Introduction

Creating a solid family tax plan isn’t just another item on your to-do list; it’s a smart move that can bring some serious financial perks and help your wealth flow smoothly from one generation to the next. Think about it: families have a unique chance to really fine-tune their tax situations by getting to know the ins and outs of tax laws, making the most of credits and deductions, and planning ahead. But with tax regulations getting more complicated and changes looming, how can families make sure they’re making the best choices to protect their financial future?

Let’s dive into this together!

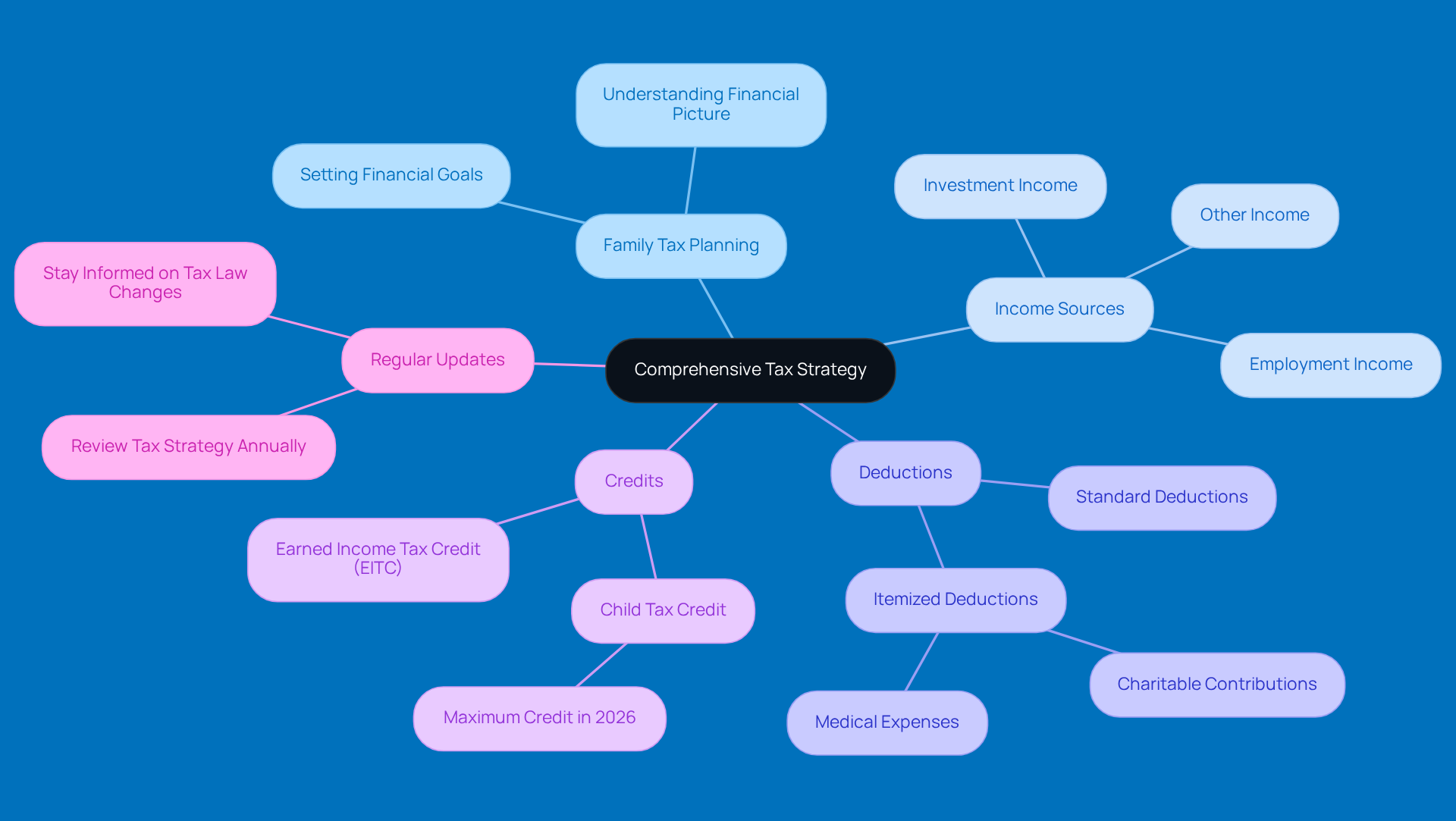

Establish a Comprehensive Tax Strategy

Crafting a solid tax strategy requires family tax planning, which means taking a good look at your household's financial picture, understanding current tax laws, and setting clear financial goals. Start by jotting down all your income sources, potential deductions, and any credits you might qualify for. For example, did you know that in 2026, the annual gift tax exclusion will be $19,000 per recipient? That’s a handy tool for transferring wealth!

