Introduction

Navigating the world of tax regulations can feel like a maze for small business owners, right? It’s a complex landscape that can really impact your financial health. But here’s the good news: the right consultancy tax strategies can help you not only stay compliant but also optimize your cash flow and minimize those pesky tax liabilities.

With tax laws constantly changing and the unique challenges that rural enterprises face, how can small business leaders like you adapt your financial strategies to thrive in 2025? In this article, we’re diving into ten essential tax strategies that empower you to take control of your financial future while keeping those tax compliance risks at bay. Let’s get started!

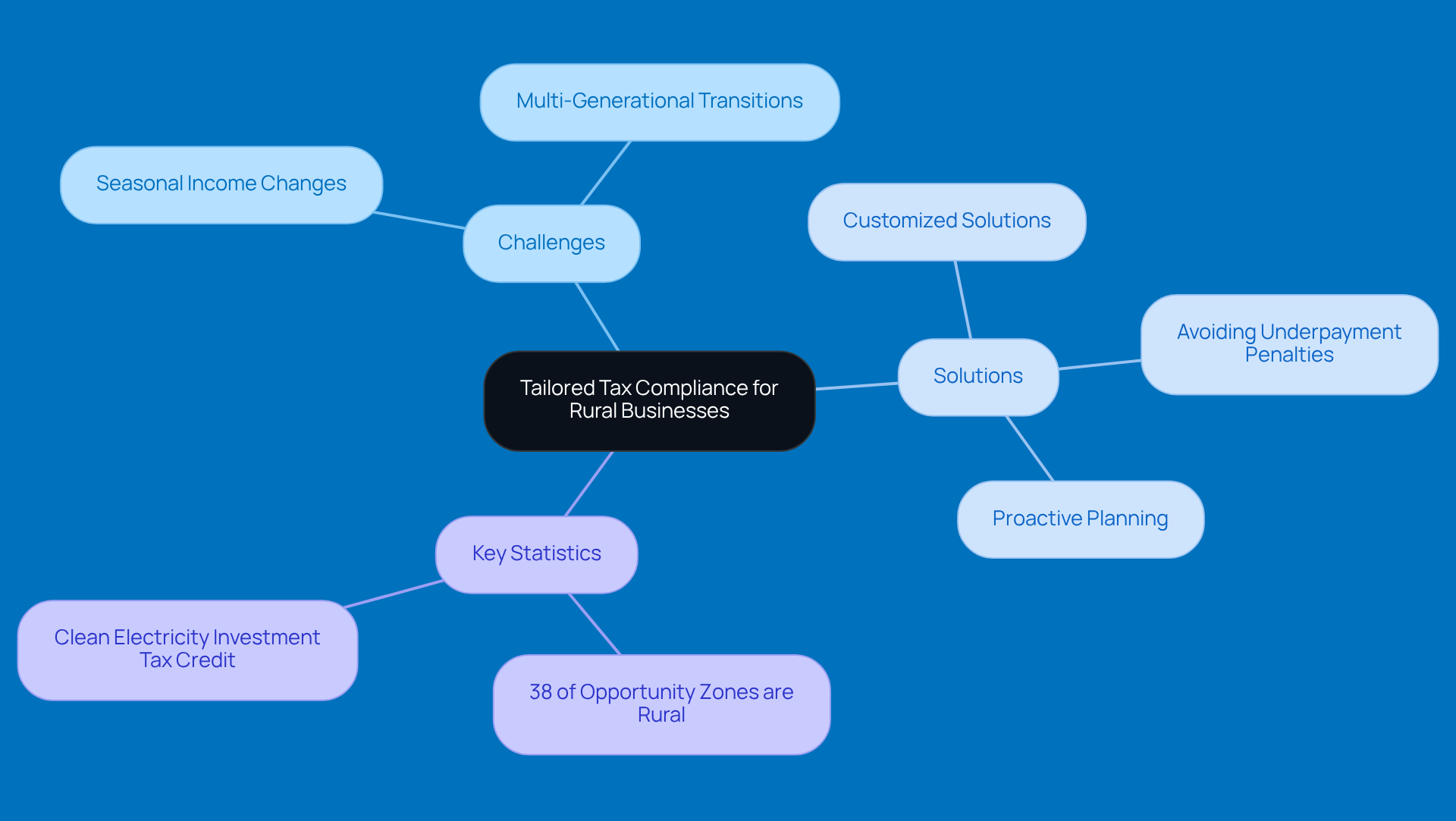

Steinke and Company: Tailored Tax Compliance for Rural Businesses

Steinke and Company really shines when it comes to tax compliance services tailored for small and micro enterprises in rural America. They get it - these businesses face unique challenges, like seasonal income changes and multi-generational transitions. That’s why they offer customized solutions that not only ensure compliance but also help reduce tax obligations.

One of the key things they do is help clients steer clear of underpayment penalties, which can hit hard on financial health. By keeping clients informed about IRS guidelines for estimated tax payments and safe harbor provisions, they empower small business owners to dodge those costly penalties. It’s all about merging local know-how with national strategies, making Steinke and Company a vital partner for rural entrepreneurs dealing with the tricky world of tax regulations.

With effective tax compliance strategies, including proactive planning to meet estimated tax obligations, they really boost the profitability of rural enterprises. And here’s something to think about:

- 38% of all current Opportunity Zones are entirely rural, which makes these tailored solutions even more crucial.

- The Clean Electricity Investment Tax Credit is a game-changer for supporting local economies.

Steinke and Company is committed to providing clarity and stability in the tax code, helping rural small enterprises not just survive but thrive.

Proactive Tax Planning: Strategies to Optimize Cash Flow

Proactive tax planning is all about anticipating those tax bills and making smart choices to keep your cash flow healthy. If you own a small business, think about speeding up your expenses and holding off on income when you can, especially as the fiscal year wraps up. This little trick can help lower your taxable income and boost your cash flow. Plus, don’t forget about those tax credits and deductions - they can really help stabilize your finances.

Regular chats with tax pros, like the folks at Steinke and Company, can ensure you’re not missing out on any great consultancy tax opportunities. And let’s not overlook the importance of understanding cash, accrual, and hybrid accounting methods. Each one has its perks that can really shape how you manage your finances and your consultancy tax strategy. So, it’s super important for entrepreneurs to pick the right method that fits their unique needs. What’s your experience with tax planning? Any tips you’d like to share?

