Introduction

In the competitive world of small agencies, you can’t underestimate the power of solid due diligence. As these businesses tackle their unique challenges, it’s super important to grasp the essential services that can boost operational efficiency and sustainability. So, let’s dive into ten key business due diligence services that help small agencies not just survive, but thrive in this ever-changing market. But seriously, what happens when the stakes are high and the right strategies aren’t in place? Exploring these services might just uncover the secret to not only staying afloat but also paving the way for long-term success.

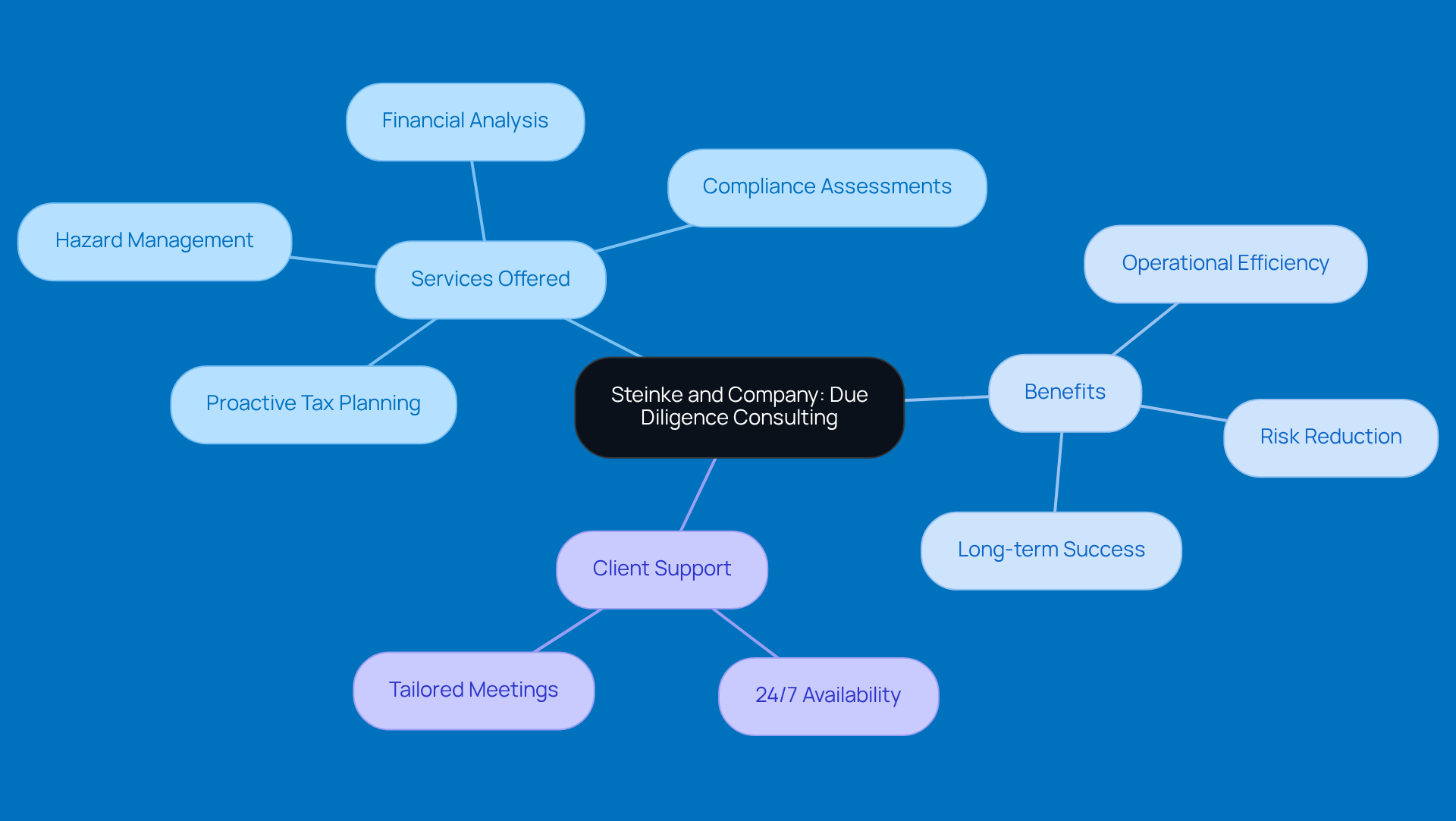

Steinke and Company: Comprehensive Due Diligence Consulting for Small Agencies

Steinke and Company really shines when it comes to providing thorough business due diligence services, particularly for small agencies in rural areas. They get that these businesses face unique challenges, so they take a comprehensive approach that covers everything from financial analysis to hazard management and compliance assessments. This all-in-one strategy not only boosts operational efficiency but also helps ensure sustainability.

With decades of experience under their belt, Steinke and Company is all about empowering clients to navigate the tricky waters of due diligence. This way, they’re ready to grab opportunities and tackle challenges head-on. And let’s be honest-effective due diligence is crucial for rural enterprises. It can seriously cut down risks and enhance decision-making. Experts in the field stress that utilizing business due diligence services isn’t just a box to check; it’s a smart move that can pave the way for long-term success.

By putting successful due diligence strategies into action, rural businesses can stay ahead of the curve in a constantly changing market, driving growth and resilience. Plus, Steinke and Company doesn’t stop there-they also offer proactive tax planning services. They meet with clients 1-3 times a year to go over tax returns and spot any missed opportunities. This tailored approach aims to lighten tax burdens while promoting business growth and efficiency.

