Introduction

Navigating the complexities of tax planning can feel pretty overwhelming for rural businesses. With unique challenges like seasonal income fluctuations and tricky regulations, it’s no wonder many entrepreneurs find themselves scratching their heads. But don’t worry! This article dives into ten tailored tax planning solutions that can really empower rural entrepreneurs. These strategies are all about helping you optimize your financial game and boost your profitability.

Now, with tax laws and compliance requirements constantly changing, you might be wondering: how can you effectively tap into expert insights to ensure long-term success? Let’s explore this together!

Steinke and Company: Customized Tax Planning Services for Rural Businesses

Steinke and Company really shines when it comes to providing customized tax planning solutions for agricultural businesses. They blend local insights with professional know-how to create tailored strategies that fit each client's unique situation. This means they understand the ups and downs of seasonal income, the challenges of multi-generational transitions, and the specific regulations that come with running a countryside enterprise.

Their proactive approach? Meeting with clients 1-3 times a year to go over tax returns and current financials. This way, they ensure everything's compliant while keeping surprises at bay. By focusing on what each client needs, Steinke and Company helps businesses optimize their tax positions without losing sight of their core values.

Lately, there's been a growing awareness of how important tax planning solutions are for boosting profitability in local enterprises. As more businesses look to navigate the tricky waters of tax regulations, the value of local knowledge in crafting effective tax planning solutions becomes even clearer. With expert insights on pricing, cash flow, and operations, Steinke and Company is like having a CFO in your corner, providing the strategic planning you need for sustainable growth.

Tax Compliance and Preparation: Essential Services for Rural Entrepreneurs

Navigating the complex world of tax compliance can be a real challenge for local entrepreneurs, right? That’s where Steinke and Company steps in. They provide comprehensive tax planning solutions that not only help you stay compliant but also work to minimize your tax liabilities strategically. Think of it as having a trusted partner who’s got your back with meticulous record-keeping, timely filing, and making the most of available deductions and credits.

For example, did you know that small businesses in agriculture enjoy an average effective tax rate of just 14.9%? This really highlights how important it is to have customized tax planning solutions tailored to your needs. By teaming up with an experienced company, you can focus on what you do best while confidently handling your tax responsibilities.

And here’s a fun fact: industry specialists say that effective tax planning solutions can lead to significant savings, which means more money to reinvest in your growth! With around 93% of small businesses filing their taxes on time, it’s clear that expert tax preparation isn’t just a luxury; it’s a necessity. It simplifies compliance and boosts economic stability and success in rural areas. So, why not take the plunge and see how a little expert help can make a big difference for your business?

Startup Consulting: Building Strong Foundations for New Rural Businesses

Starting a new rural enterprise? You’re not alone! Startup consulting can be a game-changer for folks like you looking to lay down a solid foundation. At Steinke and Company, we’re all about helping you navigate the tricky waters of launching your venture. From figuring out your organizational structure to tackling financial planning and tax planning solutions alongside compliance requirements, we’ve got your back.

Think about it: getting your company registered, understanding those pesky tax obligations, and crafting a strategic plan that includes tax planning solutions to truly reflect your vision. Sounds daunting, right? But with our expert advice, you can dodge those common pitfalls that trip up many new entrepreneurs. We’re here to help you set the stage for sustainable growth and success.

So, why not take that first step? Let’s chat about how we can support you on this exciting journey!