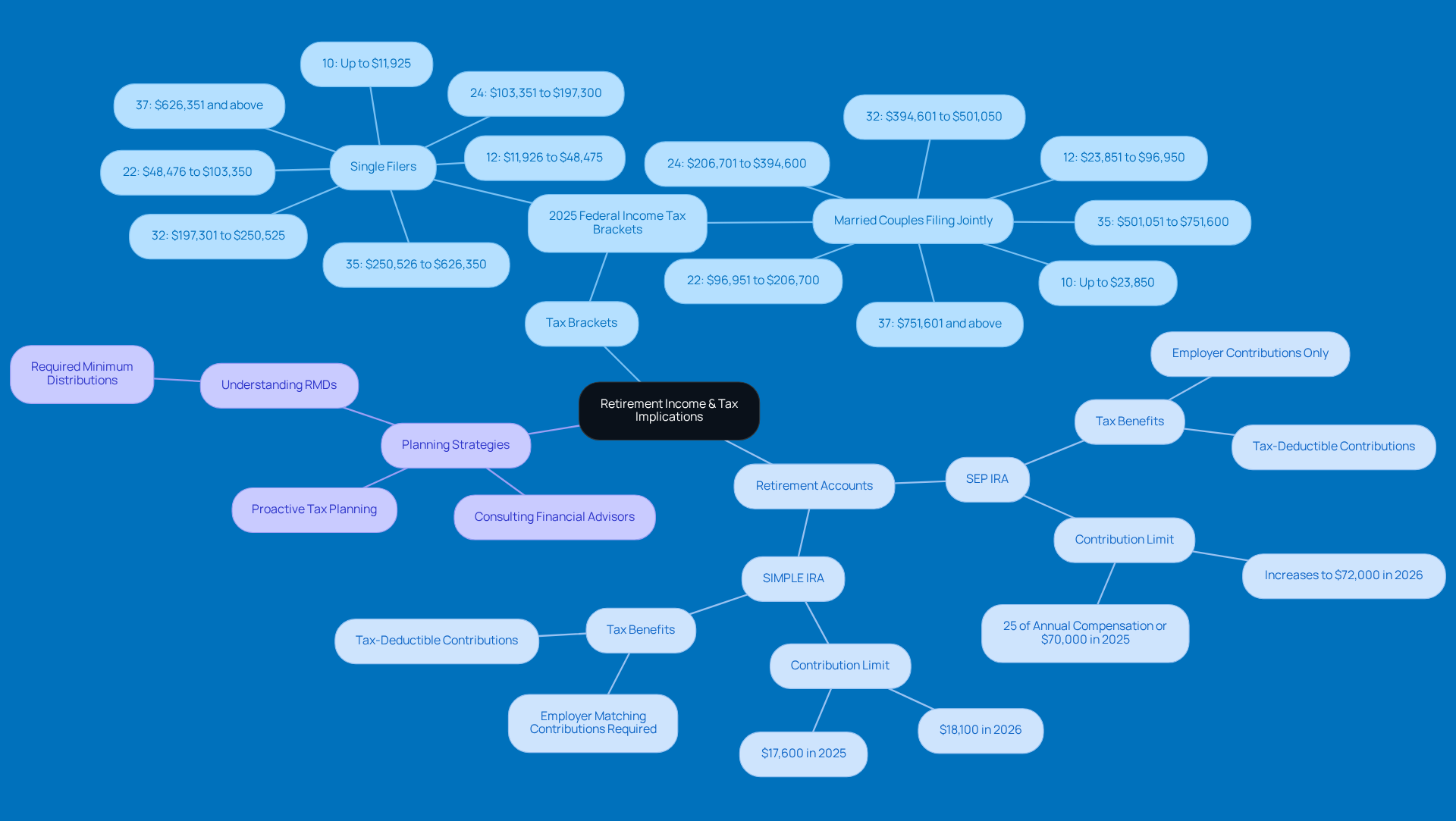

Understanding Retirement Income: Tax Implications for Small Business Owners

Hey there, small business owners! Let’s chat about something super important: the consultancy tax implications related to your retirement income. It’s a big deal because it can really affect your overall consultancy tax obligations. You see, when you take money out of retirement accounts like IRAs and 401(k)s, it’s usually taxed as ordinary income. If you’re not careful, that could bump you into a higher tax bracket. Just a heads up, in 2025, the federal income tax brackets related to consultancy tax are changing, which means you might owe more on those distributions. So, planning ahead on when to take those distributions can really help lighten your consultancy tax load, especially with the IRS shaking things up regarding Required Minimum Distributions (RMDs) and tax responsibilities for retirees.

Now, let’s explore some options that could be game-changers for you, like SEP IRAs and SIMPLE IRAs. These aren’t just about saving for retirement; they can also offer some pretty sweet consultancy tax benefits for rural entrepreneurs. For example, with a SEP IRA, you can contribute up to 25% of your annual compensation or a whopping $70,000 in 2025, and that limit goes up to $72,000 in 2026. That kind of flexibility is fantastic for small business owners looking to boost their retirement savings while minimizing their consultancy tax.

Financial planners can’t stress enough how crucial it is to understand the implications of consultancy tax distributions. One expert put it perfectly: "Most older adults can't afford to wait until 72 to take RMDs, let alone until age 75." This really highlights the need for some smart planning around your retirement income and consultancy tax. By taking advantage of the consultancy tax benefits associated with these retirement accounts, you can not only improve your financial stability but also set yourself up for a more comfortable retirement. So, what are you waiting for? Let’s get planning!

