Overview

This article dives into some smart tax optimization strategies for small business owners, making it easier to reduce those pesky tax liabilities and boost financial efficiency. We'll chat about specific tactics like:

- Maximizing your contributions to tax-advantaged retirement accounts

- Taking advantage of charitable giving

- Employing advanced planning techniques

These methods can really help lower your tax burdens and pave the way for long-term business success.

So, have you ever thought about how much you could save by tweaking your retirement contributions? Or maybe you’ve considered the impact of charitable donations on your tax bill? Let’s explore these ideas together and see how they can work for you!

Introduction

Navigating the complex world of taxes can feel pretty overwhelming for small business owners, right? Especially with regulations constantly changing. But here’s the good news: the right tax optimization strategies can lighten your financial load and set the stage for sustainable growth. In this article, we’re diving into seven actionable tax strategies designed to help entrepreneurs like you minimize liabilities, boost compliance, and ultimately strengthen your financial position. Imagine if these techniques could completely change how small businesses tackle their tax responsibilities, turning potential pitfalls into golden opportunities for savings and success!

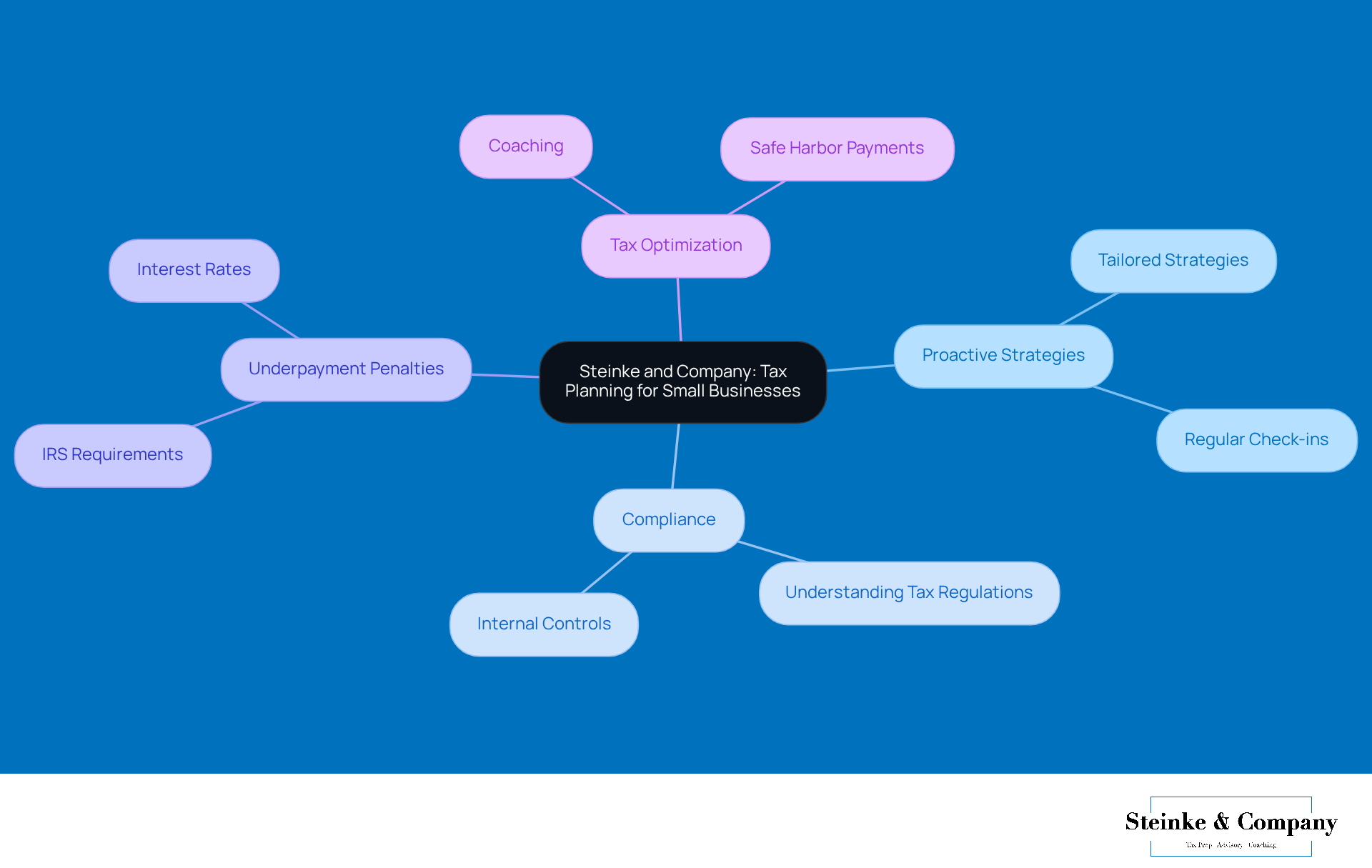

Steinke and Company: Expert Tax Planning for Small Businesses

Since it first opened its doors in 1974, Steinke and Company has been a go-to resource for micro and minor enterprises, focusing on tax compliance and planning. With a dedicated team of Enrolled Agents and CPAs, they create tailored strategies that help clients navigate the tricky waters of tax regulations, ensuring compliance