Introduction

Navigating the world of tax forms can feel a bit overwhelming, right? Understanding the differences between them is super important, especially when it comes to reporting your income.

Take Form 1099-INT, for instance. It’s all about interest income. Then there’s Form 1099-B, which is used for reporting the proceeds from selling securities.

Getting these mixed up can really mess with your tax obligations and lead to some costly mistakes. So, how can you make sure you’re using the right form and steering clear of any misreporting pitfalls? Let's dive in!

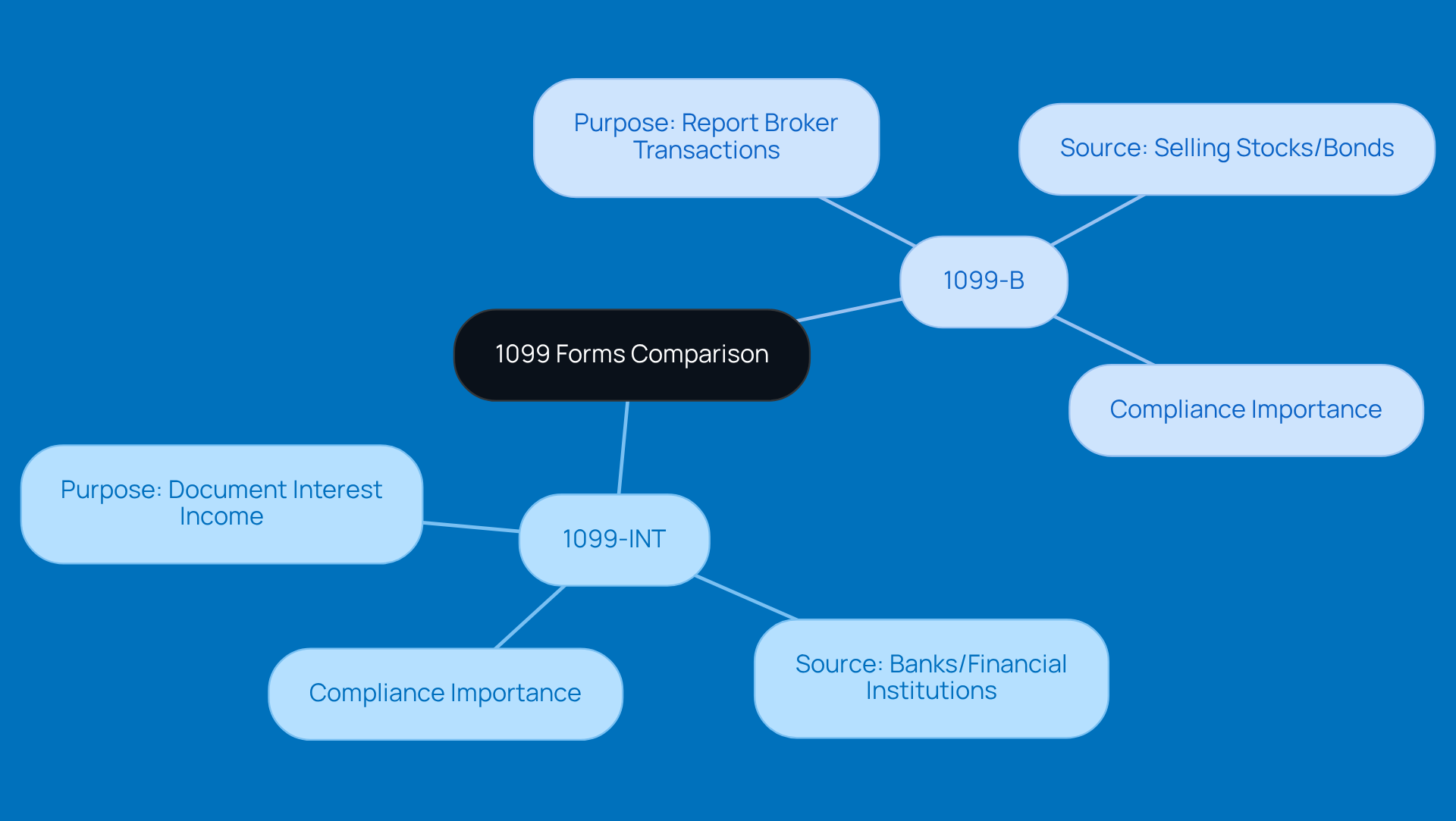

Understand the Core Differences Between 1099-INT and 1099-B

Form 1099-INT is all about documenting interest income, which usually comes from banks or financial institutions. On the flip side, Form 1099-B is what you use to report proceeds from broker transactions, like selling stocks and bonds. Understanding the difference between 1099 vs 1099 B forms is crucial as it helps you avoid misreporting your income and facing penalties from the IRS.

Did you know that, according to a survey of accounts payable pros, U.S. companies spend an average of 40 hours each January just on 1099 documentation? That really shows how tricky compliance can be! And here’s a heads-up: for the 2026 tax year, the threshold for disclosure is going up from $600 to $2,000 for payments made after December 31, 2025.