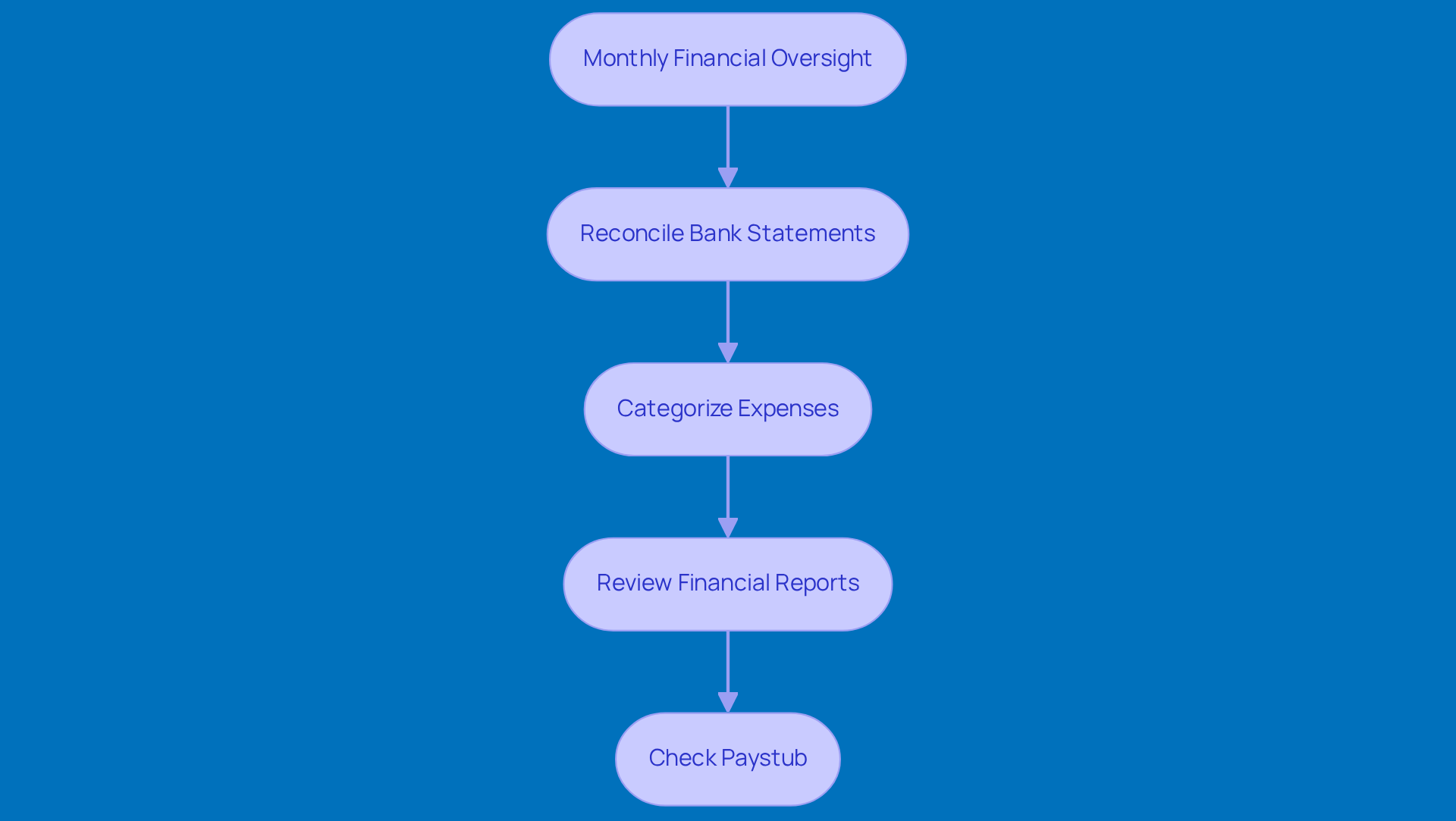

Monthly Financial Oversight: Keeping Your Books Clean and Current

Keeping your monetary records clean and up-to-date is super important for small business owners. It helps you stick to tax laws and make smart decisions. Think about it: regular monthly check-ins mean reconciling bank statements, categorizing expenses, and reviewing those detailed financial reports. This proactive approach not only helps you catch discrepancies early but also gives you a clear view of your business's financial health.

Now, understanding your paystub is a big part of this process. It ensures you're getting paid correctly and that the right amount is set aside for taxes. By regularly checking your paystub, you can avoid surprises come tax time and get a better grip on where your money is going.

Using accounting software can really make this whole process smoother. It allows you to track income and expenses accurately while boosting your operational efficiency. For those rural entrepreneurs out there, effective bookkeeping means:

- Setting a regular schedule for reviews

- Clearly categorizing expenses

- Using tech to automate routine tasks

According to a case study titled 'Ensures Compliance With Tax Laws,' keeping precise financial records is key to ensuring that consultancy tax and all other taxes owed are accounted for. This way, you minimize the risk of penalties or audits. Plus, small business owners should consider using accounting software like QuickBooks or Xero. These tools are designed for efficient financial management and can really enhance the professional tax prep services offered by Steinke and Company.

These strategies related to consultancy tax not only help you stay compliant but also empower you to make informed decisions that drive growth and sustainability. So, why not take a moment to reflect on your own bookkeeping practices? Are there areas where you could streamline or improve?