It’s super important to revisit and tweak your strategy regularly, especially with tax laws changing, like the reduction of itemized deductions for high-income earners kicking in this year. This proactive approach not only ensures compliance but also improves your family tax planning, helping your loved ones make the most of available benefits.

Think about households that have leveraged the increased GST exemption to enhance their estate management. They’re ensuring a smoother wealth transfer across generations. So, how about you? Have you thought about how these strategies could work for you?

Understand Succession Planning Tax Implications

Succession planning is super important for families looking to implement family tax planning while passing on their assets or business interests to the next generation without getting hit hard by taxes. As families go through this process, they really need to think about family tax planning, including:

- estate taxes

- gift taxes

- income tax implications that could take a big bite out of their wealth.

For example, did you know that the federal lifetime estate and gift tax exemption is set at $15 million for individuals and $30 million for married couples? This means families can use gifting strategies to help lower their taxable estate.

Tax advisors often emphasize the need for proactive planning. They recommend that families take an integrated approach to wealth management through family tax planning instead of waiting until issues arise. This way, families can see their estate plans as living, breathing systems that can adapt to changing laws and personal situations. Plus, using trusts can be a smart way to manage tax liabilities. Certain trusts can give you flexibility in choosing beneficiaries while also protecting your wealth.

As we get closer to 2026, it’s going to be crucial for families to understand the implications of estate duties and the usual gift duty rates. This knowledge will help them protect their legacies and ensure a smooth transition of their businesses. So, what steps are you considering to secure your family's future?

