Introduction

Outsourcing tax return prep has really become a game-changer for small agencies, especially out in rural America. As they tackle the tricky world of tax compliance and financial management, these businesses are finding that specialized services can lighten their load. Not only does this help them manage their tax obligations better, but it also boosts their efficiency and lets them focus on what they do best.

But here’s the thing: with tax regulations constantly changing, how can small agencies make sure they’re getting the most out of outsourcing? And how do they keep risks at bay while staying compliant? It’s a lot to think about, right? Let’s dive into this together!

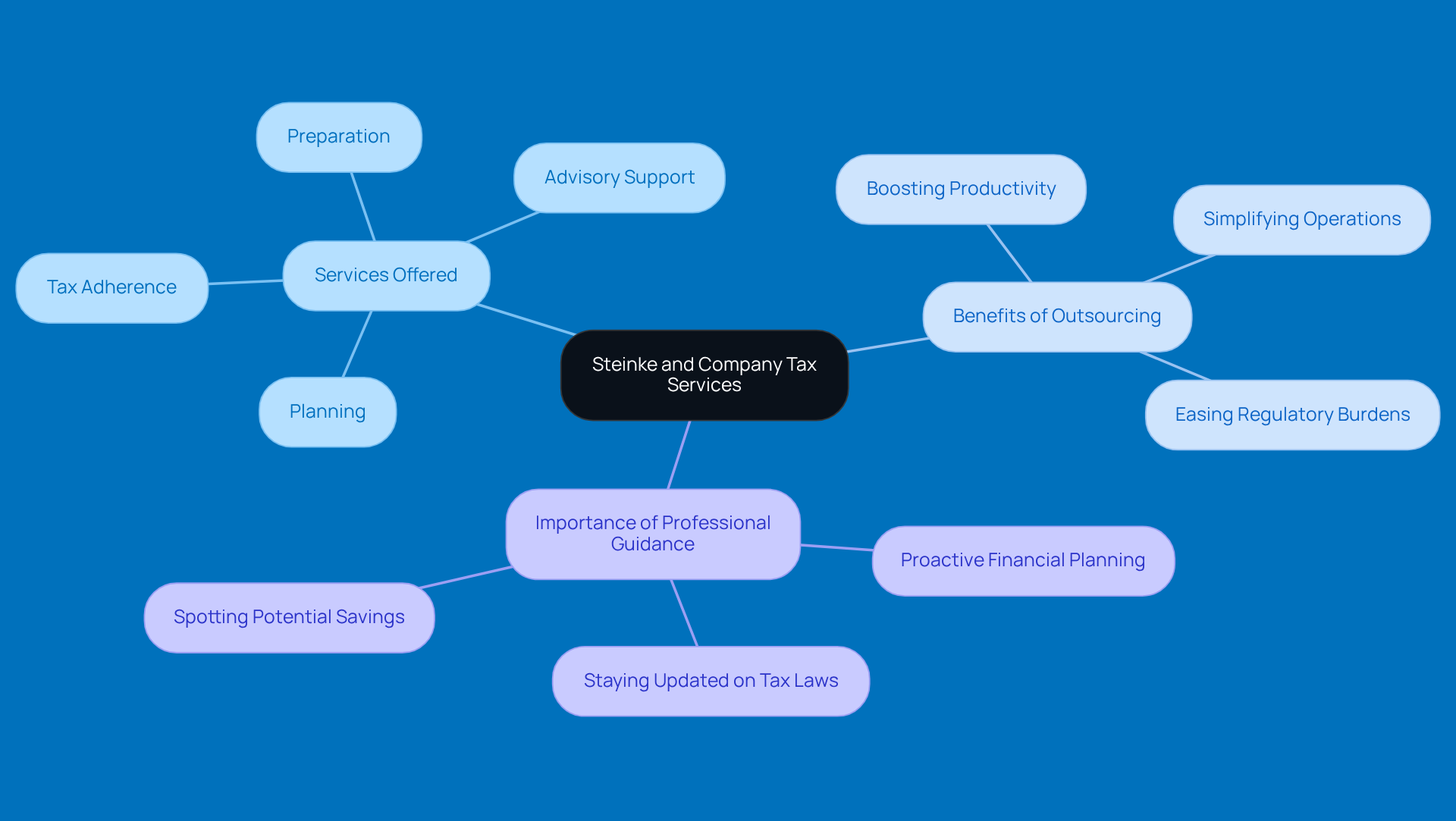

Steinke and Company: Comprehensive Tax Compliance and Preparation Services

Steinke and Company is all about helping small and micro enterprises in rural America with their tax needs. They offer a range of services, from tax adherence and preparation to planning and advisory support. This way, clients can tackle the tricky world of tax regulations with confidence. They really get the unique challenges that rural businesses face, providing personalized help that aligns with what their clients value while also driving financial success.

Lately, there’s been a noticeable trend: more rural agencies are engaging in outsourcing tax return preparation to external services. Why? Well, it’s all about simplifying operations and easing those pesky regulatory burdens. By tapping into expert tax services, these businesses can zero in on what they do best, boosting both productivity and profitability.

Outsourcing tax return preparation can make a huge difference. Outsourcing tax return preparation not only alleviates the stress of tax obligations but also promotes a proactive approach to financial planning. Many rural agencies have found success by regularly consulting with tax professionals. This helps them spot potential savings and stay on top of changing tax laws.

But the perks of tax preparation services go beyond just compliance. They provide rural enterprises with the insights they need to make smart decisions, ultimately helping them thrive in a competitive landscape. As tax regulations keep evolving, having professional guidance is more important than ever for rural businesses looking to succeed.