while keeping liabilities in check. Recent advancements in tax planning really underscore the importance of being proactive, especially for small businesses facing ever-changing regulatory landscapes. Take, for instance, a modest retail shop that successfully boosted its tax compliance during a growth spurt by adopting a proactive planning strategy, which led to better reporting accuracy and significant reductions in tax obligations.

Understanding is crucial for business owners since these penalties can hit when taxpayers don’t pay enough of their tax obligations through withholding or estimated tax contributions throughout the year. The IRS has set a requirement that you pay at least 90% of your current year's tax liability or 100% of the tax shown on your previous year's return to dodge these penalties. As of October 1, 2023, the interest rate for underpayments stands at 8% per year, compounded daily. Steinke and Company integrates coaching and strategic planning into their service model, addressing the unique challenges faced by service-oriented professionals. This all-encompassing approach not only helps with compliance but also nurtures long-term success.

Experts agree that a solid tax optimization strategy can significantly impact the success rates of businesses, as shown in various case studies where firms achieved impressive tax savings and improved financial awareness. By offering regular check-ins and strategic sessions, Steinke and Company ensures that clients can spot missed opportunities and implement actionable tax optimization strategies, thereby reinforcing their commitment to empowering businesses in a fast-paced world. Plus, understanding safe harbor payments and effectively using estimated tax payments can help clients steer clear of costly penalties, further boosting their operational efficiency.