And let’s not forget about their commitment to being there for clients. With 24/7 support available through various channels, they ensure that help is just a call or click away whenever it’s needed.

Financial Analysis: Assessing Revenue and Profit Trends

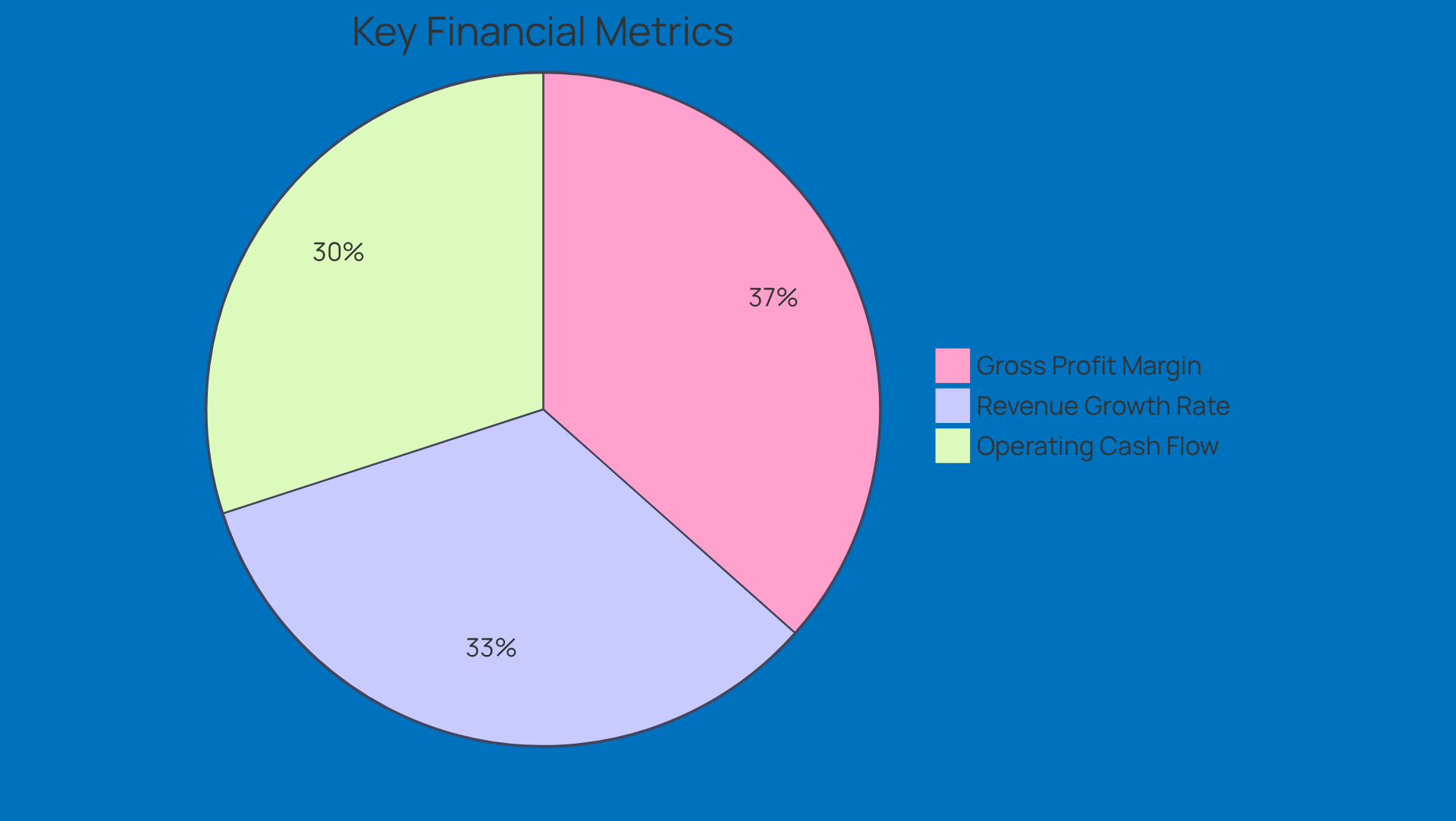

A thorough financial analysis is super important for small organizations looking to get a grip on their revenue streams and profit margins. By regularly checking out financial statements, these organizations can spot trends that show whether they’re growing or facing a decline.

So, what should you focus on? Key metrics like gross profit margin - this tells you the percentage of revenue left after deducting the cost of goods sold - and operating cash flow, which shows the cash generated from operations. Plus, keeping an eye on the revenue growth rate can give you valuable insights into how well the organization is doing overall.

Understanding these trends really empowers agencies to make smart decisions about budgeting, investments, and strategic planning. This ultimately helps them build financial resilience. Did you know that small enterprises have reported an average gross profit margin of 36.56%? This highlights just how crucial it is to maintain strong profit margins to ensure sustainability and growth in a competitive landscape.

So, how’s your organization doing in this area? It might be time to take a closer look!

Document Inspection: Ensuring Compliance and Risk Mitigation

Document inspection is super important! It’s all about taking a good look at your business documents - think contracts, tax filings, and compliance records. For small organizations, having a solid system for managing these documents is key. It helps keep everything up-to-date and easy to find, which is crucial for staying on the right side of the law.

When you manage your documents well, you can really cut down on the risks that come with audits or disputes. Did you know that 72% of organizations say that not being able to access documents can really slow down their work? Regularly checking your documents can help spot any issues, making sure your organization stays compliant and operates smoothly.