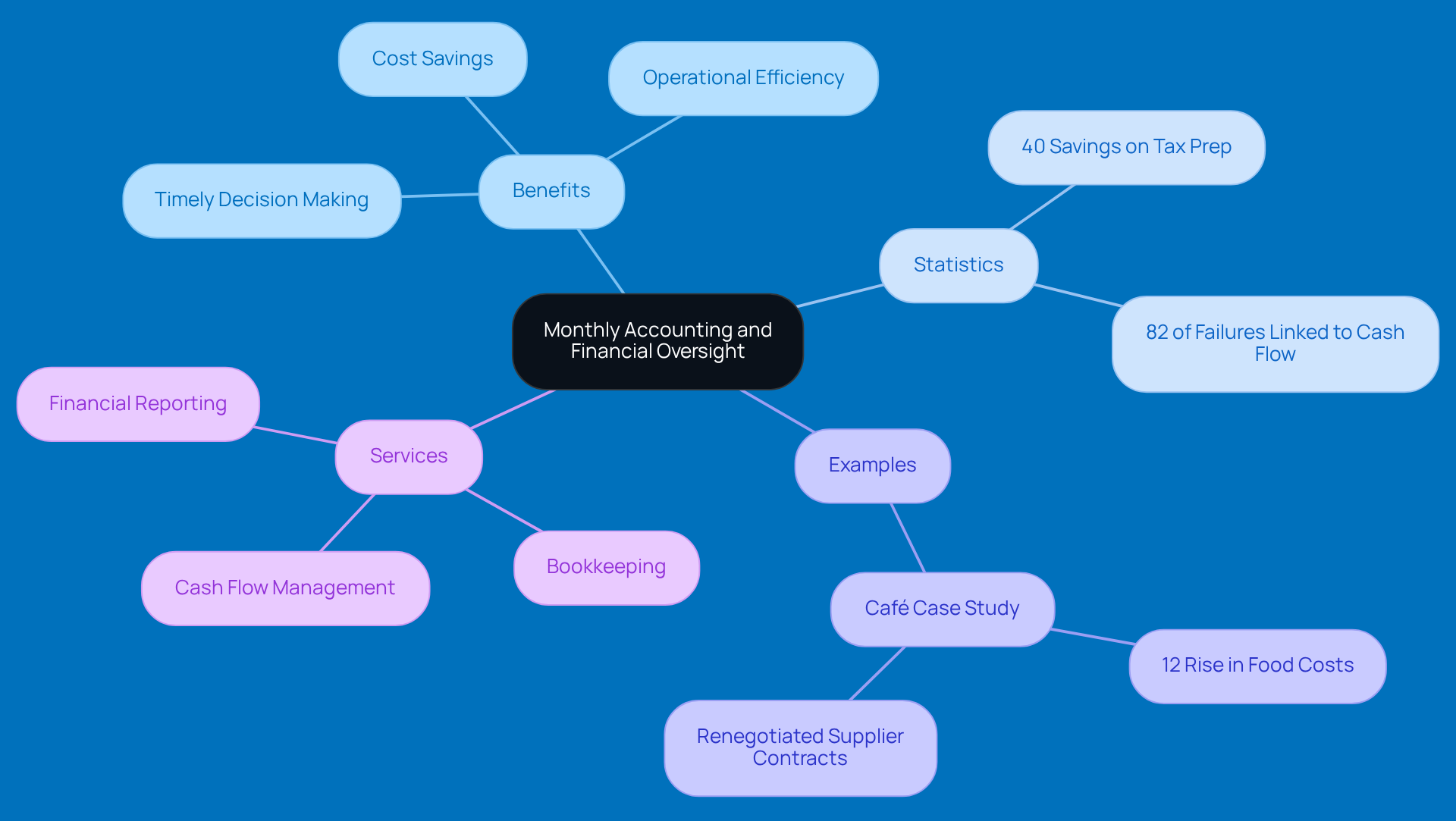

Monthly Accounting and Financial Oversight: Keeping Rural Businesses on Track

Monthly accounting and economic oversight are super important for the success of rural enterprises. At Steinke and Company, we’re here to help with ongoing support through bookkeeping, reporting, and cash flow management. This way, entrepreneurs can keep a clear view of their financial health. Regular oversight not only empowers them to make timely decisions but also helps tackle potential issues before they blow up.

Having precise and up-to-date financial records doesn’t just keep you compliant; it also boosts operational efficiency, which can lead to better profits. For example, businesses that stay organized with their bookkeeping can save up to 40% on tax prep costs compared to those who scramble at year-end. Plus, monthly financial reports can highlight cash flow trends, helping entrepreneurs prepare for seasonal ups and downs and manage overdue payments like pros.