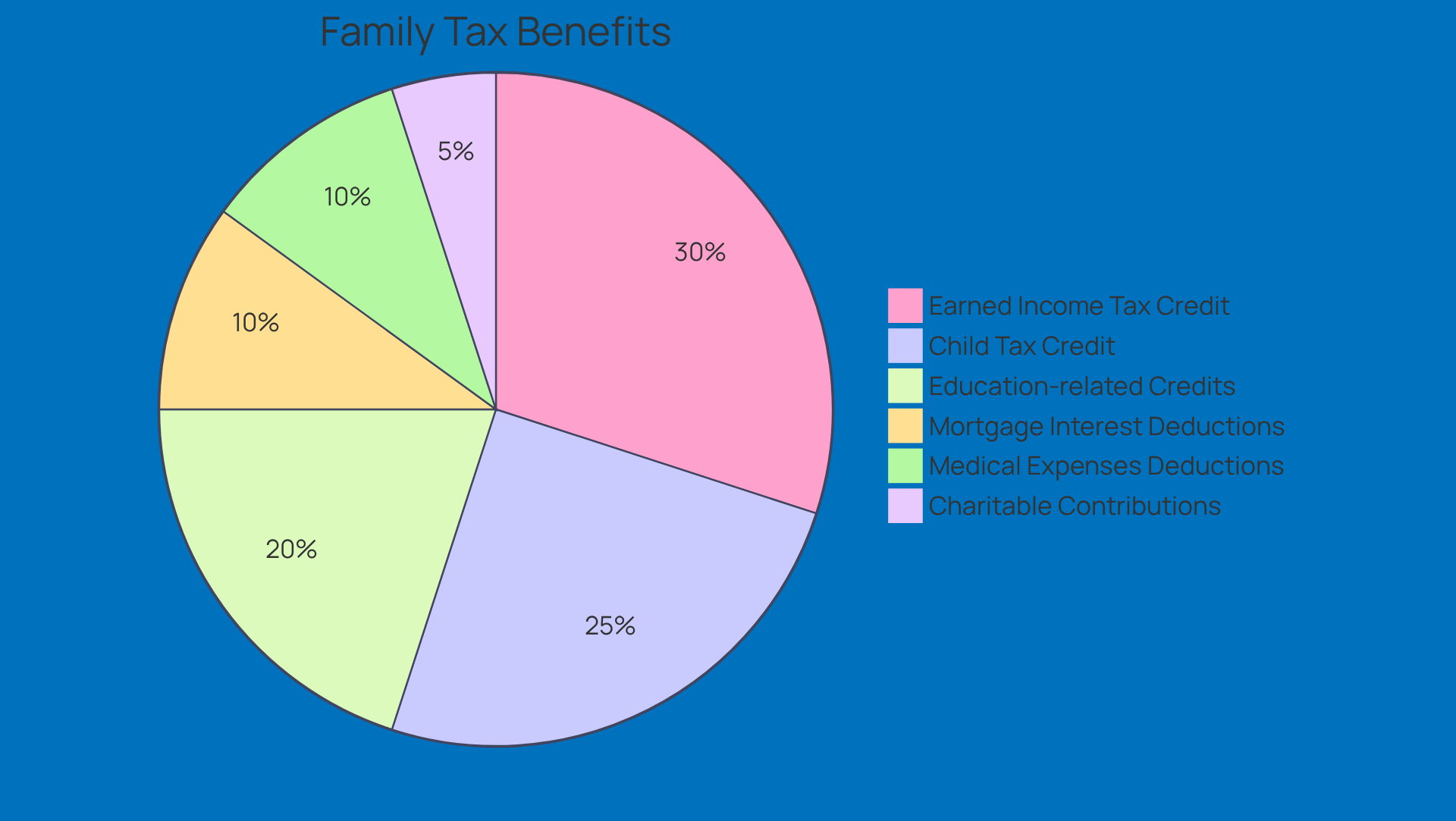

Leverage Tax Credits and Deductions

Hey there, families! Have you considered how family tax planning can help you maximize tax credits and deductions to reduce your tax burden? It’s a smart move! For instance, the Child Tax Credit can really help if you’ve got a dependent child and meet certain income guidelines. And don’t forget about the Earned Income Tax Credit, which is a great benefit for parents with one or more kids, depending on your income level.

But wait, there’s more! Education-related credits can also give you a nice financial boost. Plus, deductions for things like mortgage interest, medical expenses, and charitable contributions can lead to some serious savings. Staying in the loop about tax law changes can help you spot new opportunities to take advantage of these benefits.

And if you’re a new parent, it’s a good idea to start thinking about a realistic budget that covers all those costs that come with raising a little one. Planning for future expenses, such as college savings, is essential, and family tax planning options like a 529 college savings account should be considered. It’s all about being prepared and making the most of what’s out there!