Tax experts are clear on this: if you don’t distinguish between the 1099 vs 1099 B documents, you may end up making costly mistakes. So, it’s crucial to pay attention to your disclosure practices. By understanding the key differences between 1099 vs 1099 B, you can navigate your tax obligations more smoothly and steer clear of potential pitfalls.

If you’re feeling overwhelmed, don’t worry! Steinke and Company is here to help with expert tax preparation and planning services. We make sure you stay compliant and minimize surprises, turning the filing process into a stress-free experience for small agency owners.

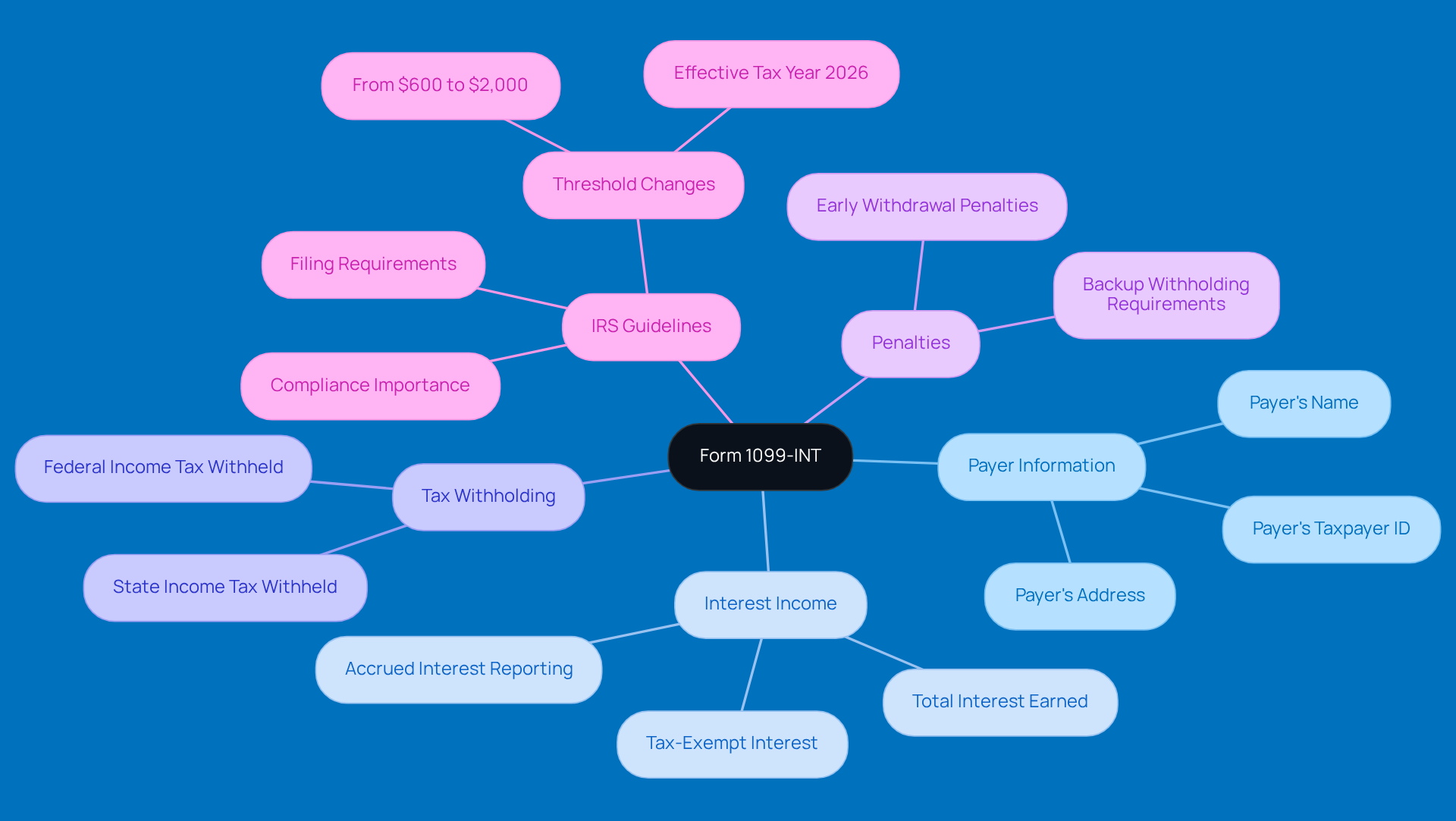

Explore What Information Is Included in Form 1099-INT

Hey there! Let’s talk about Document 1099-INT. This little form is super important for reporting your interest income. It lays out key details like the payer's name, address, and taxpayer ID, along with your info too. It’s all about showing the total interest you earned during the tax year, which is crucial for getting your taxes right.

Now, according to IRS guidelines, if you received at least $10 in amounts reported in boxes 1, 3, and 8, you’ll need a 1099-INT for each individual. This form also tells you if any federal income tax was withheld, keeping things transparent for both you and the IRS. And if there are any early withdrawal penalties? Yep, those are noted too, so you know what might affect your taxable income.

Staying on top of the latest IRS guidelines for 1099-INT submissions is key. It helps you avoid any discrepancies and ensures you’re compliant. Plus, keeping precise records with this form can really impact your overall financial situation, so don’t overlook it!

