Overview

This article dives into the essential accountancy and tax services that small agency owners need to keep their business finances on track. We’re talking about ten critical services—like tax compliance, monthly accounting, business strategy advisory, and ongoing support—each crafted to help small business owners minimize tax liabilities, ensure compliance, and promote long-term growth through savvy financial management.

Have you ever felt overwhelmed by the financial side of running your business? You’re not alone! These services are designed to take that weight off your shoulders, allowing you to focus on what you do best. Let’s explore how these offerings can make a real difference in your day-to-day operations and overall success.

Introduction

Navigating the financial landscape can feel pretty overwhelming for small agency owners, right? With all the complexities of tax compliance and accounting, it’s no wonder many feel lost. But here’s the good news: understanding the essential services available can really boost your operational efficiency and set you up for long-term success.

In this article, we’ll dive into ten critical accountancy and tax services that are designed to empower small businesses—everything from startup consultations to specialized tax knowledge.

So, what are the key services that can streamline your operations and enhance your financial health? And how can you, as an agency owner, leverage these to tackle common challenges? Let’s find out together!

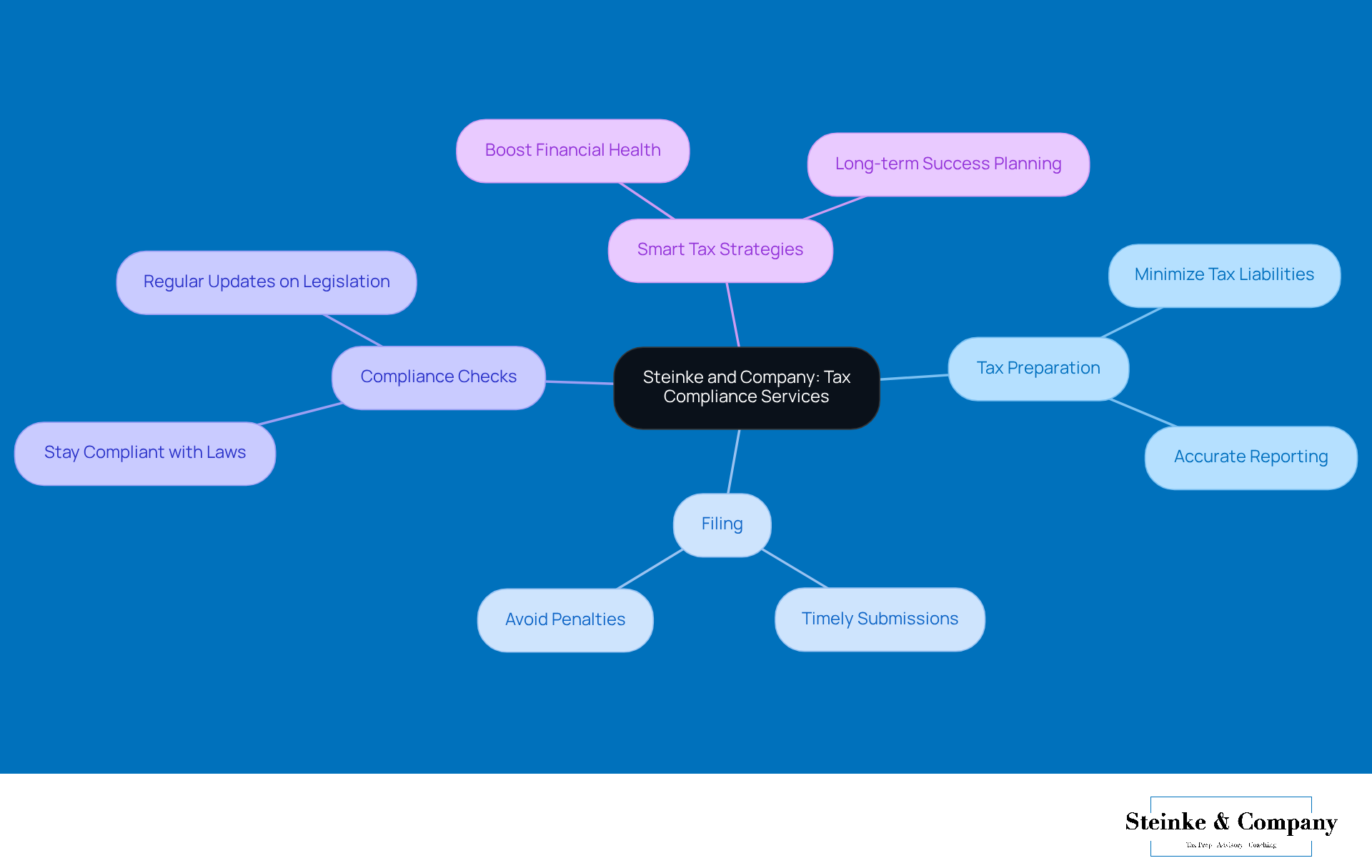

Steinke and Company: Comprehensive Tax Compliance Services