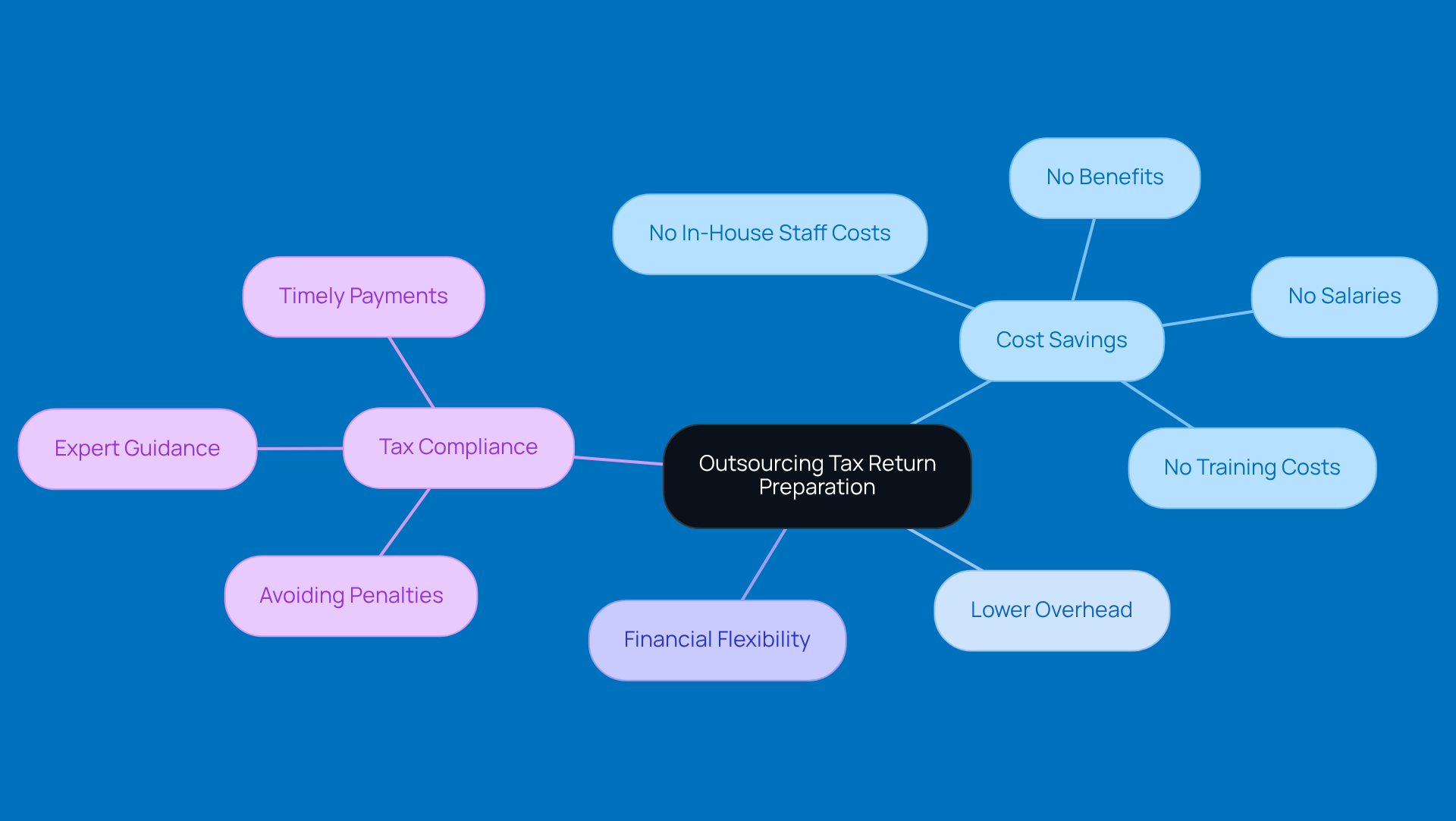

Cost Savings: Reduce Operational Expenses Through Outsourcing

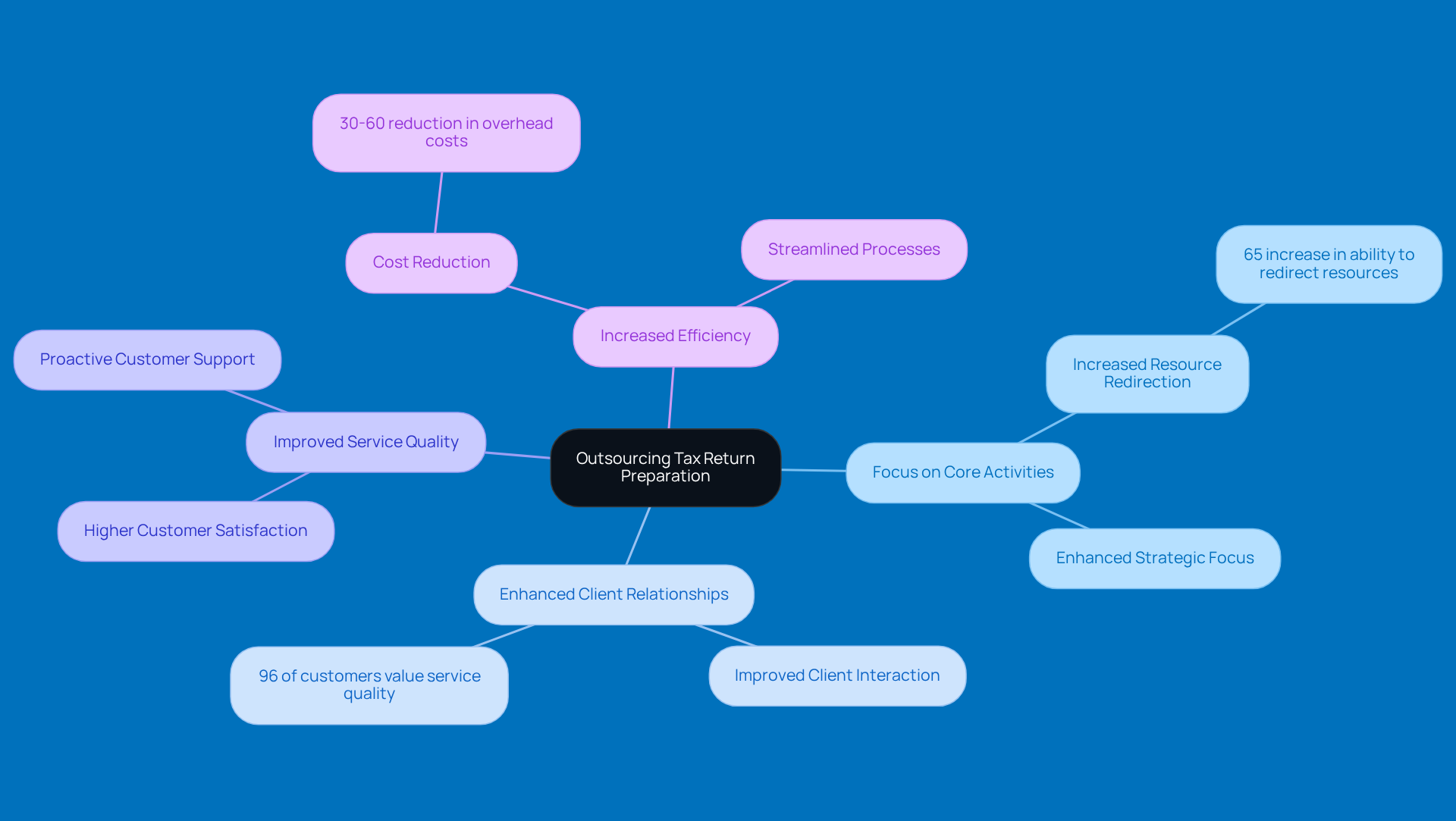

Outsourcing tax return preparation can really save small agencies a lot of money. By not having to hire in-house staff, you can dodge those costs tied to salaries, benefits, and training. Plus, outside service providers usually have lower overhead, which means they can offer their services for way less than what it would cost to keep an internal team running. This kind of financial flexibility lets small businesses put their resources to better use - like investing in growth instead of getting bogged down with admin tasks.

But that’s not all! Outsourcing can also help small agency owners navigate the tricky waters of underpayment penalties. It’s all about staying on the right side of IRS rules and avoiding those pesky fees. By tapping into the expertise of tax pros, you can pick up strategies to boost your tax compliance. Think timely estimated tax payments and adjusting withholdings - these moves can really help protect your financial health. So, why not consider outsourcing tax return preparation for your needs? It might just be the smart move your agency needs!