And here’s something to think about: 80% of organizations find that using outdated digital tools can really hold back efficiency and innovation. This just highlights how important it is to have modern document management solutions in place. Legal experts often say that being proactive about document management can save you from costly compliance headaches. In fact, 47% of organizations that went digital with their documents found they could attract new clients thanks to better data access.

By putting document management at the forefront, small organizations can boost their resilience and shield themselves from potential risks. Plus, if you’re handling sensitive customer info, understanding the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule is a must. Following this rule not only keeps customer data safe but also builds trust - something that’s essential for keeping clients around.

Using data security best practices, like encryption and multi-factor authentication, can help protect against breaches and make sure your organization is ready for any audits or legal checks that might come your way. So, how’s your document management looking? It might be time to give it a little TLC!

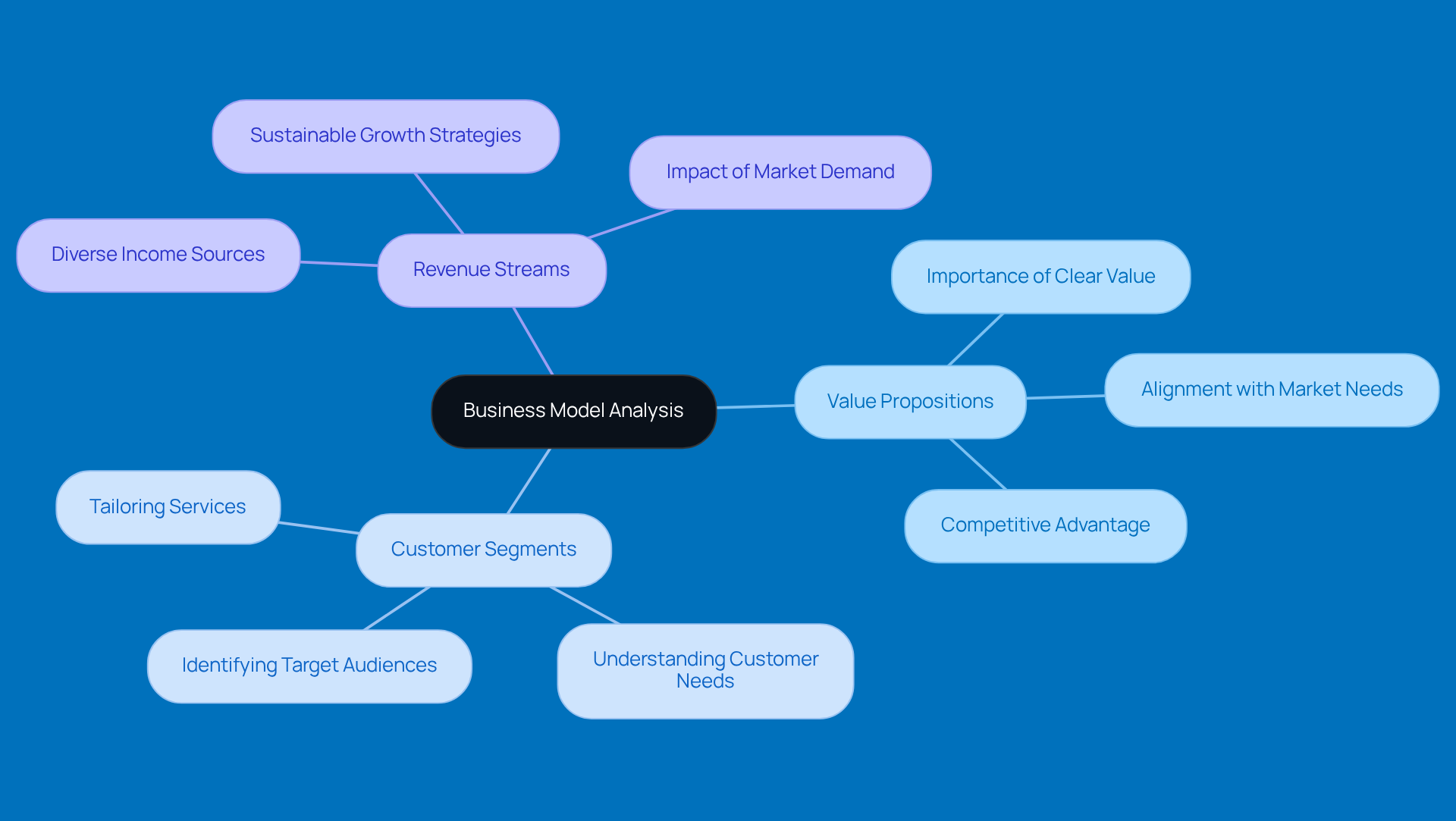

Business Model Analysis: Aligning Strategy with Market Needs

Taking a good look at your operational model is super important for organizations wanting to see how well their services match up with what the market really needs. This means digging into things like value propositions, customer segments, and revenue streams to find spots that could use a little boost. When organizations align their strategies with market demands, they can really ramp up their competitive edge and set themselves up for long-term success.

It’s also key to regularly review that operational model. Why? Because it helps organizations adapt quickly to any shifts in the market. For instance, did you know that about 42% of small businesses close their doors within five years due to not enough market demand? That’s a big wake-up call for organizations to stay in tune with what consumers want.

Strategists often point out that syncing business models with market needs not only builds resilience but also fuels growth. Just look at local businesses - they’ve created nearly 13 million net new jobs over the last 25 years! By weaving these insights into their operational strategies, like smart marketing and managing uncertainties, organizations can navigate the tricky market landscape and really thrive in a competitive world.