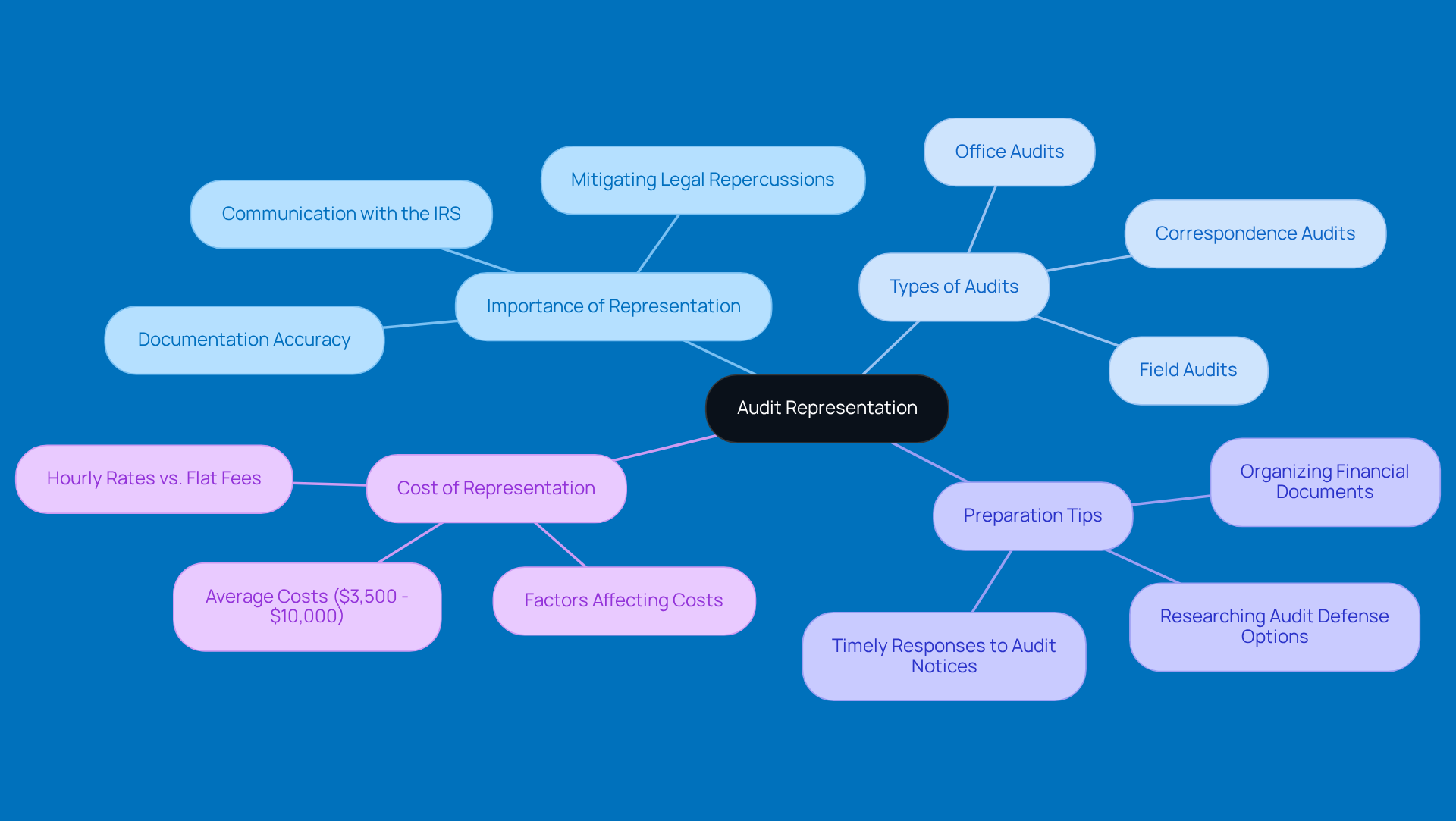

Audit Representation: Essential Support During Tax Audits

When it comes to a tax audit, having professional representation is a must for small business owners. Hiring a qualified expert in consultancy tax, like the folks at Steinke and Company, can really make a difference. They can communicate with the IRS on your behalf, which is super important for navigating the often tricky audit process. You want to make sure all your documentation - like W-2 forms, 1099s, and those pesky expense receipts - gets submitted accurately, and they can help address any discrepancies that pop up.

To avoid potential headaches, it’s wise for entrepreneurs to keep their records organized and prepare for audits ahead of time. This not only makes the audit process smoother but also boosts your chances of a favorable outcome. Did you know that the IRS says the overall risk of being audited is about 0.5%? That really highlights why having a knowledgeable representative is so crucial. As IRS Commissioner Danny Werfel put it, 'Choosing the right IRS tax representative is crucial when facing an audit.'

Understanding the different types of audits - like correspondence, office, and field audits - can also help you get ready for what’s ahead. Now, the cost for tax audit representation can range from $3,500 to $10,000, but investing in consultancy tax expert help, like what Steinke and Company offers, can significantly ease the stress and potential financial fallout of an audit.