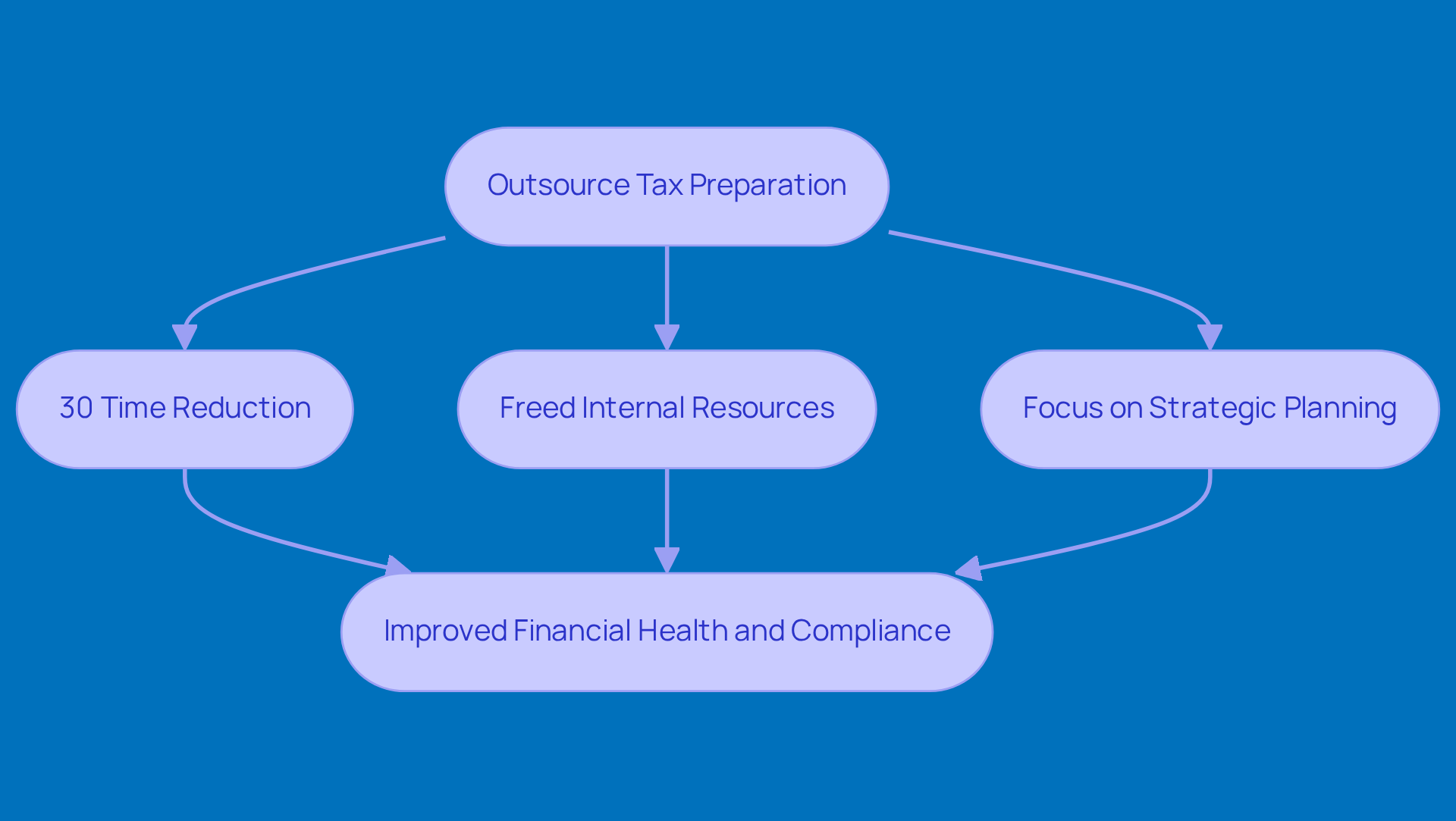

Time Efficiency: Streamline Your Tax Preparation Process

Outsourcing tax return preparation can really make life easier for small agencies. When you hand off tax-related tasks to specialized firms like Steinke and Company, you free up precious time to focus on what you do best. This shift not only speeds up the tax prep process but also takes the pressure off those looming deadlines. With experts managing the nitty-gritty of tax filings, business owners can dive into strategic planning and growth initiatives.

Did you know that small businesses that outsource their tax prep see an average time reduction of 30%? That’s a big deal! It means they can allocate their resources more effectively. Plus, about 65% of companies say that freeing up their internal staff is a major reason for outsourcing, highlighting the operational perks.

Understanding the ins and outs of paystubs and keeping accurate tax records is crucial for financial stability and compliance. Many corporate leaders have noticed how outsourcing has transformed their operations. One owner shared, "Delegating our tax preparation has saved us countless hours, allowing us to concentrate on what truly matters - expanding our company." Another expert chimed in, saying, "Outsource Tax Preparation Services have become a strategic solution."

This trend shows that outsourcing not only boosts efficiency but also promotes a proactive approach to management, leading to better financial health and compliance. As Tax Season 2025 approaches, with big changes like the return of personal exemptions and a reduction in the standard deduction, outsourcing tax return preparation is shaping up to be an even more essential strategy for small agencies. So, have you thought about how outsourcing could help your business?

