Introduction

In the world of small business ownership, tackling tax regulations can feel like a daunting task, especially for those of us in rural America where the challenges are a bit different. Did you know that a whopping 62% of small businesses struggle to turn a profit? That’s why getting expert tax advice is so crucial. In this article, we’re diving into ten essential tax tips that can help you optimize your financial strategies, streamline compliance, and boost your profitability. So, how can you, as a small business owner, use these insights to not just survive but truly thrive in today’s complex tax landscape?

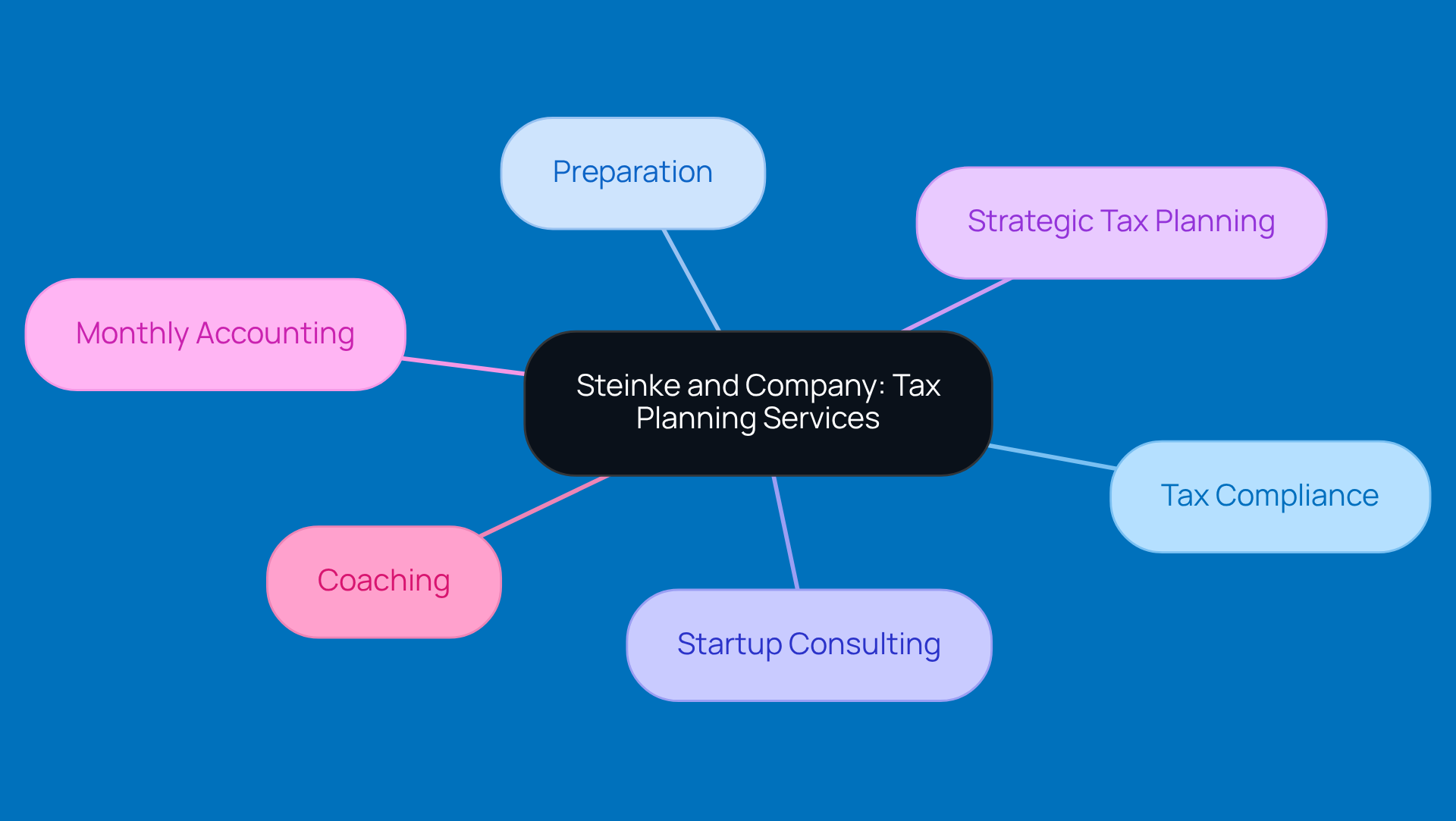

Steinke and Company: Comprehensive Tax Planning Services for Small Businesses

Steinke and Company focuses on delivering expert tax advice for small business owners in rural America to assist with their tax planning needs. They understand the unique challenges these enterprises face, and they’ve got a range of services to tackle them head-on. From tax compliance and preparation to startup consulting, strategic tax planning, monthly accounting, and coaching, they’ve got it covered. This all-in-one approach lets entrepreneurs focus on what they do best while navigating the often tricky world of tax regulations.

Did you know that in 2024, only 38% of rural small businesses reported making a profit? That really highlights how crucial expert tax advice for small business owners is in implementing effective tax strategies. By blending modern technology with local insights, Steinke and Company empowers clients to make smart financial decisions that resonate with their values and goals. And let’s be honest, effective tax compliance not only helps boost profits but also involves expert tax advice for small business owners, streamlining operations and giving rural businesses a fighting chance to thrive, even when the economy gets a bit rocky.

Identify Deductible Expenses: Key Strategies for Tax Savings

Hey there, small business owners! Let’s chat about something super important: tracking your expenses. It’s not just about keeping tabs; it’s about spotting those potential deductions that can save you some cash. Think about it-common deductible expenses like office supplies, work travel, and even your home office costs can really add up.

