Introduction

As the year wraps up, small business owners are faced with the tricky task of navigating complex tax regulations while trying to make the most of their financial outcomes. But don’t worry! This article is here to share ten strategic approaches that can turn year-end tax planning from a daunting chore into a chance for some serious savings and growth.

With potential changes on the horizon and the IRS estimating that tax complexity costs the economy over $536 billion each year, you might be wondering: how can rural entrepreneurs like you use tailored tax strategies not just to comply with regulations, but to boost your bottom line?

Leverage Steinke and Company for Comprehensive Tax Planning

Steinke and Company brings a fresh approach to tax compliance and strategic planning, specifically designed for small businesses in rural America. With their expertise, entrepreneurs can tackle the tricky world of tax regulations while making the most of deductions and credits. This partnership leads to a customized year end tax planning strategies that take into account the unique situations of each business.

But wait, there’s more! Implementing year end tax planning strategies doesn’t just keep you compliant; it can actually boost your bottom line. Smart planning can lead to significant savings, giving companies the chance to reinvest in growth opportunities. Did you know that the IRS estimates tax complexity costs the U.S. economy over $536 billion each year? That’s a lot of money! Rural businesses can really benefit from streamlined processes that ease compliance burdens.

As rural economies face new challenges, the insights from Steinke and Company help entrepreneurs make informed decisions that align with their long-term goals. By honing in on tailored strategies, they assist clients in turning tax obligations into stepping stones for financial stability and growth. This includes essential tactics for avoiding underpayment penalties on estimated taxes, like understanding safe harbor payments and the de minimis exception, which can protect businesses from hefty IRS fees. Given the financial stakes of underpayment penalties, now’s the perfect time for rural entrepreneurs to think about year end tax planning strategies that can set them up for success, especially with the upcoming changes in opportunity zones starting July 1, 2026.

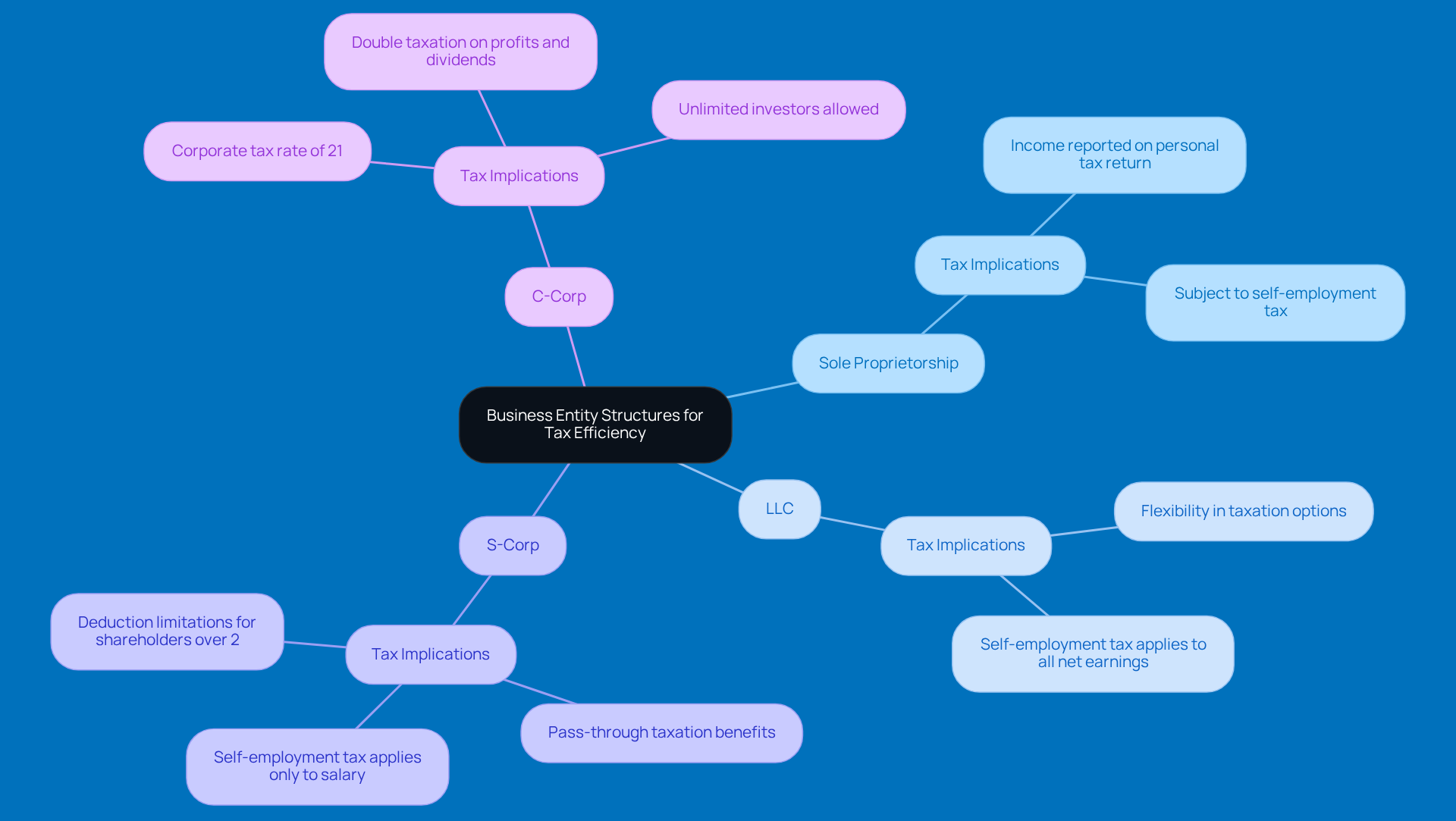

Review Your Business Entity Structure for Tax Efficiency

Hey there, small business owners! Have you taken a moment to think about your business structure lately? Whether you’re running a sole proprietorship, LLC, S-Corp, or C-Corp, it’s super important to regularly check in on how your setup affects your taxes. Each structure comes with its own set of tax implications that can really impact your overall tax burden. For example, S-Corps might give you some sweet pass-through taxation benefits, while C-Corps could face double taxation.