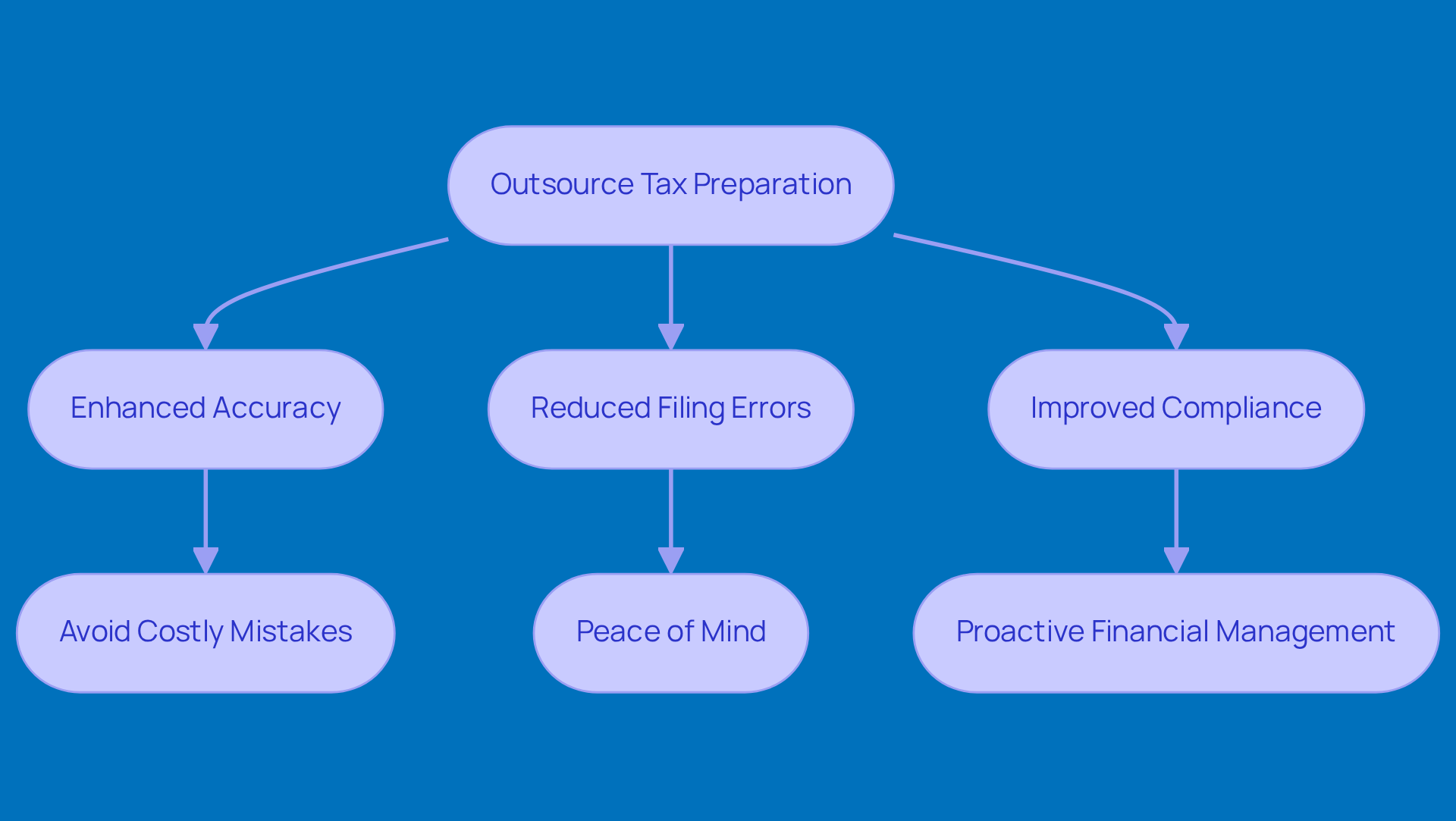

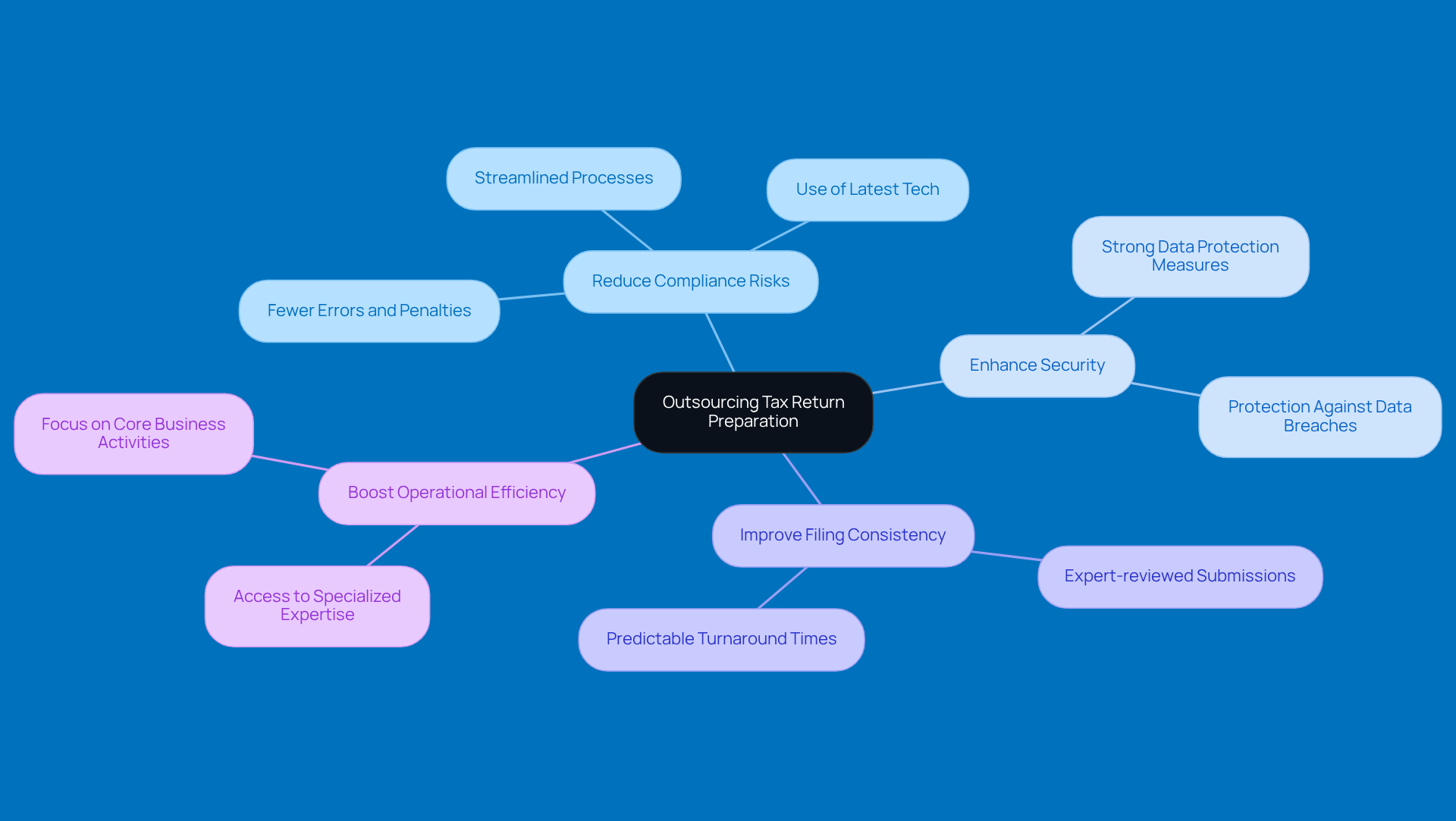

Improved Accuracy and Compliance: Minimize Errors in Tax Filings

Outsourcing tax return preparation can significantly enhance the accuracy of your filings, which is crucial for small businesses attempting to navigate the complex world of taxes. You see, professional tax preparers know the ins and outs of the latest tax laws and regulations, which means they can help you avoid costly mistakes that might lead to hefty penalties. Just think about it: small businesses that don’t follow tax rules can face fines that add up to thousands of dollars, putting a serious dent in their finances. By tapping into the expertise of these pros, you can make sure your tax returns are filed on time and accurately, which helps you stay compliant and reduces the chances of an audit.

Plus, recent studies show that companies that are outsourcing tax return preparation see a big drop in filing errors. This not only makes operations run smoother but also gives you peace of mind. Tax experts point out that keeping your tax prep accurate isn’t just about dodging penalties; it’s also about taking a proactive stance on your financial management. As tax laws change, handing off these tasks lets businesses stay ahead of the game, ensuring their tax strategies are both effective and compliant.

In a world where tax regulations are getting more complicated, outsourcing tax return preparation isn’t just a nice-to-have; it’s a smart move. It takes the pressure off your internal resources and lets you focus on the core activities that drive growth and innovation. By letting specialized firms handle your tax prep, small businesses can turn tax compliance from a reactive chore into a proactive boost for performance.

Scalability: Adjust Resources Based on Business Needs

Outsourcing tax return preparation services gives businesses the flexibility they need to scale resources based on their specific demands. Think about it: during those hectic tax seasons, agencies can easily ramp up their external service capacity. This means they can tackle bigger workloads without the long-term commitment of hiring extra staff. For instance, many small agencies have successfully adjusted their external service needs according to workload changes, keeping them agile and ready to respond to evolving demands.