Now, let’s talk paystubs. Understanding yours is key! It gives you a peek into your income and withholdings, which can totally impact your tax situation. And here’s a tip: using accounting software can make this whole process a breeze. It helps ensure you capture all those eligible expenses without the headache.

But wait, there’s more! Consulting with a tax professional can provide expert tax advice for small business owners, making it a game-changer. They can offer expert tax advice for small business owners to help you uncover those not-so-obvious deductions, like depreciation on your equipment or certain business meals and entertainment costs. Keeping accurate records isn’t just about finding deductions; it’s also about being prepared for any potential IRS audits. You want to know your rights and responsibilities as a taxpayer, right?

So, keep those records tidy and don’t hesitate to reach out for help when you need it. You’ve got this!

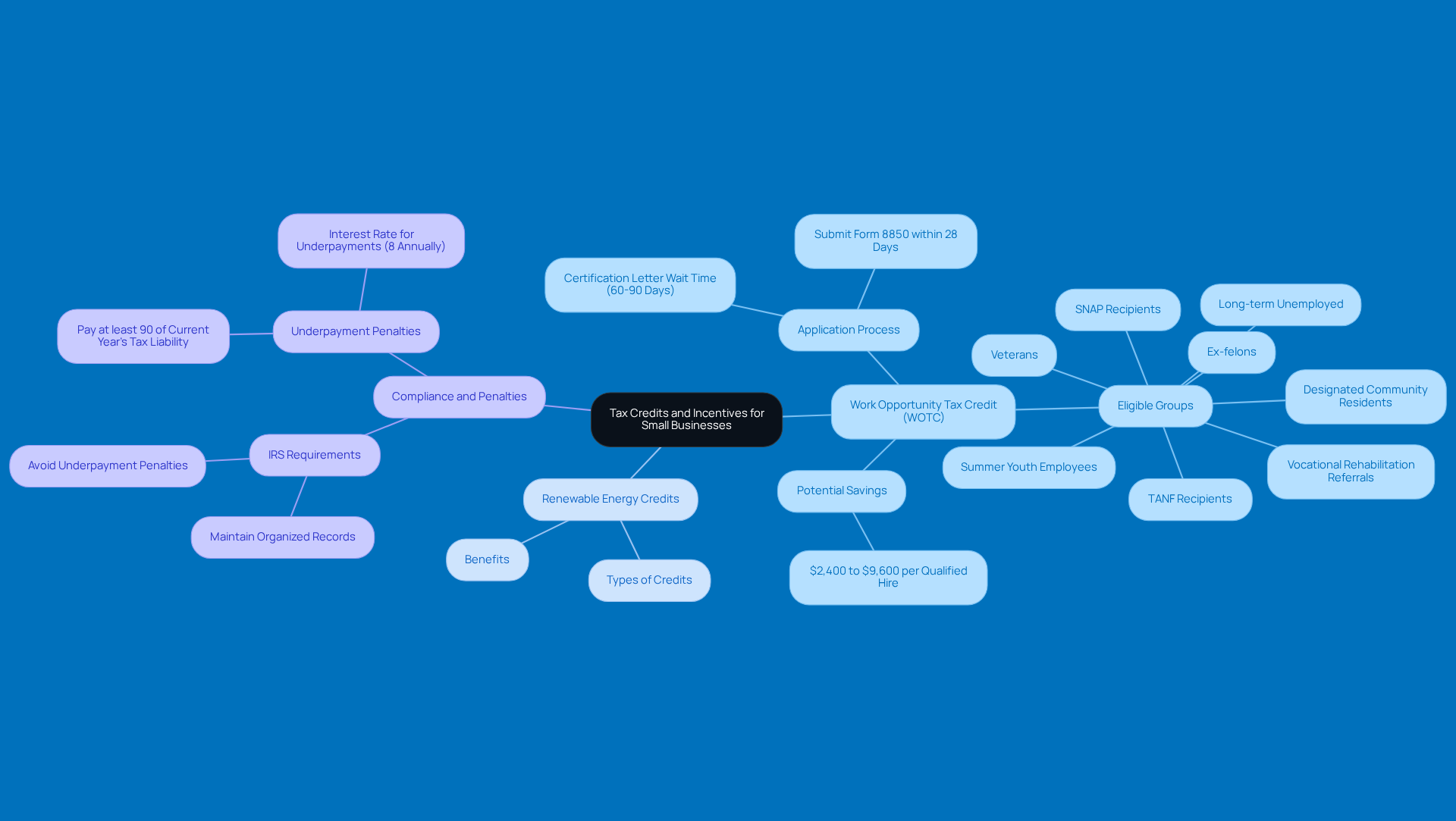

Leverage Tax Credits and Incentives: Unlock Savings for Your Business

Hey there, small business owners! Have you thought about how tax credits and incentives could lighten your tax load? One great option is the Work Opportunity Tax Credit (WOTC). This credit can really pay off if you hire folks from targeted groups, like veterans or those who’ve been out of work for a while. Depending on the employee's status and hours worked, you could claim anywhere from $2,400 to $9,600 per qualified hire. Just remember, you need to submit Form 8850 within 28 days of hiring to snag this credit. And good news: the WOTC is available until December 31, 2025, so now's the time to make the most of it!