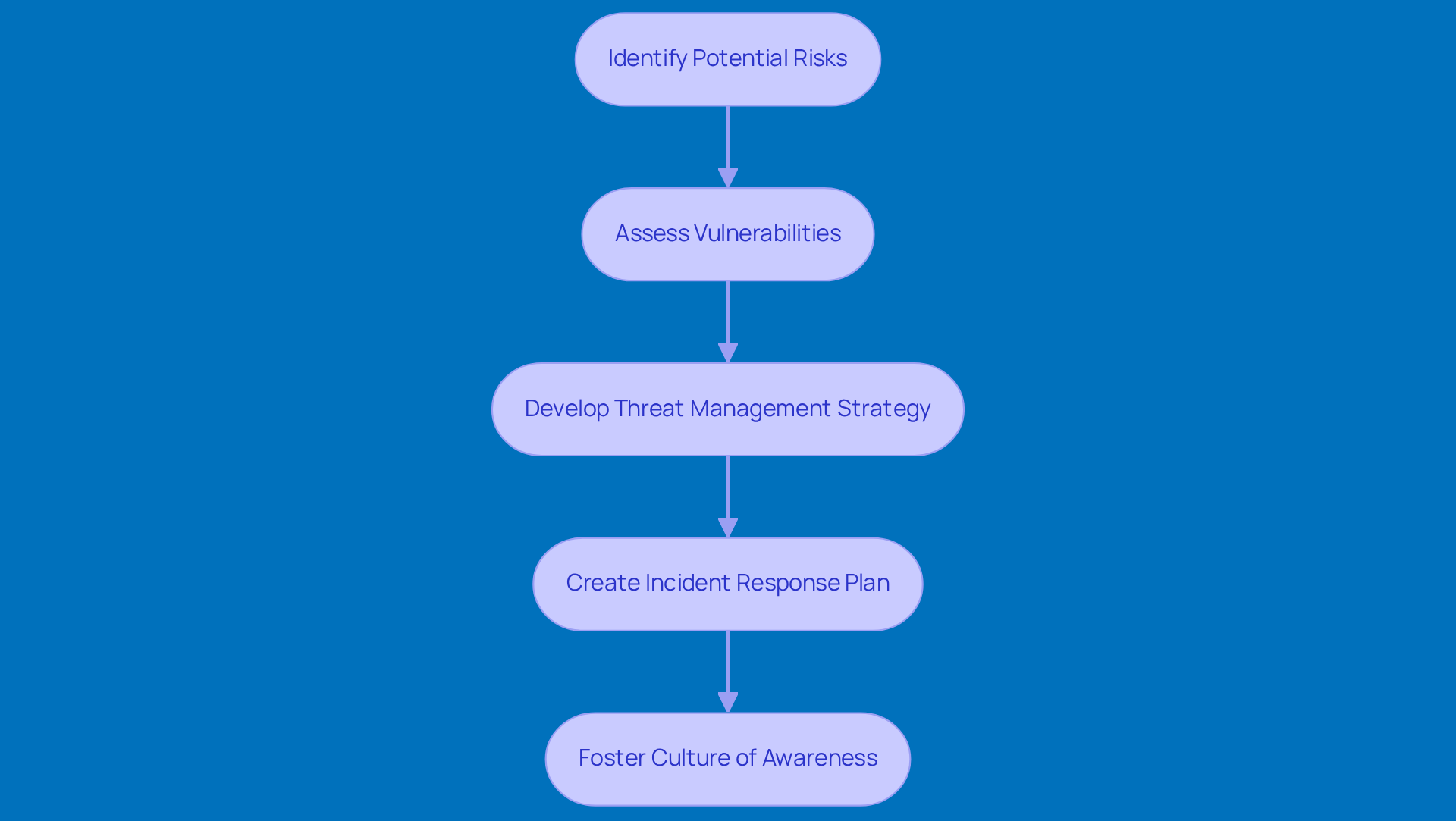

Risk Management: Identifying and Mitigating Potential Threats

Efficient threat management is super important for smaller agencies. It’s all about spotting potential risks to operations and figuring out ways to tackle those challenges. Regularly checking for vulnerabilities is key to understanding financial, operational, and reputational threats. Did you know that 92% of small business owners worry about risks to their operations? Yet, many don’t have enough insurance coverage, which leaves them open to serious dangers. By crafting a solid threat management strategy that includes backup plans, organizations can respond effectively when emergencies hit.

Creating a culture of awareness around uncertainties is crucial. Organizations that focus on threat management can boost their resilience and protect their assets. For example, having a systematic way to identify vulnerabilities helps organizations pinpoint potential weaknesses, laying the groundwork for effective management. Plus, 75% of organizations have an incident response plan, and those that regularly test it save an average of $2.66 million in breach costs! By taking proactive steps and incorporating evaluation strategies, smaller organizations can navigate the complexities of their environments and safeguard their operations against emerging threats.

Legal Review: Navigating Compliance and Liability Risks

Conducting a legal review is super important for small organizations. It’s all about taking a good look at contracts, agreements, and making sure everything’s in line with regulations to spot any potential liabilities. When you bring in legal pros, you’re ensuring that your business practices are on the right side of local, state, and federal laws. This is key to keeping risks at bay!