And speaking of keeping track, understanding your paystub is just as important. It makes sure you’re getting paid correctly and that the right amount is withheld for taxes - nobody likes surprises come tax time, right?

Oh, and here’s a heads-up: starting in tax year 2026, the threshold for issuing 1099s is going up from $600 to $2,000. That’s a big change to keep in mind for your tax planning! If you’re feeling a bit lost in all these changes, don’t worry - Steinke and Company’s tax preparation services are here to help small agency owners navigate this stuff. We’ll make sure you’re compliant and minimize any surprises during tax season!

Discover What Is Reported on Form 1099-B

The 1099-B document is super important when it comes to reporting the money you make from selling securities like stocks, bonds, and mutual funds. This form captures key details such as the sale date, the amount you received, and the cost basis. These details are crucial for figuring out your capital gains or losses. For instance, if you sell a stock for $5,000 that you bought for $3,000, the capital gain you’d report on your 1099-B would be $2,000. This info then gets transferred to form 8949, where you can lay out your transactions and ultimately report your total gains or losses on Schedule D of your tax return.

Recently, there have been some changes to the 1099-B requirements. Now, brokers and barter exchanges need to report each transaction individually. This ensures you get accurate information for your filings. Make sure to grab your 1099-B by February 15 each year so you can report your taxable capital gains correctly. Plus, the form includes details on any federal tax withheld, which can affect your overall tax bill. Just a heads up: commissions aren’t included on the 1099-B. So, understanding the ins and outs of the 1099 vs 1099 b is key for you, especially as you navigate the complexities of capital gains calculations and documentation.

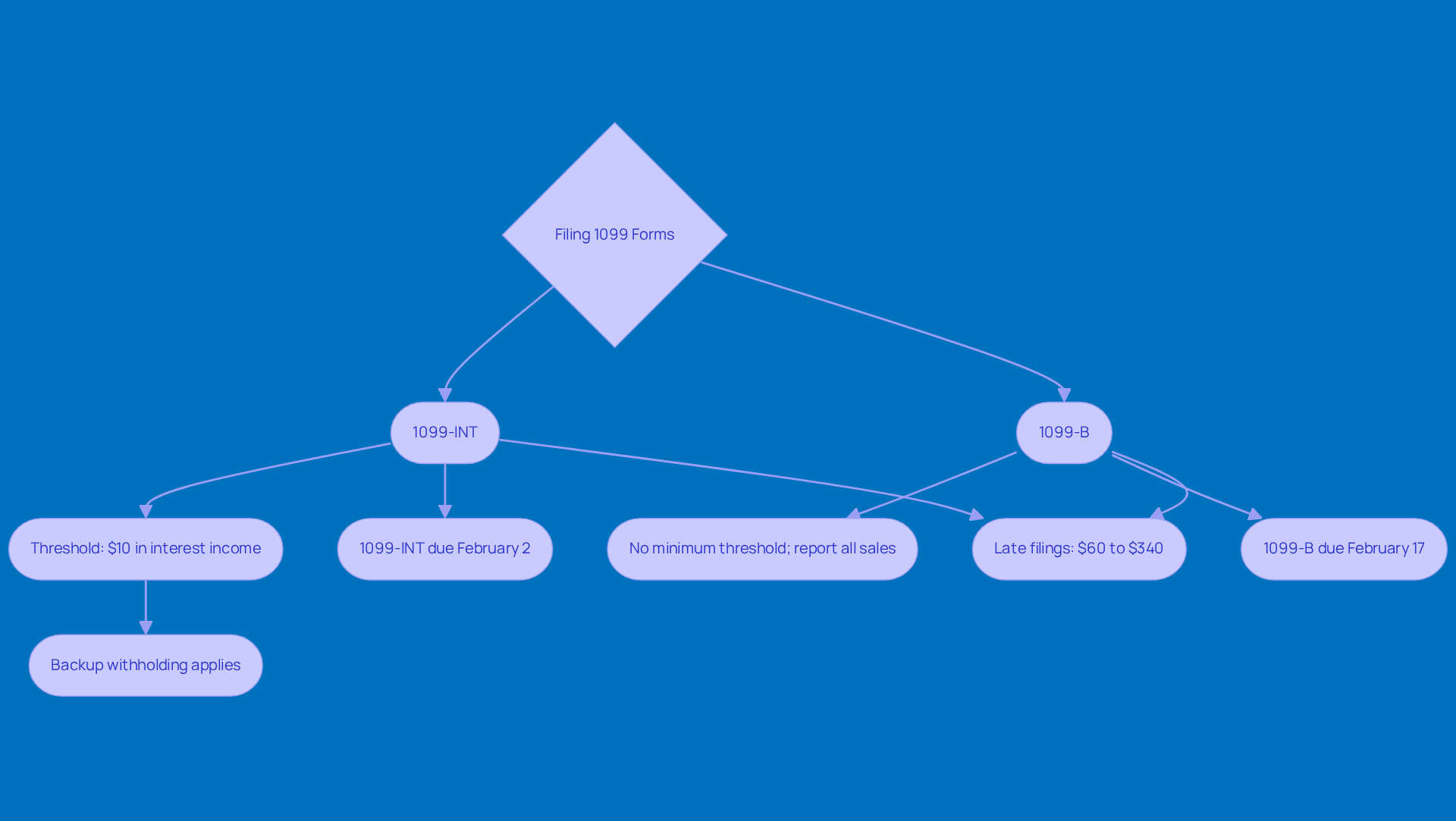

Identify the Filing Thresholds for 1099-INT and 1099-B

When it comes to document 1099-INT, the reporting threshold is set at $10 in interest income. So, if a payer credits or pays at least this amount in interest, they’ve got to file the form. But there’s more! If federal income tax was withheld under backup withholding rules, the 1099-INT still needs to be filed, no matter how much was paid.