At Steinke and Company, we offer a wide range of tax compliance services tailored just for small business owners like you. Think of us as your go-to team for everything tax-related—whether it’s meticulous , filing, or those all-important compliance checks to keep you on the right side of federal and state obligations. Our experienced crew of Enrolled Agents and CPAs is here to help you minimize tax liabilities while ensuring you stay fully compliant with the law. This way, you can focus on what you do best—running your business—without the stress of tax issues weighing you down.

By implementing smart tax strategies, we empower small business leaders to boost their financial health and aim for long-term success. So why not let us take care of the tax stuff? After all, you deserve to concentrate on growing your business while we handle the numbers!

Business Startup Consultations: Setting Up for Success

At Steinke and Company, we specialize in customized startup consultations designed to help new enterprise leaders navigate the often tricky waters of launching their ventures. We’re here to guide you through everything from —like an LLC or S-Corp—to setting up your accounting systems and ensuring you receive the necessary accountancy & tax services to comply with local regulations.

And let’s not forget about proactive accountancy & tax services in our planning! We help entrepreneurs build a solid foundation while minimizing those pesky surprises during tax season with our accountancy & tax services.

By focusing on compliance and operational efficiency, we aim to help you dodge common pitfalls and set the stage for future growth and long-term success.

So, are you ready to take the next step in your entrepreneurial journey?