Business Coaching: Bridging Financial Data and Growth Strategy

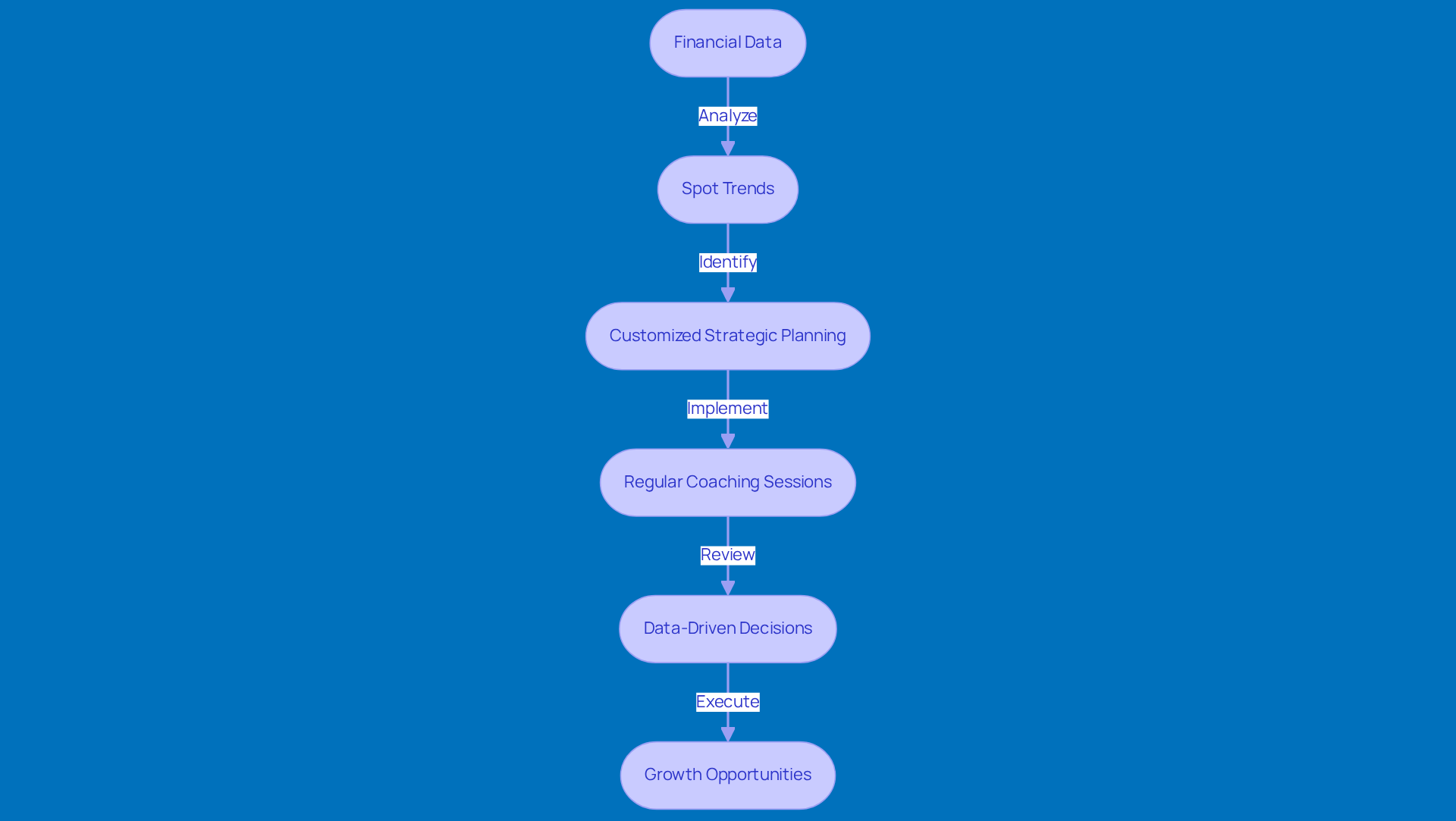

If you're a small business owner, you know how important it is to connect economic data with your growth strategies. At Steinke and Company, our expert coaches are here to help you make sense of those fiscal reports, spot trends, and make data-driven decisions that really align with your long-term goals.

We believe in the power of customized strategic planning meetings. By incorporating these into our coaching, you can tap into economic insights that boost your operational efficiency and foster sustainable growth. Plus, regular coaching sessions not only keep you accountable but also help you put those strategies into action, ensuring that you're consistently using financial data to guide your decisions.

This organized approach makes it easier for you to tackle challenges and seize opportunities for growth, all while keeping your finances crystal clear. So, are you ready to take your business to the next level? Let's chat!

Navigating Underpayment Penalties: Avoiding IRS Fees

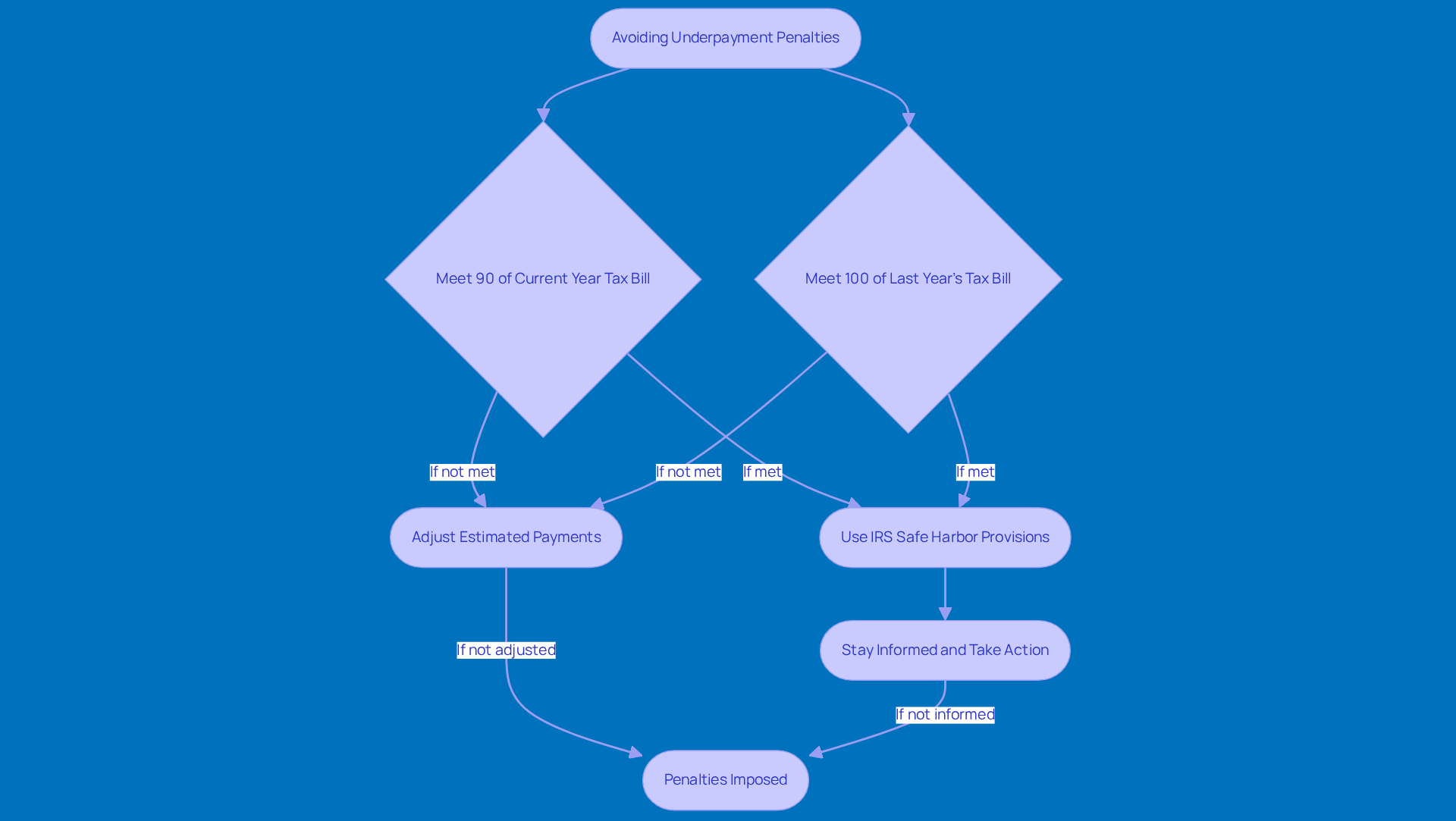

Underpayment penalties can really put a strain on small business owners who miss their estimated tax payments. To steer clear of these penalties, it’s super important to make sure your payments hit at least 90% of this year’s tax bill or 100% of last year’s. And hey, using IRS safe harbor provisions can give you a bit of breathing room, letting you avoid those pesky penalties if you meet these benchmarks.

Tax pros often say that keeping an eye on your income projections and adjusting your estimated payments is key to dodging underpayment penalties. Have you ever thought about how many small businesses overlook these provisions? It’s a real shame because it can lead to some hefty penalties. By staying informed and taking action, small business leaders can navigate the tricky waters of tax compliance and keep their finances in check.