That’s why chatting with a tax expert can be a game changer. They can help you figure out which structure is the most tax-efficient for your business. And let’s not forget about keeping your records organized! It’s not just about being neat; it’s crucial for preparing for any potential IRS audits and staying compliant with tax regulations.

Oh, and a quick tip: the IRS generally wants you to keep your income tax records for at least three years, but there are times when you might need to hold onto them longer. By knowing your rights and responsibilities, you can take a load off your shoulders and tackle the complexities of tax compliance with a bit more ease. So, how are you managing your business structure and records? Let’s keep the conversation going!

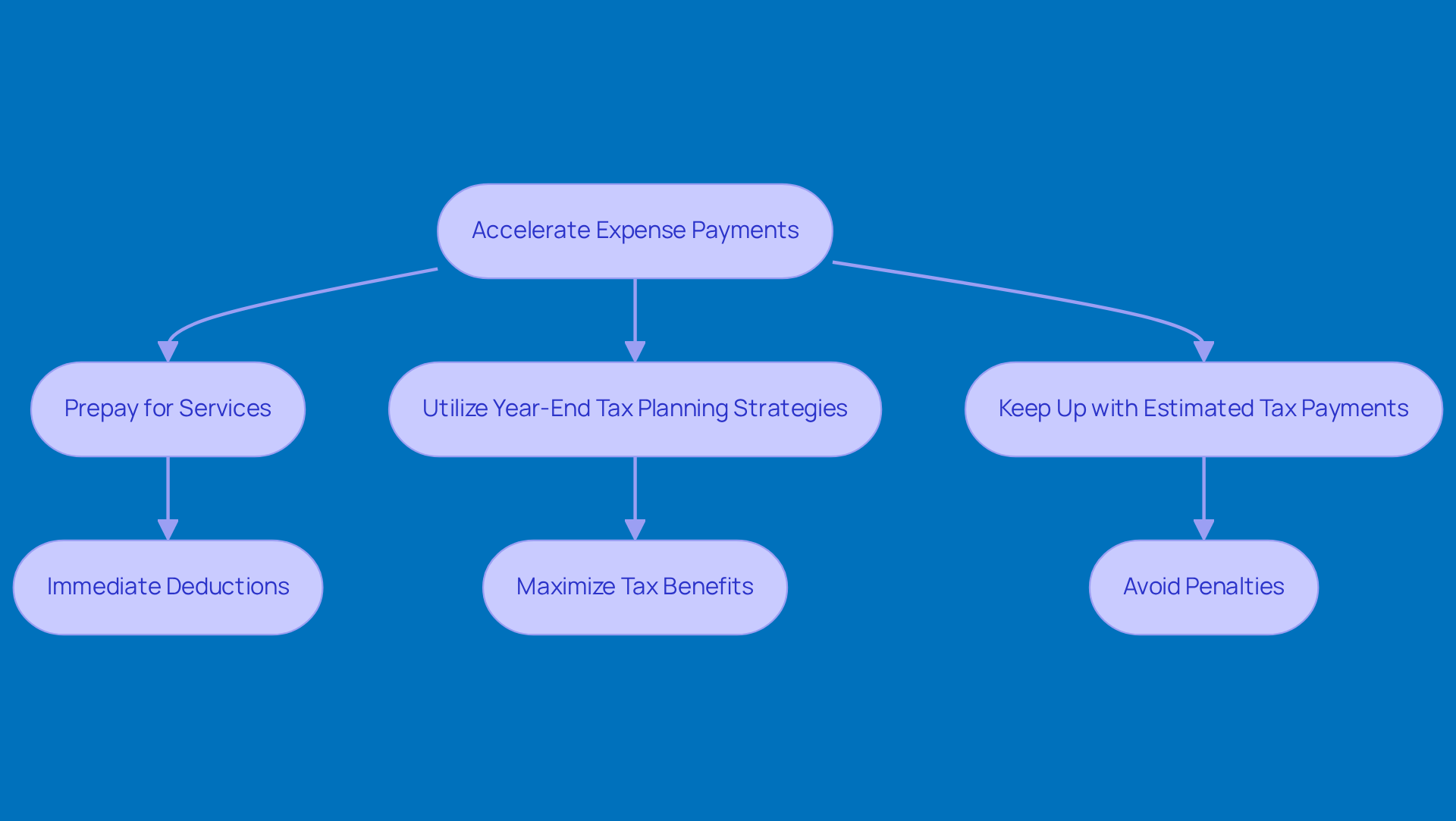

Accelerate Expense Payments to Optimize Tax Deductions

You know, speeding up your expense payments can be a game-changer when it comes to optimizing year end tax planning strategies for maximizing those tax deductions. By utilizing year end tax planning strategies, you can deduct essential operational costs like supplies, utilities, and service contracts from your taxable income before the year wraps up. This proactive move not only helps lower your tax bill but also gives your cash flow a nice boost.

For example, if you prepay for services, you can snag those immediate deductions. This way, you can make the most of any available tax credits and deductions before any potential changes in tax laws come into play. Plus, keeping up with your estimated tax payments throughout the year can save you from pesky penalties and interest, really solidifying your financial standing as you step into the new year.

So, by implementing year end tax planning strategies, small business leaders can effectively manage their expenses and maximize their tax benefits. It’s all about being smart with your money, right?