But wait, there’s more! If your business is investing in renewable energy, you can tap into various energy credits that can really boost your savings. It’s surprising, but many small businesses in rural areas aren’t taking full advantage of these tax incentives. That’s a missed opportunity for some serious savings that could help your operations thrive.

Tax pros always stress the importance of staying informed about local and federal tax incentives to offer expert tax advice for small business owners. Regularly checking out available programs and seeking expert tax advice for small business owners can help you maximize these opportunities. Plus, don’t forget about underpayment penalties! The IRS wants you to pay at least 90% of your current year’s tax liability or 100% of last year’s to avoid any penalties. With the interest rate for underpayments sitting at 8% annually, compounded daily, it’s crucial to navigate these waters carefully to keep your tax compliance in check and avoid unnecessary charges. Remember, using tax credits isn’t just about following the rules; it’s a smart move that can really impact your bottom line!

Maintain Detailed Records: Essential for Compliance and Savings

Keeping thorough records is super important for business owners who want to keep track of their income and expenses without a hitch. Think about it: organizing receipts, invoices, and bank statements in a way that makes them easy to find is a game changer, especially when tax season rolls around or if you’re facing an audit. Plus, using a digital record-keeping system can really simplify things, making it easier to manage all those financial documents. Did you know that independent business operators typically spend over 80 hours a year just on bookkeeping? That’s a lot of time! It really shows how crucial it is to have efficient systems in place that save time and reduce errors.

Regularly updating your records and reconciling accounts isn’t just about staying compliant with tax laws; it can also provide you with expert tax advice for small business owners to help you snag those potential deductions. In fact, a whopping 93% of small and medium-sized business owners end up overpaying their taxes because they miss out on deductions and credits. This really highlights how important meticulous record-keeping is for managing your finances. Businesses that adopt solid record-keeping practices often see better compliance and lower legal risks, thanks to the accountability and transparency that come with accurate documentation.

Accountants often stress the importance of digital record management. One accountant put it this way: 'An experienced accountant not only ensures you’re following tax regulations but also offers expert tax advice for small business owners that can help your business grow.' By focusing on precise and organized record-keeping, businesses can boost their financial health, make smarter decisions, and ultimately set themselves up for long-term success. So, why not take a moment to reflect on your own record-keeping practices? Are there ways you could streamline your process and save some time?