Now, when things slow down, companies can dial back their external service needs, ensuring they only pay for what they actually require. This kind of adaptability is a real lifesaver for small businesses that often deal with seasonal workload fluctuations. Picture a small accounting firm that boosts its external support during tax season to handle the influx of clients, then scales back afterward. It’s all about optimizing costs and resources!

But the perks of scalable external solutions go beyond just saving money. They allow small agencies to focus on what they do best while letting specialists tackle the tricky tax regulations. Business owners have shared that outsourcing tax return preparation helps them adjust resources seasonally, providing peace of mind during those busy times. One owner even said, 'Outsourcing tax return preparation has been a game changer; it lets us focus on our clients while ensuring compliance without the stress of managing an in-house team.' This kind of strategic flexibility not only boosts operational efficiency but also sets organizations up for sustained growth in a constantly changing tax landscape.

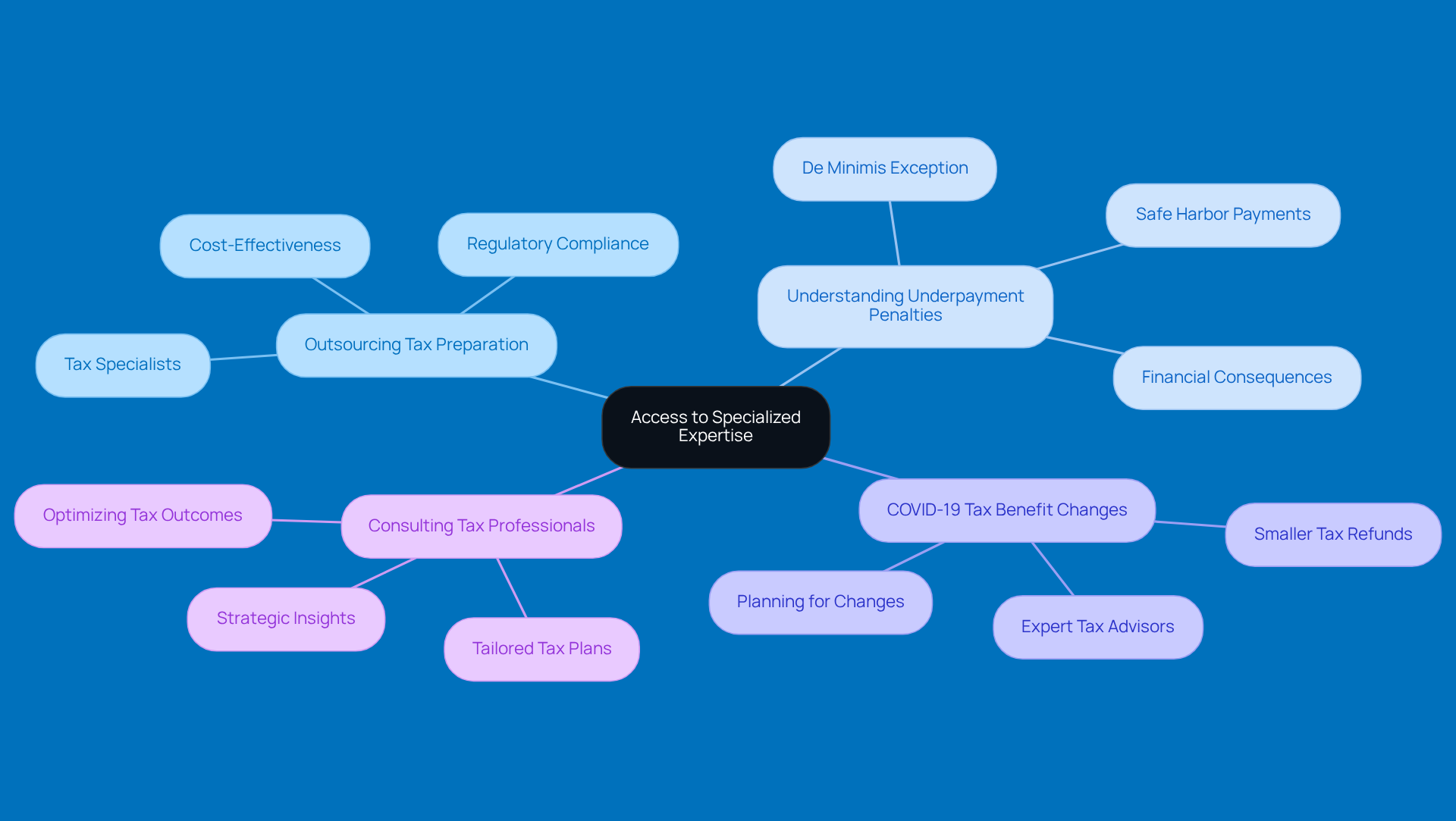

Access to Specialized Expertise: Leverage Professional Knowledge

Outsourcing tax return preparation can really open doors for companies, giving them access to specialized expertise that might not be available in-house. When businesses partner with outsourcing firms for outsourcing tax return preparation, they gain access to the expertise of tax specialists who are current on the latest regulations and compliance requirements. This means organizations can benefit from their insights, leading to smarter tax planning and better financial outcomes. In the end, it’s all about boosting the overall health of the organization.

Now, let’s talk about something crucial for small business owners: understanding underpayment penalties. These penalties can hit hard if estimated tax payments fall short throughout the year, resulting in some serious financial consequences. But don’t worry! Tax professionals can help navigate these tricky waters. They can implement strategies like safe harbor payments and the de minimis exception to help you steer clear of those penalties.