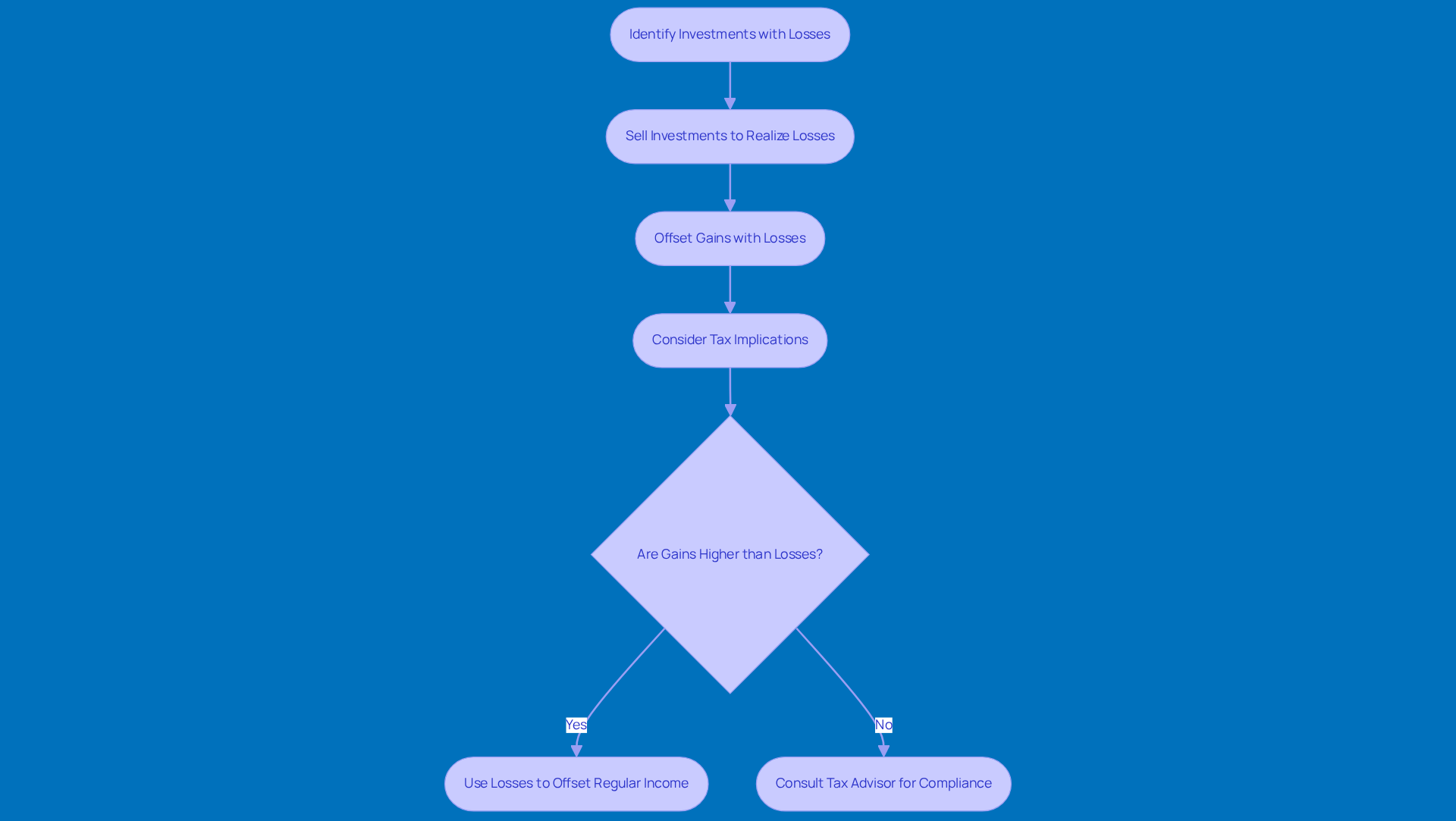

Harvest Tax Losses to Reduce Taxable Income

Tax loss harvesting is a smart strategy where you sell investments that have lost value to offset gains from others. This can be a game-changer for small business owners managing investment portfolios, as it helps lower your taxable income, potentially leading to some nice tax savings. For example, if you sell a long-term investment at a $15,000 loss but only have $5,000 in long-term gains, you can use that extra $10,000 to offset short-term gains, which are taxed at a higher rate.

But the perks of tax loss harvesting go beyond just immediate tax relief. By regularly recognizing losses, small business owners can actually boost their overall investment performance over time. This proactive approach, rather than just waiting until year-end to harvest losses, allows for more frequent and strategic loss realization, maximizing those tax benefits.

Plus, did you know that investment losses can offset up to $3,000 of regular income on your federal taxes each year? That’s a big deal for folks with significant capital gains or regular income. For instance, if a small business owner has gains from selling commercial property, they can use capital losses from tax loss harvesting to manage their tax obligations more effectively, leading to a better financial outcome.

However, it’s super important to be aware of the IRS rules around wash sales. If you buy back the same or a substantially identical security within 30 days before or after selling it, you can’t write off those losses. So, chatting with a tax advisor can really help you stay compliant and make the most of tax loss harvesting. It’s a key strategy for small business owners looking to sharpen their financial tactics through year-end tax planning strategies as the year wraps up.