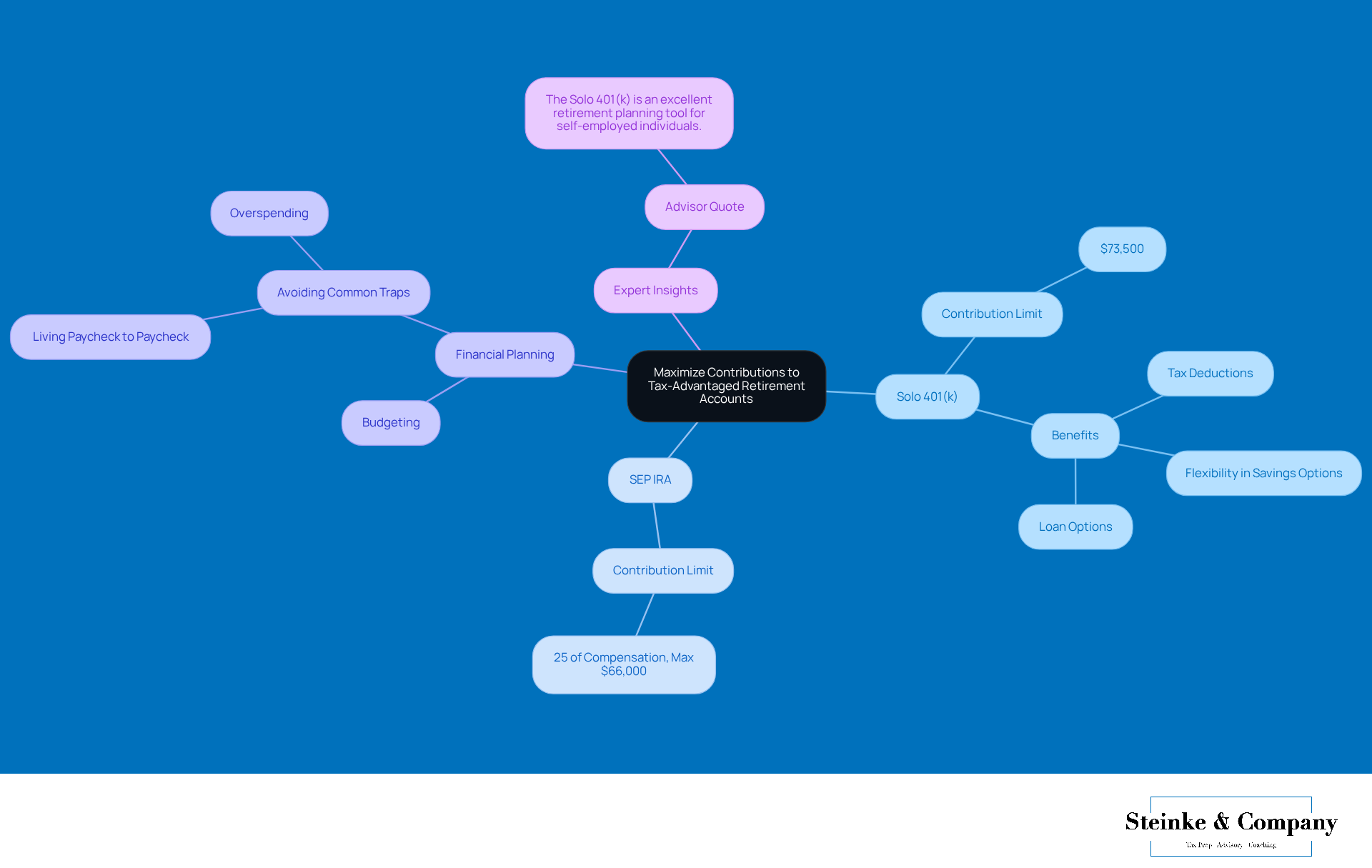

Maximize Contributions to Tax-Advantaged Retirement Accounts

Maximizing contributions to tax-advantaged retirement accounts is a smart move for entrepreneurs looking to boost their financial security. Did you know that in 2025, individuals can contribute up to a whopping $73,500 to a Solo 401(k)? That includes both employee and employer contributions, which is significantly higher than what you’d find in traditional retirement accounts. This strategy not only but also lets your investments grow tax-deferred until you withdraw them. And if you’re considering a SEP IRA, you’re in for a treat too—contribution limits are equally impressive, allowing up to 25% of compensation, with a max of $66,000 for 2025.

To really make the most of these benefits, having a solid financial plan is key. Effective planning helps you steer clear of common traps like living paycheck to paycheck or struggling with budgeting, which can lead to overspending and unnecessary stress. By crafting a realistic budget and getting a grip on your financial situation, you can allocate your funds wisely towards retirement savings without compromising other financial goals.

Let’s look at some real-world examples to see how these accounts can work wonders. Entrepreneurs who take advantage of a Solo 401(k) can benefit from those high contribution limits, allowing them to save more for retirement while enjoying some sweet tax deductions. Financial advisors often highlight that these plans are especially great for self-employed folks, as they offer flexibility in choosing between Roth and traditional savings options, plus the potential for loans if needed.

Quotes from financial experts really drive the point home. One advisor puts it nicely: "The Solo 401(k) is an excellent retirement planning tool for self-employed individuals, offering numerous advantages that can significantly affect long-term wealth accumulation." Plus, understanding your paystub and making sure your withholdings are correct can help you dodge surprises at tax time, boosting your financial stability. Just a heads up—the Roth Solo 401(k) does come with some administrative responsibilities, like filing annual reports if your plan has more than $250,000 in assets. By strategically maximizing contributions to these tax-advantaged accounts and utilizing tax optimization strategies within a proactive financial plan, small business owners can effectively lower their tax burdens while securing a brighter financial future.