And with the recent cuts in COVID-19 tax benefits, many companies might find themselves facing smaller tax refunds than in previous years. This is where expert tax advisors come in handy. They can help you plan for these changes, ensuring that small business owners are well-prepared and compliant, ultimately optimizing their tax outcomes.

So, if you want to make the most of your tax strategy, why not consider chatting with a tax professional? They can help tailor a plan that fits your specific needs, making tax season a little less daunting!

Enhanced Client Satisfaction: Focus on Core Business Activities

Are you thinking about outsourcing tax return preparation? It’s a game changer! By letting someone else handle the nitty-gritty, companies can really focus on what they do best, and guess what? That means happier clients. When agencies shift their internal resources, they can spend more time chatting with clients and delivering top-notch service. This focus on core strengths not only boosts service quality but also builds stronger client relationships, which is key for loyalty and repeat business.

Think about it: in today’s competitive world, where a whopping 96% of customers say customer service is crucial for brand loyalty, a personalized approach can really set you apart. Plus, companies that streamline their operations by outsourcing tax return preparation often see a 65% increase in their ability to redirect resources toward higher-value offerings. This shift doesn’t just improve efficiency; it leads to better client experiences and satisfaction. So, why not consider outsourcing? It could be the secret ingredient to elevating your service game!

Risk Mitigation: Reduce Compliance and Security Risks

Outsourcing tax prep? Outsourcing tax return preparation is a game changer for businesses looking to cut down on regulatory and security risks. Professional firms are all about using the latest tech and streamlined processes to keep tax filings in line with current regulations. This means fewer errors and penalties - who wouldn’t want that?

Plus, these outsourcing partners take security seriously. They implement strong measures to protect sensitive financial data, which helps keep data breaches at bay. Just think about it: organizations that utilize outsourcing tax return preparation often see big improvements in filing consistency and document accuracy. That’s super important for staying on the right side of the law!

By bringing in specialized expertise, companies can tackle the tricky world of tax regulations more effectively. This way, they can stay compliant while focusing on what they do best. Outsourcing tax return preparation is a smart move that not only boosts operational efficiency but also strengthens the overall security of the organization. So, why not consider outsourcing tax return preparation for your taxes? It could be just what you need to stay ahead of compliance challenges!

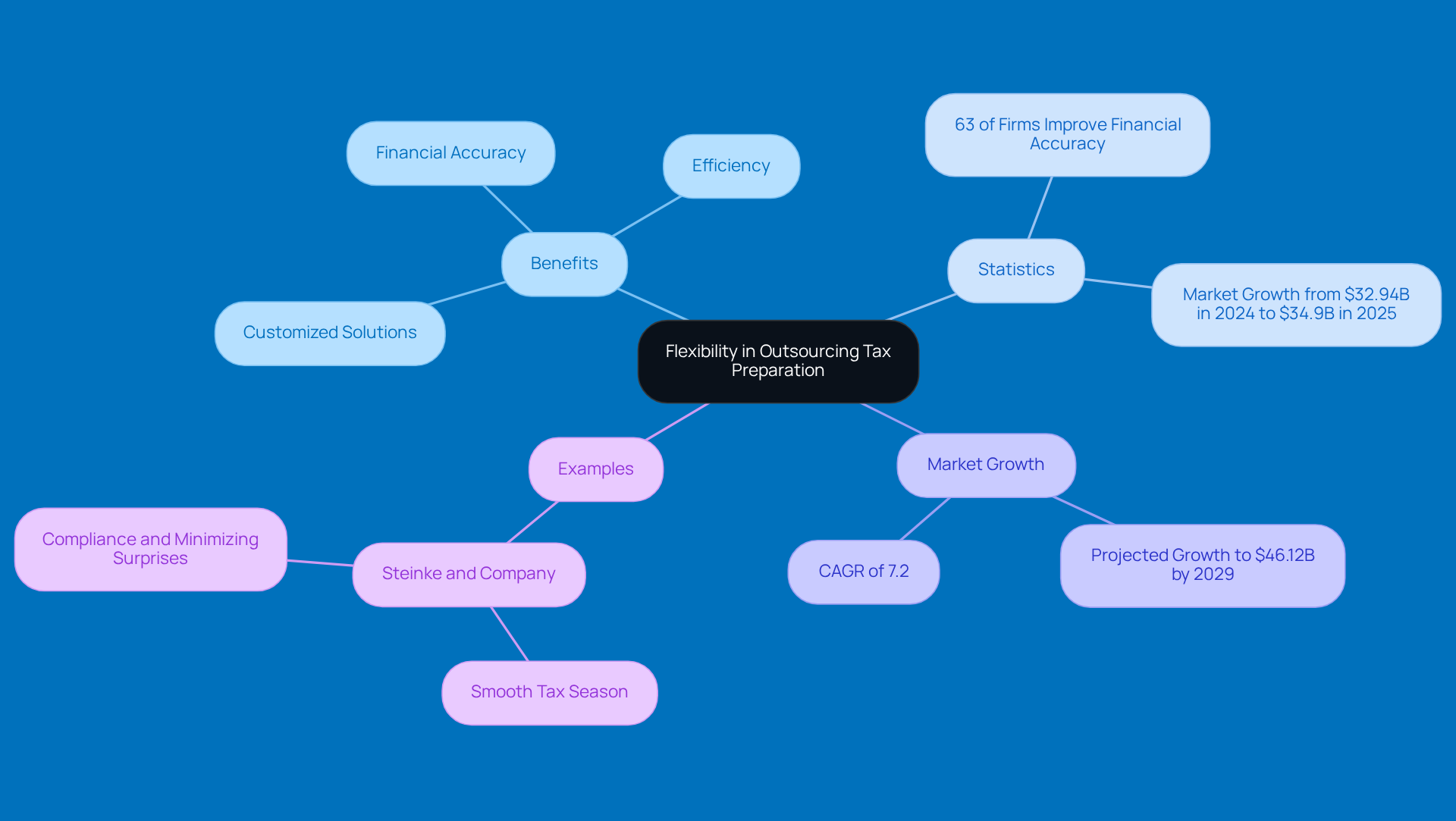

Flexibility: Tailor Outsourcing Solutions to Fit Your Business

Outsourcing tax return preparation is a smart move for companies looking to tailor solutions that fit their unique needs. Whether you’re after comprehensive tax services or just a few specific components, outsourcing firms can adjust their offerings to meet those requirements. This flexibility ensures that organizations get exactly the level of service they need, while also boosting efficiency in tax management through organized workflows and expert reviews.