Flexible Payment Options: Easing Tax Season Burdens

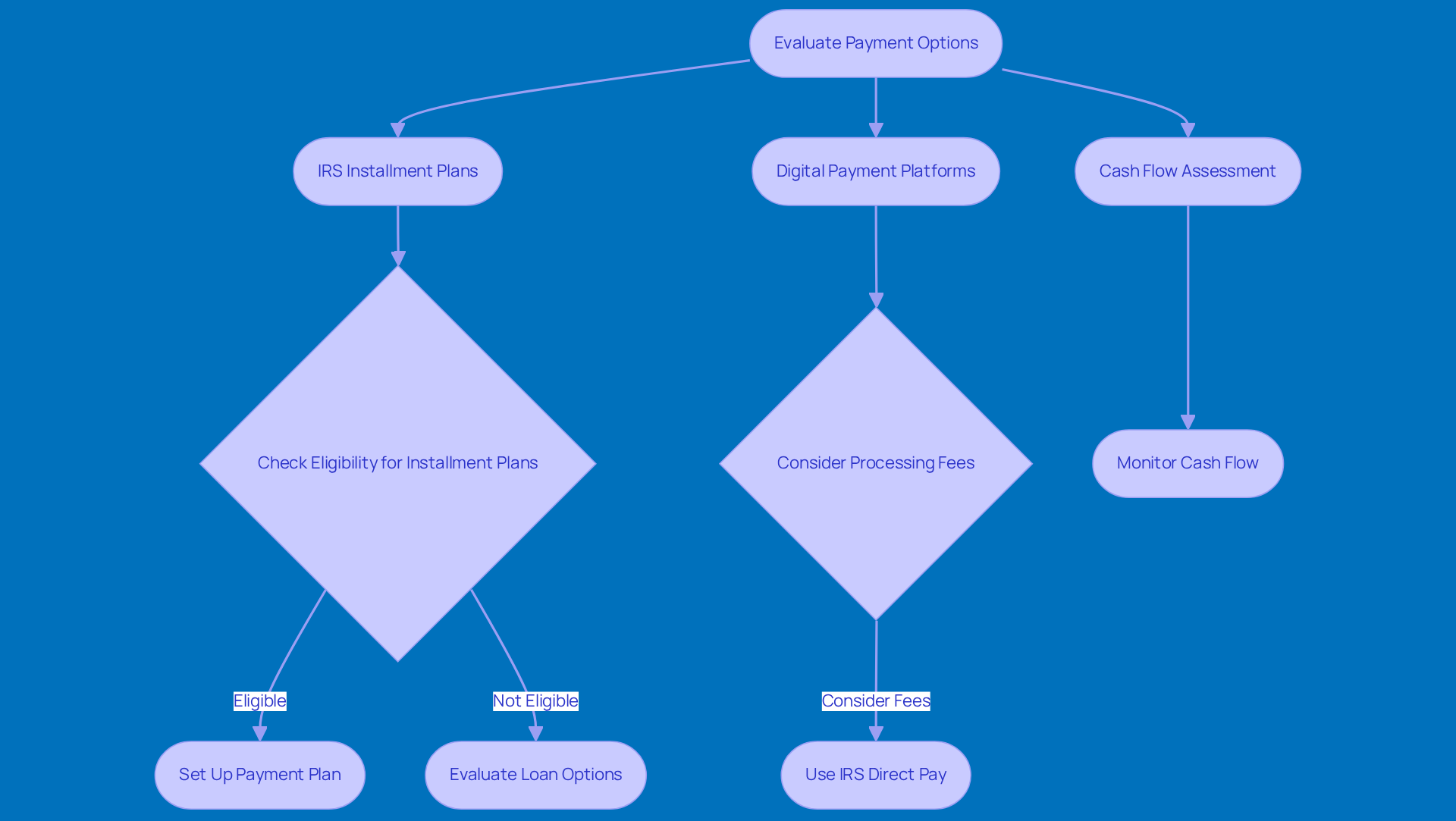

Flexible payment options can really alleviate the stress of consultancy tax season for small business owners. Steinke and Company points out that the IRS offers a variety of methods for tax payments, like online payment agreements and installment plans. These can be a lifesaver for those dealing with cash flow issues. Financial advisors often recommend setting up an IRS installment plan to handle tax obligations more smoothly. This way, businesses can pay off their tax debts gradually without racking up hefty penalties. For instance, small businesses that owe less than $50,000 can qualify for long-term payment plans, spreading payments over six years. Just keep in mind that to be eligible for certain payment plans, taxpayers need to be up to date on all tax returns for the past five years, which can be a big deal for many small business owners.

Plus, using digital payment platforms can really simplify the payment process, making it easier to keep track of finances. But, a word of caution: entrepreneurs should watch out for potential processing fees that come with credit card transactions. With options like IRS Direct Pay, business owners can pay directly from their bank accounts, ensuring timely payments while dodging those extra fees. By taking a good look at their cash flow and considering these flexible payment options, small business leaders can tackle their tax responsibilities more effectively, ultimately lightening their overall tax burden. As financial experts say, 'Paying as much of the balance as possible when submitting a return can save on interest and penalties, making it a smart strategy for managing tax obligations.'

And don’t forget about the IRS's new Simple Payment Plans rolling out in 2025! These plans offer easier and more accessible options, with over 90% of individual taxpayers with tax debt qualifying. Taxpayers can apply for a payment plan online, by phone, or by mail, giving them convenient ways to manage their tax payments. So, why not take a moment to explore these options? It could make a world of difference!