Take, for instance, a small café that spotted a 12% rise in food costs through its monthly reports. This insight allowed them to renegotiate supplier contracts and improve their margins. And let’s not forget, having solid financial oversight is key when it comes to securing funding. Contractors with professional financial reports often get loans faster than those with messy records.

As investment consultants often remind us, effective cash flow management is crucial for small businesses, with a staggering 82% of failures linked to poor cash flow practices. By prioritizing financial oversight and tapping into Steinke and Company’s coaching services, rural entrepreneurs can navigate challenges and set their ventures up for sustainable growth and success. Plus, outsourcing monthly bookkeeping can save organizations 10-20 hours each month and cut costs by up to 60% compared to hiring in-house staff. So, if you want to keep your business healthy, why not consider investing in monthly bookkeeping and coaching services from Steinke and Company?

Business Coaching and Advisory: Connecting Numbers to Growth for Rural Owners

Business coaching and advisory services play a vital role for rural owners, bridging the gap between financial know-how and strategic growth. At Steinke and Company, we offer personalized coaching that helps entrepreneurs get a grip on their economic metrics and craft actionable growth strategies. This journey starts with:

- Setting clear financial goals

- Pinpointing key performance indicators

- Mapping out comprehensive plans to reach those goals

By boosting their financial understanding, local entrepreneurs gain the insights they need to make informed decisions. This not only drives their success but also fosters sustainable development in their communities. So, are you ready to take your business to the next level? Let's dive in together!