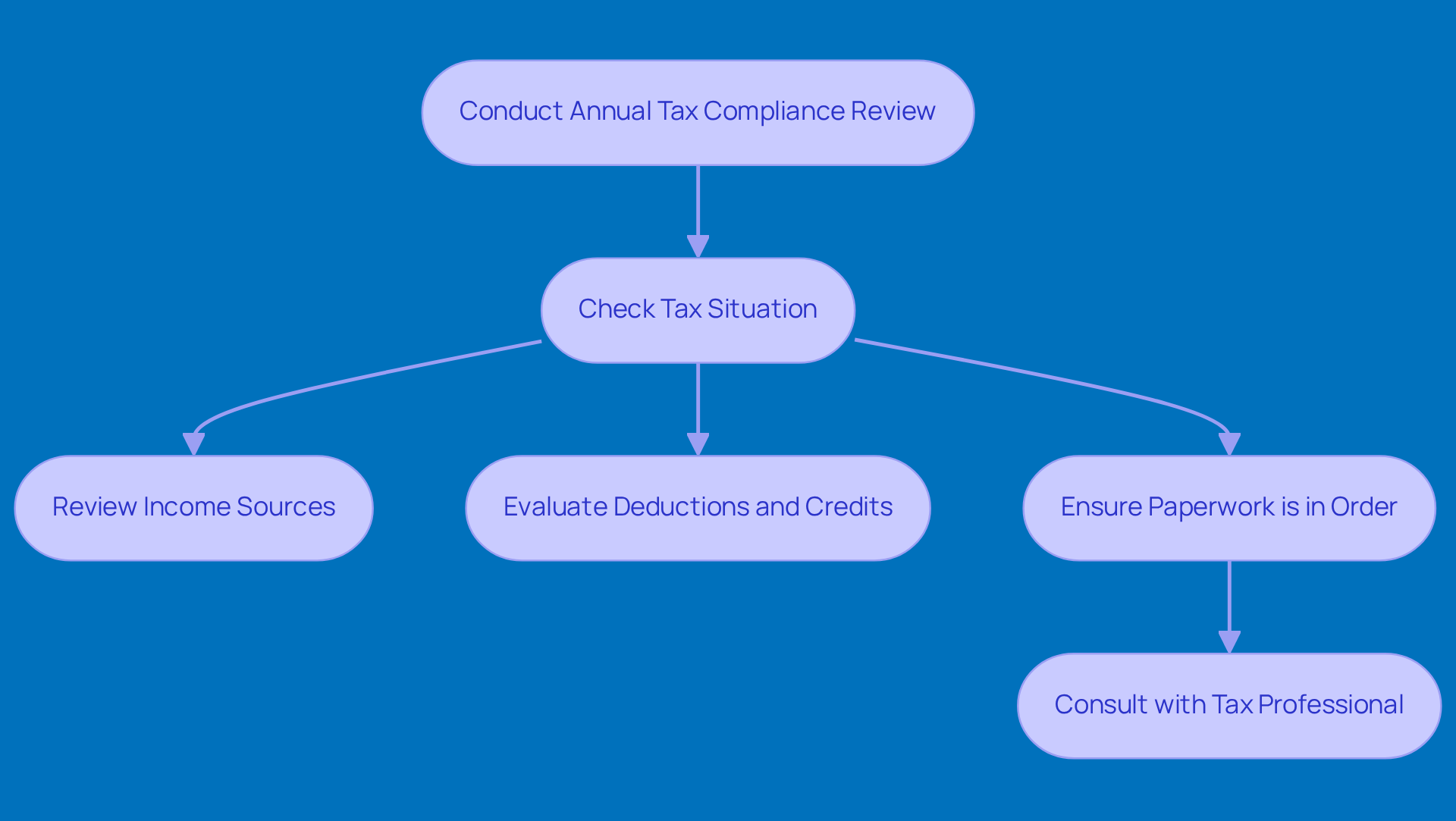

Conduct Regular Tax Compliance Reviews

Hey there! Have you ever thought about how important family tax planning is for families to perform an annual tax compliance review? It’s a great way to check in on your tax situation and make sure everything’s filed accurately and on time. This process isn’t just about crunching numbers; it involves taking a good look at your income sources, deductions, and credits, and making sure all your paperwork is in order.

Now, here’s a tip: teaming up with a tax professional can really pay off. They can offer insights that help you spot potential compliance issues before they turn into bigger headaches. Did you know that the IRS estimates taxpayers will spend nearly 7.1 billion hours on tax compliance in 2025? That’s a lot of time! So, being proactive with your reviews can really help ease the stress and boost your accuracy.

CPAs often emphasize that regular evaluations not only make the filing process smoother but can also lead to some nice savings. It’s a smart move for households looking to implement family tax planning to navigate the complexities of tax regulations without losing their minds. So, why not make it a priority? Your future self will thank you!