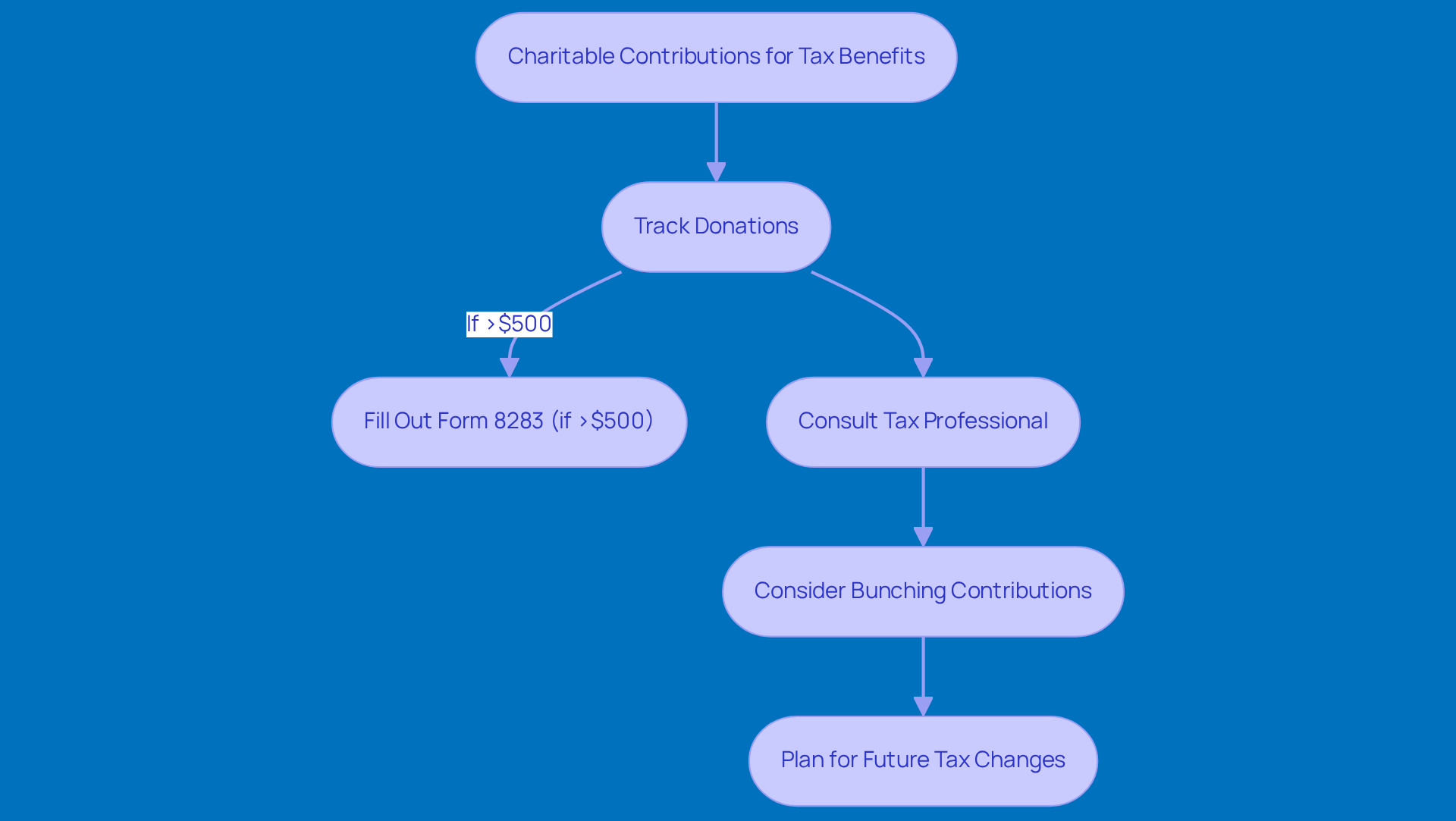

Deduct Charitable Contributions to Enhance Tax Benefits

Hey there! Did you know that charitable donations can really help out small business owners when it comes to taxes? By giving to qualified organizations, you can actually deduct those contributions from your taxable income. This not only lightens your tax load but also supports causes that you care about in your community. For instance, if you donate $30,000, you could potentially reduce your tax bill by over $7,000 if your income is around $200,000. Pretty impressive, right?

To make the most of these deductions, it’s super important to keep track of all your donations. If you give more than $500, you’ll need to fill out a separate tax Form 8283. Plus, understanding your paystub and checking your withholding can help you avoid those pesky underpayment penalties that can sneak up on you if you haven’t paid enough taxes throughout the year. A chat with a tax professional can really help you maximize those deductions as you explore year end tax planning strategies and steer clear of any costly blunders. Tax experts often say that getting a grip on the ins and outs of charitable giving can lead to better financial results.

And here’s a little tip: small businesses can benefit from 'bunching' their contributions. This means making larger donations in one go to exceed the standard deduction threshold. You might also want to think about accelerating your gifts into 2025 to get ahead of the 2026 deduction limit. With changes coming to charitable deduction rules in 2026, now’s a great time to sit down with a tax advisor to discuss your year end tax planning strategies for charitable giving. You want to make sure you’re taking full advantage of the current rules before any new restrictions kick in. By aligning your charitable contributions with your business goals, you not only boost your tax position but also strengthen those community ties.

Fund Retirement Accounts for Tax Advantages

Contributing to retirement accounts like a 401(k) or IRA can really pay off, particularly in the context of year end tax planning strategies. You see, utilizing these accounts as part of your year end tax planning strategies can be beneficial since contributions are often tax-deductible, which means they can lower your taxable income for the year. Plus, the money grows tax-deferred until you withdraw it, giving you a better chance to build your wealth over time. So, if you’re an entrepreneur, it’s definitely worth considering maxing out those contributions to make the most of these tax perks.

Now, let’s talk about your paystub. Understanding it is super important! It helps you ensure that the right amounts are being withheld for taxes and keeps you in the loop about your overall financial situation. Have you ever looked at your paystub and noticed something off? Regularly checking it can help you spot any discrepancies that might impact your retirement planning and year end tax planning strategies.

By staying on top of your paystub and your retirement contributions, you’re not just being proactive; you’re also boosting your financial stability and compliance. So, why not take a moment to review your accounts and paystub today? It could make a big difference!