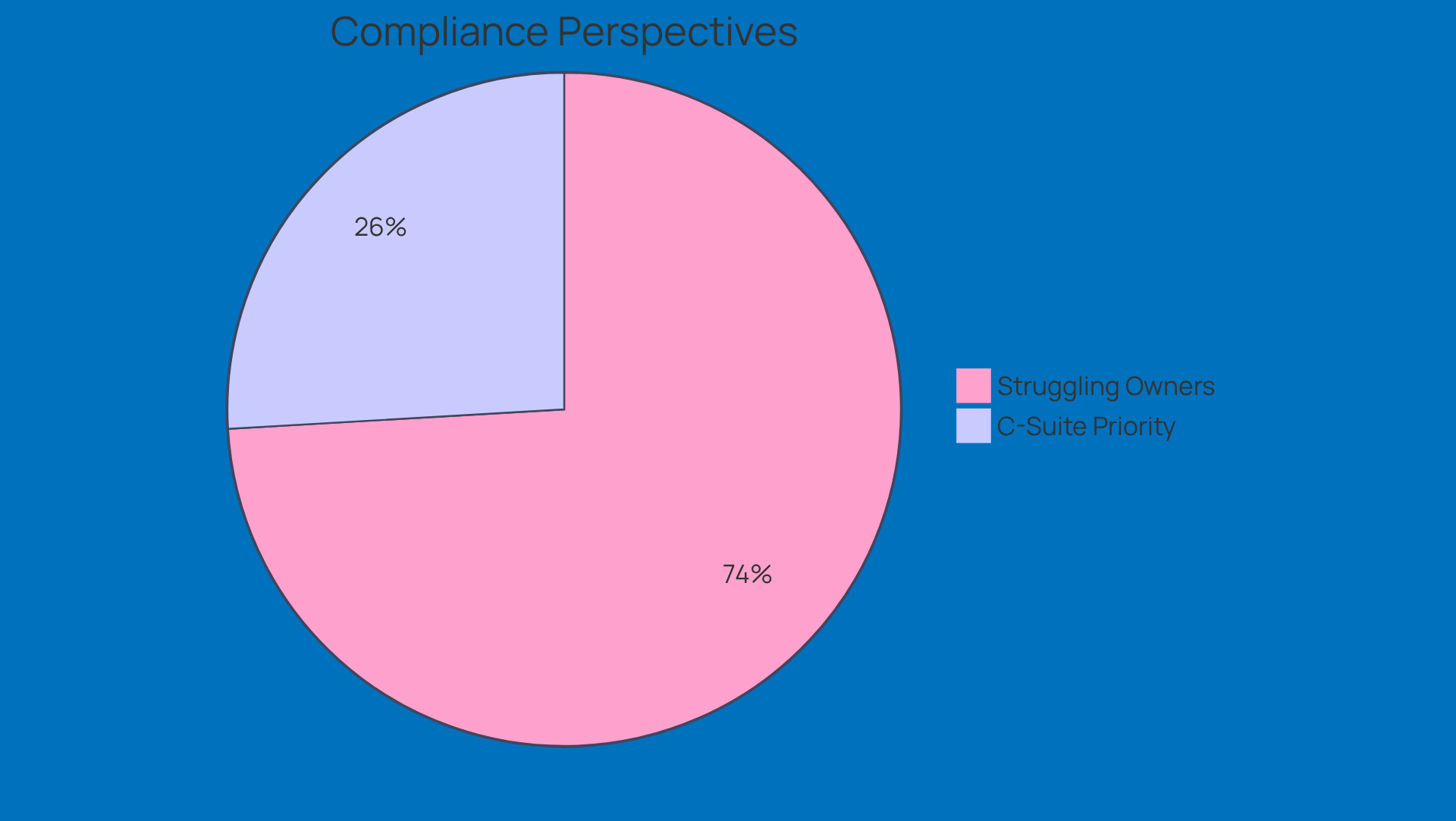

Now, let’s be real - nobody wants to deal with legal conflicts or the financial penalties that can pop up from not following the rules. That’s why being proactive is the way to go! Regular legal audits help keep you in the loop about changing regulations, so you can tweak your practices as needed. Did you know that 60% of business owners say they struggle to keep up with compliance? That really shows how crucial these reviews are.

And it gets even more interesting! About 21% of C-suite executives have pointed out that regulatory compliance is a top strategic priority. This just goes to show that more and more folks are recognizing how vital it is to weave compliance into their organizational strategy. By making legal assessments a priority, small organizations can tackle the tricky world of compliance and liability challenges head-on, paving the way for long-term growth and sustainability. So, why not take that step today?