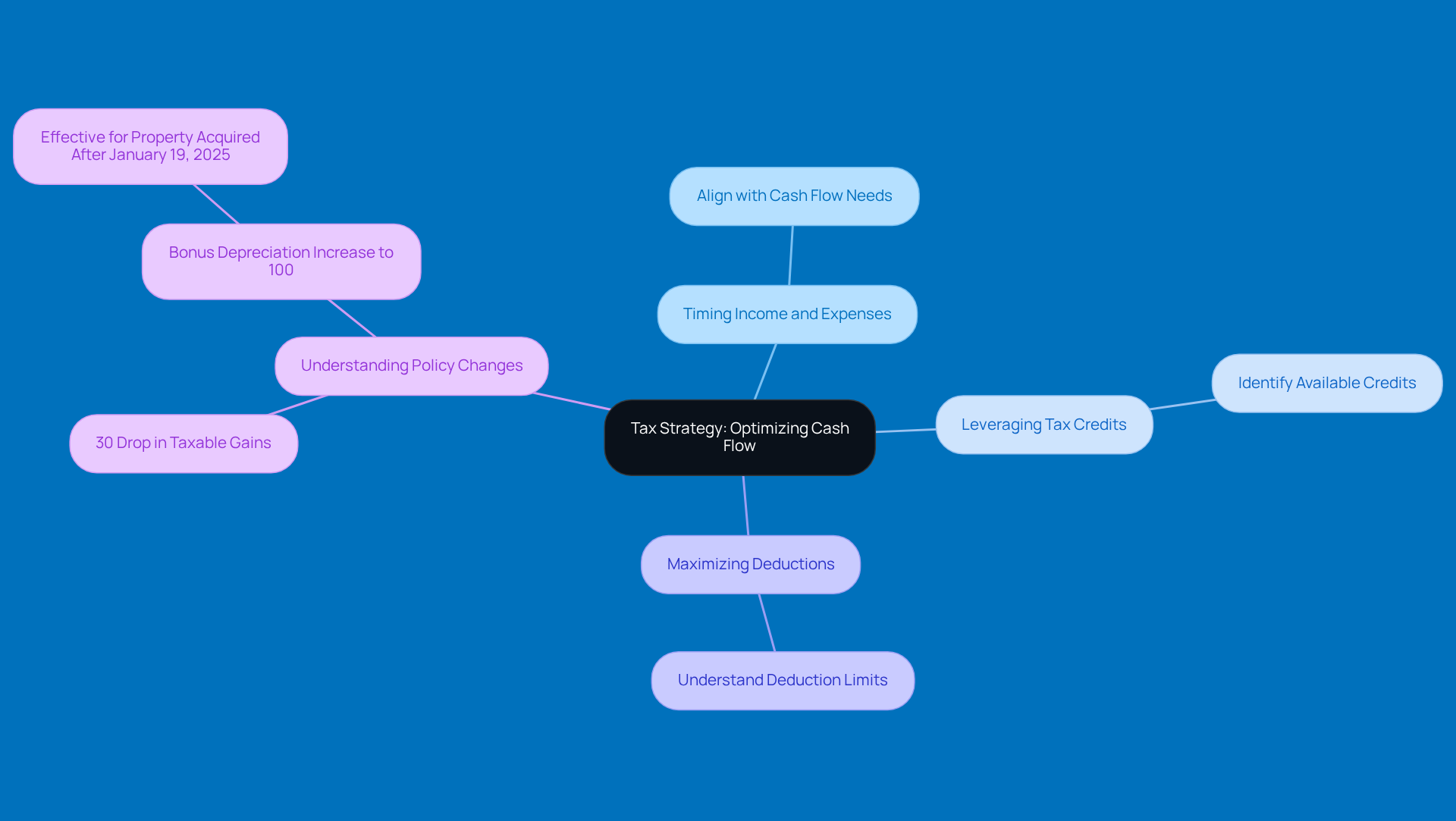

Tax Strategy: Optimizing Cash Flow for Rural Business Success

Crafting a solid tax planning solutions strategy is super important for countryside businesses looking to boost their cash flow and set themselves up for long-term success. At Steinke and Company, we help our clients discover tax planning solutions that can really make a difference in their financial management.

So, what are some key strategies? Well, timing your income and expenses to match your cash flow needs is a great start. Plus, don’t forget to leverage any available tax credits and maximize those deductions! And here’s something to note: there’s been a recent 30% drop in taxable gains for Opportunity Zone investments in less populated areas. This is a big deal and shows that there’s a strong policy focus on these investments. As Blaine Woodson from Grant Thornton Advisors LLC pointed out, the Treasury Department sees these changes as a way to enhance QOZ tax incentives for investing in underserved areas.

But wait, there’s more! The ongoing rise in bonus depreciation to 100%-effective for property acquired after January 19, 2025-presents agricultural businesses with fantastic tax planning solutions. By keeping a close eye on their tax obligations and understanding the implications of underpayment penalties, entrepreneurs in rural areas can enhance their financial resilience through effective tax planning solutions. This not only helps stabilize cash flow but also positions these businesses to thrive in the competitive countryside economy, where the entrepreneurship rate is 17%, compared to just 12% in urban areas.

So, how are you planning to take advantage of these opportunities? Let’s chat about it!