Take Required Minimum Distributions to Avoid Penalties

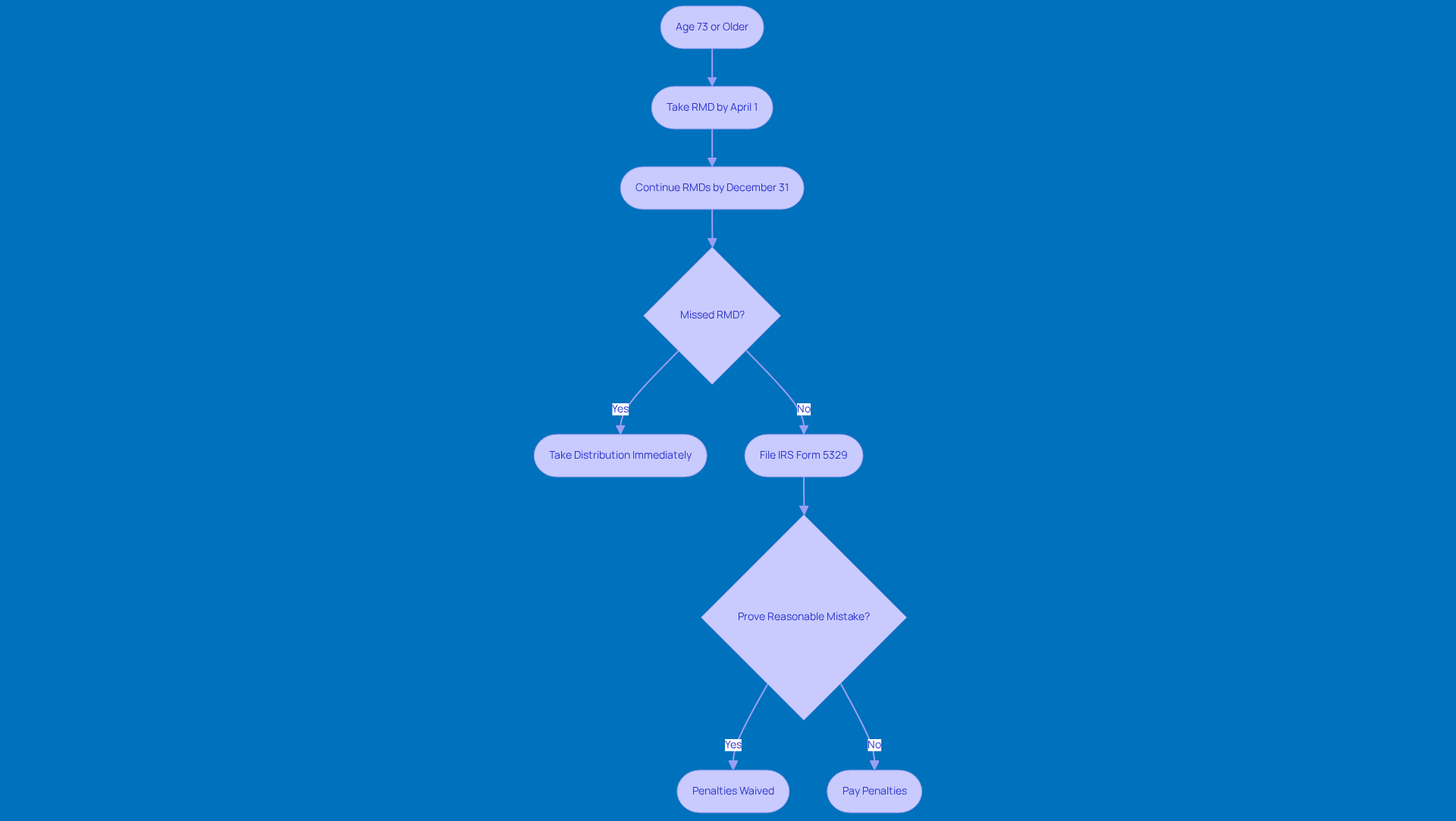

If you're an entrepreneur aged 73 or older, you need to know about Required Minimum Distributions (RMDs) from your retirement accounts. It’s not just a good idea - it’s a must! Missing these distributions can hit you hard with penalties, as the IRS can slap on an excise tax of up to 25% on the amount you didn’t withdraw. Believe it or not, nearly 7% of IRA holders forgot to take their RMD last year, missing out on an average of $11,600 each. That adds up to a staggering $1.7 billion in penalties every year!

So, how can you avoid these costly slip-ups? Planning ahead is key. Remember, your first RMD needs to be taken by April 1 of the year after your 73rd birthday, and then you’ll need to keep up with distributions by December 31 each year. If it’s your first time taking an RMD, you can actually defer your withdrawal until the following April, giving you a bit more breathing room. It’s a smart move to chat with a financial advisor to make sure you’re on track and to use tools that can help you estimate future RMDs based on your account balances and life expectancy.

Now, if you do miss an RMD, don’t panic! It’s super important to take that distribution right away to show you’re complying with IRS rules. You can file IRS Form 5329 to report the missed RMD and figure out any penalties. Sometimes, the IRS might even waive those penalties if you can prove it was a reasonable mistake and you took corrective action - just keep in mind that forgetfulness doesn’t count! Plus, if you fix the missed RMD within twenty-four months, you could see that penalty drop to just 10%.

Understanding the year end tax planning strategies for your retirement income sources, like Social Security benefits, traditional IRAs, and Roth IRAs, is crucial for effective planning. For example, while traditional IRA distributions are fully taxable, Roth IRA withdrawals can be tax-free if you meet certain conditions. By getting a handle on these requirements and utilizing year end tax planning strategies, you can navigate RMDs like a pro, lighten your tax load, and keep your retirement strategy on the right track.