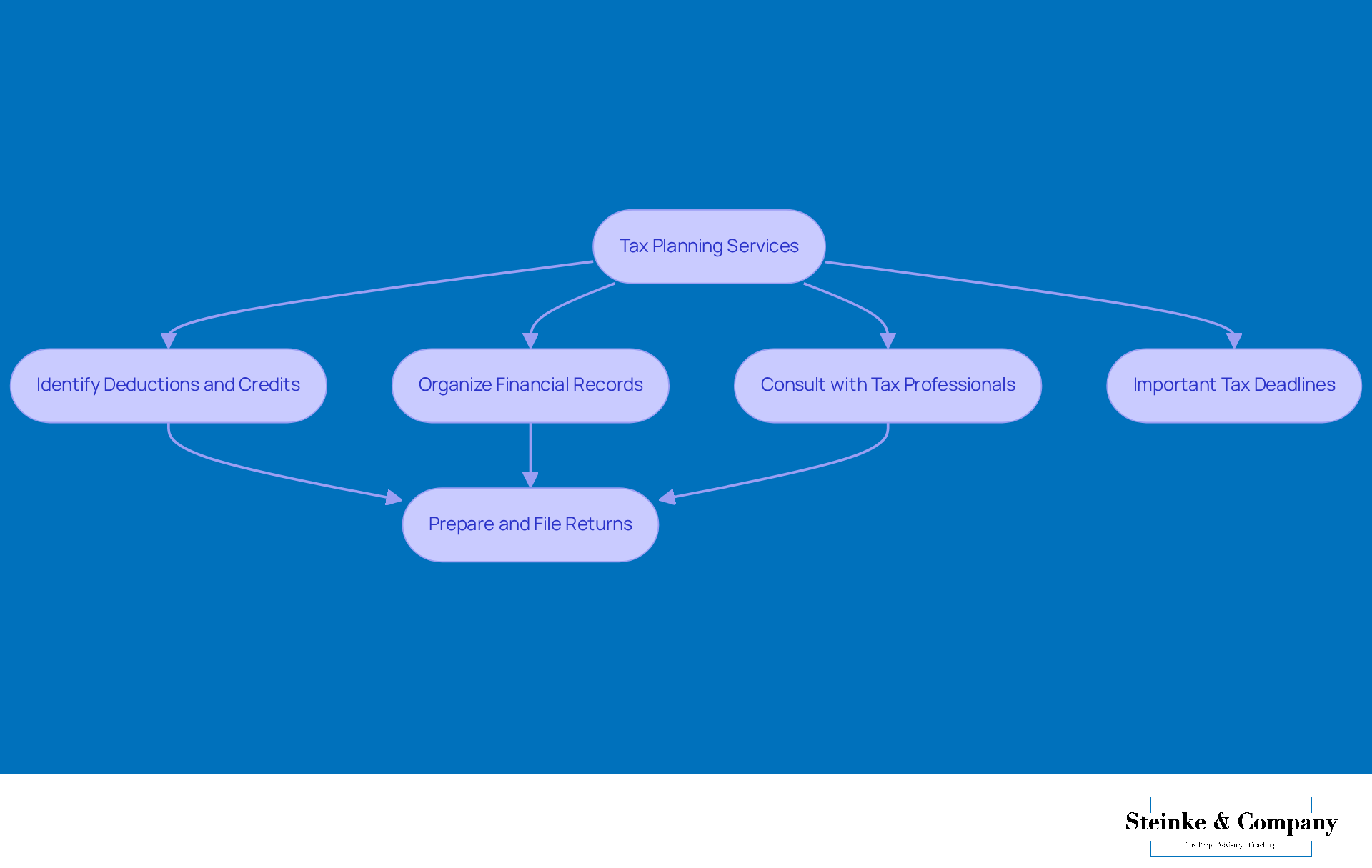

Tax Planning Services: Maximizing Deductions and Credits

At Steinke and Company, our tax planning services are all about empowering small agency owners. We help you uncover potential deductions and credits you might qualify for—think home office expenses and vehicle costs. By diving deep into your financial records and corporate activities, our team crafts personalized strategies that aim to minimize your tax liabilities while keeping you in line with IRS regulations.

We take care of preparing and filing both your business and personal returns, ensuring you don’t leave any money on the table during tax season. After all, small businesses can save thousands each year through deductions! Plus, we position you to fully leverage any available tax credits. When you interact with our seasoned tax professionals, you can rest assured that you’ll be well-informed about the , which can really boost your financial health and operational efficiency.

As Shelden Smollan, our Chief Experience Officer, puts it, "Knowing those crucial tax deadlines and being able to offer solid advice—that’s what builds trust and makes you the go-to person." And speaking of deadlines, small business owners should keep an eye on important tax due dates for 2025. Mark your calendars for:

- April 30 for personal income tax returns

- June 15 for self-employed folks

To maximize your tax savings and steer clear of those pesky underpayment penalties, it’s crucial to keep your records organized and consult with accountancy & tax services regularly. Understanding the IRS's requirements for estimated tax payments and safe harbor regulations can also help you manage your tax responsibilities with ease. So, are you ready to take control of your tax situation? Let’s make it happen together!