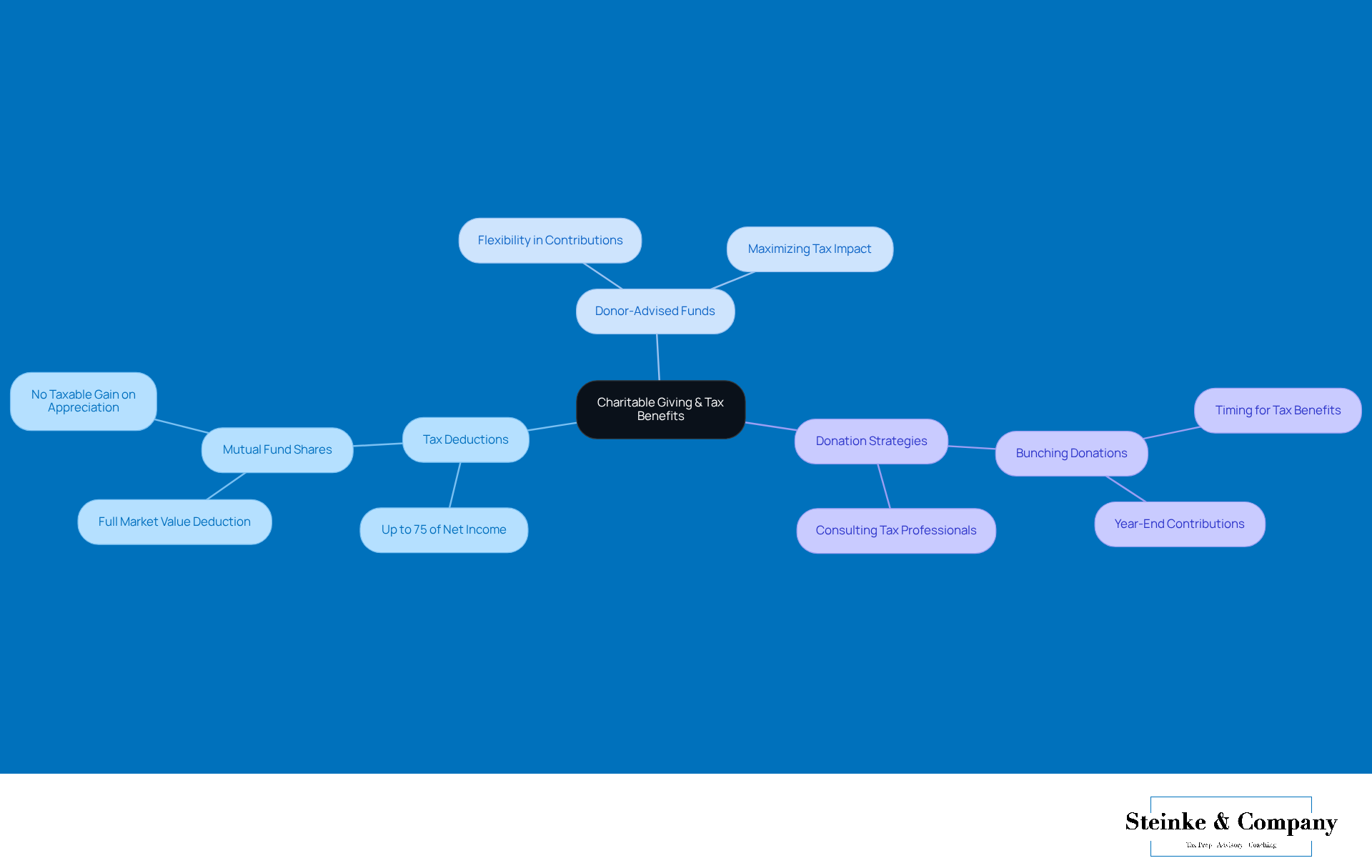

Use Charitable Giving to Offset Taxes

Charitable giving is a fantastic way to not only support meaningful causes but also help offset your taxes. In Canada, businesses can claim deductions for charitable contributions up to a whopping 75% of their net income! For example, if an organization donates $10,000, it can potentially reduce its taxable income by that amount, leading to some significant tax savings. Plus, if you contribute valued mutual fund shares, you can enjoy even more tax perks—like deducting the full market value of those shares without having to worry about a taxable gain on their appreciation.