Take Steinke and Company, for example. They make tax season smooth, accurate, and stress-free by preparing and filing both business and personal returns. They ensure compliance and help minimize those pesky surprises. Did you know that a recent survey found that 63% of firms believe using external services improves financial accuracy? That’s because it gives them access to specialized expertise and tools.

Looking ahead, the tax preparation services market is projected to grow from $32.94 billion in 2024 to $34.9 billion in 2025. This growth reflects the increasing reliance on outsourcing in the industry. Small businesses that customize their tax services often report better compliance and lighter administrative loads, allowing them to focus on what they do best.

As the IRS puts it, outsourcing tax return preparation enables companies to concentrate on their core operations while specialists manage the intricate tax filings. By tapping into customized tax preparation services from Steinke and Company, agencies can navigate the complexities of tax regulations, stay updated on new tax laws, and maximize available deductions and credits. This ultimately leads to greater financial stability. So, why not consider outsourcing tax return preparation for your taxes? It could be the key to a smoother tax season!

Strategic Advantage: Gain a Competitive Edge Through Outsourcing

Outsourcing tax return preparation can really give organizations a leg up in today’s competitive marketplace. By leveraging the expertise and efficiency of external providers, companies can boost their operational capabilities while focusing on what really matters: innovation and growth. This smart approach not only strengthens tax compliance but also helps businesses adapt quickly to market shifts and changing client needs, paving the way for long-term success.

For instance, companies that embrace external services often see a whopping 30-70% reduction in costs. That’s money they can redirect toward client-facing investments and new service lines! Plus, about 65% of firms discover that subcontracting lets them shift internal resources to higher-value services, which really enhances overall productivity.

Now, let’s talk about something crucial for small business owners: understanding and managing underpayment penalties. Agencies can ensure they’re meeting IRS requirements and steering clear of those pesky penalties by outsourcing tax return preparation. There are specific strategies, like using safe harbor payments and the de minimis exception, that can help mitigate financial risks. This proactive approach to tax compliance not only helps companies dodge penalties but also frees them up to focus on growth and innovation.

As more businesses recognize the importance of specialized knowledge in tax compliance, they’re setting themselves up to thrive in a fast-paced environment. Ultimately, this gives them a competitive edge that fuels innovation and growth. So, why not consider outsourcing tax return preparation for your tax prep? It could be the game-changer your business needs!

Conclusion

Outsourcing tax return preparation can be a game-changer for small agencies, especially those in rural areas. It lets them zero in on what they do best while boosting compliance and efficiency. By teaming up with specialized firms like Steinke and Company, businesses can tackle the tricky world of tax regulations with more confidence, paving the way for financial success and less operational stress.

The perks of outsourcing are pretty impressive. Think about it:

- Significant cost savings

- Better accuracy in tax filings

- A whole lot of time saved

Agencies can cut down on overhead by skipping the need for in-house staff, all while tapping into the expertise of tax pros who are always in the know about the latest regulations. This smart move not only helps reduce errors and compliance headaches but also lets businesses adjust their resources based on seasonal needs.

In today’s competitive landscape, choosing to outsource tax prep isn’t just a smart move; it’s a strategic edge that can really make a difference. By embracing outsourcing, small agencies can boost client satisfaction, focus on growth, and set themselves up for long-term success. As the tax world keeps changing, looking into the benefits of outsourcing tax return preparation might just be the key to discovering new opportunities and maintaining solid financial health. So, why not consider it? It could be the step that takes your agency to the next level!

Frequently Asked Questions

What services does Steinke and Company offer to rural businesses?

Steinke and Company provides comprehensive tax compliance and preparation services, including tax adherence, preparation, planning, and advisory support, specifically tailored for small and micro enterprises in rural America.

Why are rural agencies increasingly outsourcing tax return preparation?

Rural agencies are outsourcing tax return preparation to simplify operations and alleviate regulatory burdens, allowing them to focus on their core business activities and enhance productivity and profitability.

What are the benefits of outsourcing tax return preparation?

Outsourcing tax return preparation helps alleviate stress related to tax obligations, promotes proactive financial planning, provides insights for smart decision-making, and ensures compliance with evolving tax regulations.

How can outsourcing tax preparation lead to cost savings for small agencies?

By outsourcing, small agencies can avoid costs associated with hiring in-house staff, such as salaries, benefits, and training. External service providers typically have lower overhead costs, allowing them to offer services at a reduced rate.

How does outsourcing tax preparation improve time efficiency for small agencies?

Outsourcing tax preparation allows business owners to delegate tax-related tasks to experts, freeing up time to focus on strategic planning and growth initiatives. On average, businesses that outsource their tax prep experience a 30% reduction in time spent on these tasks.

What impact does outsourcing have on financial health and compliance?

Outsourcing tax preparation helps small agencies navigate IRS rules, avoid underpayment penalties, and implement strategies for timely tax payments and accurate withholdings, thereby protecting their financial health and ensuring compliance.

What trends are emerging in tax preparation as Tax Season 2025 approaches?

As Tax Season 2025 approaches, with significant changes such as the return of personal exemptions and a reduction in the standard deduction, outsourcing tax return preparation is becoming an increasingly essential strategy for small agencies.