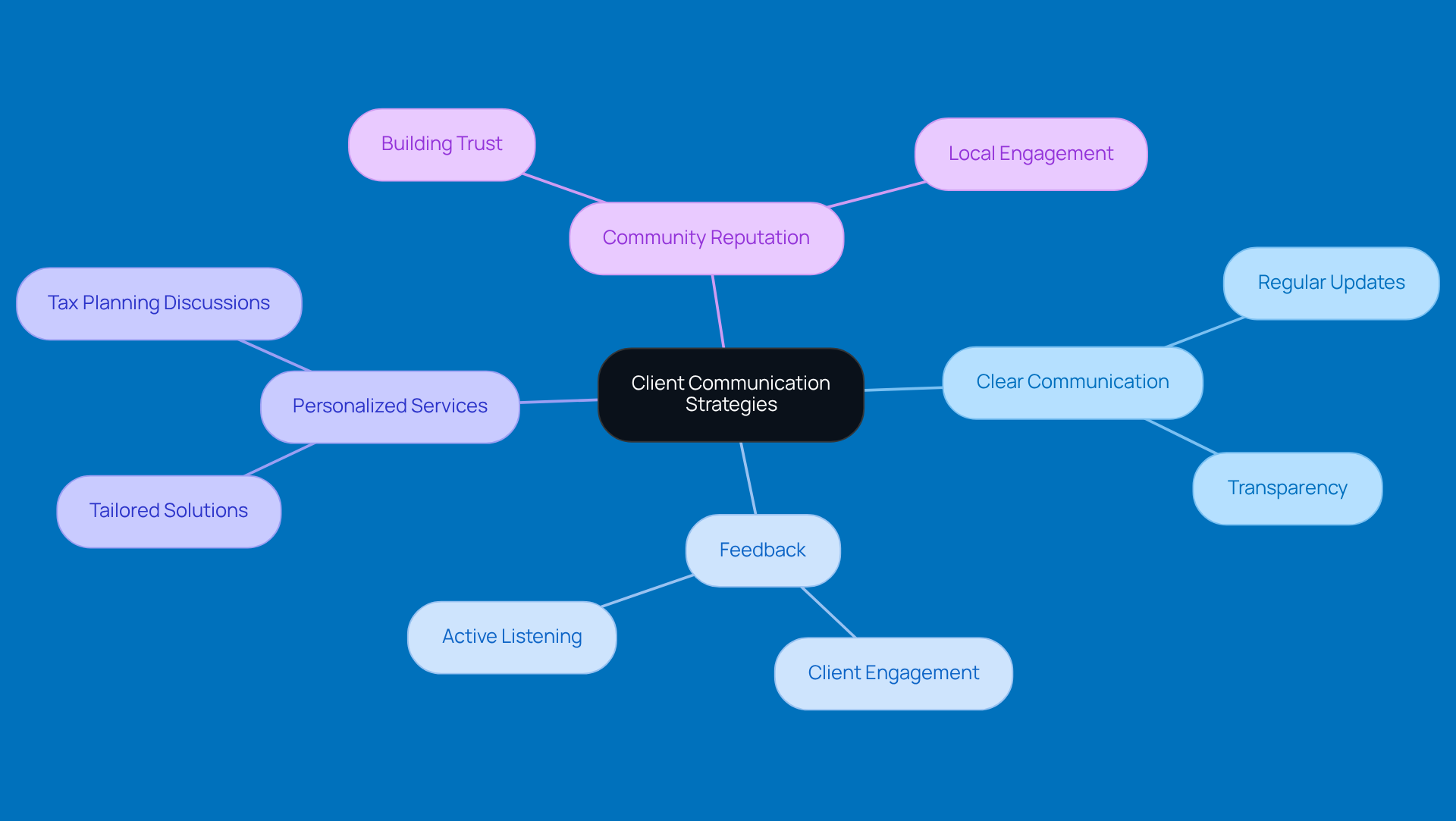

Client Communication Strategies: Enhancing Relationships for Rural Businesses

Effective client communication strategies are super important for building strong relationships in local businesses. Steinke and Company points out that when communication is clear and consistent, it really helps to build trust and loyalty among clients. This means keeping clients in the loop with regular updates on financial performance, actively asking for feedback, and offering personalized services that cater to their unique needs.

By focusing on strong communication, local entrepreneurs can not only improve their client relationships but also boost their reputation in the community. Plus, when you mix effective communication with tax planning solutions, you can really ramp up client satisfaction and retention. For example, having regular chats about tax planning solutions can make clients feel more informed and engaged, which leads to a stronger partnership.

Did you know that 96% of clients believe effective communication is key in their interactions with companies? Yet, 95% feel there’s room for improvement in this area. This gap presents a fantastic opportunity for countryside businesses to stand out with exceptional communication methods, ultimately leading to better client retention and satisfaction. So, how are you planning to enhance your communication strategies?

Demonstrating Expertise: Building Trust in Tax Planning for Rural Owners

Building trust with local business owners starts with establishing expertise in tax planning solutions. Just look at Steinke and Company - they really shine in this area! They keep things transparent, offering clear insights into tax regulations and sharing real-life case studies that showcase successful outcomes. By positioning themselves as trusted advisors, they help local entrepreneurs feel more confident when dealing with their own clients.

This approach does wonders for strengthening relationships and boosting client retention. After all, clients are much more likely to stick around when they see their advisors genuinely committed to transparency and expertise. And let’s be honest, who doesn’t appreciate a little honesty in financial matters? As industry experts often say, effective communication in financial services is crucial for nurturing trust and paving the way for long-term success with tax planning solutions.