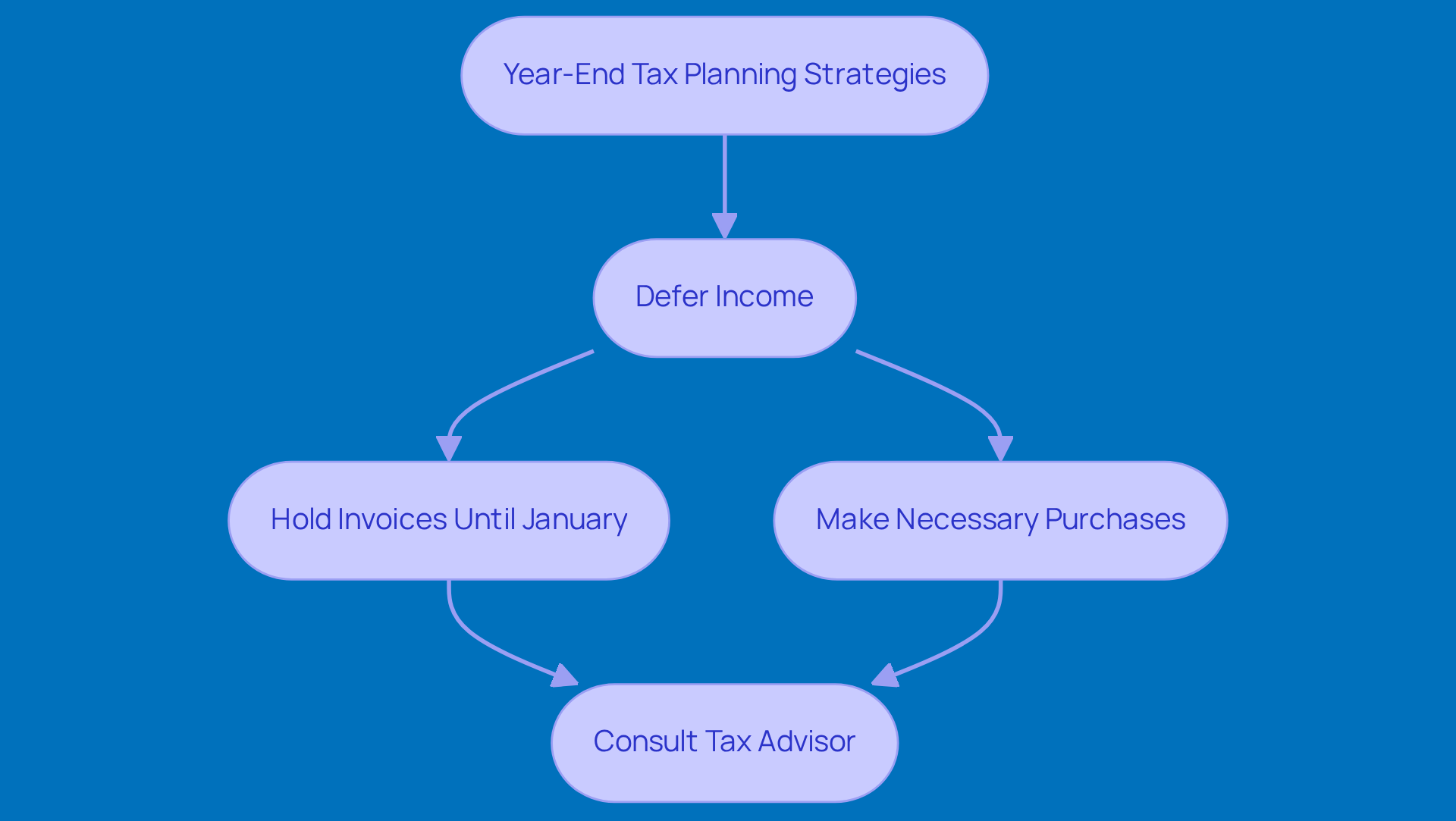

Defer Compensation to Manage Tax Liabilities

Deferring compensation can be a smart move as part of your year end tax planning strategies for managing your tax obligations. Utilizing year end tax planning strategies allows business owners to push income into the next tax period, which can really help lower your taxable income right now - especially if you think you’ll be in a lower tax bracket later on. For instance, if your cash flow allows, holding off on sending out invoices until January could mean a smaller tax bill for you this year.

Plus, don’t forget about making those necessary purchases as part of your year end tax planning strategies before December 31! This can speed up your deductions and improve your year end tax planning strategies, giving your tax situation a nice boost. But hey, before you dive into these year end tax planning strategies, it’s always a good idea to consult with a tax advisor. They can help make sure everything lines up with your financial goals and keeps you on the right side of tax regulations.

By managing income deferral wisely, small business owners can really enhance their financial health and set themselves up for a successful new year. So, what do you think? Have you tried any of these strategies before?