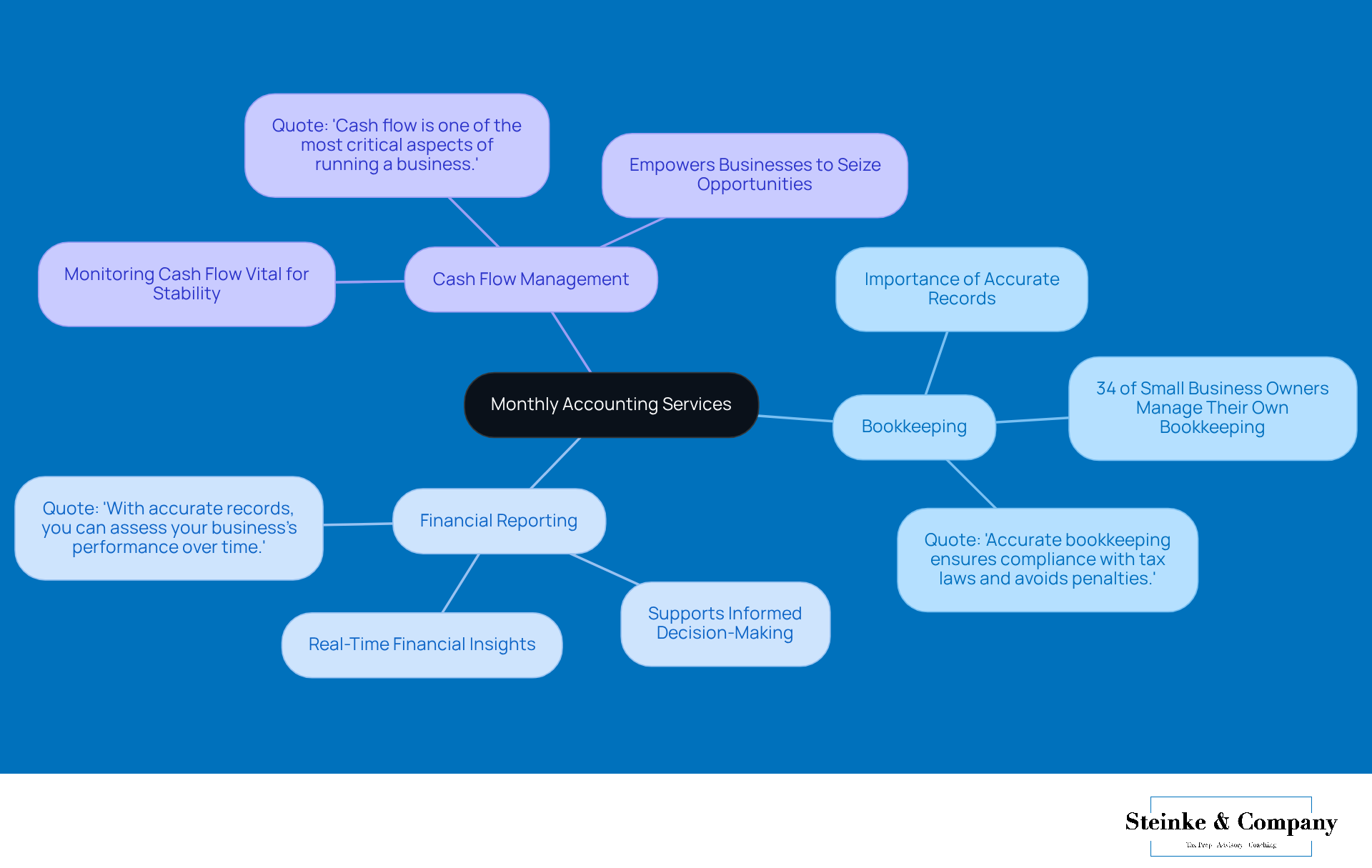

Monthly Accounting Services: Keeping Your Finances on Track

Steinke and Company is here to help small agency operators like you keep your financial records organized and up-to-date with our essential monthly accountancy & tax services. We offer a comprehensive package that includes:

- Bookkeeping

- Financial reporting

- Cash flow management

All crucial for making informed decisions. With regular insights into your , you’ll be able to spot areas for improvement and keep your operations profitable. Did you know that a 2021 survey found that 34% of small business owners handle their own bookkeeping? This really highlights how important effective financial practices are! As Lil Roberts, CEO of xendoo, wisely points out, 'Accurate bookkeeping ensures compliance with tax laws and avoids penalties, highlighting the importance of accountancy & tax services for timely and accurate filings.' By prioritizing reliable bookkeeping, you can tackle financial complexities with confidence, paving the way for growth and stability in your business.