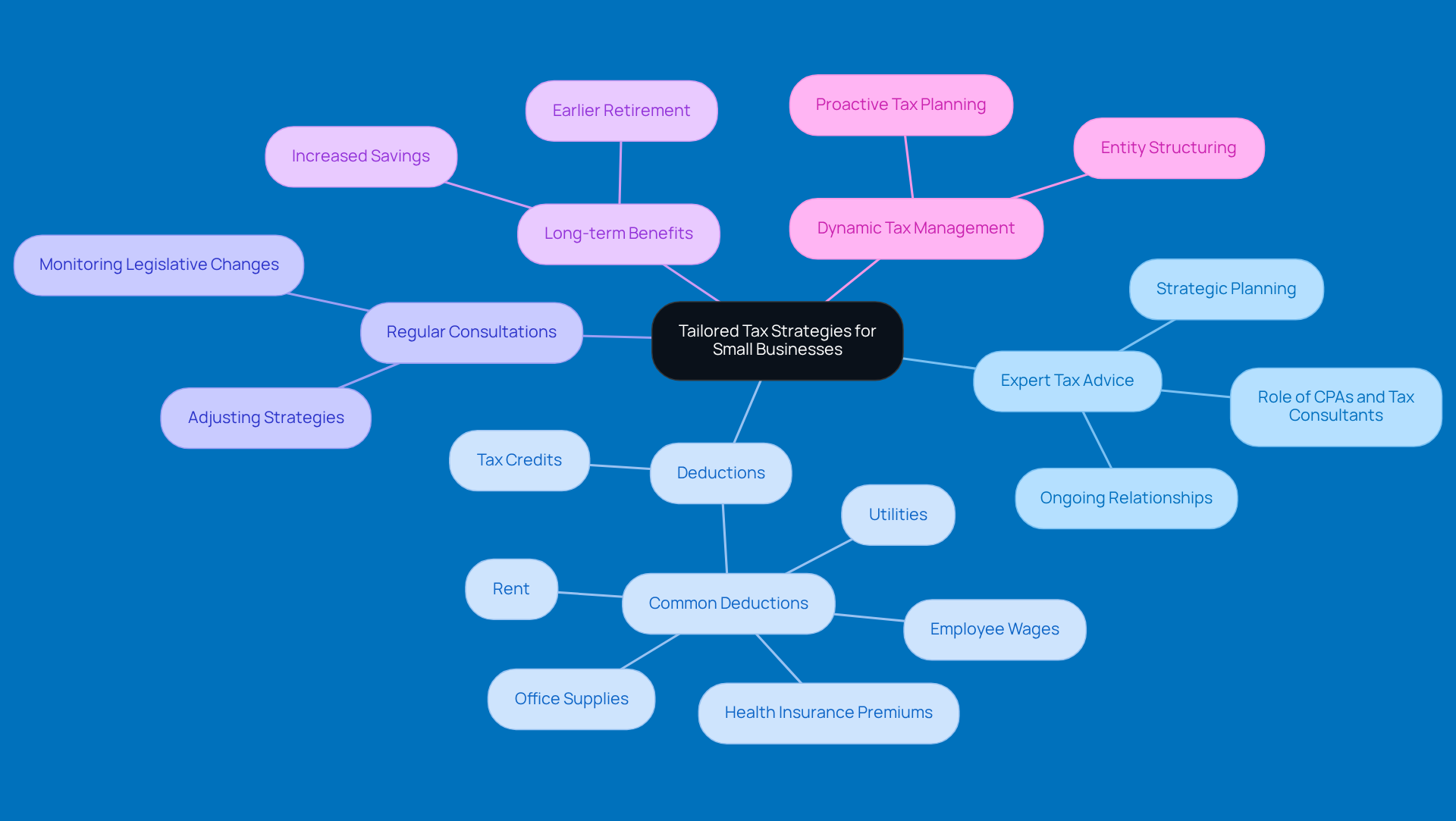

Consult Financial Experts: Tailored Tax Strategies for Small Businesses

When managing finances, obtaining expert tax advice for small business owners from financial specialists like CPAs and tax consultants is a game changer for entrepreneurs. These pros provide expert tax advice for small business owners, offering valuable insights into tax planning, compliance, and how to make the most of deductions and credits. For example, small business owners can snag deductions on things like rent, utilities, office supplies, and employee wages, which can really help lower their taxable income.

Regular catch-ups with tax consultants offer expert tax advice for small business owners, keeping them informed about changing tax laws and ensuring their strategies stay sharp and effective. This proactive approach is super important, especially as small business owners seek expert tax advice for small business owners due to the growing complexity of taxes. Did you know that small business owners who team up with financial experts can expect to retire seven years earlier than those who go it alone? That really highlights the long-term perks of smart tax planning!

Plus, having expert tax advice for small business owners from CPAs can lead to some serious savings. For instance, setting up a business as an S-Corp can cut down on self-employment tax, and contributing to retirement plans can further reduce taxable income. By keeping those relationships going, tax advisors can offer expert tax advice for small business owners while monitoring legislative changes and adjusting strategies on the fly, making tax management a lot more dynamic. This shift from just compliance-focused services to strategic advisory roles, which includes expert tax advice for small business owners, is changing the game for how businesses handle their finances, making tax advisors essential partners in achieving financial success.

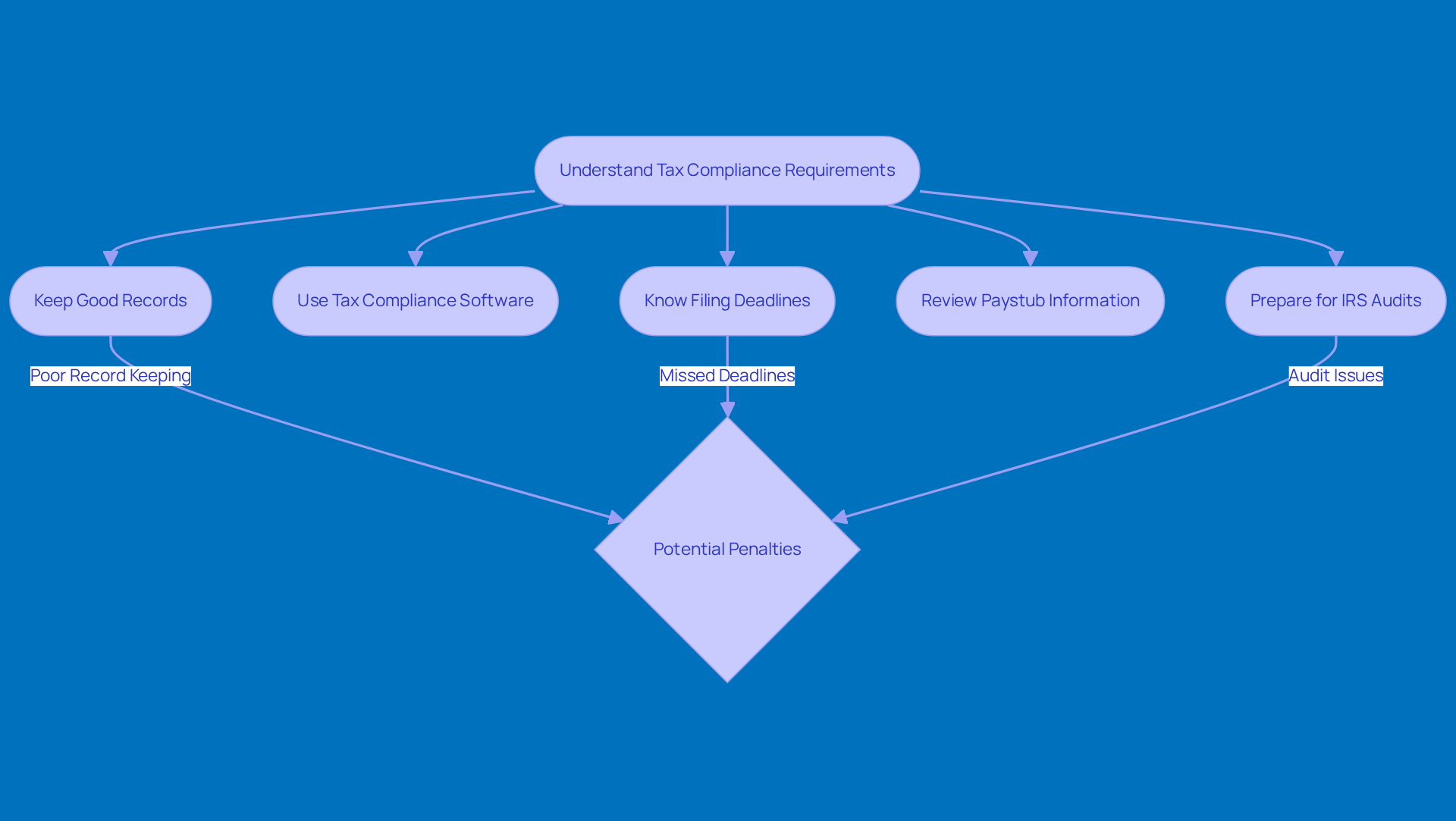

Understand Tax Compliance Requirements: Avoid Penalties and Ensure Smooth Operations