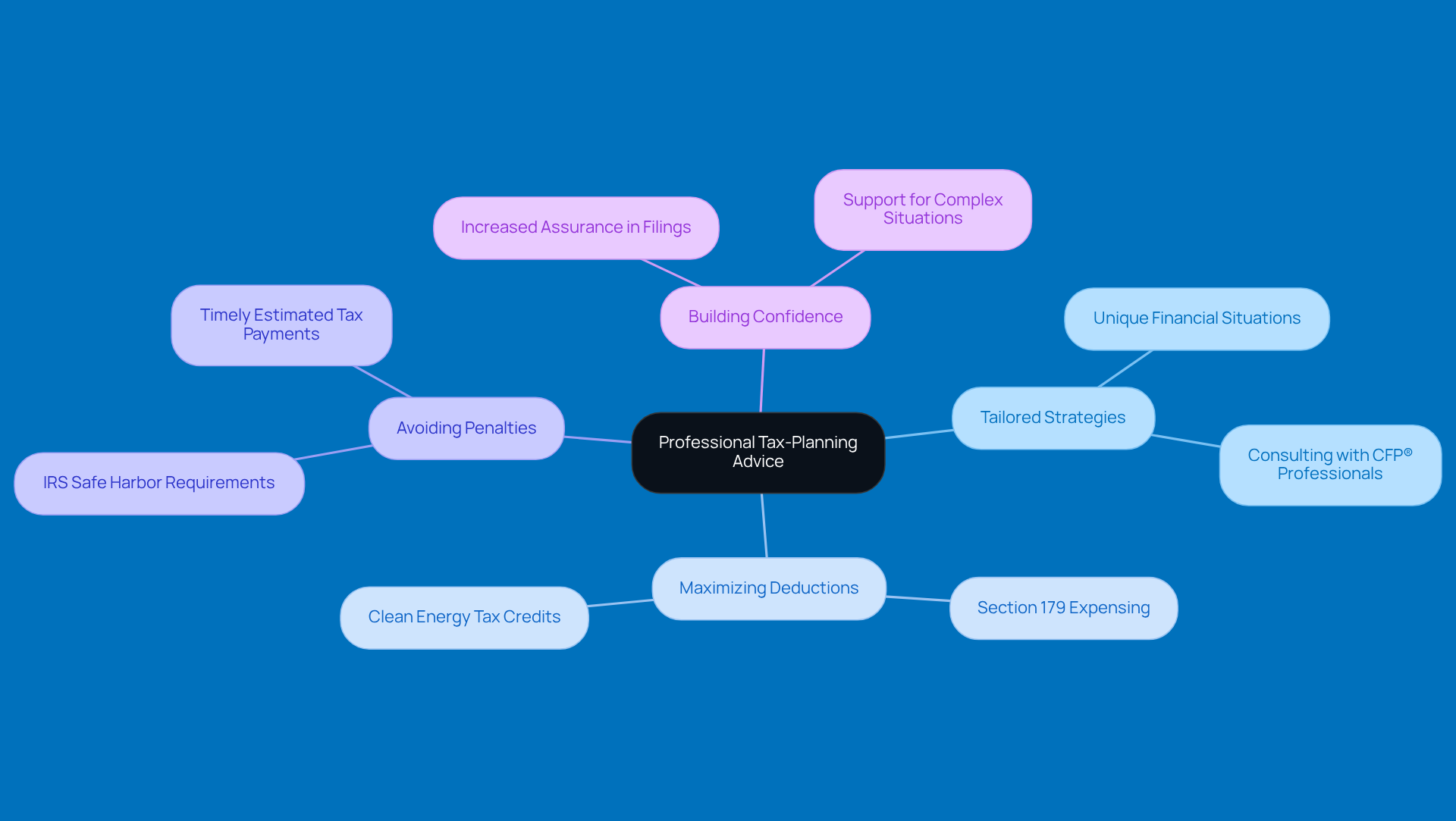

Seek Professional Tax-Planning Advice for Tailored Strategies

Working with a tax expert can really help small business leaders craft strategies that fit their unique financial situations. These pros are always up-to-date on the latest tax laws, which means they can spot potential deductions and help you navigate those tricky regulations with ease. For example, they can guide you in maximizing Section 179 expensing limits, letting you take immediate deductions for big equipment purchases while keeping you compliant with the latest documentation requirements under the One Big Beautiful Bill Act (OBBBA).

Plus, they can help you dodge those pesky underpayment penalties by making sure your estimated tax payments are on time and just right, so you meet those IRS safe harbor requirements. This partnership doesn’t just lead to significant tax savings; it also builds your confidence in meeting your legal obligations. Did you know that 96% of folks who work with tax professionals feel more assured about their tax filings? That really highlights the value of having expert guidance to optimize your financial outcomes.

So, as we gear up for the upcoming tax changes, why not consider setting up a chat with a tax expert? It’s a great way to discuss your specific needs and make sure you’re maximizing all those available deductions!