Business Strategy Advisory: Navigating Growth and Challenges

At Steinke and Company, we’re all about empowering small agency owners to craft and roll out effective growth plans. A big part of this journey is diving into thorough market analysis. This helps companies really get a handle on their competitive landscape and spot those unique positioning opportunities. By teaming up closely with our clients, our advisory crew not only uncovers paths for growth but also tackles potential roadblocks, like market saturation, which can be a real hurdle for many small businesses. This strategic approach ensures that companies are ready to in 2025 and beyond.

Did you know that:

- 62% of consumers struggle to choose between similar options? This really highlights how important it is for small businesses to stand out.

- 42% of consumers will look for alternatives if they can’t find a company’s website, making a strong online presence a key part of any growth strategy.

Insights from top strategists show that having a well-defined strategy, grounded in thorough market analysis, is essential for overcoming growth challenges and achieving lasting success.

So, how do you kick off your growth strategy? Small business leaders should start by diving into a comprehensive market analysis. This helps you identify your unique value propositions and areas where you can really differentiate yourself. Let’s get started on this exciting journey together!

Business Coaching: Aligning Values with Growth

At Steinke and Company, we’re all about helping you connect your personal values with your professional growth. This is super important for agency owners like you who are looking for sustainable success. Our comprehensive approach makes it easy for clients to define their vision and mission, ensuring everything aligns with what truly matters to them.

But we don’t stop at coaching! Our monthly accountancy & tax services help keep you organized and confident in your numbers. We offer accountancy & tax services that include reconciliations, reports, and support to help you achieve and make smart decisions—without the stress.

Regular coaching sessions, built around the Agency Growth Model™, offer insights into effective leadership, decision-making, and goal-setting. This fosters a meaningful journey for your organization. Did you know that organizations with unified leadership and clear values can hit steady monthly revenues of $50k to $60k within just 12 to 18 months? By focusing on these key aspects, you can tackle common challenges, like depending too much on referrals or feeling uncertain about future growth, and create a thriving operational environment.

Audit Support Services: Navigating Tax Audits with Confidence

At Steinke and Company, we know that small business operators often face the daunting task of managing tax audits. That’s why we’re here to provide crucial audit assistance services tailored just for you! Our experienced team is ready to guide you through the nitty-gritty of audits, covering everything from keeping meticulous documentation to crafting strategic communication with tax authorities. And let’s not forget about proactive strategies for addressing any audit findings that may pop up.

Now, we all know that audits can be triggered by discrepancies in financial records or even significant changes in income, which can feel overwhelming. But don’t worry! By building a strong client-advisor relationship based on trust and knowledge, you can approach audits with confidence. You’ll have all the tools you need to navigate the process smoothly.

As tax professionals often remind us, presenting clear and organized documentation is key. It not only makes the audit process easier but also helps avoid any misunderstandings with tax authorities. With the right preparation and support, small firm leaders can take a deep breath, , and focus on what really matters—their core operations. So, are you ready to tackle your next audit with assurance? Let's make it happen together!