To dodge those pesky penalties, small business owners really need expert tax advice for small business owners to effectively manage their tax compliance obligations at the federal, state, and local levels. This means knowing the filing deadlines, the forms they need, and when payments are due. For example, if you miss the new reporting thresholds for 1099 forms, you could face some hefty fines. The threshold just jumped from $600 to $20,000, so keeping track of those transactions is more important than ever! Using tax compliance software can make this whole process a breeze, helping you meet all your obligations on time. Plus, regular training or workshops on tax compliance can keep you in the loop about changes in regulations, like Illinois' new data privacy laws that require you to get explicit customer consent before collecting certain data.

But wait, there’s more! Companies can really benefit from some proactive tax planning strategies. Many independent business owners miss out on deductions simply because they don’t keep good records, which can lead to paying more taxes than necessary. It’s super important to understand the details on your paystubs, like wages and deductions, to ensure accurate income reporting and tax withholding. Chatting with knowledgeable professionals can provide expert tax advice for small business owners, helping you spot potential deductions and ensure you’re compliant, which sets your business up for long-term success. And don’t forget, regularly reviewing your paystub information can help you avoid issues with tax withholding and income reporting.

Also, being ready for potential IRS audits by keeping your records organized and knowing your rights can really help reduce stress and make the process smoother. By putting compliance first and using the resources available to them, small business leaders can navigate their tax responsibilities with ease and benefit from expert tax advice for small business owners to cut down on the risk of penalties. So, what are you waiting for? Let’s get started on making tax season a little less daunting!

Optimize Entity Structure: Impact on Tax Obligations and Savings

Choosing the right business entity - whether it’s a sole proprietorship, LLC, S-Corp, or C-Corp - can really impact your tax responsibilities and financial health. Each structure has its own tax implications, like how profits are taxed and what deductions you can take. For example, LLCs offer pass-through taxation, which means profits show up on the owners' personal tax returns. This can make tax filing easier and might even lower your tax bill. On the flip side, C-Corps face double taxation on profits and dividends, which can be a downside for some smaller businesses.

Tax advisors often emphasize the importance of choosing an entity that aligns with your long-term financial goals to ensure you receive expert tax advice for small business owners. One expert puts it nicely: "The selection of organizational entity often relies on the particular objectives of your organization and how you aim to enhance revenue through efficient tax planning strategies." This really highlights why it’s smart for independent business owners to seek expert tax advice for small business owners regarding the ins and outs of each option.

Real-life examples show just how beneficial choosing the right entity can be. Take a small retail shop, for instance; it might go for an S-Corp to enjoy pass-through taxation and dodge double taxation, which helps keep more money in the business. On the other hand, a startup eyeing rapid growth might opt for a C-Corp structure to make it easier to raise capital through stock sales, even if that comes with some tax headaches.

Ultimately, understanding the tax consequences of each business structure is essential for entrepreneurs who need expert tax advice for small business owners to enhance tax efficiency and ensure compliance. Regularly reviewing and tweaking your organizational structure as your business grows can lead to some serious tax savings and operational perks.