Now, let’s talk about the comparison of 1099 vs 1099 b. Unlike the 1099-INT, there’s no minimum threshold here; any sale of securities has to be reported, regardless of the amount. This distinction regarding 1099 vs 1099 b is super important for taxpayers. Understanding these thresholds helps ensure you’re in compliance with IRS requirements and can save you from potential penalties.

Looking ahead to 2026, timely filing is key. The deadlines for Form 1099-INT are set for February 2, while the comparison of 1099 vs 1099 B shows that Form 1099-B is due on February 17. And don’t forget, the IRS submission deadline for paper documents is March 2, 2026, for both forms. Following these guidelines not only helps you keep your documentation on point but also supports your overall adherence to IRS regulations.

And just a heads up-penalties for late filings can range from $60 to $340! So, it’s really important to meet these deadlines. Have you got your forms ready? Let’s make sure you’re all set!

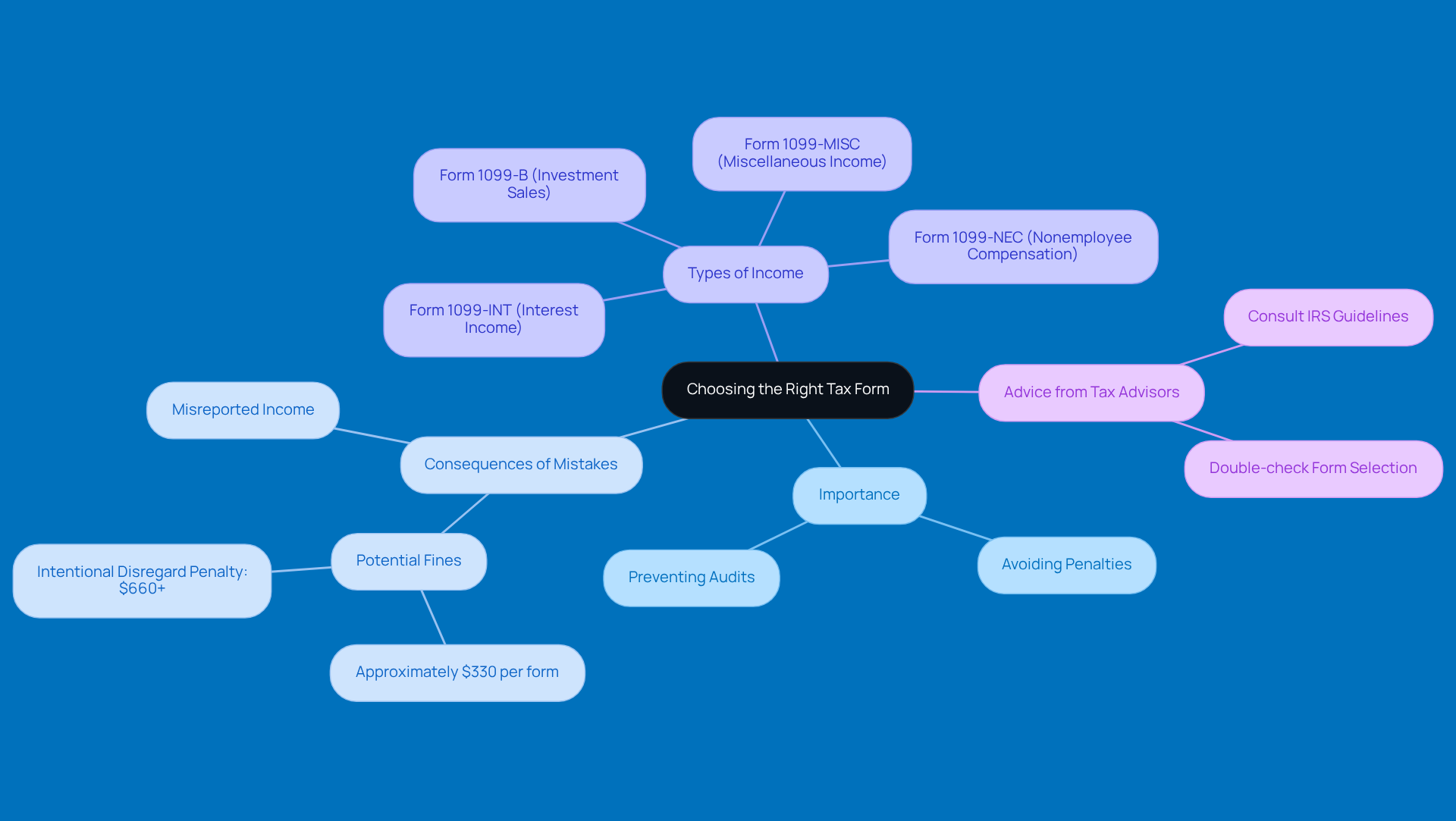

Recognize the Importance of Choosing the Right Form

Choosing the right form in the 1099 vs 1099 B comparison is super important for getting your taxes right. If you accidentally use Form 1099-INT, which is meant for reporting interest income, instead of the correct Form 1099 vs 1099 B for investment sales, you could run into some serious tax headaches. Many folks get confused between the 1099 vs 1099 B forms, highlighting how crucial it is to understand the type of income you’re dealing with.