Customer Concentration Analysis: Assessing Client Dependency Risks

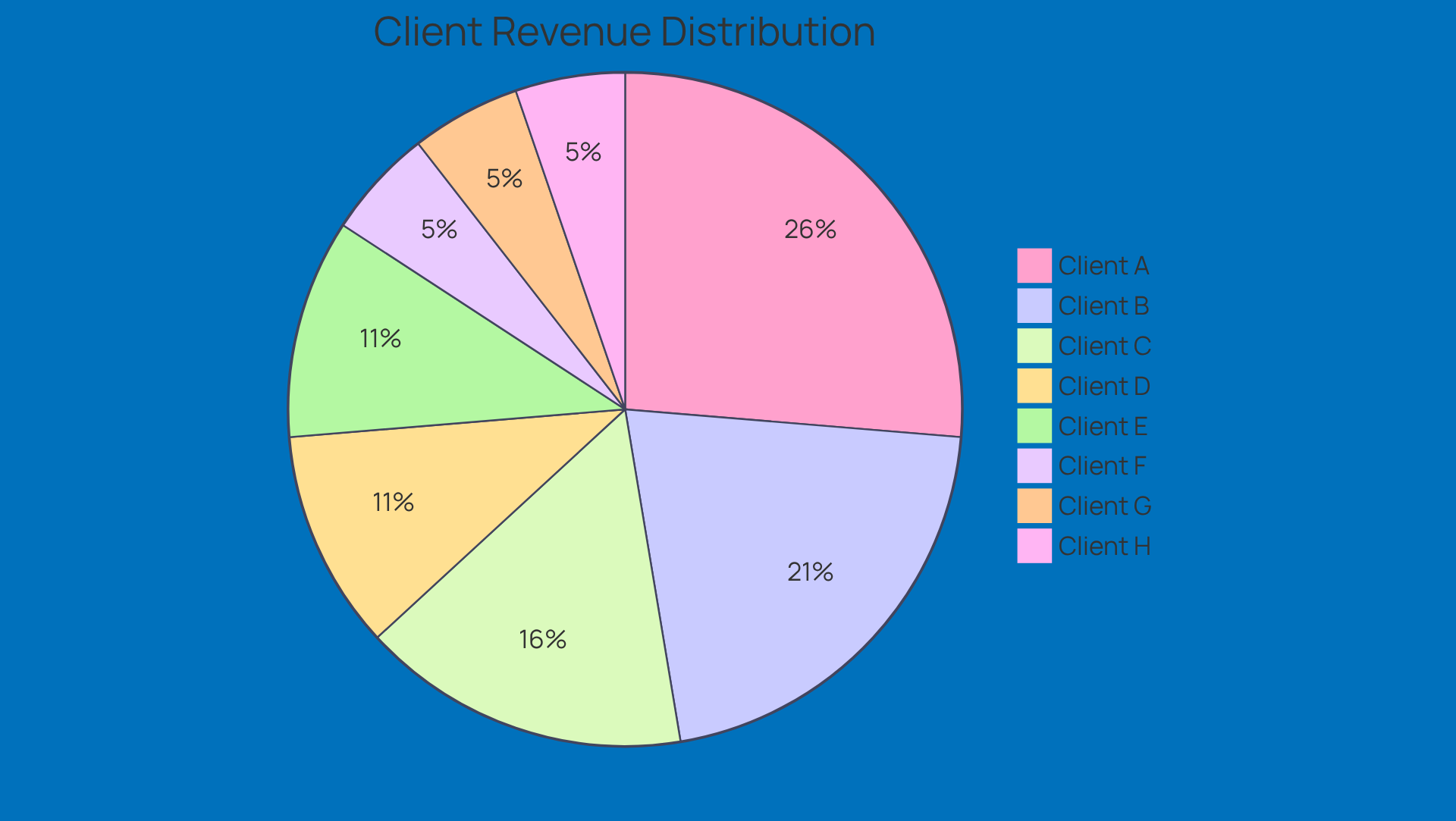

Understanding customer concentration is key to grasping how much an agency relies on just a few clients for its revenue. It’s important for agencies to take a good look at how much income comes from their main clients. After all, if too much of your revenue is tied up in a handful of accounts, it can lead to some serious challenges. Ideally, no single client should make up more than 25% of your total revenue. This helps keep things stable and reduces the risk of revenue swings and operational headaches that can come from losing a major account.

So, how do you tackle this? Diversifying your client base is a smart move. Think about expanding your services or reaching out to new market segments to lessen your reliance on just a few clients. For example, you might consider upselling additional services to your current clients or teaming up with other firms to broaden your client portfolio. By spreading out your revenue sources, you not only boost your financial stability but also open the door to better financing options and more strategic freedom. This way, you’re setting yourself up for sustainable growth in the long run.

Technology Integration: Streamlining Due Diligence Processes

Incorporating technology is super important for boosting due diligence processes in small organizations. By using digital tools like M-Files for document management, compliance software, and data analytics platforms, organizations can really step up their operational efficiency. These technologies take care of routine tasks, which means better data accuracy and real-time compliance monitoring.

For example, advanced document management systems make it easier to organize and find critical documents, while compliance software helps keep everything in line with regulatory requirements without a hitch. Plus, data analytics platforms let organizations pull actionable insights from huge datasets, which is a game-changer for informed decision-making.

Adopting these innovative solutions not only lightens the administrative load tied to due diligence but also frees up organizations to focus on strategic initiatives that drive growth and success. But here’s the catch: it’s crucial for leaders to get involved in this transformation and create a culture that welcomes change.

As Bill Gates points out, automation can actually make inefficiencies worse if it’s applied to flawed operations, so thoughtful implementation is key. And let’s not forget what Jim Swanson says - leadership and culture are at the heart of successful digital transformation, ensuring that technology acts as an enabler rather than a roadblock. So, how are you thinking about incorporating technology in your own organization?