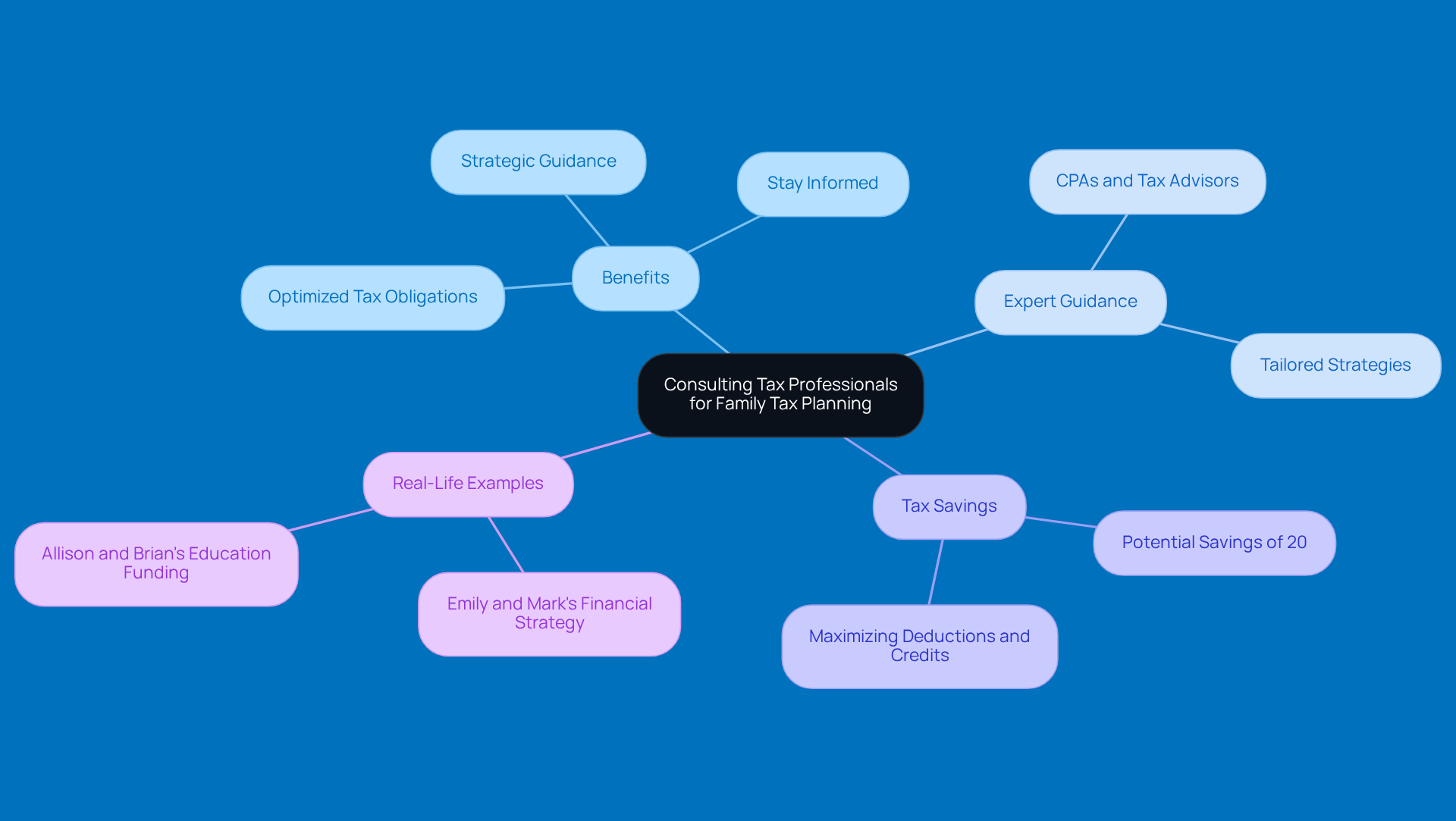

Consult with Tax Professionals for Expert Guidance

Families, have you ever thought about how family tax planning with a tax professional could make your life easier? Engaging with experts like CPAs or tax advisors can really help you with family tax planning based on your unique tax situation. These specialists are like treasure maps, revealing tax-saving opportunities and ensuring you stay on top of those ever-changing regulations. Plus, they provide strategic guidance that aligns with your family tax planning objectives.

Regular chats with these pros keep you in the loop about important tax law changes, allowing you to make smart financial decisions. Did you know that households involved in family tax planning with CPAs often save around 20% on their tax bills? That’s a pretty solid reason to seek professional help! As Thomas Watson once said, 'To be successful, you have to have your heart in your business, and your business in your heart.' This really rings true in the world of taxes, where aligning your financial strategies with your personal values can lead to some impressive results.

For instance, consider Emily and Mark in the context of family tax planning. They engaged in family tax planning by consulting with tax advisors and managed to optimize their tax obligations, which boosted their overall financial well-being. By tapping into the insights of tax professionals, you can turn family tax planning from a daunting chore into a strategic advantage. So, why not consider reaching out to a tax expert? It could be the best decision you make for your family's financial future!

Maintain Accurate Financial Records

Keeping your financial records neat and tidy is super important if you want to make tax season a breeze. It’s all about tracking your income, expenses, and any documents you might need for deductions and credits throughout the year. Using accounting software can really help simplify this process, letting you whip up reports in no time and get ready for tax season with a smile.

Regularly checking and updating your records not only helps you stay on top of your tax obligations but can also boost your savings. For instance, folks using platforms like QuickBooks or FreshBooks have found they save a ton of time and stress during tax season, allowing them to focus on what really matters.

And hey, if you want to step up your game, consider adopting some smart practices for keeping your finances in check. Categorizing your expenses and keeping digital copies of your receipts can really ramp up your efficiency. As we gear up for 2026, using the latest accounting software designed for personal finance will be key to making tax prep smoother and ensuring a hassle-free filing experience. So, why not start organizing those records today?