Now, have you considered setting up a donor-advised fund (DAF)? It’s a great way to streamline your charitable giving and maximize those tax benefits. This approach not only boosts charitable initiatives but also gives companies the flexibility to time their contributions for the best tax impact. By utilizing DAFs, organizations can make smart decisions about their charitable donations, ensuring they align with both their financial goals and social responsibilities.

As tax pro Zachary J. Hall wisely puts it, 'The trick is to 'bunch' your donations in a year that does you the most tax good.' This strategy can really help businesses utilize to optimize their deductions and enhance their overall tax savings. So, if you’re a small business owner, it’s a good idea to stay in the loop about the latest tax regulations and maybe even chat with a tax consultant to tailor your giving strategies effectively. What do you think? Are you ready to make the most of your charitable contributions?

Prioritize Tax-Efficient Investment Strategies

For entrepreneurs running modest enterprises, prioritizing tax optimization strategies is essential for maximizing returns. Have you considered how investments in tax-advantaged accounts like Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs) can work for you? These accounts allow your capital to grow without immediate tax implications, which is a pretty sweet deal! In fact, many small businesses are tapping into these accounts to boost their financial positions.

Now, let’s chat about the types of investments that might be worth your while. Focusing on those that yield qualified dividends or long-term capital gains can really help lower your tax liabilities, especially with the favorable tax treatment coming up in 2025. It’s super important to connect with financial advisors who can help craft a customized portfolio that aligns with your personal tax optimization strategies. This way, you can while maximizing those investment returns.

And speaking of navigating, Steinke and Company is here to help with preparing and submitting both corporate and personal returns. They ensure compliance and help reduce those unexpected surprises. If you’re running a small enterprise, remember to keep your tax documentation for at least three years—longer if specific situations pop up. This little practice can save you from potential headaches during audits. By staying organized, you’ll be in a much better position to manage those tax intricacies while reaping the benefits of your investments.

Optimize Business Structures for Tax Efficiency

Enhancing your organizational framework with tax optimization strategies is super important if you're an independent entrepreneur. The choice between being a can really impact your tax liabilities. For instance, corporations often enjoy reduced tax rates on the first $500,000 of active earnings, while sole proprietors face higher personal tax rates that can climb as their income increases. It's surprising how many small business owners miss out on significant tax savings simply because they aren't aware of the deductions and credits available to them.

Many entrepreneurs opt for sole proprietorships because they’re straightforward, but this choice can put personal assets at risk if things go sideways with the business. On the flip side, setting up a corporation not only provides that much-needed liability protection but also opens the door to various tax optimization strategies. This means you can keep your profits within the business for reinvestment rather than having to deal with immediate tax bills.

Tax pros really stress how essential it is to understand these differences. For example, did you know that you can deduct up to 20% of qualified business income under IRC Section 199A? That can lead to some serious savings for qualifying independent operators. Plus, taking advantage of retirement plans like SEP IRAs or Solo 401(k)s can boost your tax efficiency even more, helping you contribute in ways that significantly lower your taxable income.

In the end, it’s a great idea for entrepreneurs to collaborate with tax strategists to assess their unique situations and develop effective tax optimization strategies for their organizational structure. This way, you can make the most of the tax advantages out there while keeping your liabilities in check. So, what are you waiting for? Let’s get optimizing!