Tax advisors often point out that picking the right form isn’t just about following the rules; it can save you from costly mistakes and even audits. Using the wrong document can lead to misreported income, and that can mean penalties that pile up over time - think fines that can hit around $330 per document if you don’t file correctly.

At Steinke and Company, we make tax season a breeze! We handle your business and personal returns, ensuring everything’s filed accurately and on time, so you can avoid those nasty surprises. Recently, there’s been a lot of chatter in the tax community about how sticking to the right reporting guidelines is key to dodging big financial issues. So, it’s really important for taxpayers to be careful when choosing their documents. What’s your experience with tax forms? Let’s make sure you’re on the right track!

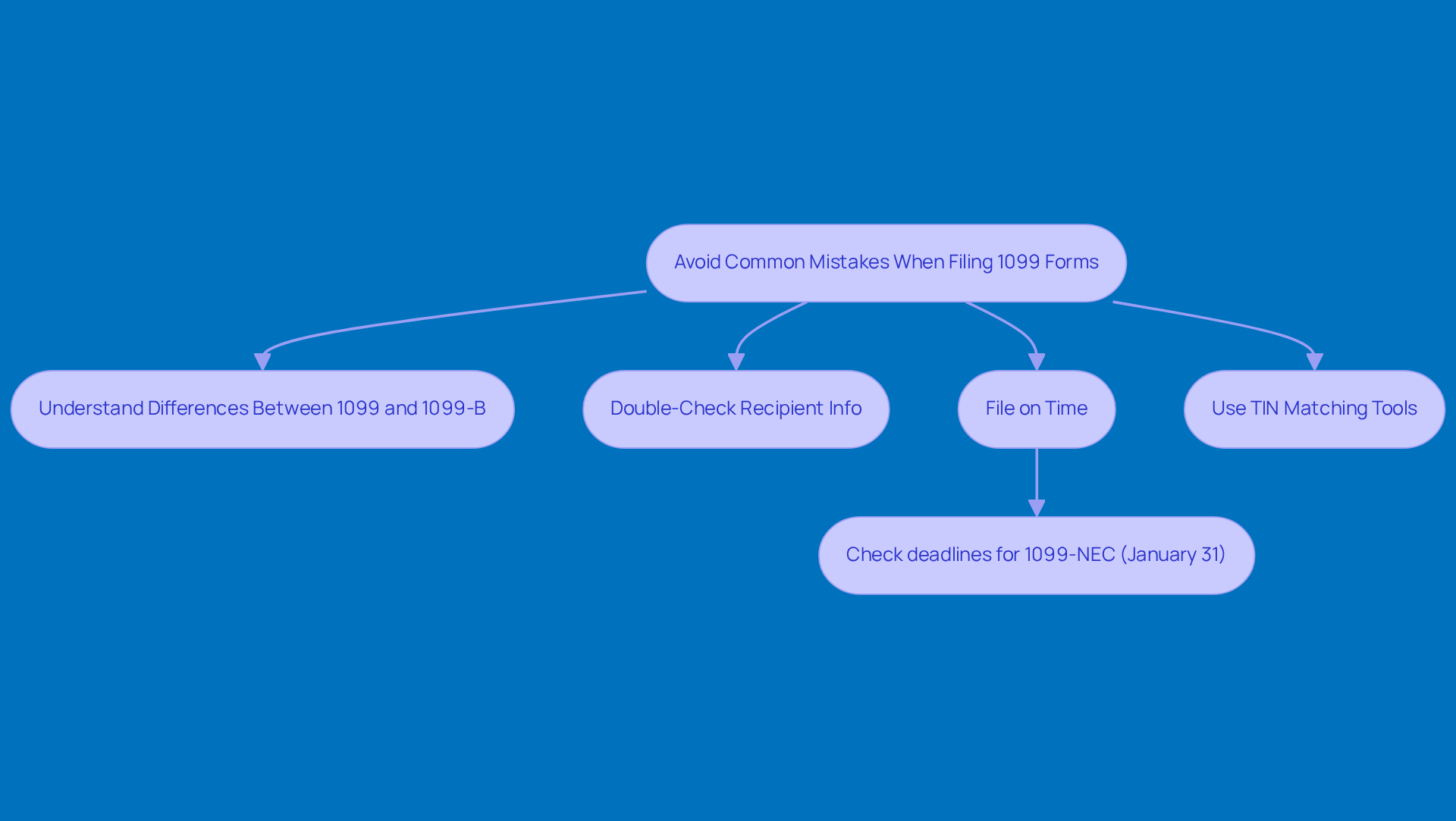

Avoid Common Mistakes When Filing 1099 Forms

Common mistakes in the differences between 1099 vs 1099 b filings can really lead to some hefty penalties and complications. You know, things like using the wrong type of document, entering incorrect recipient info, or missing those filing deadlines are all too common. Just a heads up: in 2026, the IRS raised penalties for late submissions, with fines ranging from $60 to $280 per document, depending on how overdue it is. For instance, if a business forgets to file for 50 contractors, they could be looking at penalties exceeding $33,000. Yikes!