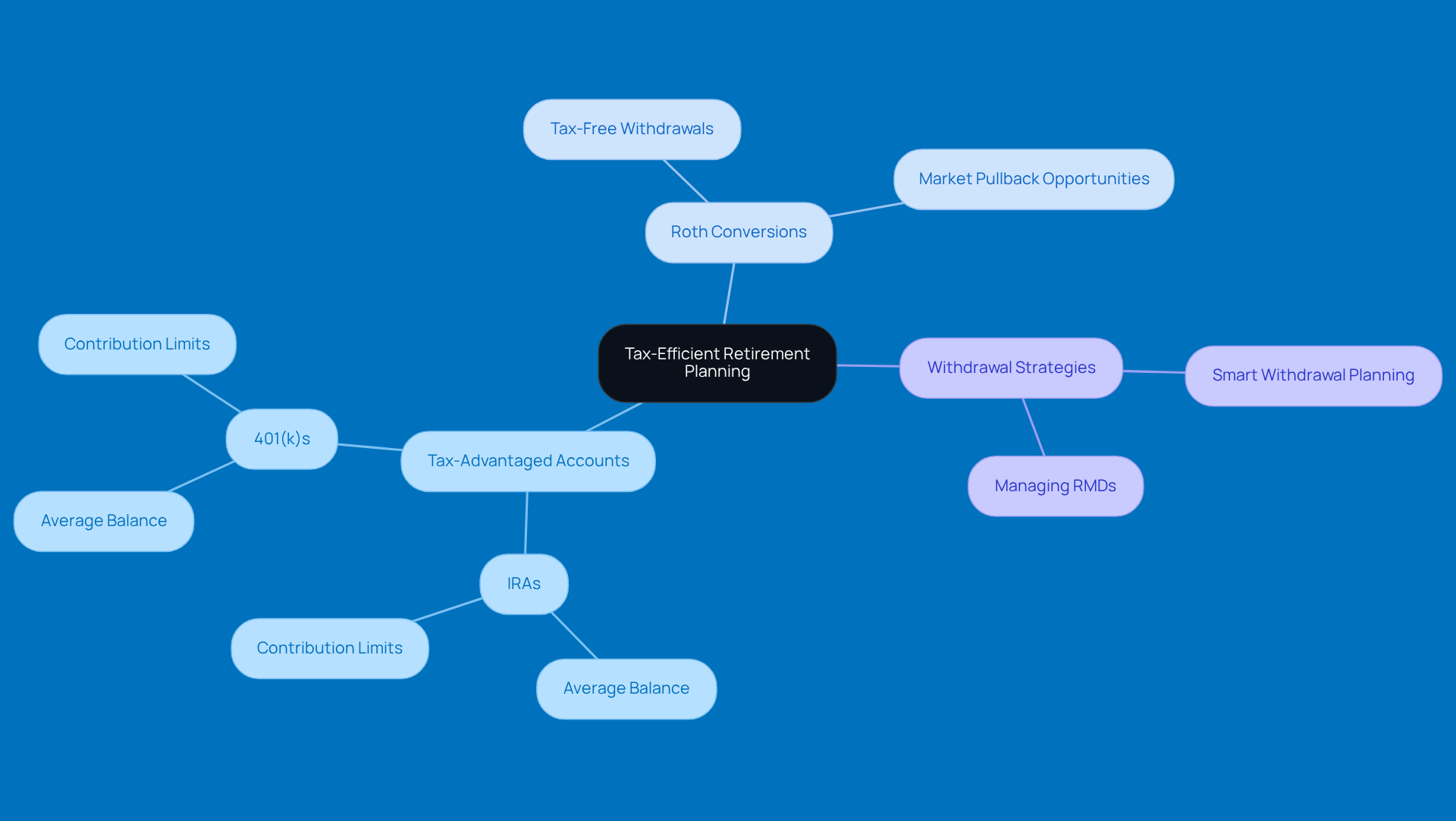

Implement Tax-Efficient Retirement Planning

When it comes to retirement planning, families should really focus on family tax planning strategies that are tax-efficient. One great way to do this is by using tax-advantaged accounts like IRAs and 401(k)s. Not only do contributions to these accounts help grow your retirement savings, but they also come with some nice immediate tax benefits. For example, did you know that the average IRA balance hit $137,902 in the third quarter of 2025? That’s a pretty clear sign that more folks are catching on to how effective these accounts can be!

But wait, there’s more! Households can also boost their tax strategy with options like Roth conversions. This nifty move allows for tax-free withdrawals when you retire. Plus, implementing smart withdrawal strategies can help keep those tax bills down. It’s a win-win! Regular chats with a financial consultant can really help families stay on track with their retirement goals, especially when it comes to family tax planning as tax regulations change. Speaking of changes, with new advantages coming in 2026, it’s super important to stay updated so you can make the most of your financial situation.

So, what do you think? Are you ready to dive into tax-efficient retirement planning? It’s never too early to start thinking about your future!