So, how are you building trust with your clients?

Tailored Marketing Solutions: Attracting Clients in Rural Markets

Effective marketing solutions are key to attracting clients in remote markets, right? Steinke and Company suggests that local businesses should craft marketing strategies that really connect with the unique needs and preferences of their communities. This means:

- Tapping into local events

- Using social media to its fullest

- Getting involved in community outreach to boost brand visibility

By embracing a localized marketing strategy, countryside entrepreneurs can forge meaningful connections with potential clients. It’s all about nurturing those long-term relationships that support sustainable growth. Plus, these strategies not only help draw in clients but also strengthen community ties, positioning businesses as vital parts of their local economies. So, how are you planning to connect with your community?

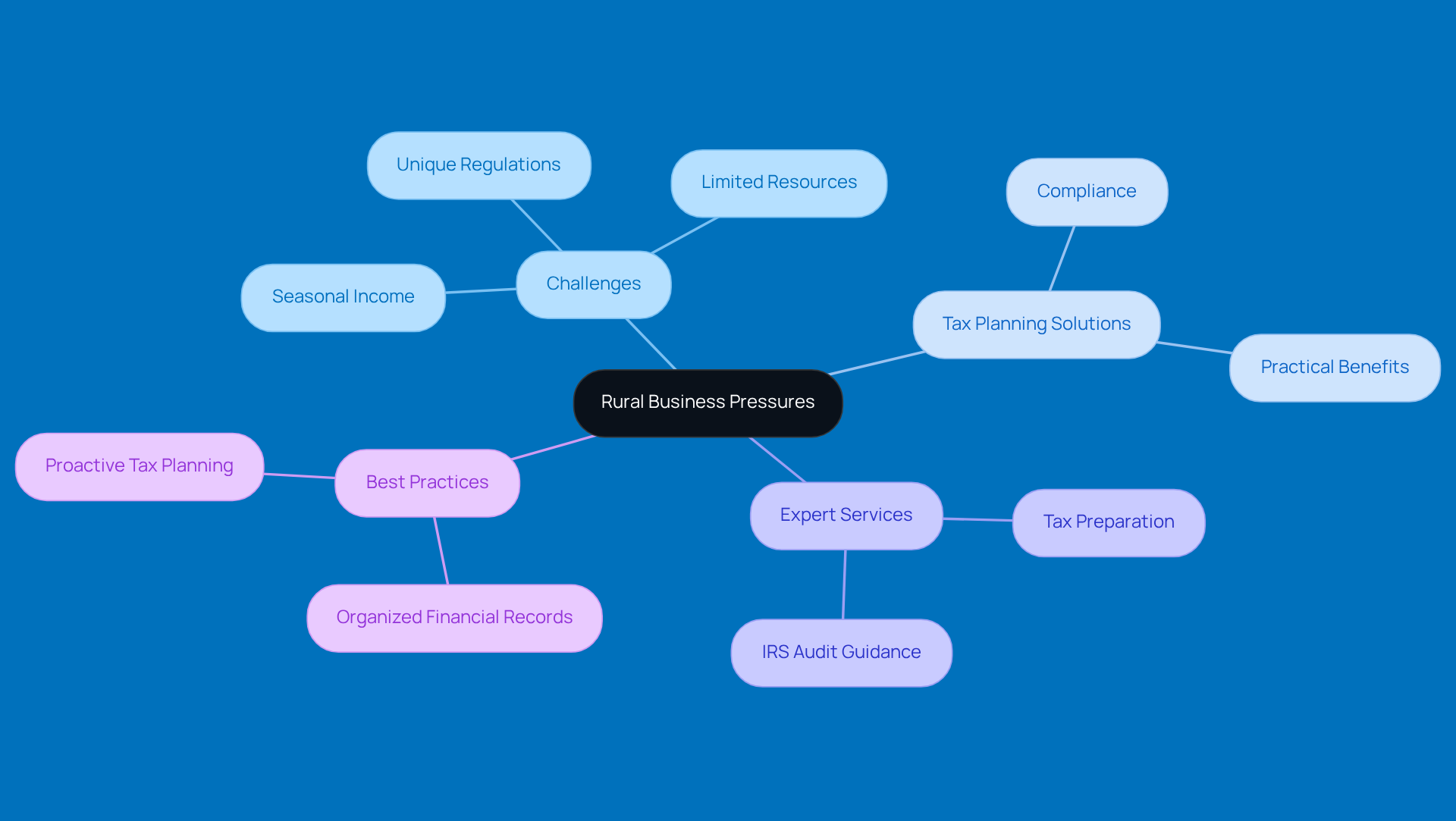

Understanding Rural Business Pressures: Essential for Effective Tax Planning

Understanding the challenges faced by rural businesses is key to developing smart tax planning solutions. At Steinke and Company, we get that local entrepreneurs often deal with seasonal income ups and downs, limited resources, and some pretty unique regulations. By keeping these factors in mind, we can develop tax planning solutions that are not just compliant but also practical and beneficial for our clients. This tailored approach helps rural entrepreneurs utilize tax planning solutions to manage their tax obligations while focusing on growth and sustainability.

Plus, we offer expert tax preparation services that help minimize surprises come tax season. We provide thorough guidance on navigating IRS audits, making sure our clients understand their rights and are well-prepared. This is super important for reducing stress and paving the way for business success.

To make your tax planning solutions even smoother, consider keeping your financial records organized throughout the year. This simple step can really simplify the audit process and help ensure compliance. So, how do you keep track of your finances? Let's chat about it!

Conclusion

Steinke and Company really highlights how important customized tax planning is for rural businesses. They show that tailored strategies can boost profitability and keep things compliant. By getting to know the unique challenges these businesses face - like seasonal income swings and specific regulations - they offer support that helps entrepreneurs tackle tax obligations with confidence.

Throughout the article, we see key insights about the value of proactive communication, monthly financial check-ins, and smart tax planning. When rural businesses engage with their clients regularly, share expert advice, and manage cash flow effectively, they set themselves up for sustainable growth. And it’s not just about ticking boxes for compliance; these services help create a culture of informed decision-making and financial resilience.