Personalized Tax Advice: Tailoring Strategies to Unique Challenges

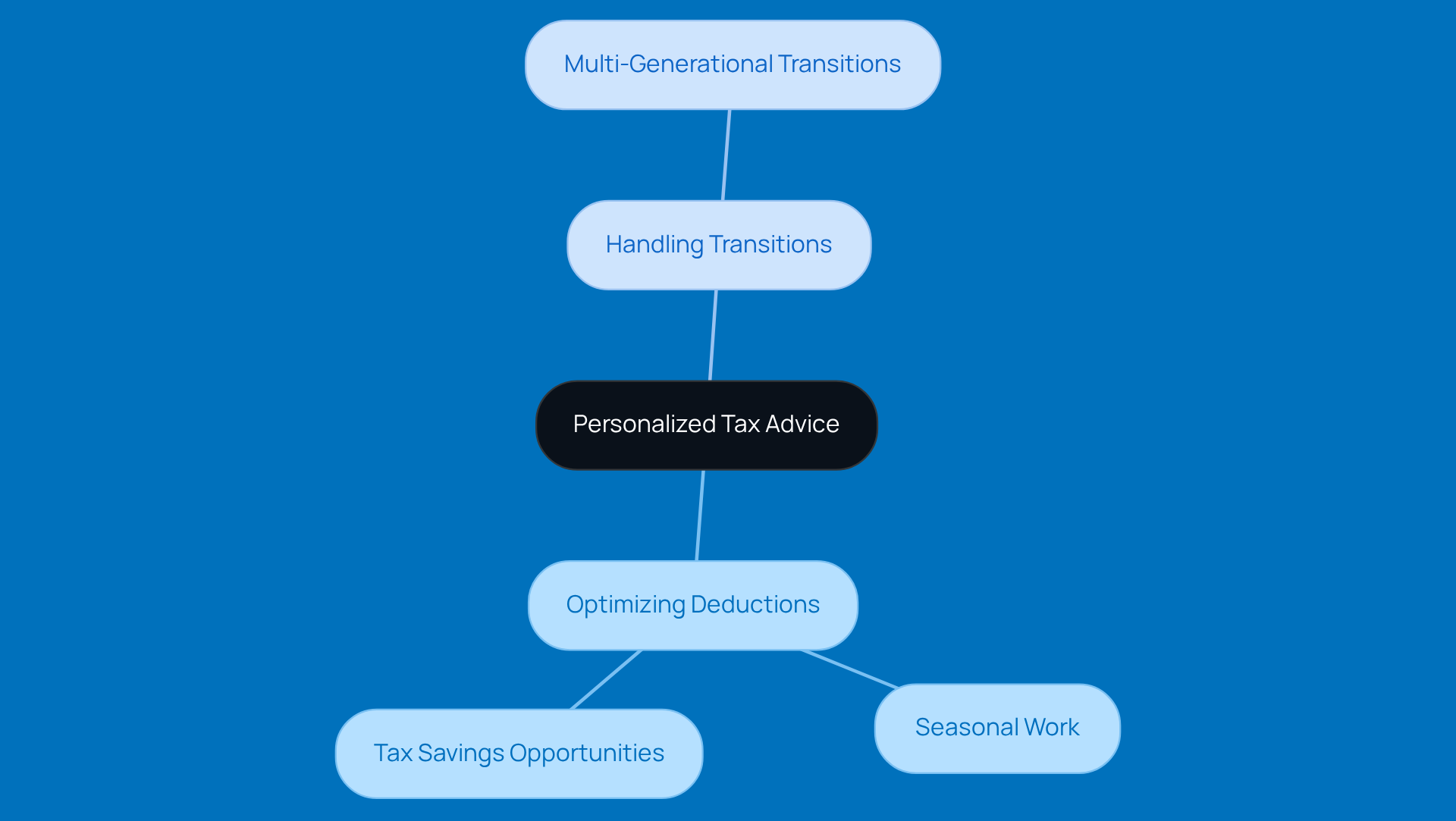

Customized consultancy tax guidance is crucial for small business owners who want to effectively tackle their unique challenges. Every company has its own financial quirks, so a one-size-fits-all approach just doesn’t cut it. Teaming up with a consultancy tax expert who understands the specific needs of rural businesses can lead to personalized strategies that not only help lower tax bills but also boost compliance.

For example, these tailored strategies might focus on:

- Optimizing deductions for seasonal work

- Handling multi-generational transitions, which are pretty common in rural areas

Regular chats with tax pros keep entrepreneurs in the loop about changing tax laws and help spot savings opportunities. This proactive approach is key because it allows for adjustments in strategies based on real-time legislative changes, making sure rural businesses stay compliant and financially sound.

So, how often do you check in with your tax expert? Keeping that line of communication open can really make a difference!