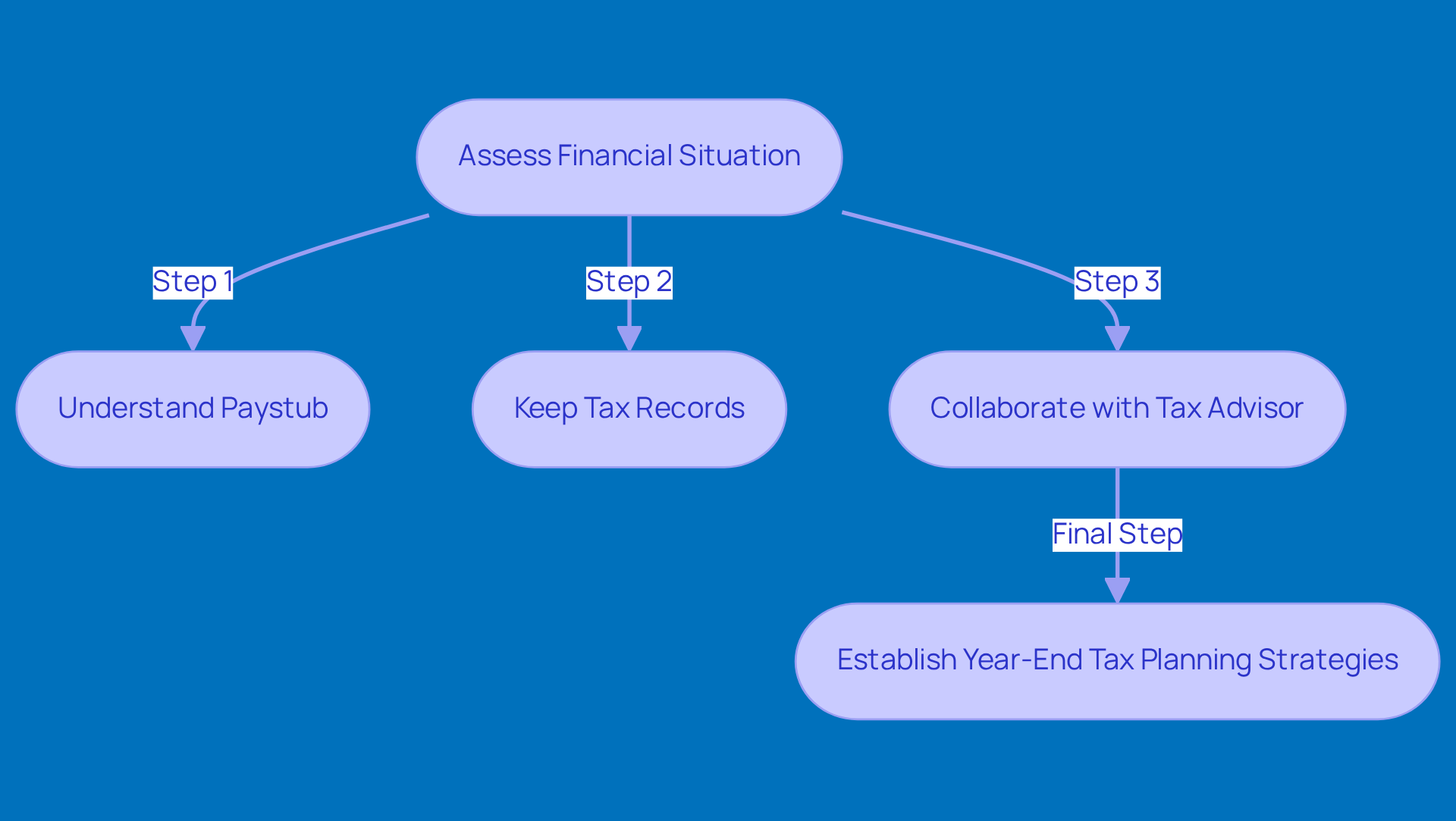

Develop a Tax Baseline for Effective Year-End Planning

Creating a tax baseline is all about taking a good look at your current financial situation and figuring out what your tax liability might be for the year. This process is super helpful for business owners because it helps spot potential tax-saving opportunities and utilize year end tax planning strategies to make smart decisions before the year wraps up.

Now, understanding your paystub is key in this whole assessment. It gives you a peek into your gross income, taxable wages, and deductions - essential info for planning your taxes accurately. Plus, keeping those tax records, like paystubs and other financial documents, is crucial for staying compliant and can really help if you ever face an IRS audit.

Collaborating with a tax advisor to establish year end tax planning strategies can be a game changer. It allows you to plan your financial moves strategically, optimizing your tax outcomes. So, why not take that step? Your future self will thank you!

Conclusion

As we wrap up our discussion on year-end tax planning, it’s clear that this step is super important for small business owners looking to make the most of their finances and stay on the right side of tax regulations. By using tailored strategies and getting some expert advice, you can turn those tax obligations into real opportunities for growth and stability. Understanding the ins and outs of tax planning can lead to some serious savings, giving you the chance to reinvest in your business’s future.

Throughout this article, we’ve highlighted a bunch of strategies that can really make a difference. From reviewing your business entity structures for tax efficiency to accelerating expense payments for maximum deductions, and even utilizing tax loss harvesting to lower your taxable income - there’s a lot to consider! Plus, we talked about how charitable contributions, funding retirement accounts, and managing required minimum distributions can enhance your tax benefits. Each of these strategies not only helps minimize tax liabilities but also boosts your business’s overall financial health.

As tax regulations keep changing, it’s crucial for small business owners to stay proactive with their planning. Engaging with tax professionals can offer you invaluable insights and tailored strategies that fit your specific business goals. So, why not take the time to develop a comprehensive year-end tax plan? It’ll help you navigate the complexities of the tax system and set you up for a successful and prosperous new year. Ready to tackle your tax planning? Let’s make it happen!

Frequently Asked Questions

What services does Steinke and Company provide for small businesses?

Steinke and Company offers comprehensive tax compliance and strategic planning services tailored for small businesses in rural America, helping entrepreneurs navigate tax regulations and optimize deductions and credits.

How can year-end tax planning strategies benefit small businesses?

Year-end tax planning strategies can enhance compliance and potentially boost a business's bottom line by leading to significant savings that can be reinvested in growth opportunities.

What is the estimated cost of tax complexity to the U.S. economy?

The IRS estimates that tax complexity costs the U.S. economy over $536 billion each year.

What are some key tactics to avoid underpayment penalties on estimated taxes?

Essential tactics include understanding safe harbor payments and the de minimis exception, which can help protect businesses from significant IRS fees.

Why is it important for small business owners to review their business entity structure?

Regularly reviewing the business structure is crucial because each type, such as sole proprietorships, LLCs, S-Corps, or C-Corps, has different tax implications that can significantly impact the overall tax burden.

How can a tax expert assist small business owners?

A tax expert can help determine the most tax-efficient business structure and provide guidance on record-keeping to prepare for potential IRS audits and ensure compliance with tax regulations.

What is a recommended practice for keeping tax records?

The IRS generally advises keeping income tax records for at least three years, although there may be circumstances requiring retention for a longer period.

How can accelerating expense payments optimize tax deductions?

By speeding up expense payments, businesses can deduct operational costs from taxable income before year-end, which helps lower tax bills and improves cash flow.

What should small business leaders do to maximize their tax benefits?

They should implement year-end tax planning strategies, manage their expenses effectively, and keep up with estimated tax payments throughout the year to avoid penalties and interest.