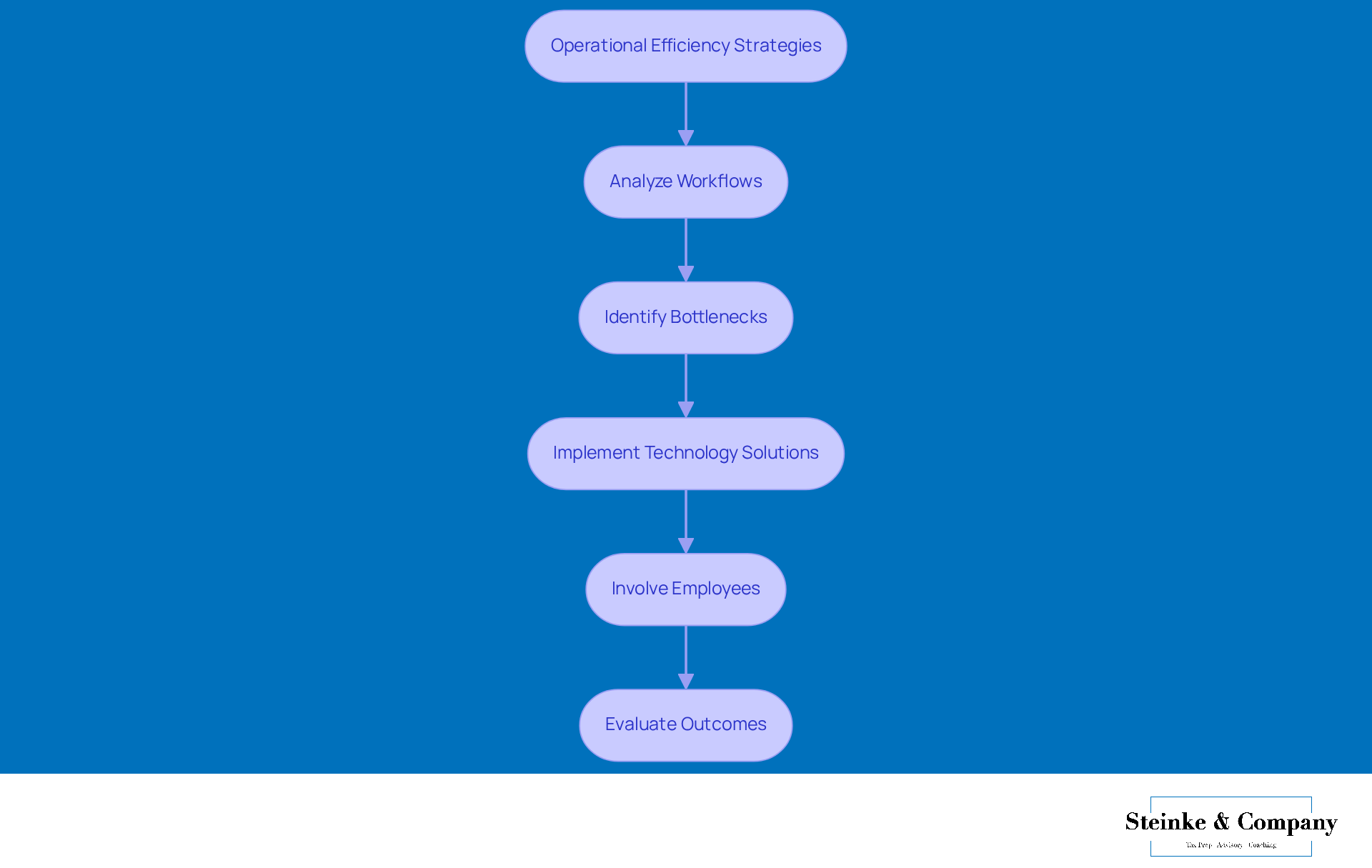

Operational Efficiency Strategies: Streamlining Your Business

Steinke and Company helps small firm leaders embrace strategies for that truly streamline their processes. It all starts with a good look at workflows to spot any bottlenecks—think of those pesky signs like tasks dragging on forever or roles that aren’t quite clear. By tapping into technology solutions, like project management tools such as Trello or Asana and nifty automation tools, organizations can boost productivity and cut down on errors.

But here’s the kicker: successful workflow optimization doesn’t just trim operational costs; it also elevates service delivery, which means happier customers and better profits. Industry experts agree that getting employees involved in the decision-making process creates a culture of continuous improvement. This way, the solutions put in place are not only practical but also effective. Plus, framing operational efficiency in a positive light can ease employee worries about job cuts, making them more likely to support these essential changes.

So, by focusing on these strategies, leaders can cultivate a more efficient and adaptable environment. What do you think? Ready to take the plunge into operational efficiency?