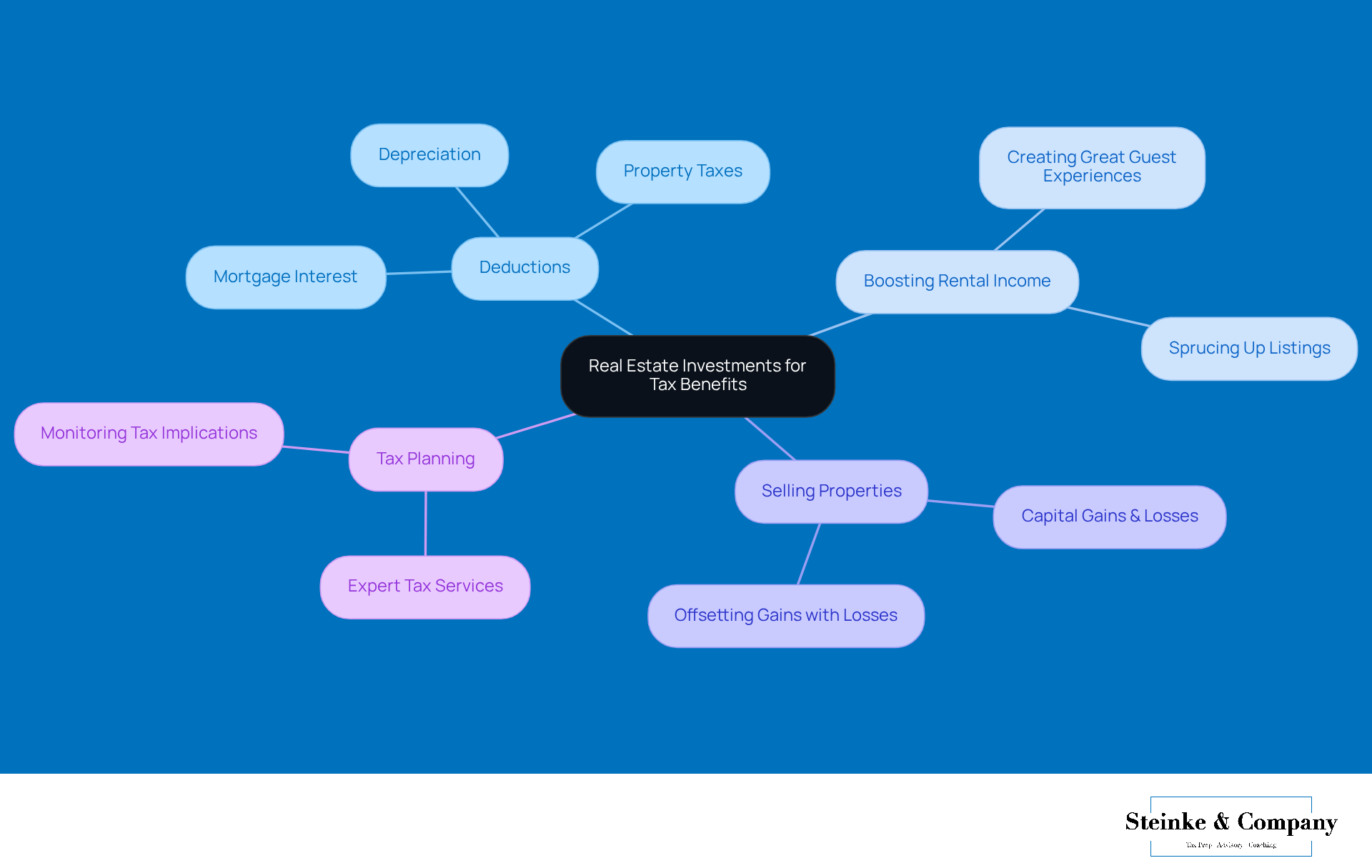

Explore Real Estate Investments for Tax Benefits

Exploring real estate investments can really offer some nice tax perks for small business entrepreneurs. For instance, rental properties, especially those on platforms like Airbnb, allow you to deduct expenses like mortgage interest, property taxes, and depreciation. By sprucing up your listings and creating great guest experiences, you can boost your rental income, which can help with your tax situation too. Plus, if you sell a property, any capital gains can be offset by losses from other investments, which means lower overall tax liability.

So, why not think about adding real estate to your investment mix as a means to enhance your tax optimization strategies? Just remember to keep an eye on the tax implications of rental income and any potential installment sales. And hey, teaming up with expert tax prep and planning services can help you stay compliant and avoid any surprises down the road. This way, you can focus on what really matters—your !

Implement Advanced Tax Planning Strategies

Hey there, small business owners! Let’s chat about some advanced tax optimization strategies that can really help you cut down on those pesky tax obligations. Techniques like:

- Income splitting

- Tax-loss harvesting

- Using holding companies

can make a big difference in what you owe. For instance, income splitting lets you share income with your relatives, which might just lighten your overall tax load. This works especially well when paired with holding companies, as they help with income allocation and can offer some neat tax perks.

Now, have you heard of tax-loss harvesting? It’s a clever way to offset capital gains with realized losses, which can lower your taxable income. This strategy shines in volatile markets where your investments might be all over the place. By strategically selling off those underperforming assets, you can 'harvest' losses to balance out your gains, ultimately trimming your tax liabilities.