Evaluate Business Structure for Tax Efficiency

If your family has business interests, it's wise to incorporate family tax planning by regularly reviewing your business structure to ensure you’re optimizing your tax situation. You’ve got a few options to consider - sole proprietorships, partnerships, LLCs, and corporations - each with its own tax quirks. For example, S-Corps can help you dodge double taxation, while LLCs give you some flexibility without too much red tape.

Now, it’s super important to chat with a tax pro, like the folks at Steinke and Company. They know the ins and outs of preparing and filing both business and personal returns, which helps keep you compliant and avoids any nasty surprises. As Jackie Cunningham puts it, "Choosing the right tax-efficient business structure is a complex decision that requires careful consideration." And she’s right! Making the right choice can lead to average tax savings of 15% or more. Just look at that mid-sized manufacturing company that slashed its effective tax rate with a solid tax plan.

By getting a grip on the details of each structure, you can make smart choices that fit your financial goals and improve your family tax planning. Plus, with the One Big Beautiful Bill Act (OBBBA) shaking things up in 2026, it’s worth thinking about how these changes might impact your business structure decisions. And remember, Steinke and Company is here to help you navigate these complexities!

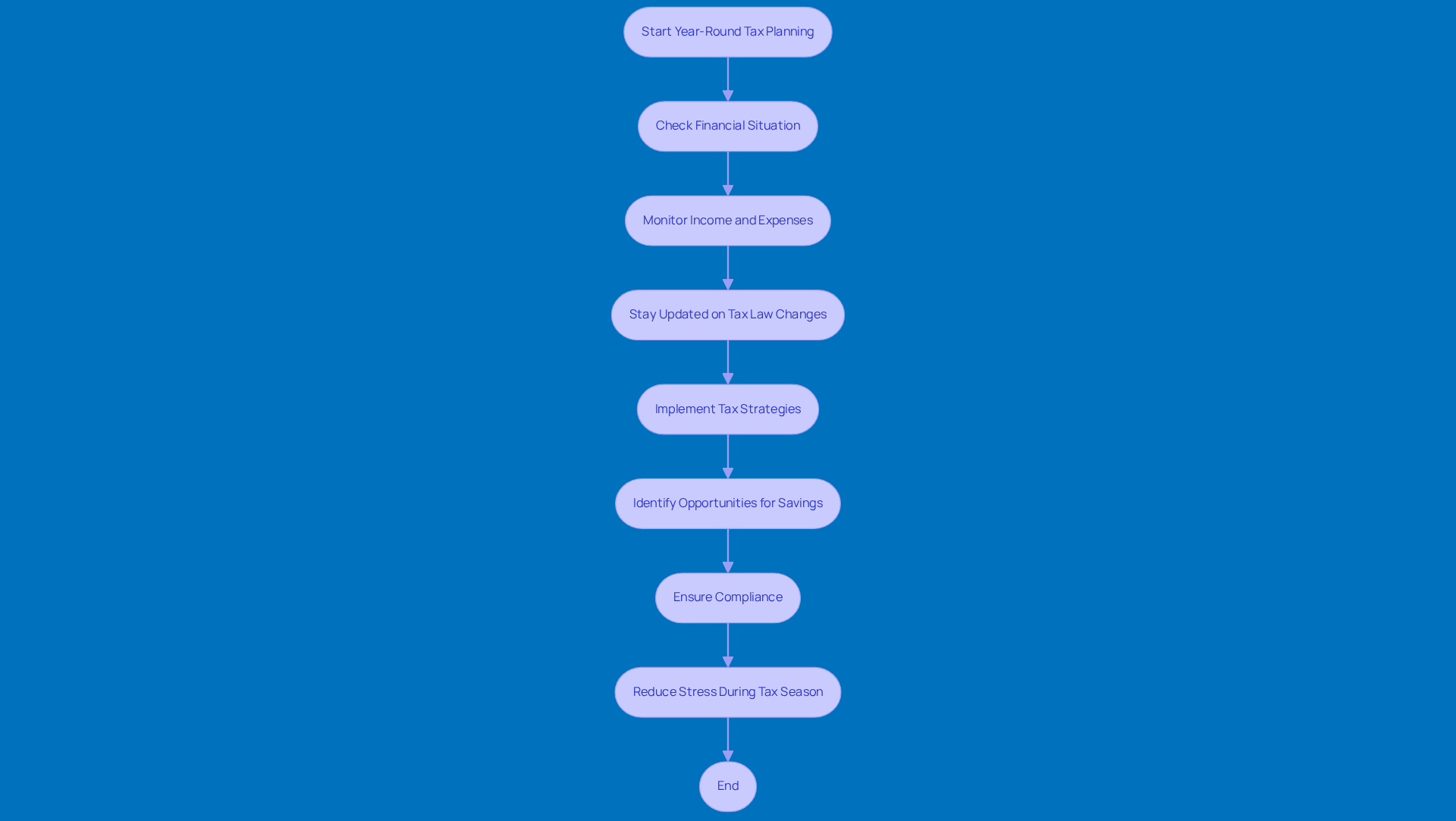

Adopt Year-Round Tax Planning Practices

Families should really consider family tax planning throughout the year to manage their tax obligations more effectively. This proactive approach means regularly checking in on your financial situation, keeping a close eye on income and expenses, and staying in the loop with any changes in tax laws. By incorporating family tax planning into your regular routine, you can spot opportunities for savings and ensure compliance, which can significantly reduce stress when tax season arrives.

For example, families that implement family tax planning strategies like systematic loss harvesting or optimizing retirement contributions often find themselves much better prepared when it’s time to file taxes. As one tax advisor puts it, 'Don’t wait until tax season. Start planning now-and keep more of what you earn.' This kind of mindset not only boosts your financial confidence but also helps you navigate the complexities of tax duties with ease. In the end, it leads to a smoother and less stressful tax season for everyone.

Educate Family Members on Tax Responsibilities

Hey there! Let’s talk about something super important: educating everyone in the family about family tax planning and the value of financial literacy. It’s crucial to have open conversations about income, deductions, and how taxes affect your household finances. By providing resources like workshops and handy informational materials, families can empower each member to get involved in family tax planning and compliance. This teamwork not only boosts understanding but also helps improve compliance rates, creating a healthier economic environment for everyone.

Experts are saying that economic literacy is key to navigating the tricky waters of family tax planning, especially as we look ahead to 2026. With tax laws and credits changing - like the increased Earned Income Tax Credit - being informed is more important than ever. So, investing in family tax planning can really pay off, leading to better financial outcomes and a stronger family unit. Why not start the conversation today?