Specialized Tax Knowledge: Addressing Unique Business Needs

At Steinke and Company, we’re all about providing specialized accountancy & tax services tailored to the unique needs of small business operators in various sectors. Our dedicated team offers accountancy & tax services while keeping a keen eye on the latest industry-specific tax regulations and opportunities, ensuring you receive guidance that fits your specific operational model. This focused approach helps business leaders navigate the complexities of tax compliance with ease—especially when it comes to understanding underpayment penalties and how to avoid them, which is where accountancy & tax services can assist by utilizing safe harbor payments and the de minimis exception.

And let’s not forget about the recent cuts to COVID-19 tax benefits that are affecting 2022 tax refunds. We’re here to help you adapt your to tackle these changes head-on. By implementing the right strategies, small businesses can optimize their financial results, boost operational efficiency, and ultimately enhance profitability—even in a tricky tax landscape. So, how are you planning to navigate these challenges? Let’s chat about it!

Ongoing Support and Check-Ins: Ensuring Long-Term Success

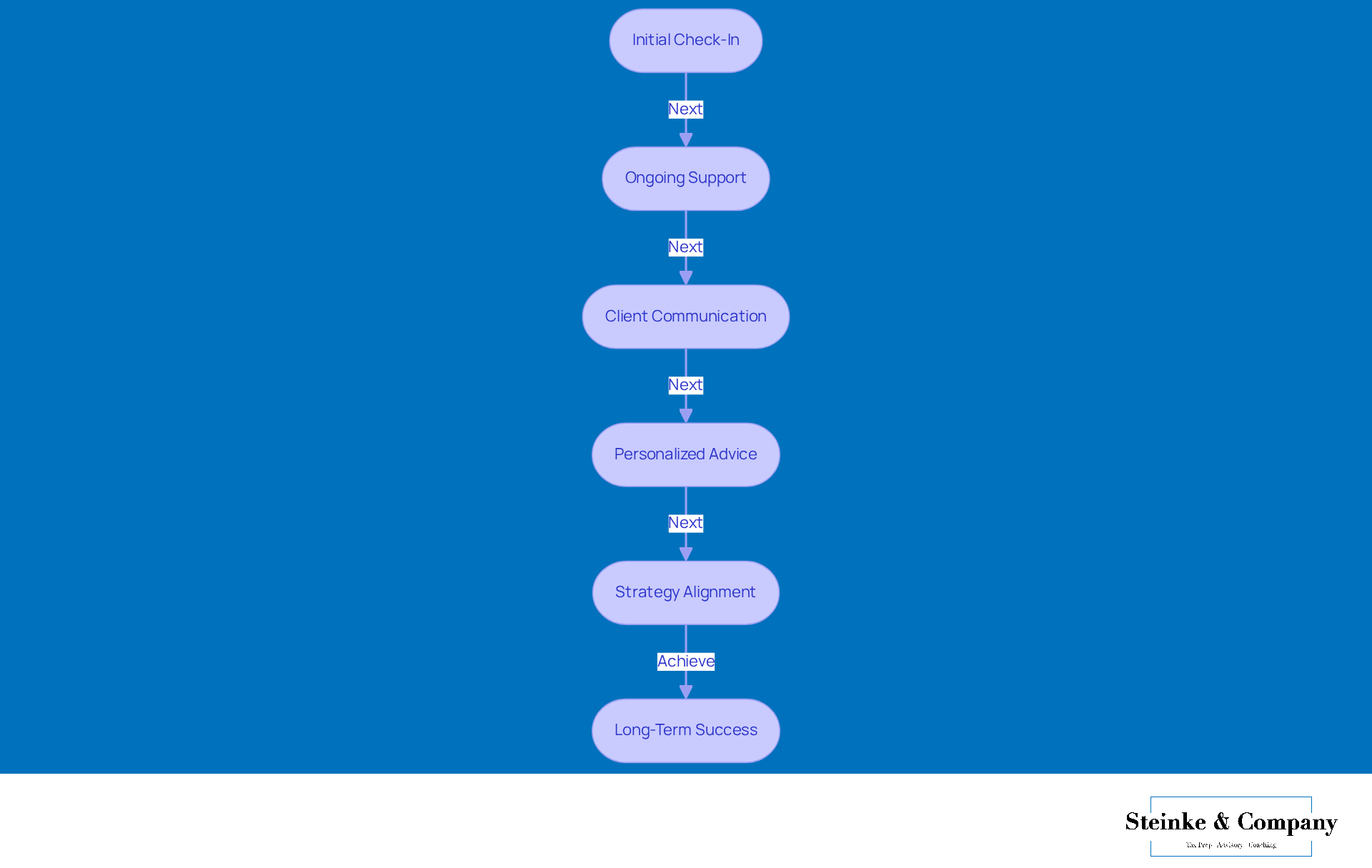

At Steinke and Company, we really emphasize the importance of ongoing support and regular check-ins for small agency owners. This proactive approach not only helps ensure but also allows our clients to navigate changes in their operational environment with ease, utilizing our accountancy & tax services. Need to make an appointment? Just give us a call! Onboarding happens at specific times of the year, and we're currently open for that until Labor Day.

By building long-term relationships, we assist our clients in utilizing accountancy & tax services to discover missed opportunities and implement actionable strategies that lead to sustained growth and success. Insights from industry coaches show that these regular interactions are key to maintaining strong client relationships—they create a space for open communication and personalized advice. And let’s be honest, the impact of those check-ins goes beyond just following the rules; they actually boost overall organizational performance by aligning strategies with the ever-changing market and client needs.

Plus, we take data privacy seriously, ensuring that client information is handled securely and in line with regulations. This holistic approach empowers small agency owners to thrive in a dynamic environment, positioning them to be proactive rather than just reactive in their business efforts.

Conclusion

At Steinke and Company, we’re all about providing a comprehensive suite of accountancy and tax services that are tailored just for small agency owners. This way, you can focus on what you do best—running your business—while we help you stay compliant with all those tricky tax regulations. We know how important it is to have a reliable partner by your side as you navigate the complexities of financial management and tax compliance, and that’s where our personalized support, strategic planning, and ongoing assistance come into play.