So, what can you do? Taxpayers should double-check all entries like it’s their job, making sure the right document is used, particularly understanding the differences in reporting between 1099 vs 1099 b, and that recipient details, including names and taxpayer identification numbers (TINs), are spot on. And don’t forget to file on time! To avoid those pesky penalties, it's important to understand the differences in deadlines for 1099 vs 1099 b, with the 1099-NEC needing to be submitted by January 31. Plus, if you’re filing 250 or more information returns, you’ll need to submit electronically to avoid even more penalties.

To keep these risks at bay, taking a proactive approach is key. This means validating payee data early, using TIN matching tools, and getting a head start on those 1099 filings. Tax pros often say that many common errors can be avoided by keeping accurate records and sticking to IRS guidelines. By adopting these best practices, businesses can really cut down on the chances of costly mistakes and ensure a smooth filing process. So, why not start today?

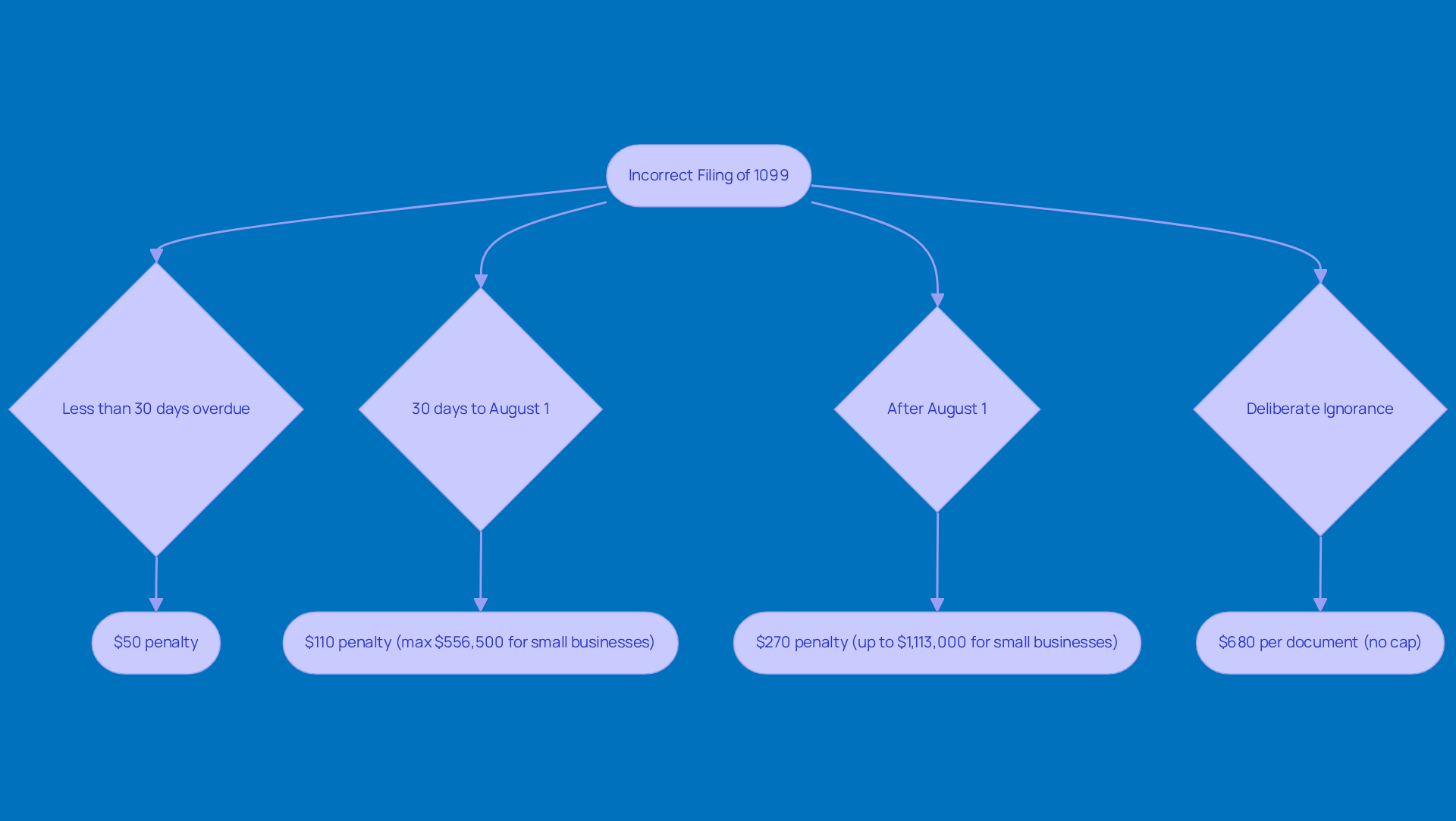

Understand the Consequences of Incorrect Filing

Filing 1099 documents incorrectly can really hit you with some hefty penalties, and they can vary depending on how late you are. For instance, if you submit a document that's less than 30 days overdue, you're usually looking at a fine of about $50 for each submission. But if you miss that window and file after that but before August 1, the penalty jumps to $110 per submission, with small businesses facing a maximum penalty of $556,500! And if you wait until after August 1? Well, that’ll cost you even more - $270 per submission, which can add up to a staggering $1,113,000 for small enterprises.