Conclusion

Effective family tax planning is super important for keeping your finances stable and making the most of the benefits available to households. By taking a proactive approach to your tax strategy, you can navigate the complexities, adapt to changing laws, and secure your financial future. This article highlights why it’s crucial to create a comprehensive tax strategy, understand succession planning implications, leverage tax credits and deductions, and keep accurate financial records.

Some key strategies we’ll discuss include:

- The need for regular tax compliance reviews

- The benefits of consulting with tax professionals to boost your planning efforts

- Adopting year-round tax planning practices

- Educating family members about their tax responsibilities

Each of these components plays a vital role in optimizing your tax situation and reducing stress when tax season rolls around.

So, here’s the takeaway: families are encouraged to take charge of their tax planning by implementing the tips outlined here. By prioritizing education, seeking expert advice, and regularly reviewing your financial strategies, you can not only improve your current tax situation but also lay a solid foundation for future generations. Embracing these practices ensures that you and your family are well-equipped to maximize your financial well-being, making informed decisions that pave the way for a secure and prosperous future.

Frequently Asked Questions

What is a comprehensive tax strategy?

A comprehensive tax strategy involves family tax planning, which includes reviewing your household's financial situation, understanding current tax laws, and setting clear financial goals. It requires documenting all income sources, potential deductions, and any applicable tax credits.

Why is it important to revisit your tax strategy regularly?

It is important to revisit your tax strategy regularly due to changing tax laws, such as reductions in itemized deductions for high-income earners. This proactive approach ensures compliance and helps maximize available benefits for your family.

What is succession planning in the context of family tax planning?

Succession planning involves preparing to pass on assets or business interests to the next generation while minimizing tax liabilities. It requires consideration of estate taxes, gift taxes, and income tax implications.

What are the federal lifetime estate and gift tax exemptions?

The federal lifetime estate and gift tax exemption is set at $15 million for individuals and $30 million for married couples, allowing families to utilize gifting strategies to reduce their taxable estate.

How can families effectively manage tax liabilities?

Families can manage tax liabilities by taking an integrated approach to wealth management through family tax planning and utilizing trusts, which provide flexibility in choosing beneficiaries and protecting wealth.

What tax credits and deductions should families consider?

Families should consider tax credits like the Child Tax Credit and the Earned Income Tax Credit, as well as deductions for mortgage interest, medical expenses, and charitable contributions to reduce their tax burden.

What should new parents consider regarding family tax planning?

New parents should begin planning a realistic budget for the costs of raising a child and consider future expenses, such as college savings, using family tax planning options like a 529 college savings account.