Let’s talk about some key insights from our services. Whether it’s:

- Business startup consultations

- Tax planning

- Monthly accounting

- Operational efficiency strategies

Each service is designed to empower you as a small business leader. We want to help you optimize your financial health, streamline your operations, and manage your tax responsibilities effectively. With our specialized tax knowledge and proactive support, you can avoid those common pitfalls and seize exciting opportunities for growth.

So, what’s the takeaway? Investing in essential accountancy and tax services goes beyond just ticking boxes for compliance—it’s about fostering long-term success and sustainability in a competitive landscape. We encourage small agency owners like you to take proactive steps, engage with expert advisors, and embrace strategies that align with your business goals. Together, let’s pave the way for a prosperous future!

Frequently Asked Questions

What tax compliance services does Steinke and Company offer?

Steinke and Company provides a wide range of tax compliance services tailored for small business owners, including tax preparation, filing, and compliance checks to ensure adherence to federal and state obligations.

How can Steinke and Company help minimize tax liabilities?

The experienced team at Steinke and Company, which includes Enrolled Agents and CPAs, implements smart tax strategies to help small business leaders minimize tax liabilities while ensuring full compliance with the law.

What does the startup consultation service include?

The startup consultation service at Steinke and Company includes guidance on selecting the right business entity (like an LLC or S-Corp), setting up accounting systems, and ensuring compliance with local regulations.

How does Steinke and Company assist with tax planning?

Steinke and Company offers tax planning services that help small agency owners uncover potential deductions and credits, craft personalized strategies to minimize tax liabilities, and prepare and file both business and personal tax returns.

What are some examples of deductions and credits that can be maximized?

Examples of deductions and credits include home office expenses and vehicle costs, which can significantly reduce tax liabilities for small business owners.

What important tax deadlines should small business owners be aware of for 2025?

Small business owners should note the following tax deadlines for 2025: April 30 for personal income tax returns and June 15 for self-employed individuals.

How can small business owners avoid underpayment penalties?

To avoid underpayment penalties, small business owners should keep their records organized, consult with accountancy and tax services regularly, and understand IRS requirements for estimated tax payments and safe harbor regulations.