Navigate Tax Planning Complexity: Strategic Approaches for Small Businesses

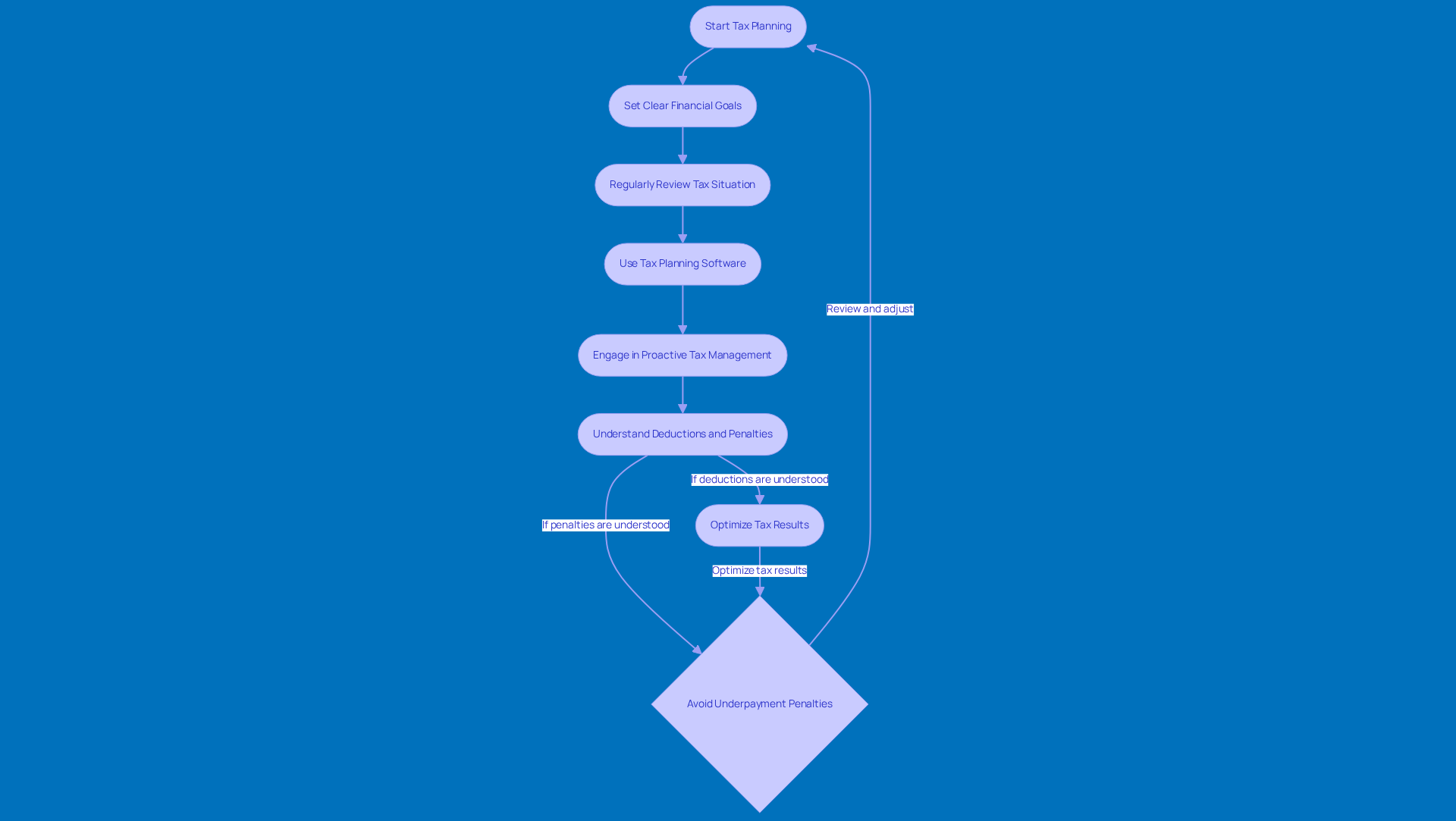

Navigating the complexities of tax planning can feel like a maze for small business owners, but with expert tax advice for small business owners, it doesn’t have to be that way! It all starts with setting clear financial goals that align with your business objectives. And hey, don’t forget to regularly review your tax situation! This way, you can make timely adjustments as tax laws and your personal circumstances change. Did you know that the Tax Preparation Services industry is projected to hit a whopping $14.5 billion by 2025? That just goes to show how crucial effective tax management is becoming.

Using tax planning software can really simplify things, making it easier to forecast and make informed decisions. Instead of waiting until tax season rolls around, engaging in proactive tax planning throughout the year can lead to some serious benefits. For example, companies that adopt year-round tax strategies often see a boost in their financial health. Just look at Gadget Guru, which managed to significantly reduce its tax obligations after embracing a solid tax planning approach.

Proactive management is a key focus for tax professionals offering expert tax advice for small business owners. One expert points out that tweaking the timing of your income and expenses can really optimize your tax results. Another emphasizes the importance of knowing what deductions and credits are available to you. Plus, it’s essential to be aware of underpayment penalties, which can sneak up on you if you don’t comply with IRS standards for estimated tax payments. By understanding these penalties and using strategies like safe harbor payments or adjusting your withholdings, you can dodge unnecessary fees and boost your financial stability.

And let’s not forget about the recent cuts in COVID-19 tax advantages that might impact your tax refunds. It’s more important than ever for independent entrepreneurs to strategize accordingly. By taking these steps, you can not only lighten your tax burden but also benefit from expert tax advice for small business owners to enhance your overall financial stability and growth potential. So, what are you waiting for? Let’s get planning!