Now, it’s not just about the fines. Taxpayers might also find themselves under the IRS microscope, especially if there are any discrepancies in reported income. If you deliberately ignore submission requirements, you could be slapped with fines of $680 per document, and there’s no cap on that! Just think about a city that faced a jaw-dropping $42,000 penalty for not filing W-2 and 1099 forms on time. That really shows the financial risks of not keeping up with compliance.

So, how can businesses dodge these pitfalls? It’s crucial to understand your filing obligations and make sure you’re submitting everything on time and accurately. Keeping an eye on IRS updates and having solid vendor validation processes in place can really help lower the chances of racking up those penalties.

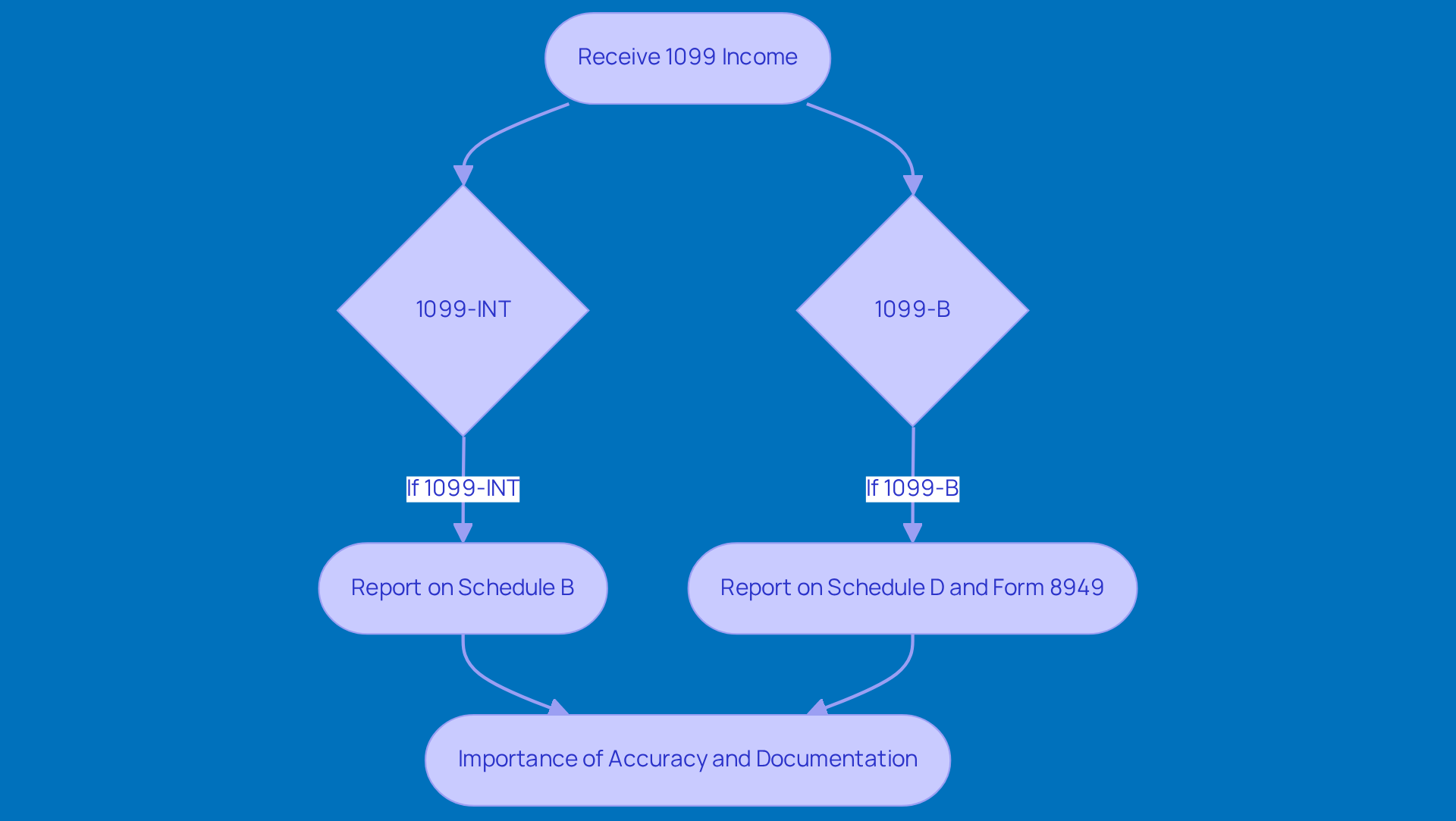

Learn How to Report Income from 1099-INT and 1099-B on Tax Returns

When you receive income reported on a 1099-INT, it typically goes on Schedule B of your 1040. This is where you report your interest income. Now, if you’ve got proceeds from a Form 1099 vs 1099 B, which indicates gains or losses from selling securities, those are reported on Schedule D and Form 8949. It’s super important for taxpayers to make sure these amounts are accurately reflected on their returns to stay in line with IRS guidelines.