Don’t forget, regular chats with a qualified tax advisor are super important! They can help you spot savings opportunities and keep you in line with the ever-changing tax laws. With some , staying proactive is crucial. For example, understanding the IRS wash-sale rule is key to maximizing the benefits of tax-loss harvesting.

Incorporating these advanced tax optimization strategies not only aids in immediate tax savings but also positions you for long-term financial success. As tax experts often say, effective tax optimization strategies aren’t just about compliance; they’re about crafting plans that protect your wealth and prepare your business for future growth. By using these techniques, you can navigate the complexities of tax planning with confidence. So, what are you waiting for? Let’s get started on making your tax strategy work for you!

Conclusion

Tax optimization is super important for small business owners who want to boost their financial health and set themselves up for long-term success. By using effective tax planning strategies, entrepreneurs can really cut down on their tax bills while staying on the right side of those ever-changing regulations. This article shines a light on several key tactics, like:

- maximizing contributions to tax-advantaged retirement accounts

- making the most of charitable giving

- prioritizing tax-efficient investments

- optimizing business structures

- exploring real estate investments

- adopting advanced tax planning strategies

Each of these strategies comes with its own unique perks, from lowering taxable income to creating opportunities for wealth building. For instance, being able to contribute significant amounts to accounts like Solo 401(k)s and the benefits of charitable donations can lead to some serious tax savings. Plus, understanding the ins and outs of different business structures and leveraging real estate investments can really boost tax efficiency. Working with experts, like those at Steinke and Company, can help small business owners navigate these complexities and come up with tailored solutions that fit their specific needs.

In the end, the importance of tax optimization is huge. By actively embracing these strategies, small business owners not only protect their financial futures but also set themselves up for sustainable growth. As the tax landscape keeps changing, staying informed and adaptable is key. So, taking the time to chat with tax professionals and exploring innovative tax planning techniques will help ensure that businesses can thrive while keeping their tax burdens as low as possible.

Frequently Asked Questions

What services does Steinke and Company provide for small businesses?

Steinke and Company offers expert tax compliance and planning services, focusing on creating tailored strategies to help clients navigate tax regulations and ensure compliance while managing tax liabilities.

Why is proactive tax planning important for small businesses?

Proactive tax planning is crucial for small businesses to adapt to changing regulatory landscapes, improve reporting accuracy, and potentially reduce tax obligations, as demonstrated by successful case studies.

What are underpayment penalties, and how can they affect business owners?

Underpayment penalties occur when taxpayers do not pay enough of their tax obligations throughout the year. Business owners can avoid these penalties by ensuring they pay at least 90% of their current year's tax liability or 100% of the previous year's tax.

What is the current interest rate for underpayments as of October 1, 2023?

The interest rate for underpayments is 8% per year, compounded daily.

How does Steinke and Company support service-oriented professionals?

Steinke and Company integrates coaching and strategic planning into their services to address the unique challenges faced by service-oriented professionals, aiding in compliance and fostering long-term success.

What are the benefits of maximizing contributions to tax-advantaged retirement accounts for entrepreneurs?

Maximizing contributions to tax-advantaged retirement accounts, such as Solo 401(k)s and SEP IRAs, helps entrepreneurs lower their taxable income and allows investments to grow tax-deferred until withdrawal.

What are the contribution limits for a Solo 401(k) in 2025?

In 2025, individuals can contribute up to $73,500 to a Solo 401(k), which includes both employee and employer contributions.

What are the contribution limits for a SEP IRA in 2025?

For a SEP IRA in 2025, contribution limits allow up to 25% of compensation, with a maximum of $66,000.

What common financial traps should entrepreneurs avoid?

Entrepreneurs should avoid living paycheck to paycheck and poor budgeting practices, which can lead to overspending and increased financial stress.

What should entrepreneurs understand about their paystubs to enhance financial stability?

Entrepreneurs should ensure that their withholdings on paystubs are correct to avoid surprises at tax time, which can help boost financial stability.

What responsibilities come with a Roth Solo 401(k)?

A Roth Solo 401(k) comes with administrative responsibilities, such as filing annual reports if the plan has more than $250,000 in assets.