Assess Audit Risks: Prepare and Mitigate Potential Issues

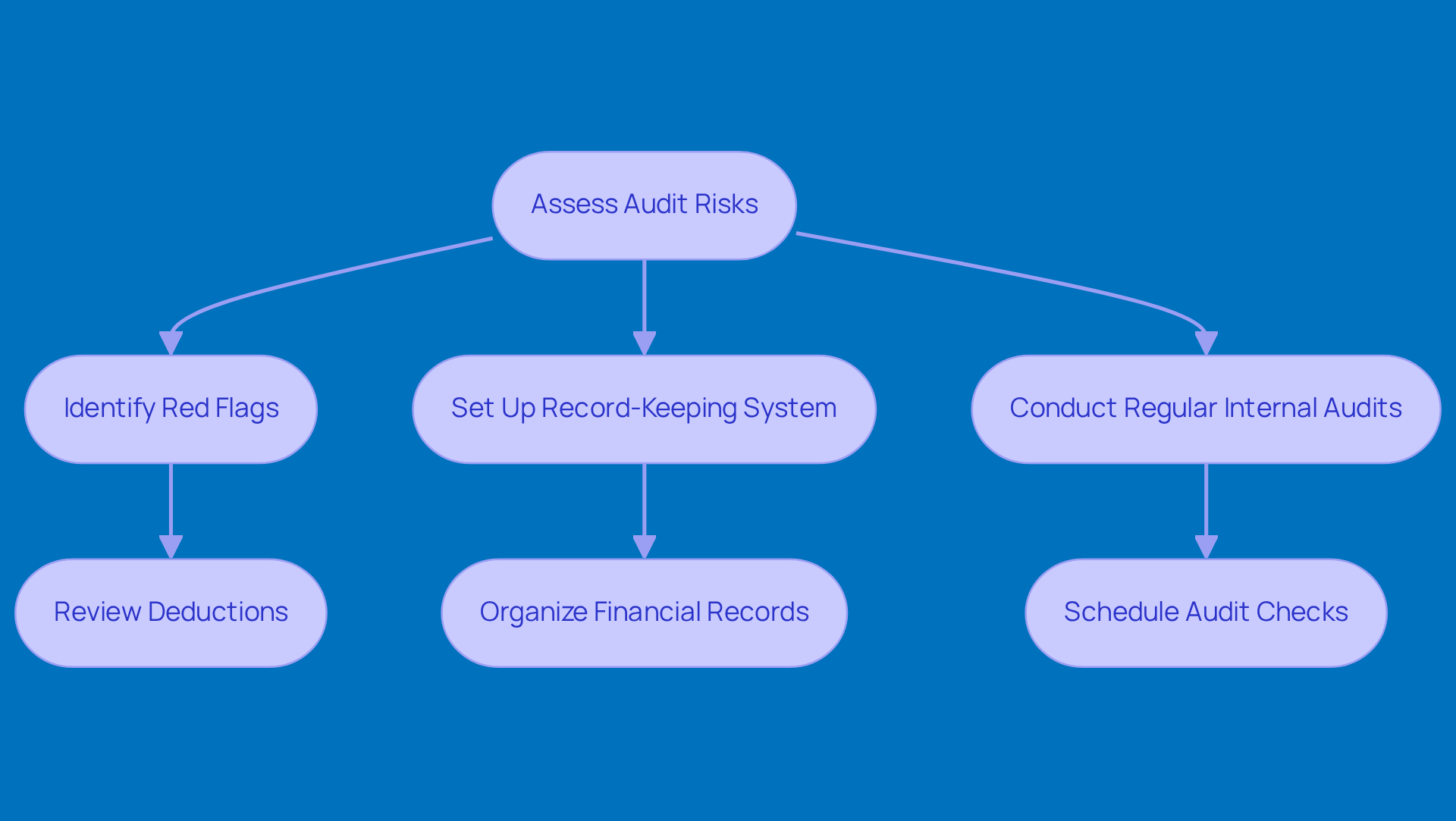

Hey there, small business owners! It’s super important to regularly check in on your audit risks. You know, taking a good look at your financial practices and making sure you’re following those pesky tax regulations. Some common red flags that might trigger an audit include hefty deductions, discrepancies in your reported income, and, let’s be honest, messy record-keeping.

So, how can you keep those audit worries at bay? First off, think about setting up a solid record-keeping system. It doesn’t have to be complicated! Regular internal audits can also help you catch any issues before they become a problem. And don’t hesitate to reach out to tax professionals for expert tax advice for small business owners regarding compliance and audit readiness.

By taking these proactive steps, you can really lower your chances of facing an audit. Plus, if one does come your way, you’ll be ready to tackle it head-on. So, why not start today? Your future self will thank you!