Staying Updated: Essential Tax Changes for Small Business Owners

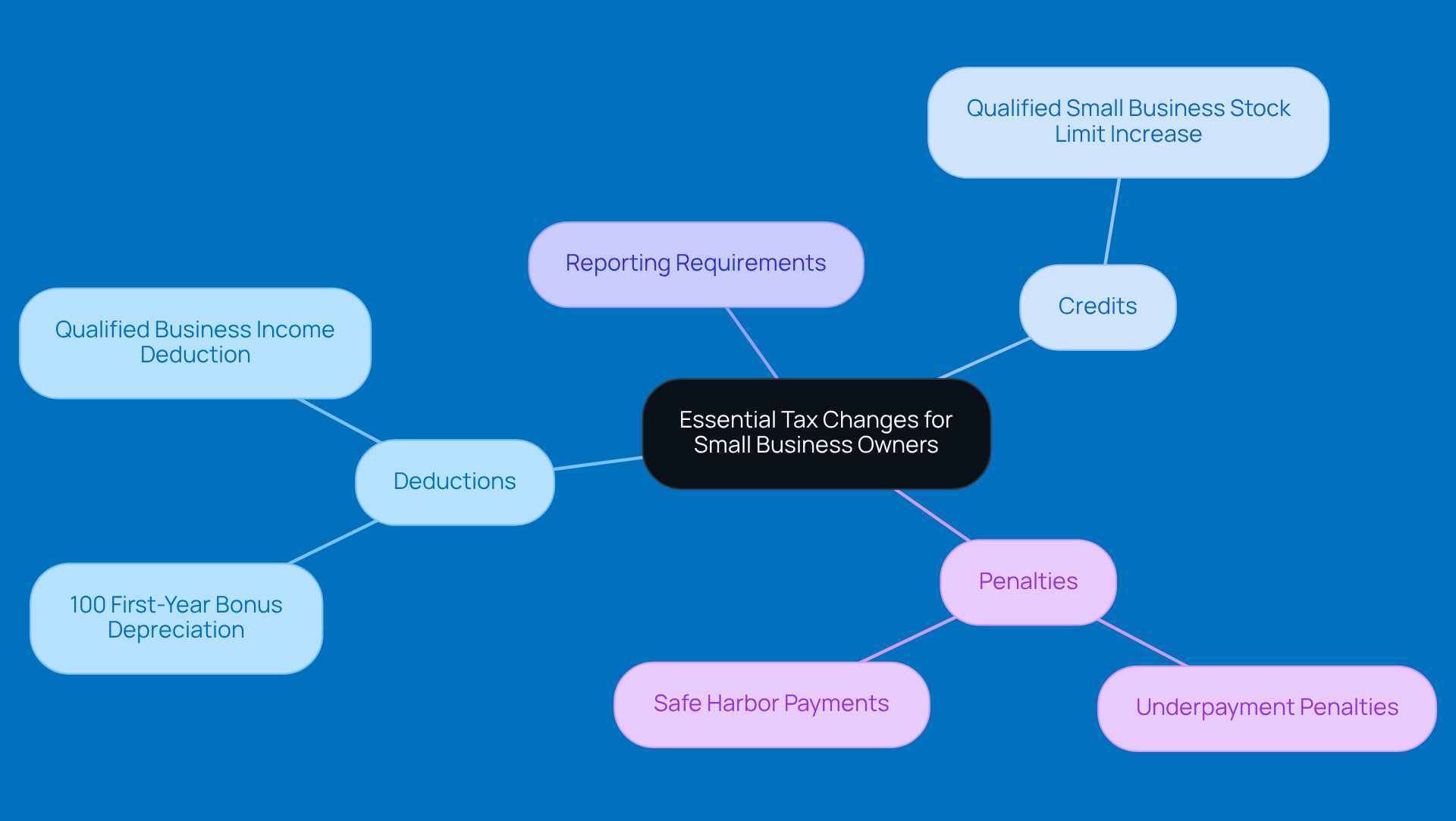

Hey there, small business leaders! Staying on top of tax changes is super important if you want to keep everything running smoothly and maybe even improve your tax strategies. The tax landscape for 2025 has some big shifts, like changes to deductions, credits, and reporting requirements. For example, the One Big Beautiful Bill Act (OBBBA) has made 100% first-year bonus depreciation permanent for qualifying property. This is a great nudge for investing in new assets!

And there’s more good news: the Qualified Business Income (QBI) deduction has been extended. This means qualifying entrepreneurs can deduct up to 20% of their qualified earnings indefinitely, plus the income phase-in limits have been raised. That’s a win for many!

But wait, there’s even more! The limit on gain exclusions for Qualified Small Business Stock (QSBS) has jumped from $10 million to $15 million. This change offers even more incentives for small venture investments. Plus, the permanent Excess Loss Limitation is set at $313,000 for single filers and $626,000 for joint filers in 2025. It’s definitely something entrepreneurs should keep in mind when planning their taxes.

Now, let’s talk about something that can sneak up on you: underpayment penalties from the IRS. These can hit if you don’t pay enough of your tax liability through withholding or estimated payments during the year. To dodge these penalties, it’s crucial to understand safe harbor payments. These can protect you from underpayment penalties if you prepay a minimum amount of your tax obligation. And don’t forget about the de minimis exception! It can save you from penalties if your total tax liability minus withholdings and credits is less than $1,000.

Keeping an eye on IRS updates and engaging in consultancy tax discussions with experts can really help you navigate these changes. Experts agree that being proactive is key to adapting to the fast-paced world of tax laws. Staying informed not only helps you comply but can also improve your financial planning, possibly leading to lower tax bills. So, why not engage with knowledgeable tax advisors? They can offer personalized insights into how these changes might affect your specific business situation, helping you take full advantage of new deductions and credits.

Conclusion

Navigating the complexities of tax obligations can feel like a maze for small business owners, right? Especially with all the unique challenges that pop up along the way. This article really drives home the need for tailored tax strategies - because let’s face it, a one-size-fits-all approach just doesn’t cut it. By teaming up with specialized consultancy services like Steinke and Company, rural entrepreneurs can tackle their tax compliance head-on, optimize cash flow, and boost their financial stability.

So, what are some key strategies to keep in mind? Well, proactive tax planning is a biggie. Understanding the tax implications of retirement income, keeping those financial records in tip-top shape, and being ready for potential audits are all crucial. Plus, staying in the loop about tax changes and using flexible payment options can really lighten the load during tax season. Each of these elements is vital for small business owners - not just to comply with tax regulations, but to seize opportunities that can help minimize their tax liabilities.

As tax laws keep evolving, it’s super important for small business owners to connect with savvy tax advisors who can offer personalized insights and strategies. Embracing these consultancy tax strategies isn’t just about dodging penalties; it’s about empowering your business to thrive in a competitive landscape. Taking proactive steps today can pave the way for a more secure financial future. So, why not take a moment to reflect on your current practices and explore tailored solutions that fit your unique needs? You’ve got this!

Frequently Asked Questions

What services does Steinke and Company provide for rural businesses?

Steinke and Company offers tailored tax compliance services specifically designed for small and micro enterprises in rural America, addressing unique challenges such as seasonal income changes and multi-generational transitions.

How does Steinke and Company help clients avoid tax penalties?

They help clients avoid underpayment penalties by keeping them informed about IRS guidelines for estimated tax payments and safe harbor provisions, empowering small business owners to manage their tax obligations effectively.

What is the significance of Opportunity Zones for rural businesses?

Approximately 38% of all current Opportunity Zones are entirely rural, making tailored tax solutions from Steinke and Company crucial for businesses in these areas.

What proactive tax planning strategies can small business owners use?

Small business owners can optimize cash flow by speeding up expenses and delaying income, especially at the end of the fiscal year. They should also take advantage of available tax credits and deductions.

Why is it important for small business owners to consult with tax professionals?

Regular consultations with tax professionals, like those at Steinke and Company, ensure that business owners do not miss out on beneficial tax opportunities and can make informed decisions regarding their tax strategies.

What are the tax implications of retirement income for small business owners?

Withdrawals from retirement accounts like IRAs and 401(k)s are typically taxed as ordinary income, which can push individuals into a higher tax bracket. Planning when to take distributions is essential to manage tax obligations.

What retirement account options can benefit rural entrepreneurs?

Options like SEP IRAs and SIMPLE IRAs provide not only a means to save for retirement but also offer significant tax benefits, allowing contributions of up to 25% of annual compensation or specific dollar limits.

What changes to federal income tax brackets should small business owners be aware of?

In 2025, federal income tax brackets will change, potentially increasing tax obligations on distributions from retirement accounts, making it important for business owners to plan their withdrawals carefully.