Local Accounting Firms

Kick off your search by tapping into online resources and local directories! Here are some handy methods to get you started:

- First up, use search engines to hunt down accounting firms in your area. Try including keywords like 'accounting near me' or '' to narrow it down.

- Don’t forget to check out professional associations, like the American Institute of CPAs (AICPA), where you can find listings of certified accountants.

- Have a chat with fellow entrepreneurs or industry pals who might have some great recommendations based on their own positive experiences with local firms.

- And, of course, dive into social media platforms and company review sites to gather insights about local businesses and see what their reputations are like.

So, what are you waiting for? Start exploring and find the right accountant for you!

Evaluate Qualifications and Expertise

When you're on the hunt for accounting near me, there are a few key factors you definitely want to keep in mind. These can really make a difference for your business's financial health:

- Certifications: First things first, check if the firm has the right credentials, like CPA (Certified Public Accountant) or EA (Enrolled Agent). These certifications show that they know their stuff and follow professional standards, which is super important for staying compliant with taxes and planning strategically.

- Industry-Specific Experience: Next up, take a look at their experience in your specific industry. Accountants who understand the unique challenges you face can offer tailored advice and solutions, helping you operate more efficiently and stay compliant.

- Familiarity with Accounting Software: Don’t forget to ask about their skills with the accounting software you currently use or are thinking about adopting. A firm that knows your tools can help streamline your processes and improve accuracy in your financial reporting.

- Continuing Education: It's also worth evaluating how committed they are to ongoing education. The accounting world is always changing, with new tax laws and regulations popping up all the time. Firms that value continuing education are in a better position to navigate these shifts and provide you with informed guidance.

- Expert Tax Preparation and Planning: Think about companies like Steinke and Company, which focus on making tax season smooth, accurate, and stress-free. They handle both corporate and personal returns, ensuring compliance while minimizing surprises. By emphasizing proactive planning strategies—like regular financial reviews and tailored tax strategies—they help you dodge that last-minute panic when deadlines roll around, which is key for keeping your finances healthy.

So, compile a list of firms that tick these boxes, noting their strengths and weaknesses. This organized approach will help you find the near me for your business needs, ensuring you get the expert support you need for growth and compliance.