Engage in Ongoing Tax Education: Stay Informed and Maximize Savings

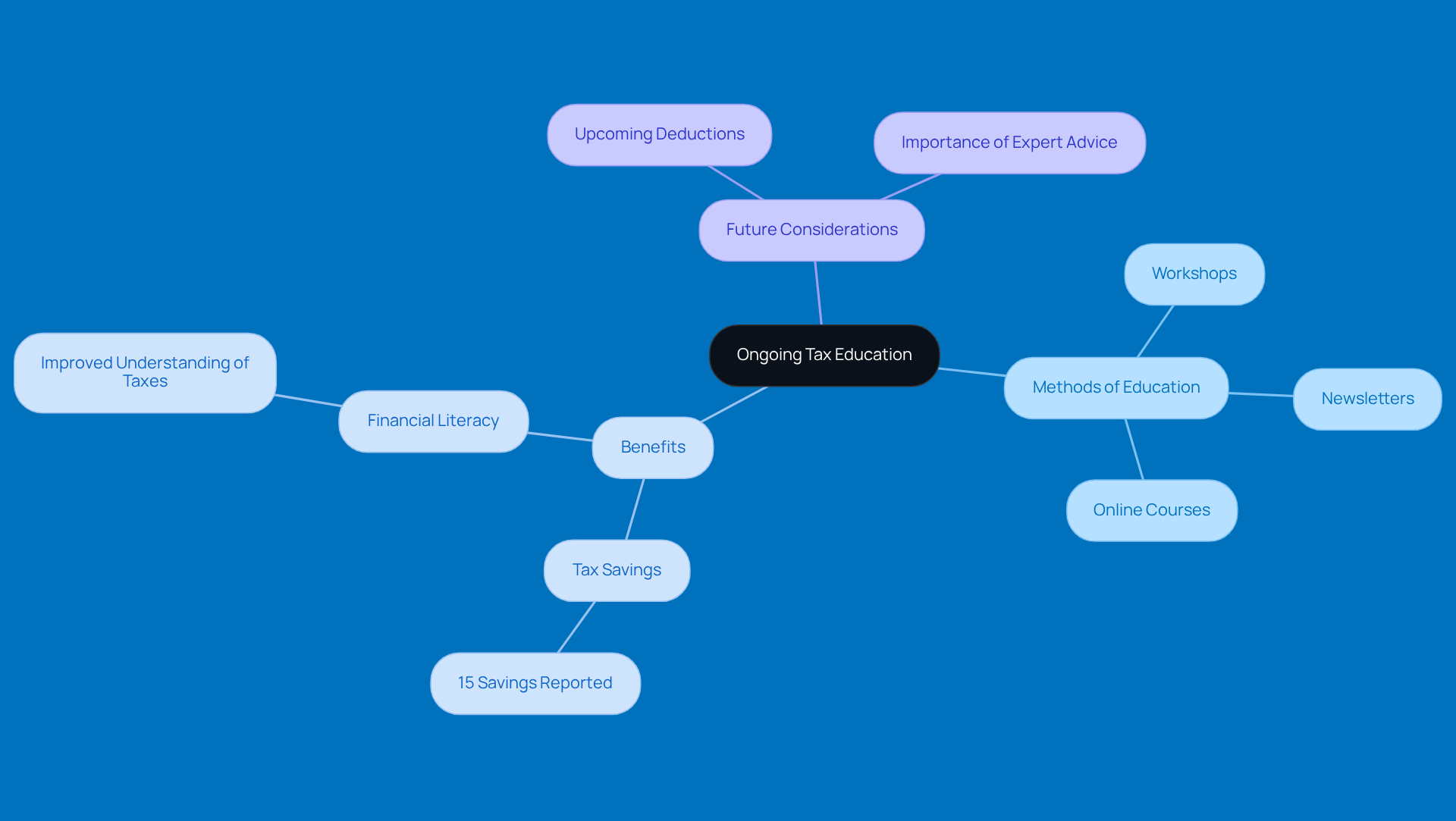

Continuous tax education is super important for entrepreneurs trying to navigate the ever-changing world of tax regulations and strategies. By joining workshops, subscribing to tax newsletters, or taking online courses, entrepreneurs can keep up with new deductions and credits, which can really help boost their tax savings. For instance, small businesses that have participated in tax workshops often report saving around 15% on their tax bills, thanks to a better understanding of available credits and deductions.

It’s pretty eye-opening to see that 71% of small business leaders still rely on old-school methods like pen and paper for managing their finances. This puts them at risk of missing out on valuable opportunities! With tax laws evolving - especially with new regulations coming in 2025 - staying informed is more crucial than ever. Tax instructors emphasize that understanding these changes can significantly impact a company’s financial health. Many have noticed that savvy business owners are much better at taking advantage of tax benefits.

Looking ahead to 2025, there will be new temporary deductions and credits rolling out, making it essential for entrepreneurs to chat with tax experts regularly. This proactive approach not only helps with compliance but also boosts overall financial literacy, which is key to thriving in today’s complex tax landscape. By prioritizing tax education, small business owners can benefit from expert tax advice for small business owners to turn potential challenges into real opportunities for growth and stability. So, why not take that first step today?

Conclusion

Navigating the world of taxes can feel overwhelming for small business owners, but with the right expert advice, it doesn’t have to be! Think of tax planning as a crucial part of your business success. By being proactive, keeping detailed records, and taking advantage of available tax credits and deductions, you can really make a difference.

So, what are some key strategies? Well, identifying deductible expenses, optimizing your business structure, and committing to ongoing tax education are all essential. These steps not only help you minimize tax liabilities but also set your business up for long-term growth. And let’s not forget the importance of consulting with tax experts - after all, informed decisions lead to better outcomes. This way, you can focus on what you do best while navigating the sometimes tricky tax regulations.

As the tax landscape keeps changing, staying informed and adapting to new rules is crucial. Embracing continuous education and seeking expert guidance can turn potential hurdles into opportunities for financial stability and growth. By taking these steps, you’re not just preparing for a successful tax season; you’re empowering your business to thrive in an ever-evolving economic environment. So, why not take that leap? Your business deserves it!

Frequently Asked Questions

What services does Steinke and Company offer for small businesses?

Steinke and Company provides a range of services including tax compliance and preparation, startup consulting, strategic tax planning, monthly accounting, and coaching, specifically tailored for small business owners in rural America.

Why is expert tax advice important for small business owners?

Expert tax advice is crucial for small business owners as it helps implement effective tax strategies, streamline operations, and boost profits, especially given that only 38% of rural small businesses reported making a profit in 2024.

How can tracking expenses benefit small business owners?

Tracking expenses helps small business owners identify potential deductions, such as office supplies, work travel, and home office costs, which can lead to significant tax savings.

What role does understanding paystubs play in tax planning?

Understanding paystubs provides insights into income and withholdings, which can significantly impact a business's tax situation.

How can accounting software assist small business owners with tax deductions?

Accounting software simplifies the process of capturing eligible expenses, ensuring that small business owners can easily track and identify potential deductions without hassle.

What is the Work Opportunity Tax Credit (WOTC)?

The WOTC is a tax credit available to businesses that hire individuals from targeted groups, such as veterans or long-term unemployed individuals, allowing businesses to claim between $2,400 to $9,600 per qualified hire.

What is required to claim the Work Opportunity Tax Credit?

To claim the WOTC, businesses must submit Form 8850 within 28 days of hiring a qualified employee.

What are some benefits of investing in renewable energy for small businesses?

Investing in renewable energy can provide access to various energy credits, which can lead to significant tax savings for small businesses.

Why is it important for small business owners to stay informed about tax incentives?

Staying informed about local and federal tax incentives allows small business owners to maximize their opportunities for savings and ensure compliance with tax regulations.

What are the consequences of underpayment penalties by the IRS?

To avoid underpayment penalties, businesses must pay at least 90% of their current year’s tax liability or 100% of last year’s. The interest rate for underpayments is 8% annually, compounded daily, making it crucial to manage tax compliance carefully.