M&A Due Diligence: Evaluating Opportunities for Growth

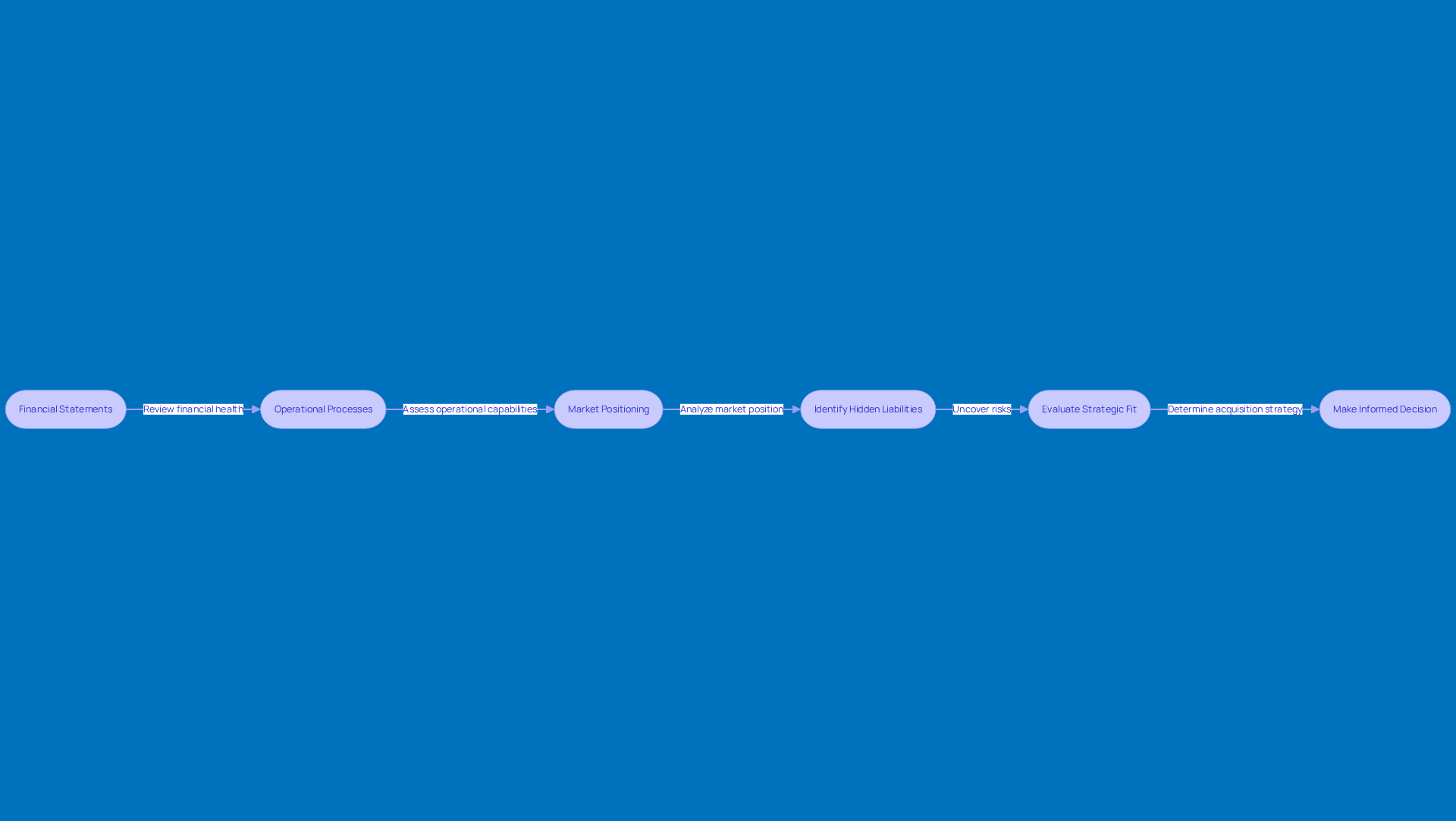

M&A due diligence is super important! It’s all about taking a close look at potential acquisition targets, especially their financial health, operational capabilities, and how well they fit with your strategy. If you’re a smaller firm thinking about a merger or acquisition, doing your homework is key. You want to uncover any hidden liabilities or challenges that might come with the target company.

This process involves:

- Digging into financial statements

- Checking out operational processes

- Understanding market positioning

As Jacob Orosz, President of Morgan & Westfield, puts it, "For an enterprise to sell for what it’s truly worth - or even more - you need to properly prepare." By putting in the effort for thorough evaluations, organizations can make smart decisions that not only reduce risks but also help them grow.

Take a look at some successful rural businesses; they show that when due diligence is done right, it can lead to great mergers that boost operational efficiency and expand market reach. So, if you’re navigating the complexities of M&A, remember that a structured approach to due diligence can really help you seize opportunities for sustainable growth. What’s your experience with due diligence? Let’s chat about it!