So, let’s not underestimate the power of effective tax planning solutions. They do more than just help rural businesses survive tough times; they also play a big role in the economic stability of their communities. By investing in tailored tax services and expert guidance, entrepreneurs can focus on what they do best while keeping their financial health strong and ready for future opportunities. Why wait? Now’s the perfect time to explore how these strategies can take your rural business to new heights!

Frequently Asked Questions

What customized services does Steinke and Company provide for rural businesses?

Steinke and Company offers customized tax planning solutions specifically for agricultural businesses, blending local insights with professional expertise to create tailored strategies that address each client's unique situation.

How often does Steinke and Company meet with clients?

They meet with clients 1-3 times a year to review tax returns and current financials, ensuring compliance and minimizing surprises.

Why is tax planning important for local enterprises?

Effective tax planning is crucial for boosting profitability and navigating complex tax regulations, allowing businesses to optimize their tax positions while focusing on their core values.

What specific challenges do agricultural businesses face that Steinke and Company addresses?

They understand the seasonal income fluctuations, multi-generational transitions, and specific regulations that come with running a countryside enterprise.

How does Steinke and Company help with tax compliance for rural entrepreneurs?

They provide comprehensive tax planning solutions that assist in staying compliant while strategically minimizing tax liabilities through meticulous record-keeping, timely filing, and maximizing available deductions and credits.

What is the average effective tax rate for small businesses in agriculture?

Small businesses in agriculture enjoy an average effective tax rate of just 14.9%.

What benefits can effective tax planning provide for businesses?

Effective tax planning can lead to significant savings, allowing businesses to reinvest more money into their growth and enhancing economic stability and success in rural areas.

What services does Steinke and Company offer for startups?

Steinke and Company provides startup consulting services that help new rural businesses with organizational structure, financial planning, tax planning solutions, and compliance requirements.

How can Steinke and Company help new entrepreneurs avoid common pitfalls?

Their expert advice guides new entrepreneurs through the complexities of launching a business, helping them navigate tax obligations and develop strategic plans that align with their vision.