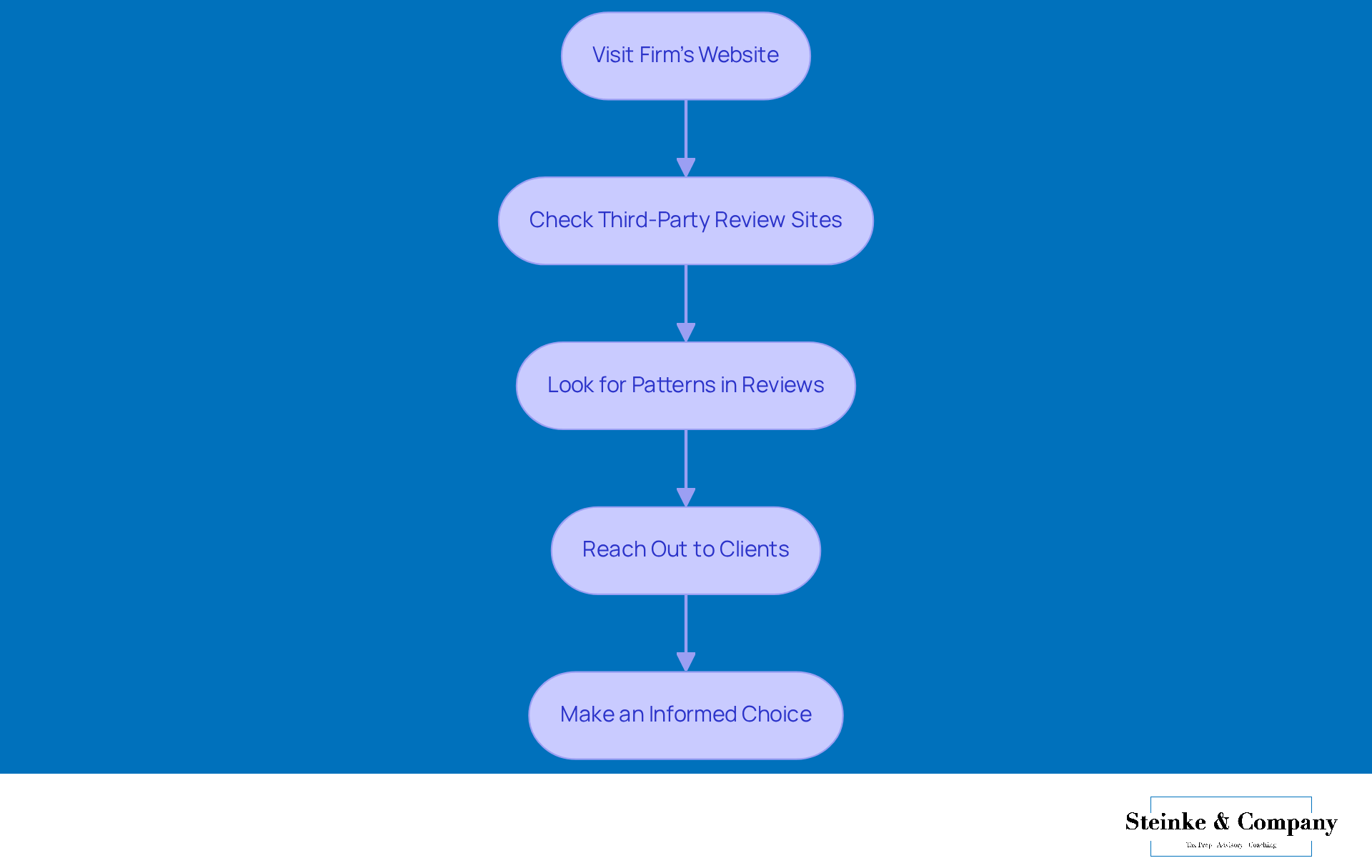

Assess Client Reviews and Testimonials

To assess , start by visiting the firm's website. There, you can read testimonials from previous clients and get a sense of their experiences. Next, check out third-party review sites like Google Reviews, Yelp, or any industry-specific platforms. These sources can provide you with unbiased feedback, which is super helpful!

As you dive into the reviews, keep an eye out for patterns. Are clients consistently praising the firm's responsiveness or expertise in certain areas? That’s a good sign! If you can, try reaching out to current or former clients directly. Asking about their experiences can give you valuable insights that you won’t find anywhere else.

Gathering this information will help you make a more informed choice about which company aligns best with your expectations. Remember, it’s all about finding the right fit for you!