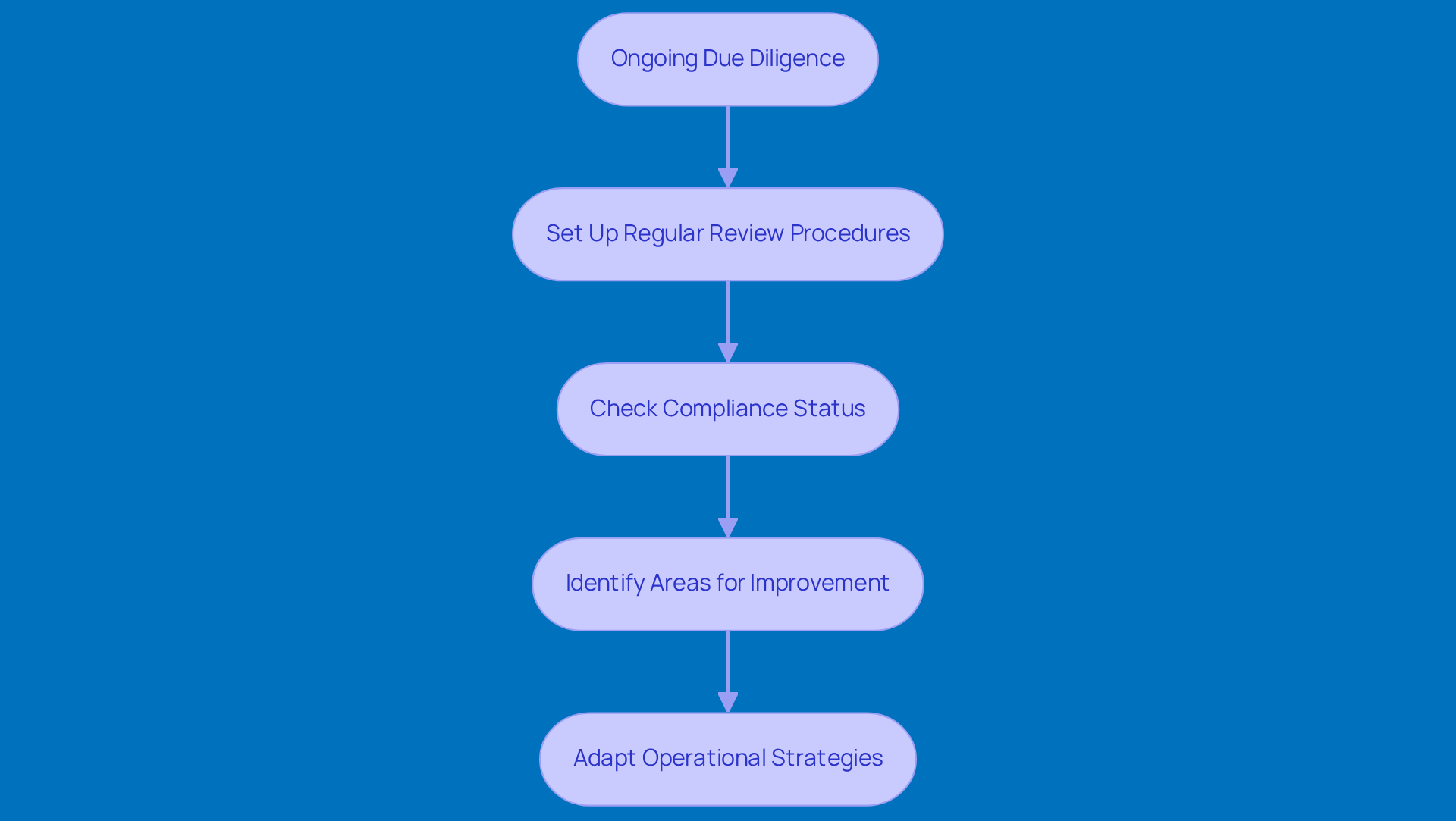

Ongoing Due Diligence: Maintaining Compliance and Competitive Edge

Ongoing due diligence is super important for small organizations. It’s all about keeping an eye on compliance and operational practices so you can adapt to changing regulations and market dynamics. By setting up regular review procedures, organizations can check their compliance status and spot areas that need a little TLC.

This proactive approach doesn’t just keep you on the right side of the law; it also gives your organization a competitive edge. You’ll be able to tweak your operational strategies quickly when needed. Plus, fostering a culture of continuous improvement helps you navigate the twists and turns of the business world with ease.

As Rick Stevenson, a former Manager of Compliance Advisory Services, points out, organizations that make compliance a priority can really boost their operational resilience and market positioning. So, continuous compliance monitoring isn’t just a box to check; it’s a strategic advantage that helps small agencies thrive, even when things get a bit bumpy.

So, how does your organization approach compliance? It might be time to think about how you can enhance your practices and stay ahead of the game!

Conclusion

Steinke and Company really highlights how important comprehensive due diligence services are for small agencies, especially when it comes to tackling the unique challenges they face. By bringing together thorough financial analysis, document management, risk assessment, and ongoing compliance monitoring, these services help agencies boost their operational efficiency and secure long-term sustainability.

Throughout this discussion, we see key points that stress the need for various due diligence practices. Think about:

- Financial analysis to grasp revenue trends

- Document inspection for compliance

- Risk management to spot potential threats

Plus, it’s crucial to align business models with market needs and use technology to streamline processes. Each of these elements plays a part in crafting a solid strategy that positions small agencies for growth and resilience in a competitive landscape.

Ultimately, the insights shared here serve as a friendly nudge for small agency leaders to make due diligence a priority in their operational strategy. By embracing these essential services and fostering a culture of continuous improvement, agencies can not only reduce risks but also grab opportunities for sustainable growth. Adopting these practices strengthens their foundation and sets the stage for a thriving future in an ever-evolving market. So, why not take that step today?

Frequently Asked Questions

What services does Steinke and Company offer for small agencies?

Steinke and Company provides comprehensive business due diligence services, including financial analysis, hazard management, compliance assessments, and proactive tax planning.

Why is effective due diligence important for rural enterprises?

Effective due diligence is crucial for rural enterprises as it helps reduce risks, enhances decision-making, and promotes long-term success in a constantly changing market.

How often does Steinke and Company meet with clients for tax planning?

Steinke and Company meets with clients 1-3 times a year to review tax returns and identify missed opportunities.

What is the significance of financial analysis for small organizations?

Financial analysis is important for small organizations as it helps them understand revenue streams and profit margins, enabling informed decisions about budgeting, investments, and strategic planning.

What key metrics should small organizations focus on during financial analysis?

Organizations should focus on metrics such as gross profit margin, operating cash flow, and revenue growth rate to assess their financial health.

How does document inspection benefit small organizations?

Document inspection helps small organizations manage their business documents effectively, ensuring compliance, reducing risks associated with audits or disputes, and maintaining operational efficiency.

What challenges do organizations face with document management?

Many organizations struggle with accessing documents, which can slow down work processes, and using outdated digital tools can hinder efficiency and innovation.

What are some best practices for document management?

Best practices include using modern document management solutions, understanding compliance regulations like the Gramm-Leach-Bliley Act (GLBA) Safeguards Rule, and implementing data security measures such as encryption and multi-factor authentication.

How can effective document management impact client relations?

Effective document management can enhance data access, which may help organizations attract new clients and build trust with existing customers.