Looking ahead to the 2026 tax year, you’ll want to pay close attention to the IRS's documentation requirements for 1099 income. Why? Because any discrepancies could lead to audits or penalties, and nobody wants that! Keeping your documentation precise not only helps you stay compliant but also makes it easier to manage your tax obligations. So, let’s keep everything in check and make tax time a little less stressful!

Leverage Steinke and Company for Expert Guidance on 1099 Forms

At Steinke and Company, we’re all about helping small business owners navigate the tricky world of 1099 vs 1099 b filings. With the recent changes, like the jump for 1099 vs 1099 b from $600 to $2,000 starting in 2026, it’s more important than ever to get a grip on these responsibilities. Our expert team is here to help you dodge common pitfalls, keep you compliant, and save you from those pesky penalties that can hit up to $340 for each missed form.

Take Sarah, for example. She’s a small business owner who took advantage of our personalized tax strategies and saw her taxable income drop significantly. This not only eased her stress but also gave her the chance to reinvest in her business. How great is that?

And it doesn’t stop there! Our consulting services have really made a difference for our clients. Just look at a mid-sized construction company we worked with - they improved their invoice processing time by a whopping 60% after following our recommendations. By letting us handle the nitty-gritty of 1099 vs 1099 b compliance, our clients can concentrate on what they do best, fostering a stronger business environment all around.

Review Key Takeaways on 1099-INT vs 1099-B

So, here’s the scoop: when discussing 1099 vs 1099 B, Form 1099-INT is all about reporting your interest income, while Form 1099-B dives into the details of proceeds from selling securities. It’s super important to grasp these differences, along with the filing thresholds and reporting requirements, to keep your tax game strong and compliant.

At Steinke and Company, we’re here to make your tax season a breeze! Our expert tax preparation and planning services ensure everything runs smoothly, accurately, and without the stress. We focus on compliance and proactive planning, which means fewer surprises for you. So, you can tackle your tax obligations with confidence and maybe even a smile!

Conclusion

Understanding the differences between Form 1099-INT and Form 1099-B is super important for getting your taxes right. While 1099-INT is all about interest income, 1099-B deals with the money you make from selling securities. Knowing these distinctions can save you from some costly mistakes and help you stay on the IRS's good side, avoiding any nasty penalties.

Throughout this article, we’ve highlighted some key points, like:

- What info each form includes

- The different filing thresholds

- What happens if you submit the wrong thing

It’s crucial to pick the right form and stick to deadlines - this diligence in tax prep can really pay off. Plus, getting some expert advice from folks like Steinke and Company can make the filing process a whole lot easier.

So, what’s the takeaway? Taxpayers should take proactive steps to understand their responsibilities when it comes to 1099 forms. By doing this, you can manage your tax duties with confidence and reduce the risks of misreporting income or missing deadlines. Taking action now will set you up for a smoother tax season ahead, ensuring you stay compliant and keep your finances in check.

Frequently Asked Questions

What is Form 1099-INT used for?

Form 1099-INT is used to document interest income that usually comes from banks or financial institutions. It reports the total interest earned during the tax year.

What information is included in Form 1099-INT?

Form 1099-INT includes the payer's name, address, taxpayer ID, the recipient's information, the total interest earned, any federal income tax withheld, and any early withdrawal penalties.

What is the threshold for issuing Form 1099-INT?

According to IRS guidelines, if you received at least $10 in amounts reported in boxes 1, 3, and 8, you will need a 1099-INT for each individual.

What is Form 1099-B used for?

Form 1099-B is used to report proceeds from broker transactions, such as selling stocks, bonds, and mutual funds. It captures key details like the sale date, the amount received, and the cost basis.

How do I report capital gains using Form 1099-B?

To report capital gains, you transfer the information from Form 1099-B to Form 8949, where you can detail your transactions and report total gains or losses on Schedule D of your tax return.

What recent changes have been made to Form 1099-B requirements?

Recent changes require brokers and barter exchanges to report each transaction individually, ensuring accurate information for your filings.

When should I expect to receive my Form 1099-B?

You should receive your Form 1099-B by February 15 each year to report your taxable capital gains correctly.

What is the new threshold for issuing 1099 forms starting in 2026?

Starting in the tax year 2026, the threshold for issuing 1099 forms will increase from $600 to $2,000 for payments made after December 31, 2025.

Why is it important to distinguish between Form 1099-INT and Form 1099-B?

Distinguishing between the two forms is crucial to avoid misreporting income, which can lead to penalties from the IRS. Understanding their differences helps in navigating tax obligations more smoothly.

How can I get help with tax preparation and compliance?

Steinke and Company offers expert tax preparation and planning services to help small agency owners stay compliant and minimize surprises during tax season.