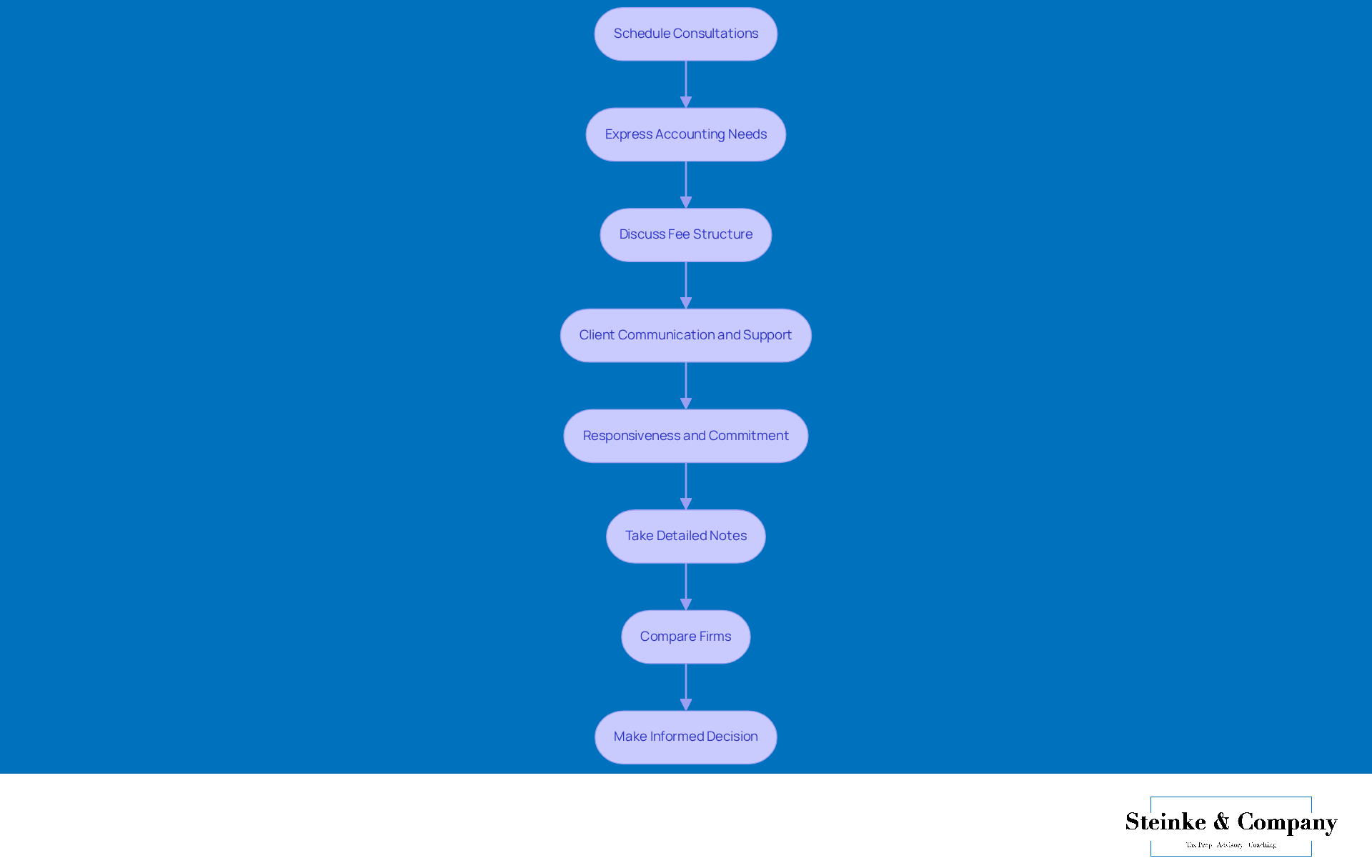

Schedule Consultations to Discuss Services and Fees

Once you've narrowed down your options, it's time to set up some consultations with your top picks. During these chats, keep an eye on a few key areas:

- Make sure to clearly express your accounting needs and ask how the firm plans to tackle them, especially when it comes to data security practices.

- Don't forget to dig into their fee structure—it's crucial to uncover any hidden costs or extra charges that might pop up.

- Talk about their approach to client communication and ongoing support; this can really shape your experience.

- Pay attention to how responsive they are and how willing they are to answer your questions—this often reflects their commitment to client service.

Taking some detailed notes during each consultation will help you compare the firms effectively and figure out which one aligns best with your needs. This proactive approach is key to ensuring compliance with regulations like the , which not only protects customer data but also builds trust, supporting your business growth.

Conclusion

Finding the right accounting partner for your business is a big deal—it can really make a difference in your financial health and compliance. This guide offers a straightforward way to find the best accounting services that fit your specific needs. By getting a grip on your unique financial requirements, doing some research on local firms, checking qualifications, looking at client feedback, and scheduling consultations, you can make informed decisions that align with your operational goals.

It's super important to define your accounting needs right from the get-go. Think about factors like your business structure, the services you need, and any industry regulations. Take the time to dig into local accounting firms; client reviews and industry credentials can be incredibly helpful. Plus, don’t forget that direct communication during consultations is key! It helps clarify services and fees, ensuring the firm you choose not only meets compliance standards but also builds a supportive partnership with you.

Remember, selecting an accounting firm isn’t just about crunching numbers; it’s about building a relationship that supports your growth and stability. So, take proactive steps in your search! Use the insights from this guide to find an accounting partner that not only meets your needs but also enhances your overall financial strategy. Choosing wisely can lead to smoother operations and a lot more peace of mind as you navigate the complexities of financial management.

Frequently Asked Questions

How can I define my accounting needs?

To define your accounting needs, evaluate your organization's unique financial requirements by considering your business entity type, the level of services you need (basic bookkeeping vs. financial planning), any specific industry regulations, and the frequency of required services (monthly, quarterly, or annually).

Why is it important to know my business entity type?

Knowing your business entity type (such as sole proprietorship, LLC, or corporation) is crucial because it affects your tax responsibilities and financial needs.

What types of services might I need from an accountant?

You might need basic bookkeeping and tax preparation or more comprehensive services like financial planning and consulting, depending on your business's financial practices.

How can industry regulations impact my accounting practices?

Different sectors have specific regulations and compliance issues that can significantly influence your financial practices, making it essential to be aware of them to avoid risks of material misstatement.

How often should I seek financial services?

The frequency of financial services can vary; you may need them monthly, quarterly, or annually, depending on your business's requirements and the need for regular check-ins to stay compliant with changing tax laws.

What should I consider regarding IRS audits?

It's important to keep accurate records, as you will need to prove any claimed deductions during an IRS audit. Diligent record-keeping can help you avoid issues during such audits.

How can I start researching local accounting firms?

You can start by using search engines to find accounting firms in your area, checking professional associations like the AICPA, asking for recommendations from fellow entrepreneurs, and exploring social media platforms and company review sites for insights about local businesses.

What keywords should I use to find local accountants online?

Use keywords like "accounting near me" or "local accountants" to narrow down your search for accounting firms in your area.